Previous Session Recap

Trading volumes at PSX floor dropped by 90.95 million shares or 31.37% on DoD basis, during the last trading session. The Benchmark KSE100 Index opened at 49300.90, posted a day high of 49303.31 and a day low of 48665.09 during last trading session, while the session suspended at 48689.42 with a net change of -611.48 and a net trading volume of 88.07 million shares. Daily trading volume of KSE100 listed companies dropped by 22.48 million shares or 21.75%, DoD basis.

Foreign Investors remained in a net selling position of 0.29 million shares and the net value of Foreign inflow dropped by 4.7 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani Investors have added 0.069 and 0.66 million shares to their holdings but Foreign Corporate Investors have offloaded 1.02 million shares during the last trading session. While on the other side, Local Individuals and Banks remained in net buying positions of 12.78 and 2.8 million shares but Local Companies, Mutual Funds and Brokers remained in net selling positions of 4.78, 5.41 and 3.65 million shares, respectively.

Analytical Review

Asian stocks followed global indexes higher on Wednesday, as strong earnings and manufacturing data boosted risk appetite, while expectations that the Federal Reserve will signal a June rate increase later in the session lifted the dollar. Oil prices pulled higher after a sharp fall on Tuesday on technical selling in a market already worried about oversupply and following a rise in output from several members of the Organization of Petroleum Exporting Countries. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent early on Wednesday, within a hair of a near-two-year high hit on Tuesday. Australian shares slipped 0.1 percent. Hong Kong and South Korea are closed for birthday of the Buddha, and Japan is shut for the rest of the week for the Golden Week holiday. The MSCI World index .MIWD00000PUS hit a record high overnight, while the pan-European Stoxx index jumped to its highest level since August 2015 overnight as major European indexes posted gains.

The International Monetary Fund (IMF) has warned Pakistan and other oil importers that because of an increase in global prices, their oil bills for 2017 will be almost 30 per cent higher than the last year. “Any further increases could undermine consumption, increase fiscal risks, and worsen external imbalances,” the IMF warns in its May 2017 Regional Economic Outlook for the Middle East, the Gulf, and North Africa, Afghanistan and Pakistan (MENAP).

SBP borrows $3.93b to bolster forex reserves. The central bank has borrowed a whopping $3.93 billion mainly from commercial banks for up to three months to artificially sustain official foreign exchange reserves at $16 billion level, which had started depleting due to a sudden spike in imports. The aggregate short position in forward and future contracts has alarmingly increased to $3.925 billion as of end March this year, revealed official data of the State Bank of Pakistan (SBP).

Dasu hydropower project: guarantee for $350 million financing approved by ECC. The Economic Co-ordination Committee (ECC) of the Cabinet has approved the government guarantee for commercial financing of US $350 million from the international market under the World Bank partial guarantee for the Dasu hydropower project. A meeting of the ECC presided over by Finance Minister Ishaq Dar on Friday was sought by Ministry of Water and Power to approve the government guarantee for repayment of US $140 million loan - 40% of loan $350 million - and was informed that the World Bank will provide guarantee for the remaining $210 million.

K-Electric plans to install 900MW LNG power plant. K-Electric (KE), the country’s only vertically-integrated power company, planned to install a 900-megawatt of liquefied natural gas (LNG)-based electricity generation plant in place of an outdated oil-run 420MW plant at its Bin Qasim site, a company’s official said. KE’s project manager, in a statement, said the company planned to replace its existing and old 420MW heavy fuel oil (HFO)-run power generation units with 900MW LNG-based combined cycle power generation units at Bin Qasim power station unit-1 (BQPS-1).

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

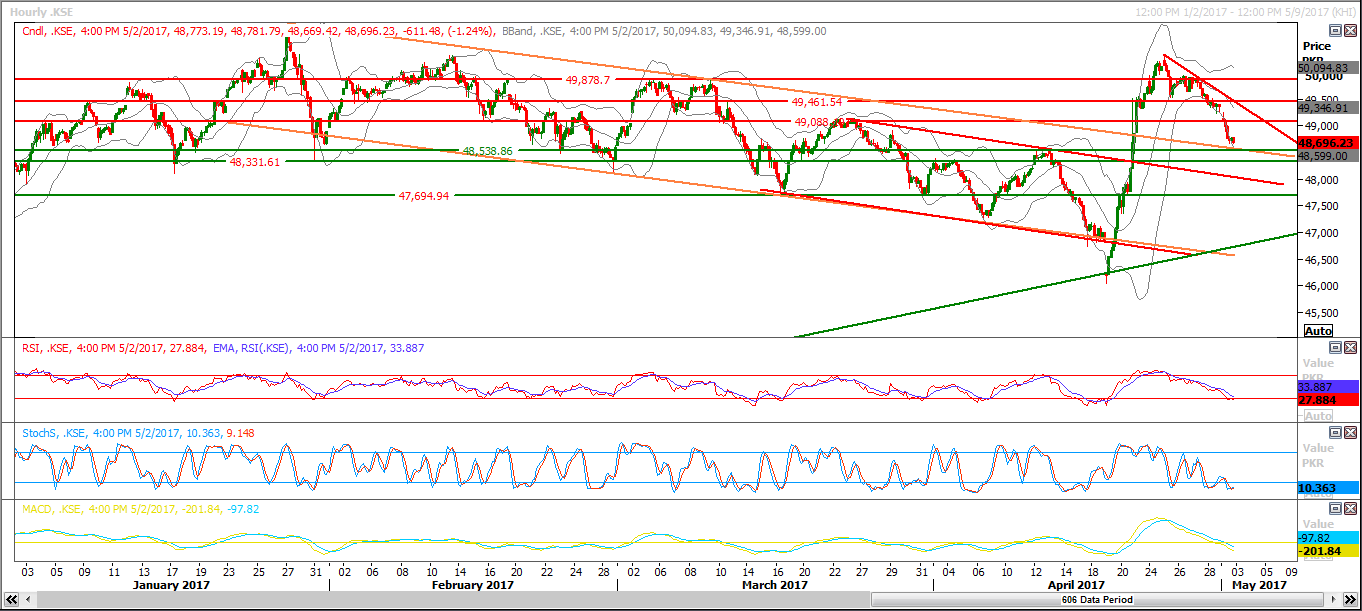

The Benchmark KSE100 index found support at 38.2% correction of its last bullish rally during the last trading session, but for current trading session it has a supportive region ahead at 48530 where it will take a breath if fresh volumes come in. However, penetration of 48530 will call for 48330 and 48210. New buying is not recommended until and unless it starts a reversal from any of its correction levels or supportive regions. If index bounces back from its correction levels at 48210 and 47700 then a new history high would be witnessed. However, a closing below 47700 will call for a new bearish trend towards 45460.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.