Previous Session Recap

Trading volume at PSX floor dropped by 0.14 million shares or 0.12%, DoD basis, whereas, the benchmark KSE100 Index opened at 40508.89, posted a day high of 40842.25 and a day low of 40353.48 during the last trading session. The session suspended at 40498.87 with a net change of 45.23 and net trading volume of 66.96 million shares. Daily trading volume of KSE100 listed companies increased by 3.45 million shares or 5.44%, DoD basis.

Foreign Investors remained in a net buying position of 1.86 million shares but net value of Foreign Inflow dropped by 0.04 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in a net buying positions of 0.05 and 4.63 million shares but Foreign Corporate Investors remained in a net selling position of 2.83 million shares. While on the other side Local Individuals and Banks remained in net selling positions of 15.07 and 0.79 million shares but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 4.47, 5.06, 2.54 and 1.46 million shares respectively.

Analytical Review

Asian shares advanced on Thursday after the U.S. Federal Reserve expressed optimism about the economy, virtually cementing the case for a year-end rate hike as investors awaited the formal nomination of the next head of the central bank. The White House plans to nominate current Fed Governor Jerome Powell as the next chair when Janet Yellen’s term expires in February, a source familiar with the matter said on Wednesday. Powell’s nomination is expected later on Thursday and would need to be confirmed by the Senate. Rising expectations that President Donald Trump will tap Powell, who is seen as more dovish on interest rates, have pressured U.S. Treasury yields and the dollar this week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.1 percent in early trading, moving back toward a 10-year peak scaled in the previous session. Japan's Nikkei stock index .N225 was up 0.2 percent, probing fresh 21-year highs and on track to gain 2.3 percent in a holiday-shortened week. Japanese markets will be closed for a national holiday on Friday.

The Bank of England on Thursday raised its main interest rate for the first time since 2007, or before the global financial crisis, as it tackles Brexit-fuelled inflation. Policymakers voted 7-2 to tighten borrowing costs to 0.50 percent from a record low of 0.25 percent, as a weak pound caused by Brexit uncertainty has hiked the cost of imports into Britain and in turn sent the country’s inflation rising far above the BoE''s target.The hotly-anticipated move mirrors policy tightening seen in the United States and euro zone as the global economy strengthens overall. "The time has come to ease our foot off a little from the accelerator," BoE Governor Mark Carney told a press conference following the decision. The minutes of the meeting showed that Carney himself voted for the rate hike.

Government is likely to face Rs70 billion in customs duty losses after a sudden change in auto policy that bounds overseas Pakistanis to pay levies on car exports to Pakistan in US dollars, industry officials said. Presidents of the Pak Japan Auto Association Javed Nazi and Pak Japan Business Council Rana Abid Hussain told The News that the Pakistani government allows import of used vehicles under personal baggage, transfer of residency and gift scheme.

Despite being a clean and cheaper source of energy, compressed natural gas (CNG) has been unable to beat the use of petrol, which continues to post sale and import records. Petrol imports hit a record high of 549,968 tons in September while its sales stood at 642,000 tones. Petrol sales reached their peak of 684,440 tons in August. In October, petrol imports were 447,128 tons while sales stood at 595,000 tones, an official of the Oil Companies Advisory Council (OCAC) said.

TThe Securities and Exchange Commission of Pakistan has barred stock market brokers from allowing or working with any person (freelancers/marketing agents/introducers), who provide fee/commission based services to get clients and promote their business, unless such persons has SECP''s valid registration/license as an agent. In this regard, SECP has issued circular 25 of 2017 here Thursday to the Pakistan Stock Exchange (PSX).According to the SECP, the Commission has observed during onsite inspections of Securities Brokers ("the brokers") that some of the brokers are operating through persons in the name of freelancers/marketing agents/introducers to get clients and promote their business. These persons are neither licensed as an agent of the broker nor are their business places approved as a branch office of the said broker.

Today OGDC, PPL and TRG may lead the market in the positive direction.

Technical Analysis

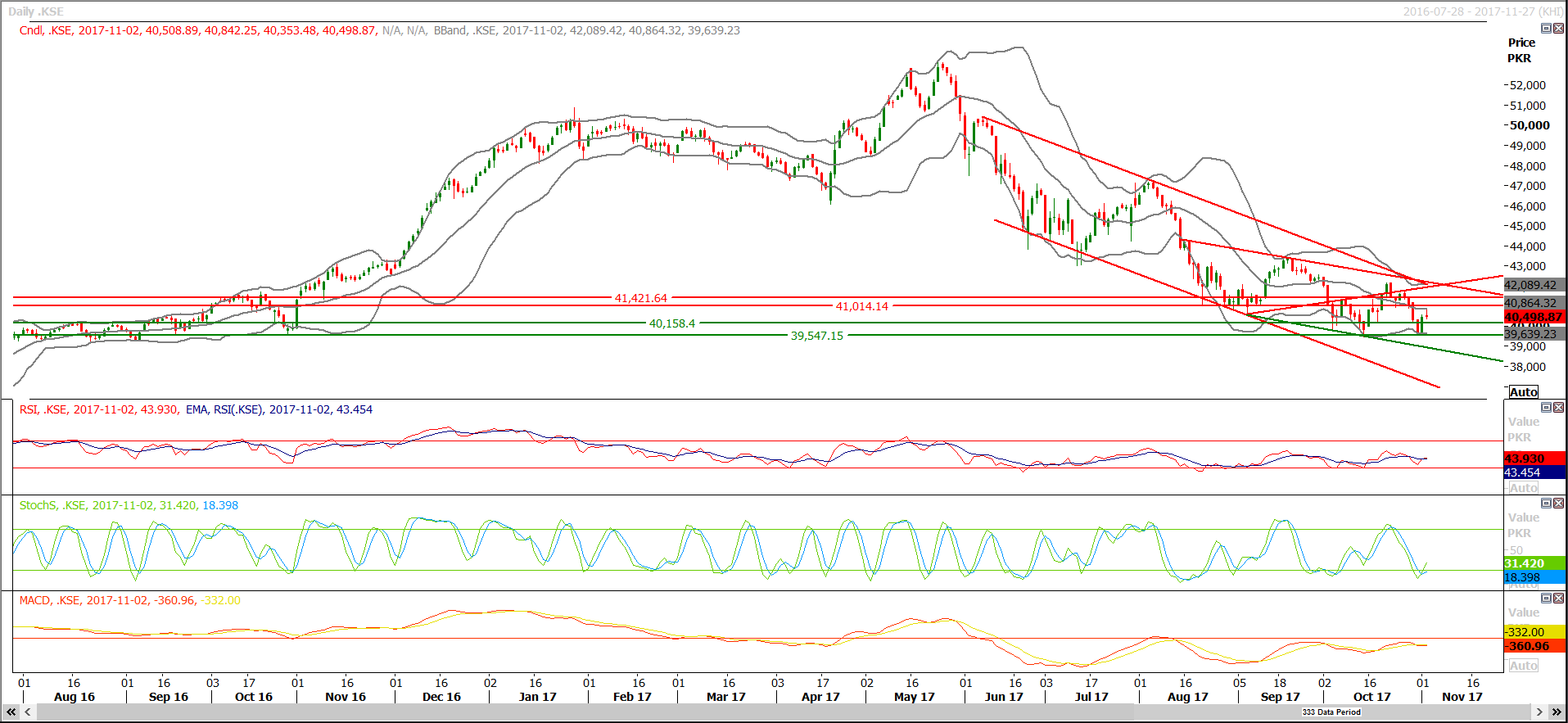

The Benchmark KSE100 Index has bounced back after testing 61.8% correction of its last rally and getting resistance from a horizontal resistance. As of right now Index has supportive regions at 40158 and 39547 while resistant regions are standing at 40800 and 41015. Daily and Weekly Stochastic and MAORSI are in bullish mode and these might try to push index in upward direction during the current trading session. Bullish momentum might strengthen if index gives a breakout of 40800 points otherwise it may start a reversal after posting a double top on the daily chart. It is also capped by a resistant trend line on hourly chart at 40800 therefore a cautious trading strategy is recommended for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.