Previous Session Recap

Trading volume at PSX floor dropped by 84.09 million shares or 48.61%,DoD basis, whereas, the benchmark KSE100 Index opened at 42431.54, posted a day high of 42434.82 and a day low of 41944.37 during the last trading session. The session suspended at 42018.90 with a net change of -390.37 points and net trading volume of 41.23 million shares. Daily trading volume of KSE100 listed companies dropped by 51.08 million shares or 55.33% on DoD basis.

Foreign Investors remained in a net selling position of 0.51 million shares and net value of Foreign Inflow dropped by 0.14 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.14 and 2.93 million shares but Foreign Coporate Investors remained in a net selling position of 3.59 million shares.On the other side Local Individuals, NBFCs, Mutual Funds and Brokers remained in net selling positions of 6.18, 0.39, 0.96 and 10.71 million shares respectively but Local Companies, Banks and Insurance Companies remained in net buying positions of 0.52, 16.29 and 3.21 million shares respectively.

Analytical Review

Asian shares tiptoed lower on Tuesday, pressured by weaker oil prices but supported by records on Wall Street and upbeat economic data that lifted U.S. Treasury yields and the dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.1 percent in early trade. Japan's Nikkei stock index .N225 added 0.3 percent, getting a tailwind from a weaker yen. Australian shares slipped 0.4 percent ahead of the Reserve Bank of Australia’s (RBA) policy decision. While no monetary steps are expected, investors will be looking to see if the central bank adopts a more hawkish bias.

Amid provincial concerns, the federal government’s push for gas sector reforms has accelerated since the elevation two months ago of Prime Minister Shahid Khaqan Abbasi from the minister for the erstwhile Ministry of Petroleum And Natural Resources. Under the gas sector reforms proposed by the World Bank, the federal government wants to divide two gas utilities — SSGCL and SNGPL — into at least five public-sector companies and to ultimately allow some private operators to enter the distribution sector. This also creates two different tiers of gas consumers — one based on local natural gas and the other on imported liquefied natural gas (LNG) — at two different prices.

According to the weekly statement of position of all scheduled banks for the week ended September 15, deposits and other accounts of all scheduled banks stood at Rs11,647.739bn after a 0.47pc increase over the preceding week’s figure of Rs11,593.328bn. Compared with last year’s corresponding figure of Rs10163.595bn, the current week’s figure was higher by 14.60pc. Deposits and other accounts of all commercial banks stood at Rs11,570.858bn against preceding week’s deposits of Rs11,519.695bn, showing a rise of 0.44pc. Total assets of all scheduled banks stood at Rs16,502.60bn, higher by 0.06pc over preceding week’s figure of Rs16,491.542bn.

The business community has feared that the proposed hike in the industrial and commercial power tariff will disrupt market equilibrium, as the government is going to raise average tariff of power distribution companies to Rs12.9 per unit from over Rs11 per unit, up by almost 18.5 percent. Pakistan Industrial and Traders Associations Front (PIAF) Chairman Irfan Iqbal Sheikh called for withdrawal of the whooping increase, suggesting to government to reconsider the decision to control the rapidly going up cost of doing business, which is actual reason of decline in export. The rise in average tariff of power distribution companies is also aimed at passing on Rs118 billion to the consumers. Previously, the Nepra had determined average tariff of Rs10.9 per unit for 2015-16 which was recently increased by 4.4 percent to Rs11.38 per unit. However, now it will jump to Rs12.9 per unit.

After serious efforts of Sindh Chief Minister Syed Murad Ali Shah the federal government has finally approved 3.5 mmcf gas for Special Economic Zone (SEZ) Khairpur. The Board of Investment (BOI) Chairman Miftah Ismail, who called on the Sindh chief minister at the CM House, told him that his efforts have produced results and 3.5 mmcf gas has been approved for SEZ Khairpur. The chief minister said that the SEZ Khairpur is located on main National Highway at Khairpur. "It is on the best location and its entire infrastructure has been developed, only gas was required to formally launch it," he said and added that it would strengthen provincial economy and generate employment opportunities.

Today ISL, NCL and STPL may lead the market in the positive direction.

Technical Analysis

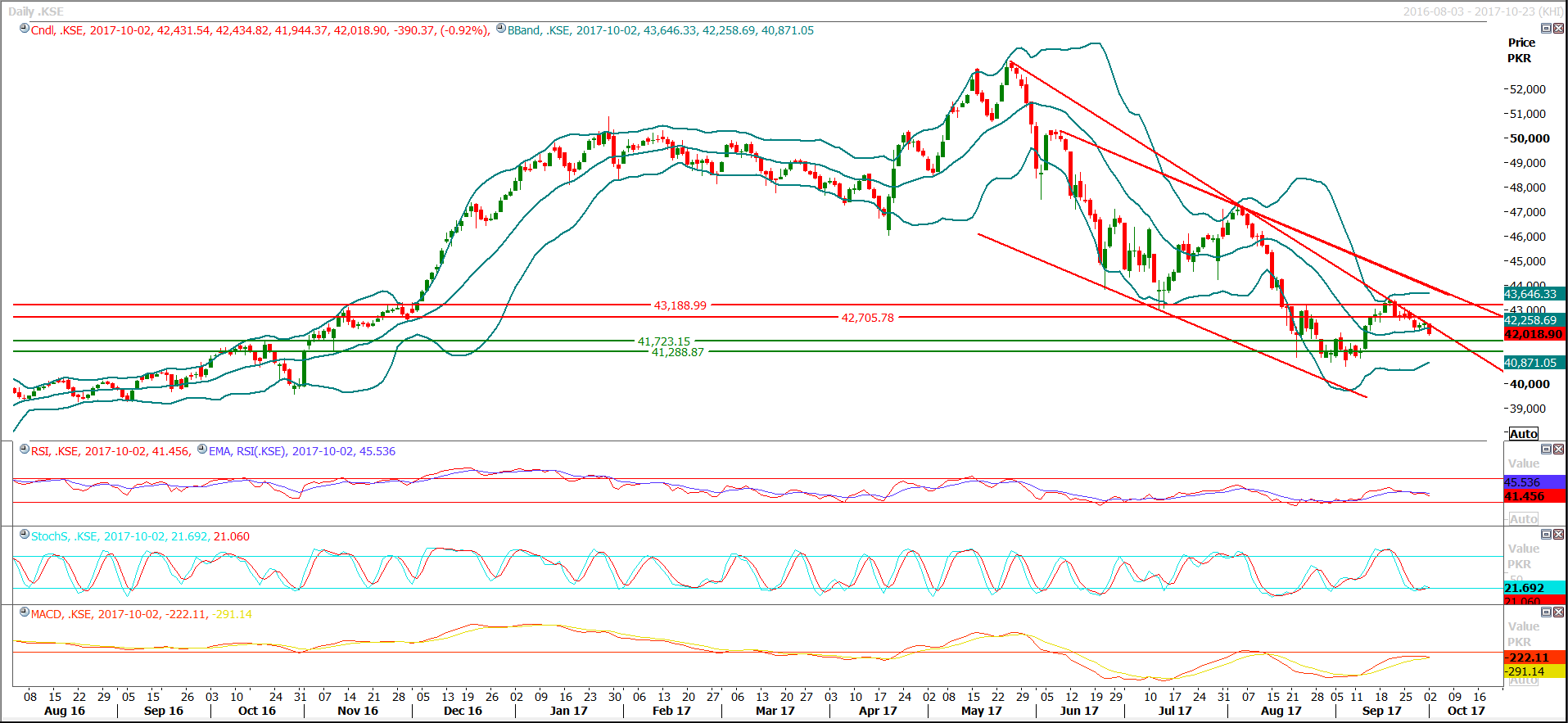

The Benchmark KSE100 Index has penetrated its major support and right now it is capped by a resistant trend line on the daily and hourly chart. Last hope for bulls is standing at 41700 and breakout of that region might call for a freefall of around 1000-1500 points towards 40500 and 40000. Weekly stochastic is ready for a bearish crossover which might add pressure to bearish momentum if index closes below 41700. For the current trading session selling on strength is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.