Previous Session Recap

Trading volume at PSX floor increased by 0.25 million shares or 023% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,974.07, posted a day high of 41,210.45 and a day low of 40,747.09 during last trading session. The session suspended at 40,800.25 with net change of -129.19 and net trading volume of 66.60 million shares. Daily trading volume of KSE100 listed companies dropped by 4.89 million shares or 6.84% on DoD basis.

Foreign Investors remain in net selling positions of 5.33 million shares and net value of Foreign Inflow dropped by 4.69 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistanis investors remained in net selling positions of 0.07, 4.36 and 0.90 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 0.17, 0.43, 0.87, 0.17, 0.48, 1.38 and 0.92 million shares.

Analytical Review

Asian shares ease, euro near six-week lows on Italian woes; gold jumps

Asian shares ticked down on Wednesday and the euro held at six-week lows as Italy’s mounting debt and Rome’s budget plan set it on a collision course with the European Union. Japan’s Nikkei eased 0.5 percent on a stronger yen. Australian shares gained 0.3 percent while New Zealand’s benchmark index fell 0.2 percent. E-Minis for the S&P 500 were a shade softer as were Dow futures. Investors remained jittery even as a new U.S.-Mexico-Canada trade agreement appeared to ease global trade tensions. A controversial clause in the trilateral pact put the focus back on the Sino-U.S. tariff dispute. China’s financial markets are closed for the National Day holiday and will resume trade on Oct. 8. The markets in the world’s second biggest economy have taken a hammering this year as investors fretted the trade dispute could put a significant dent on growth.

By-elections: Govt again delays power tariff hike

The PTI-led coalition government on Tuesday once again delayed the increase in electricity tariff apparently due to upcoming by-elections. The Economic Coordination Committee (ECC) of the Cabinet, which met under the chair of Finance Asad Umar, considered the proposal regarding tariff rationalization for power sector. However, it was deferred on the request from the Finance and Power Divisions which asked for further time to deliberate the proposed revisions.

BISE, Karandaaz to ensure economic uplift of beneficiaries

The Benazir Income Support Programme and Karandaaz Pakistan Tuesday entered into an agreement under which the latter would support the BISP’s efforts to catalyse economic empowerment of its beneficiaries. Karandaaz will conduct an assessment of BISP and its various programmes of government to person (G2P) payments and develop recommendations encompassing the operational, functional, and policy aspects of BISP.

ADB shows interest in upgradation of PR

Asian Development Bank (ADB) delegation, headed by Ko Sakamovo, Transport Specialist, Tuesday visited Ministry of Railways and showed interest in upgradation of Pakistan Railways (PR) as it is providing technical assistance to PR through Pakistan Railways Strategic Plan (PRSP). The PR has shown interest if ADB can help in replacing its old fleet of locomotives in next 10 years and procurement of passenger and freight wagons. The PR also showed interest in upgrading ML 2, ML 3, branch lines (Shangla and Shorkot section) and connectivity of Gawader to Besima through railway line.

Cement sector pre-tax profits down by 36pc

While net earnings of the cement industry are up by 45 percent annually in 4QFY18, pre-tax profits have fallen by 36 percent to a four-year low of Rs11 billion. Industry experts from Topline observed in a report that industry’s dispatches during 4QFY18 were up 10 percent led by 7 percent increase in local dispatches and 39 percent increase in exports. Exports grew thanks to currency devaluation, additional production from new capacities in South and higher clinker sales to regional countries on the back of closure of some clinker production lines in China owing to strict environmental regulation.

Asian shares ticked down on Wednesday and the euro held at six-week lows as Italy’s mounting debt and Rome’s budget plan set it on a collision course with the European Union. Japan’s Nikkei eased 0.5 percent on a stronger yen. Australian shares gained 0.3 percent while New Zealand’s benchmark index fell 0.2 percent. E-Minis for the S&P 500 were a shade softer as were Dow futures. Investors remained jittery even as a new U.S.-Mexico-Canada trade agreement appeared to ease global trade tensions. A controversial clause in the trilateral pact put the focus back on the Sino-U.S. tariff dispute. China’s financial markets are closed for the National Day holiday and will resume trade on Oct. 8. The markets in the world’s second biggest economy have taken a hammering this year as investors fretted the trade dispute could put a significant dent on growth.

The PTI-led coalition government on Tuesday once again delayed the increase in electricity tariff apparently due to upcoming by-elections. The Economic Coordination Committee (ECC) of the Cabinet, which met under the chair of Finance Asad Umar, considered the proposal regarding tariff rationalization for power sector. However, it was deferred on the request from the Finance and Power Divisions which asked for further time to deliberate the proposed revisions.

The Benazir Income Support Programme and Karandaaz Pakistan Tuesday entered into an agreement under which the latter would support the BISP’s efforts to catalyse economic empowerment of its beneficiaries. Karandaaz will conduct an assessment of BISP and its various programmes of government to person (G2P) payments and develop recommendations encompassing the operational, functional, and policy aspects of BISP.

Asian Development Bank (ADB) delegation, headed by Ko Sakamovo, Transport Specialist, Tuesday visited Ministry of Railways and showed interest in upgradation of Pakistan Railways (PR) as it is providing technical assistance to PR through Pakistan Railways Strategic Plan (PRSP). The PR has shown interest if ADB can help in replacing its old fleet of locomotives in next 10 years and procurement of passenger and freight wagons. The PR also showed interest in upgrading ML 2, ML 3, branch lines (Shangla and Shorkot section) and connectivity of Gawader to Besima through railway line.

While net earnings of the cement industry are up by 45 percent annually in 4QFY18, pre-tax profits have fallen by 36 percent to a four-year low of Rs11 billion. Industry experts from Topline observed in a report that industry’s dispatches during 4QFY18 were up 10 percent led by 7 percent increase in local dispatches and 39 percent increase in exports. Exports grew thanks to currency devaluation, additional production from new capacities in South and higher clinker sales to regional countries on the back of closure of some clinker production lines in China owing to strict environmental regulation.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

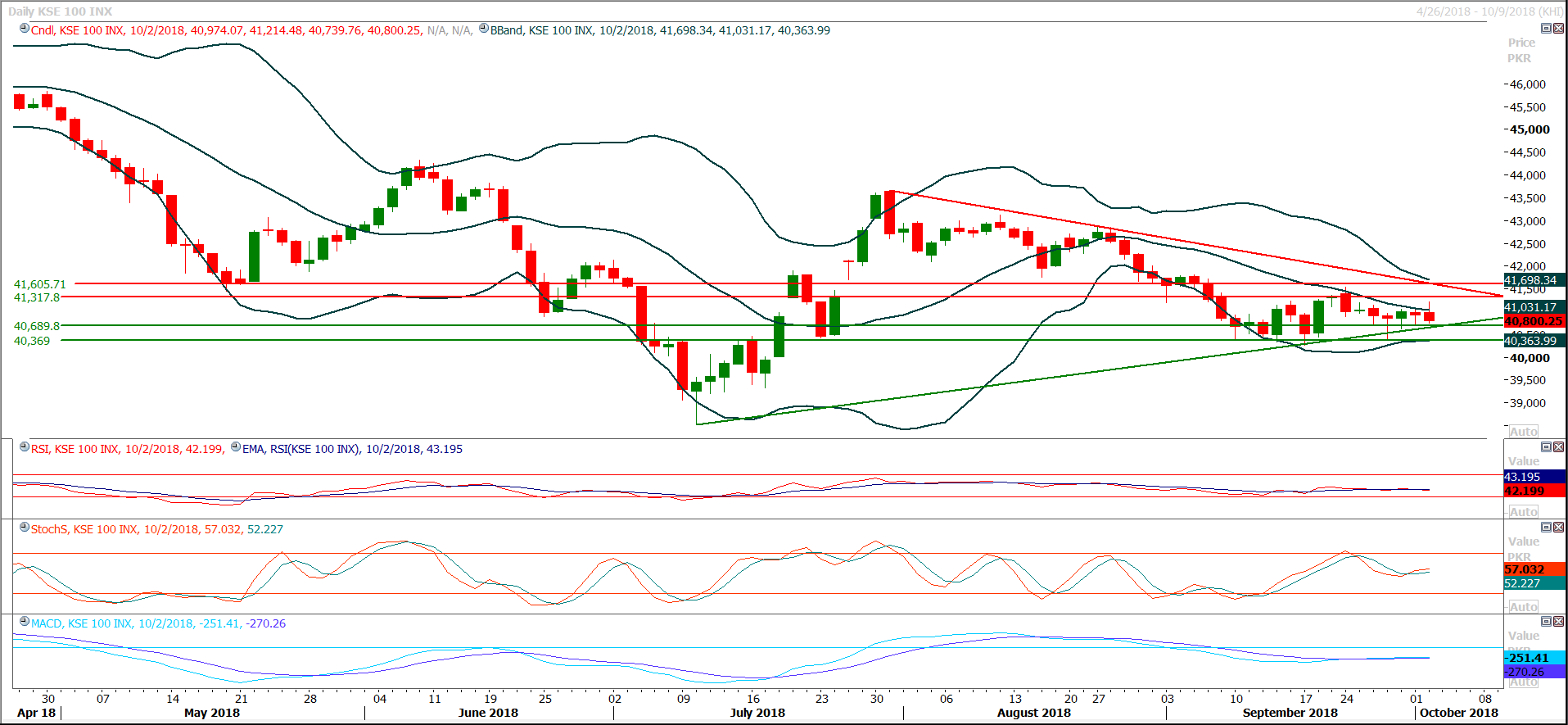

The Benchmark KSE100 index is caged in a triangle on daily chart and it’s also not becoming able to recover above 61.8% correction of last bearish rally which was started from 41,533 and ended up at 40,383 points. As of now daily momentum indicators are mixed and index is showing an uncertain behavior until it close above 41,300 or below 40,660 points therefore it’s recommended to stay cautious and adopt swing trading strategy with strict stop loss. Index have once again touched the supportive region on daily chart and it would become a little bit difficult for index to penetrate 41,110 points in first go therefore for short positions selling below 41,110 with strict stop loss of 41,300 points could be initiated.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.