Previous Session Recap

Trading volume at PSX floor dropped by 31.67 million shares or 16.54% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,888.23, posted a day high of 42,006.03 and a day low of 41,626.70 during last trading session. The session suspended at 41,742.24 with net change of -121.28 and net trading volume of 88.50 million shares. Daily trading volume of KSE100 listed companies increased by 2.57 million shares or 2.99% on DoD basis.

Foreign Investors remain in net buying positions of 1.31 million shares but net value of Foreign Inflow dropped by 0.63 million US Dollars. Categorically Foreign Individuals and Foreign Corporate remained in net buying positions of 0.01 and 1.70 million shares but Overseas Pakistanis investors remained in net selling positions of 0.41 million shares. While on the other side Local Individuals and Mutual Fund remained in net selling positions of 3.35 and 3.88 million shares respectively but Local Companies, Banks, NBFCs, Brokers and Insurance Companies and remained in net buying positions of 0.14, 0.58, 0.35, 1.79 and 3.35 million shares.

Analytical Review

Asian stocks dip on trade, emerging market woes

Asian stocks dipped on Monday on worries about further escalation of the U.S-China trade war and unstable emerging market currencies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.2 percent while Japan's Nikkei .N225 fell 0.4 percent though trade could be subdued due to a U.S. market holiday on Monday. “It looks almost certain that Trump will impose 25 percent tariffs on $200 billion worth of imports from China,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. Trump said last week he is ready to implement the new tariffs as soon as a public comment period on the plan ends on Thursday, which would be a major escalation after it has applied already tariffs on $50 billion of exports from China. Shanghai shares .SSEC fell 5.3 percent last month on worries about the trade war while U.S. shares, especially technology shares, have fared better thanks in part due to the strength of the current economic data and corporate profits. The Nasdaq index .IXIC gained 5.7 percent last month.

Over 0.231 million cars manufactured in FY2018

The production of cars and jeeps witnessed 21.35 percent increase during the fiscal year 2017-18 against the output of the same period of last fiscal year, Pakistan Bureau of Statistics (PBS) reported. As many as 231,138 jeeps and cars were manufactured during July-June (2017-18) against the production of 190,466 units during July-June (2016-17), showing growth of 21.35 percent. The production of light commercial vehicles (LCVs) witnessed an increase of 19.74 percent in production during the period under review by growing from 24,265 units last year to 29,055 LCVs during 2017-18. The production of motorcycles during the period under review increased by 12.97 percent by growing from the output of 2,500,650 units last year to 2,825,073 units during 2017-18.

US withdraws $300m in aid to Pakistan

The US military said it has made a final decision to cancel $300 million in aid to Pakistan that had been suspended over Islamabad’s perceived failure to take decisive action against militants, in a new blow to deteriorating ties."

Businessmen for focusing on major economic issues

The business community on Sunday demanded the new government to immediately focus on major economic issues, especially enhancing exports. Businessmen representatives also called for formulating as well as implementing an effective industrial policy with major focus on lowering cost of doing business. FPCCI former president and UBG chairman Iftikhar Malik said that circular debt, trade deficit, discouraging exports, rupee devaluation, water shortage and miseries of industrial sector have led to stagnant growth in Pakistan. He added that the new government must have to address these issues through good economic reforms in consultation with the real stakeholders. He said that Pakistan has all resources to become an economic giant, but setting directions with zeal, courage and sincerity is the need of the hour.

Petrol price slashed by Rs 2.41, diesel”s by Rs 6.37

The federal government on Monday reduced the prices of all petroleum products for the month of September. Finance Division has notified the new prices of petroleum products with effect from 1st September to the end of September. The government has reduced the price of MS petrol by Rs 2.41 per litre to Rs 92.83 per litre from Rs 95.24 per litre and High Speed Diesel (HSD) by Rs 6.37 per litre to Rs 106.57 from Rs 112.94 per litre.

Asian stocks dipped on Monday on worries about further escalation of the U.S-China trade war and unstable emerging market currencies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.2 percent while Japan's Nikkei .N225 fell 0.4 percent though trade could be subdued due to a U.S. market holiday on Monday. “It looks almost certain that Trump will impose 25 percent tariffs on $200 billion worth of imports from China,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. Trump said last week he is ready to implement the new tariffs as soon as a public comment period on the plan ends on Thursday, which would be a major escalation after it has applied already tariffs on $50 billion of exports from China. Shanghai shares .SSEC fell 5.3 percent last month on worries about the trade war while U.S. shares, especially technology shares, have fared better thanks in part due to the strength of the current economic data and corporate profits. The Nasdaq index .IXIC gained 5.7 percent last month.

The production of cars and jeeps witnessed 21.35 percent increase during the fiscal year 2017-18 against the output of the same period of last fiscal year, Pakistan Bureau of Statistics (PBS) reported. As many as 231,138 jeeps and cars were manufactured during July-June (2017-18) against the production of 190,466 units during July-June (2016-17), showing growth of 21.35 percent. The production of light commercial vehicles (LCVs) witnessed an increase of 19.74 percent in production during the period under review by growing from 24,265 units last year to 29,055 LCVs during 2017-18. The production of motorcycles during the period under review increased by 12.97 percent by growing from the output of 2,500,650 units last year to 2,825,073 units during 2017-18.

The US military said it has made a final decision to cancel $300 million in aid to Pakistan that had been suspended over Islamabad’s perceived failure to take decisive action against militants, in a new blow to deteriorating ties."

The business community on Sunday demanded the new government to immediately focus on major economic issues, especially enhancing exports. Businessmen representatives also called for formulating as well as implementing an effective industrial policy with major focus on lowering cost of doing business. FPCCI former president and UBG chairman Iftikhar Malik said that circular debt, trade deficit, discouraging exports, rupee devaluation, water shortage and miseries of industrial sector have led to stagnant growth in Pakistan. He added that the new government must have to address these issues through good economic reforms in consultation with the real stakeholders. He said that Pakistan has all resources to become an economic giant, but setting directions with zeal, courage and sincerity is the need of the hour.

The federal government on Monday reduced the prices of all petroleum products for the month of September. Finance Division has notified the new prices of petroleum products with effect from 1st September to the end of September. The government has reduced the price of MS petrol by Rs 2.41 per litre to Rs 92.83 per litre from Rs 95.24 per litre and High Speed Diesel (HSD) by Rs 6.37 per litre to Rs 106.57 from Rs 112.94 per litre.

Market is expected to remain volatile therefore its recommended to trade cautiously.

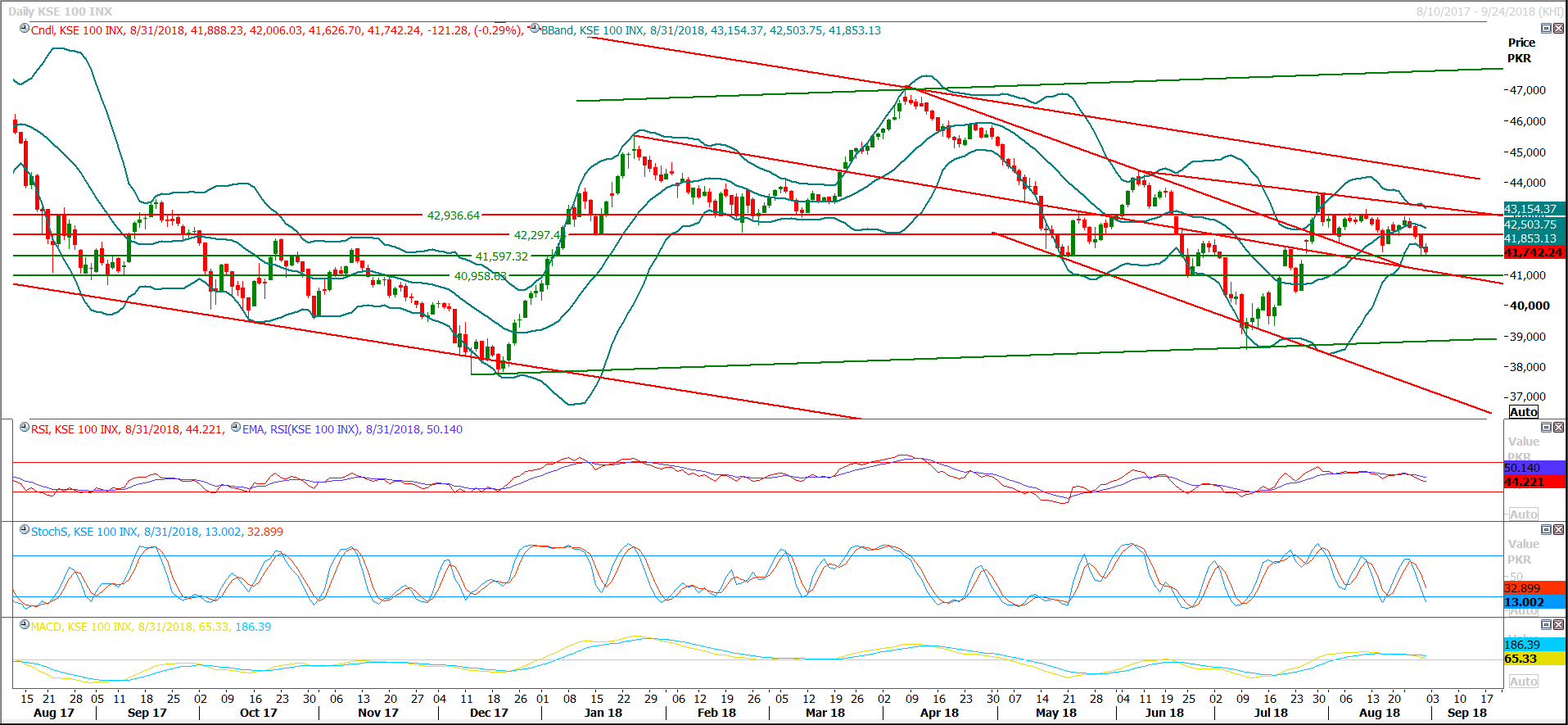

Technical Analysis

The Benchmark KSE100 Index is moving gradually towards its targets on daily chart and right now it’s about to complete expansion of its latest bearish correction which falls on a supportive trend line, but before that it would also find some ground at 41,500 points and if index would succeed in sliding below that region then next targets would be 41,000 and 40,500 points. Bollinger Band on daily chart has squeezed and it needs a lot of volume to expand its deviation lines therefore some extraordinary volatility could be witnessed during current trading session. Momentum indicators are still not supporting bulls and pressure on weekly chart have increased because during last trading session index have closed the week with a clear crossovers of Stochastic and MAORSI in bearish direction. For current trading session index would face resistance at 42,000 and 42,300 points while on the other side supportive regions could resist against current bearish pressure at 41,550 and 41,430 points. Its recommended to wait for a clear breakout of either side before initiating long or short term positions in any direction.

ATRL, PAEL, PSO, ISL and SNGP may try to lead the bearish momentum during current trading session because they have just confirmed their bearish momentum during last trading session. As all these scripts are moving downward after retesting their resistant regions therefore it’s expected that they would try to slide below their respective supports therefore its recommended to start selling them on strength with strict stop loss. TRG, SSGC and DGKC are trying to bounce back from their supportive regions therefore they can be bought in chunks with strict stop loss.

ATRL, PAEL, PSO, ISL and SNGP may try to lead the bearish momentum during current trading session because they have just confirmed their bearish momentum during last trading session. As all these scripts are moving downward after retesting their resistant regions therefore it’s expected that they would try to slide below their respective supports therefore its recommended to start selling them on strength with strict stop loss. TRG, SSGC and DGKC are trying to bounce back from their supportive regions therefore they can be bought in chunks with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.