Previous Session Recap

Trading volume at PSX floor dropped by 32.52 million shares or 29.57% on DoD basis, whereas the benchmark KSE100 index opened at 29,672.12, posted a day high of 30,178.57 and a day low of 29,672.12 points during last trading session while session suspended at 30,057.29 points with net change of 385.17 points and net trading volume of 48.17 million shares. Daily trading volume of KSE100 listed companies dropped by 37.75 million shares or 43.94% on DoD basis.

Foreign Investors remained in net selling positions of 3.57 million shares and net value of Foreign Inflow dropped by 1.54 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net selling positions of 1.14 and 3.56 million shares. While on the other side Local Individuals and NBFCs remained in net long positions of 3.8 and 5.0 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 3.32, 0.18, 0.34, 1.71 and 1.08 million shares respectively.

Analytical Review

Asia stocks dented by trade war, Brexit showdown paralyzes pound

Global stocks faced headwinds on Tuesday, stymied by U.S.-China trade frictions while the British pound flirted with 2 1/2-year lows as Prime Minister Boris Johnson indicated he could call an election to block lawmakers’ efforts to avert a no-deal Brexit. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shed 0.3% while Japan's Nikkei .N225 rose by 0.1%. China's mainland shares .CSI300 were fractionally lower while Hong Kong's benchmark edged up 0.1% .HSI. The United States began imposing 15% tariffs on a variety of Chinese goods on Sunday and China began imposing new duties on U.S. crude oil, the latest escalation in their trade war.

Rs210bn GIDC write-off is ‘no free lunch’, says Omar

The government on Monday defended its decision to write off about Rs210 billion to big businesses out of their outstanding Rs420bn bills on account of Gas Infrastructure Development Cess (GIDC), saying it gave up ‘uncertain’ past bills to secure a lower but more certain future revenue stream. “It is not a free lunch to fertiliser or any other sector,” said Energy Minister Omar Ayub Khan at a hurriedly called joint news conference with Special Assistant to Prime Minister on Petroleum Nadeem Babar who said the GIDC waiver ordinance was drawn up on the pattern of GIDC (Amendment) Act introduced by the PML-N government for a similar settlement with the CNG sector.

Banks attract Rs690bn in fresh deposits

Improved returns following a sustained increased in policy rate has helped attract fresh rupee deposits of Rs690 billion this year for banks, while reducing the appetite of greenback deposits for domestic investors. Bankers said deposits of rupee have proved attractive as compared to those in dollars since the two currencies have substantial difference in returns. The State Bank of Pakistan has been increasing the interest rates for more than a year as they currently stand at 13.25 per cent, making rupee deposits an attractive avenue. Between January and July, rupee deposits of banks have increased by Rs690bn to Rs13.747 trillion, according to latest data of the State Bank of Pakistan.

Exporters get Rs22bn refunds via new system

The Federal Board of Revenue (FBR) on Monday released Rs22 billion of verified sales tax refunds to exporters through the newly installed Fully Automated Sales Tax e-Refund (FASTER) system. The first payment through FASTER module against the refund claims for July has been made and the State Bank of Pakistan confirmed the credit of refund amount in the claimants’ bank accounts, the FBR said. Adviser to the Prime Minister on Finance Dr Hafeez Shaikh took to his twitter account to share the decision that the government has taken important decisions on tax refunds “for the promotion of economic activity in the country and to provide liquidity support to businesses.”

Power firms seek tariff hike for July

The ex-Wapda Distribution companies (Discos) have sought about Rs1.93 per unit increase in consumer tariff on account of monthly fuel price adjustment due to higher than estimated power generation cost. The National Electric Power Regulatory Authority (Nepra) will take up for public hearing on September 4 a petition for increase in consumer tariff for ex-Wapda distribution companies (Discos) on account of fuel cost adjustment of electricity consumed in July. The higher electricity rates, on approval by the regulator, would be recovered from consumers in the upcoming billing month. The Central Power Purchasing Agency (CPPA) on behalf of Discos claimed an additional cost of Rs1.93 per unit under base tariff 2015-16.

Global stocks faced headwinds on Tuesday, stymied by U.S.-China trade frictions while the British pound flirted with 2 1/2-year lows as Prime Minister Boris Johnson indicated he could call an election to block lawmakers’ efforts to avert a no-deal Brexit. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shed 0.3% while Japan's Nikkei .N225 rose by 0.1%. China's mainland shares .CSI300 were fractionally lower while Hong Kong's benchmark edged up 0.1% .HSI. The United States began imposing 15% tariffs on a variety of Chinese goods on Sunday and China began imposing new duties on U.S. crude oil, the latest escalation in their trade war.

The government on Monday defended its decision to write off about Rs210 billion to big businesses out of their outstanding Rs420bn bills on account of Gas Infrastructure Development Cess (GIDC), saying it gave up ‘uncertain’ past bills to secure a lower but more certain future revenue stream. “It is not a free lunch to fertiliser or any other sector,” said Energy Minister Omar Ayub Khan at a hurriedly called joint news conference with Special Assistant to Prime Minister on Petroleum Nadeem Babar who said the GIDC waiver ordinance was drawn up on the pattern of GIDC (Amendment) Act introduced by the PML-N government for a similar settlement with the CNG sector.

Improved returns following a sustained increased in policy rate has helped attract fresh rupee deposits of Rs690 billion this year for banks, while reducing the appetite of greenback deposits for domestic investors. Bankers said deposits of rupee have proved attractive as compared to those in dollars since the two currencies have substantial difference in returns. The State Bank of Pakistan has been increasing the interest rates for more than a year as they currently stand at 13.25 per cent, making rupee deposits an attractive avenue. Between January and July, rupee deposits of banks have increased by Rs690bn to Rs13.747 trillion, according to latest data of the State Bank of Pakistan.

The Federal Board of Revenue (FBR) on Monday released Rs22 billion of verified sales tax refunds to exporters through the newly installed Fully Automated Sales Tax e-Refund (FASTER) system. The first payment through FASTER module against the refund claims for July has been made and the State Bank of Pakistan confirmed the credit of refund amount in the claimants’ bank accounts, the FBR said. Adviser to the Prime Minister on Finance Dr Hafeez Shaikh took to his twitter account to share the decision that the government has taken important decisions on tax refunds “for the promotion of economic activity in the country and to provide liquidity support to businesses.”

The ex-Wapda Distribution companies (Discos) have sought about Rs1.93 per unit increase in consumer tariff on account of monthly fuel price adjustment due to higher than estimated power generation cost. The National Electric Power Regulatory Authority (Nepra) will take up for public hearing on September 4 a petition for increase in consumer tariff for ex-Wapda distribution companies (Discos) on account of fuel cost adjustment of electricity consumed in July. The higher electricity rates, on approval by the regulator, would be recovered from consumers in the upcoming billing month. The Central Power Purchasing Agency (CPPA) on behalf of Discos claimed an additional cost of Rs1.93 per unit under base tariff 2015-16.

Market is expected to remain volatile during current trading session.

Technical Analysis

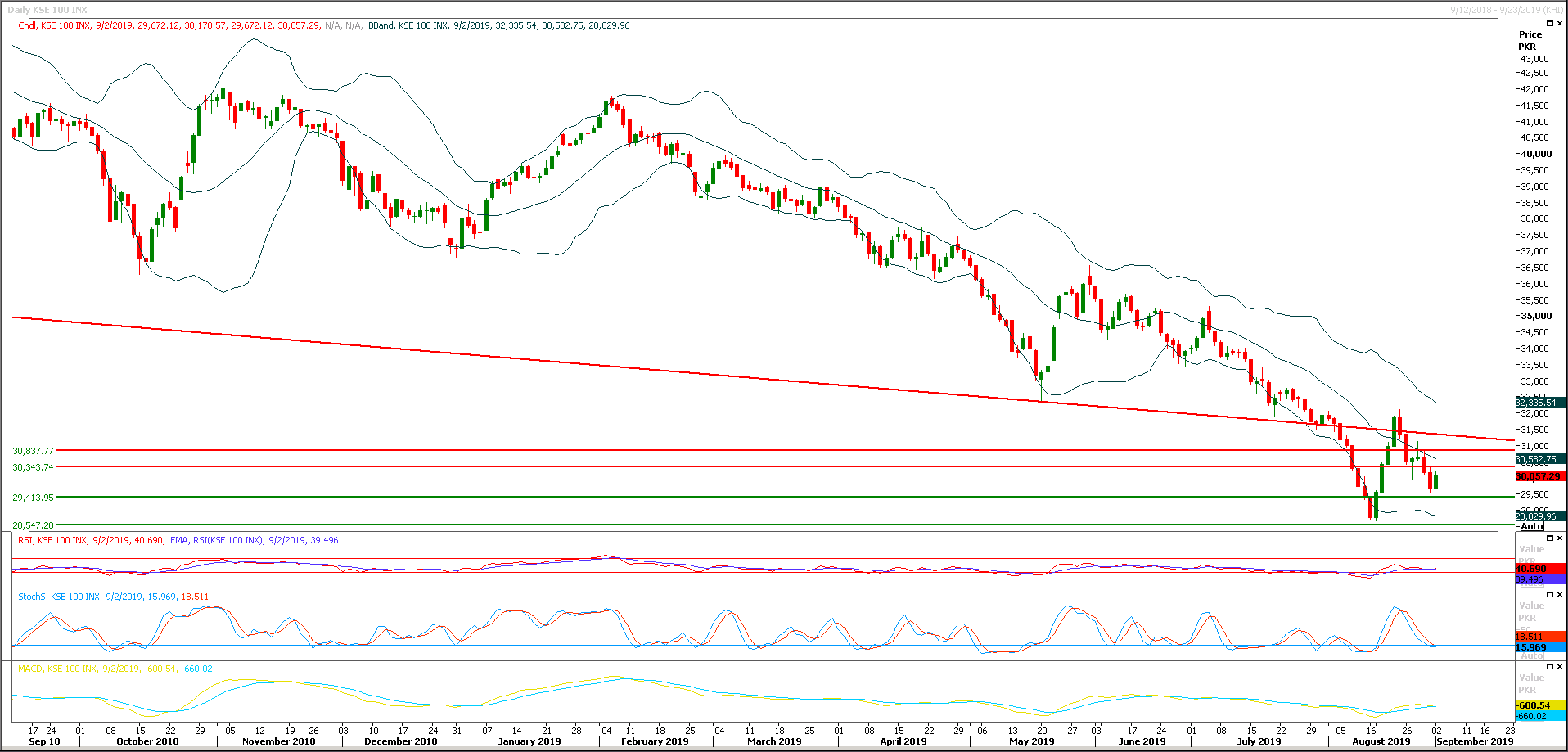

The Benchmark KSE100 index have tried to bounce back during last trading session and it have created piercing line on daily chart which indicates start of a bullish reversal but index have a major resistant regions ahead at 30,350 and 30,860 while 31,200 points would try to react as a pivotal value on short term basis, but on bearish side it have supportive regions standing at 29,400 and 29,000 points. As of now it's recommended to practice caution while trading during current trading session because it's expected that index would got a push back in bearish direction before 30,500 or 30,860 points and it may continue its bearish rally in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.