Previous Session Recap

Trading volume at PSX floor increased by 20.12 million shares or 7.67% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,744.57, posted a day high of 46,057.53 and a day low of 45,692.02 during last trading session. The session suspended at 46,013.34 with net change of 271.91 and net trading volume of 135.74 million shares. Daily trading volume of KSE100 listed companies increased by 7.56 million shares or 5.9% on DoD basis.

Foreign Investors remained in net selling position of 0.42 million shares and net value of Foreign Inflow dropped by 2.1 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.14 and 1.5 million shares but Overseas Pakistanis remained in net buying position of 1.23 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net selling positions of 0.46, 5.29 and 9.15 million shares respectively but Local Companies, Banks, NBFCs and Mutual Funds remained in net buying positions of 9.65, 1.23, 3.8 and 2.96 million shares respectively.

Analytical Review

Asia shares fail to bounce with Wall St. as trade fears lurk

Asian share markets faltered on Wednesday as simmering fears of a Sino-U.S. trade war overshadowed a bounce on Wall Street and left investors reluctant to take positions in anything. For now, caution was the watchword and MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was wavering either side of flat. Japan's Nikkei .N225 added 0.1 percent in thin volumes, while South Korea .KS11 eased 0.2 percent. EMini futures for the S&P 500 ESc1 also dipped 0.2 percent. Safe-haven bonds, gold and the yen had run into selling as Wall Street benefited from bets that President Donald Trump’s Twitter attacks on Amazon would not translate to actual policy. Yet trade worries weren’t far away. Late on Tuesday, the Trump administration announced 25 percent tariffs on $50 billion of annual imports from China, covering around 1,300 industrial technology, transport and medical products.

PM likely to seek China’s help in maintaining forex reserves

Prime Minister Shahid Khaqan Abbasi is likely to seek support from China during his upcoming visit to Beijing to sustain the depleting foreign exchange reserves of the country. "Prime Minister will visit to China within this month where he may look for Chinese assistance that can be in shape of parking some amount in central bank of Pakistan," said an official of the Ministry of Finance. He further said that government desperately needing $3 billion to finance the previous loans and current account deficit before June this year. "The government can request the Chinese government either to provide some loan or to keep money into State Bank of Pakistan for some time in order to build Pakistan's foreign exchange reserves," he said. Reserves held by State Bank of Pakistan (SBP) are sharply depleting from last one and half year and reached to $11.8 billion last week. The official informed that government has another option of borrowing from the commercial banks. Pakistan had already borrowed $1.78 billion from the commercial banks during eight months (July-February) of the current fiscal year.

Ginneries get 11.571m cotton bales

Over 11.571 million bales of cotton have arrived at various ginneries till March across the country showing an increase of 7.88 percent as compared to 10.725 million bales of last season, said a fortnightly report on Tuesday. The report was released by Pakistan Cotton Ginners Association (PCGA) with cooperation of All Pakistan Textile Mills Association (APTMA) and Karachi Cotton Association (KCA). According to the report, in the major cotton producing province of Punjab, total cotton arrivals increased by 5.46 percent year-on-year to 73,17,73 bales. In Sindh province, cotton arrivals increased 12.31 percent to 4.253 million bales. Of which 1,10,84,233 million bales were sold, leaving an unsold stock of 4,86,963 bales with the ginners. The textile mills in Pakistan consumed 10.867 million bales, while surplus cotton was sold to exporters, according to the data.

Punjab collects Rs75b in 9 months

The Punjab Revenue Authority has collected a revenue of Rs75 billion during first nine months of the current fiscal year, which is 50 percent higher for the corresponding period. These remarks were stated by PRA Chairman Dr Raheal Ahmed Siddiqui at an event conducted at a local hotel as part of Tax Day celebrations. The event was also attended by Javed Ahmed (Member Operation PRA), Ali Mansoor (Commissioner Appeal PRA), Aman Anwar Kadwai (Additional Commissioner PRA), Salman Zafar (Director IT PRA) and delegates of Institute of Chartered Accounts of Pakistan, Pakistan Tax Bar, Lahore Chamber of Commerce and Industry, Overseas Investors of Commerce & Industry, Department of International Development, Pakistan Business Council and delegation from all provincial authorities including the FBR.

ICCI for withdrawing hike in tax on POL products

Islamabad Chamber of Commerce and Industry (ICCI) has called upon the government to immediately withdraw hike in sales tax on some POL products as it would put additional burden on consumers and enhance the cost of doing business in the country. ICCI President Sheikh Amir Waheed urged that government to pass on full benefits of educed oil prices in international market to the consumers. In a press statement, he said that FBR vide its SRO No.414(1)/2018 issued on 31st March 2018 has further enhanced sales tax on motor spirit from 17 percent to 21.5 percent and on high speed diesel oil from 25.5 percent to 27.5 percent which was not justified.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Asian share markets faltered on Wednesday as simmering fears of a Sino-U.S. trade war overshadowed a bounce on Wall Street and left investors reluctant to take positions in anything. For now, caution was the watchword and MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was wavering either side of flat. Japan's Nikkei .N225 added 0.1 percent in thin volumes, while South Korea .KS11 eased 0.2 percent. EMini futures for the S&P 500 ESc1 also dipped 0.2 percent. Safe-haven bonds, gold and the yen had run into selling as Wall Street benefited from bets that President Donald Trump’s Twitter attacks on Amazon would not translate to actual policy. Yet trade worries weren’t far away. Late on Tuesday, the Trump administration announced 25 percent tariffs on $50 billion of annual imports from China, covering around 1,300 industrial technology, transport and medical products.

Prime Minister Shahid Khaqan Abbasi is likely to seek support from China during his upcoming visit to Beijing to sustain the depleting foreign exchange reserves of the country. "Prime Minister will visit to China within this month where he may look for Chinese assistance that can be in shape of parking some amount in central bank of Pakistan," said an official of the Ministry of Finance. He further said that government desperately needing $3 billion to finance the previous loans and current account deficit before June this year. "The government can request the Chinese government either to provide some loan or to keep money into State Bank of Pakistan for some time in order to build Pakistan's foreign exchange reserves," he said. Reserves held by State Bank of Pakistan (SBP) are sharply depleting from last one and half year and reached to $11.8 billion last week. The official informed that government has another option of borrowing from the commercial banks. Pakistan had already borrowed $1.78 billion from the commercial banks during eight months (July-February) of the current fiscal year.

Over 11.571 million bales of cotton have arrived at various ginneries till March across the country showing an increase of 7.88 percent as compared to 10.725 million bales of last season, said a fortnightly report on Tuesday. The report was released by Pakistan Cotton Ginners Association (PCGA) with cooperation of All Pakistan Textile Mills Association (APTMA) and Karachi Cotton Association (KCA). According to the report, in the major cotton producing province of Punjab, total cotton arrivals increased by 5.46 percent year-on-year to 73,17,73 bales. In Sindh province, cotton arrivals increased 12.31 percent to 4.253 million bales. Of which 1,10,84,233 million bales were sold, leaving an unsold stock of 4,86,963 bales with the ginners. The textile mills in Pakistan consumed 10.867 million bales, while surplus cotton was sold to exporters, according to the data.

The Punjab Revenue Authority has collected a revenue of Rs75 billion during first nine months of the current fiscal year, which is 50 percent higher for the corresponding period. These remarks were stated by PRA Chairman Dr Raheal Ahmed Siddiqui at an event conducted at a local hotel as part of Tax Day celebrations. The event was also attended by Javed Ahmed (Member Operation PRA), Ali Mansoor (Commissioner Appeal PRA), Aman Anwar Kadwai (Additional Commissioner PRA), Salman Zafar (Director IT PRA) and delegates of Institute of Chartered Accounts of Pakistan, Pakistan Tax Bar, Lahore Chamber of Commerce and Industry, Overseas Investors of Commerce & Industry, Department of International Development, Pakistan Business Council and delegation from all provincial authorities including the FBR.

Islamabad Chamber of Commerce and Industry (ICCI) has called upon the government to immediately withdraw hike in sales tax on some POL products as it would put additional burden on consumers and enhance the cost of doing business in the country. ICCI President Sheikh Amir Waheed urged that government to pass on full benefits of educed oil prices in international market to the consumers. In a press statement, he said that FBR vide its SRO No.414(1)/2018 issued on 31st March 2018 has further enhanced sales tax on motor spirit from 17 percent to 21.5 percent and on high speed diesel oil from 25.5 percent to 27.5 percent which was not justified.

Technical Analysis

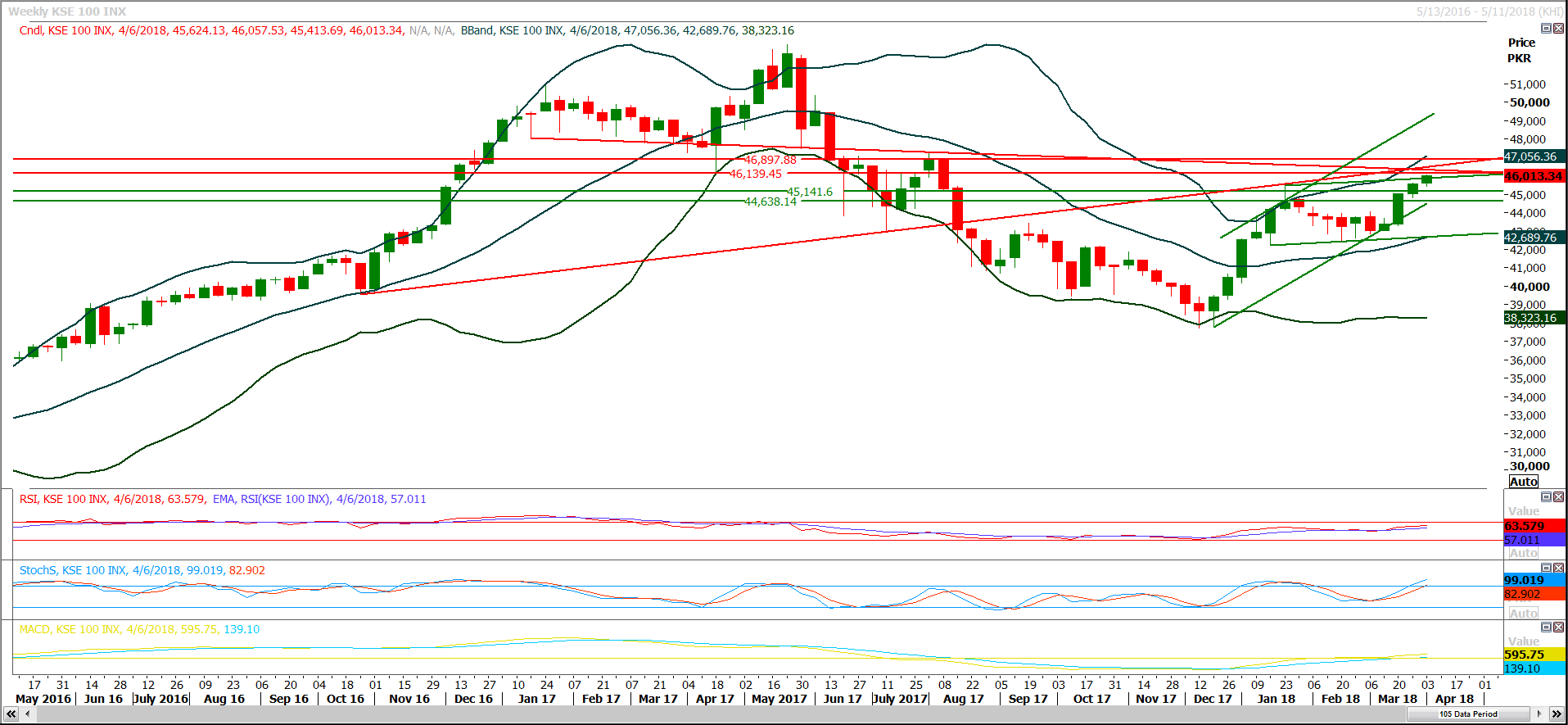

The Benchmark KSE100 Index is capped by multiple resistances ahead and it would face a tough time before posting a high of 46,500 in this rally, immediately it would face a resistance from resistant trend line of its daily channel which falls on completion of expansion of its triangle and then two major horizontal resistant regions would try to cap current bull run at 46,140 points. The ultimate resistance region falls at 46500 which fall on 61.8% correction of its last bearish rally on weekly chart and that resistant region would be strengthen by two resistant trend lines. On supportive side index have supportive regions around 45,140 and 44,640 points and these both regions would try to support index against any bearish pressure in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.