Previous Session Recap

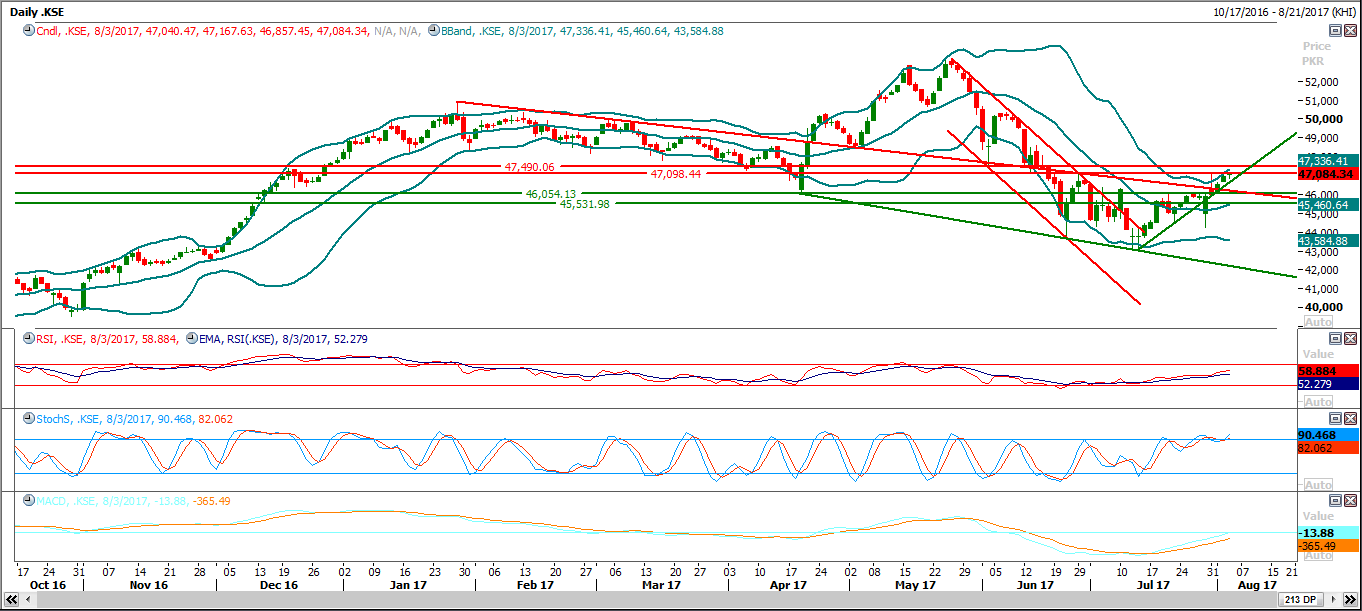

Trading volume at PSX floor increased by 87.47 million shares or 23.78%, DoD basis, whereas, the Benchmark KSE100 Index opened at 47040.47 posted a day high of 47167.63 and a day low of 46857.45 during the last trading session. The session suspended at 47084.34 with a net change of 135.30 points and the net trading volume of 201.99 million shares. Daily trading volume of KSE100 listed companies increased by 47.44 million shares or 30.7%, DoD basis.

Foreign Investors remained in a net selling position of 26.33 million shares and the net value of Foreign Inflow dropped by 9.2 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 24.29 and 2.06 million shares, respectively. While on the other side, Local Individuals, Companies, Banks and Mutual Funds remained in net buying positions of 25.58, 7.09, 0.1 and 4.24 million shares, respectively. However Brokers remained in a net selling position of 9.41 million shares.

Analytical Review

Asian stocks inched up on Friday after a technology-led drop on Wall Street, while U.S. Treasury yields and the dollar were pressured by news Special Counsel Robert Mueller had issued grand jury subpoenas in his investigation of alleged Russian interference in the 2016 U.S. elections. MSCI broadest index of Asia-Pacific shares outside Japan rose 0.2 percent, although gains were kept in check by the reluctance of many investors to stake out fresh positions ahead of U.S. job data later in the global day. The index was poised to climb 0.3 percent for the week, taking its gains for far this year to nearly 24 percent. Japanese Nikkei dropped 0.3 percent on a stronger yen, and looked set to end the week little changed. South Korean KOSPI, which closed at a 3-1/2-week low on Thursday, recovered 0.3 percent. It is down 0.4 percent this week.

The National Electric Power Regulatory Authority (Nepra) on Thursday allowed power producers to charge consumers through tariff one per cent cost of 19 power projects worth $15.56 billion under the China-Pakistan Economic Corridor (CPEC) for 20-30 years on account of security cost. In an order, the power sector regulator said it allowed building in tariff the additional security cost on the orders of the federal government and estimated it at $155.6 million (about Rs17 billion) for all 19 power projects under the CPEC. Nepra worked out the annual cost at about $2.92m (Rs315m).

The wholesale price of sugar swelled to Rs54-56 per kilogram from Rs47 three days ago owing to the suspension in supplies by sugar mills. However, retailers had already been selling the commodity at Rs55-58 per kg as they did not pass on the benefit of falling wholesale prices to consumers. Traders said that Dandia Bazaar, a wholesale market, is running out of stocks as millers have stopped supplying sugar. They said the wholesale market has been under pressure since Monday. Karachi Retail Grocers Group (KRGG) General Secretary Farid Qureishi said the wholesale rate of sugar was Rs47 per kg three days ago.

Dalda Foods Ltd and its parent company are going to raise more than Rs7 billion through the stock market by selling 25 per cent shares in the edible oil business, according to a recent regulatory filing. The food entity will issue 30 million new shares at the minimum price of Rs85 apiece while its holding company, DFL Corporation, will sell 52.5m existing shares at the same price. Dalda Foods wants to reduce its reliance on the import of edible oil by backward-integration. It will use the raised funds to expand the crushing capacity of its seed extraction plant from 300 tonnes per day to 500 tonnes.

The total liquid foreign reserves held by the country stood at $20,283.1 million on July 28, 2017. The weekly break-up of the foreign reserves position released on Thursday showed that foreign reserves held by the State Bank of Pakistan stood at $14,698.2 million and net foreign reserves held by commercial banks are $5,584.9 million. During the week ending 28th July, SBP’s reserves decreased by $305 million to $14,698 million.

The Market is expected to remain volatile today. We advice traders to exercise caution, Buying on dips and booking gains on strength is recommended.

Technical Analysis

The Benchmark KSE100 Index may find resistance from its triple top on daily chart and 47110 and 47400 points regions are resisting against current bullish trend, as these regions fall at 38% correction of its whole previous bearish rally which started from 53127 and ended at 43027 points. For current trading session, a cautious trading strategy is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.