Previous Session Recap

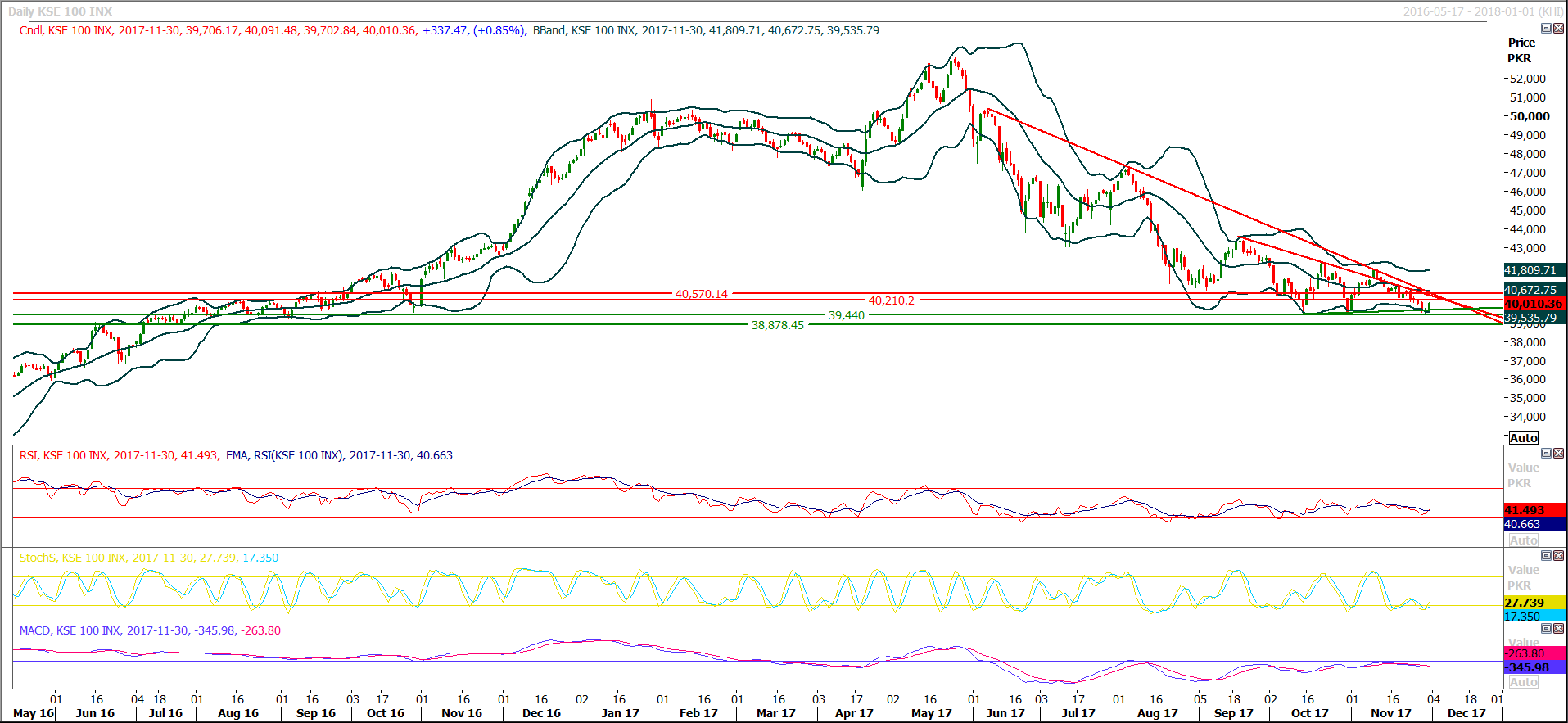

Trading volume at PSX floor increased by 65.87 million shares or 57.32% on DoD basis, whereas, the benchmark KSE100 Index opened at 39706.17, posted a day high of 40091.48 and a day low of 39702.84 during last trading session. The session suspended at 40010.36 with net change of 337.47 and net trading volume of 126.12 million shares. Daily trading volume of KSE100 listed companies increased by 53.02 million shares or 72.55% on DoD basis.

Foreign Investors remained in net selling of 8.01 million shares and net value of Foreign Inflow dropped by 19.88 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling of 7.57 and 0.46 million shares. While on the other side Local Individuals, Companies and Banks remained in net selling of 2.42, 0.32 and 0.64 million shares respectively, but Mutual Funds, Brokers and Inusrance Companies remained in net buying of 3.98, 0.43 and 4.54 million shares respectively.

Analytical Review

The U.S. dollar bounced to a two-week top on Monday and S&P futures rallied as traders marked the passage of a Senate tax bill over the weekend, a move that raises the risk of more aggressive rate hikes in the world’s largest economy. Asian shares were less euphoric, with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS hovering near a one-month trough on fears U.S. policy tightening could suck liquidity from emerging markets and derail global growth. Traders will be focusing their attentions on a meeting scheduled for British Prime Minister Theresa May and EU President Jean-Claude Juncker to work on a Brexit deal. The euro EUR= slipped 0.1 percent, while the British pound GBP= was steady amid media reports that a deal was near on the terms of the Brexit divorce.

Amidst robust growth in local consumption in the first four months of fiscal year 2017-18, the cement industry utilised over 93 percent of its installed capacity . Industry experts said that this is the highest capacity utilisation by the industry in the last 20 years. However, 1.08 million tons capacity still remained idle, which could have been covered by exports if the government policies are export-friendly. They said that higher cement consumption does not mean that the economic planners ignore the genuine difficulties faced by this sector. They said the industry is performing in stiff regulatory environment and is only surviving because it has upgraded its technology that has provided it the strength to take any challenge head on.

THE local currency market operation was reduced to four sessions last week as markets remained closed on Friday owing to public holiday declared by the government on account of Eid Miladun Nabi. During the week, the rupee traded firm against the dollar but fluctuated against the euro. Trading activity mostly remained sluggish throughout November with the rupee-dollar parity moving both ways in narrow ranges in the interbank market. In the open market, however, the rupee remained under slight pressure against the dollar due to prevailing political uncertainty in the country. Currently, the dollar is trading at Rs105.50-52 in the interbank market and Rs107.40-60 in the open market.

BUSINESSMEN in terrorism-hit Khyber Pakhtunkhwa are complaining about the financial sector’s evasive attitude in providing credit and banking facilities to them despite collecting huge deposits. There is a growing disconnect between banks’ lending and their deposit mobilisation in the province. In recent interactions with the federal government and the State Bank of Pakistan (SBP), businessmen recorded their displeasure over the attitude of the banks operating in the province to “export” their funds to other provinces.

Chinese entrepreneurs are willing to develop cooperation with their Pakistani counterparts to construct highrise buildings. Private sectors of both the countries should jointly exploit untapped areas of mutual collaboration. These views were expressed by Adven Zhu, the managing director of Suzhou China Aviation Technology Equipment Co, at the Islamabad Chamber of Commerce and Industry (ICCI) on Saturday. The delegation, led by Mr Zhu, represented various sectors, including infrastructure development, construction of roads, high-rise buildings, IT, manufacturing of mechanical products, cold-bend steel, elevator components, mechanical components and furniture.

ATRL, TRG, PAEL and ENGRO may lead the index in positive direction today.

Technical Analysis

The Benchmark KSE100 Index have formatted a morning star on daily chart which is strong indication of reversal pattern and stochastic and MAORSI also have generated bullish crossover on daily chart. These factors would try to push index towards 40210 and 40431 points. If index would become able to give a clear breakout of 40760 points then it can target 42200 and 42800 points in coming trading session. But supportive regions are standing at 39440 and 38680 points. If index would slip below 39440 then next target would be 38680 which falls on 61.85% correction of its last weekly bullish rally. For current trading session buying on dip and selling on strength is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.