Previous Session Recap

Trading volume at PSX floor dropped by 108.52 million shares or 19.47% on DoD basis, whereas the benchmark KSE100 index opened at 40,124.22, posted a day high of 40,444.05 and a day low of 39,725.70 points during last trading session while session suspended at 39,788.73 points with net change of -335.49 points and net trading volume of 286.77 million shares. Daily trading volume of KSE100 listed companies dropped by 74.89 million shares or 20.71% on DoD basis.

Foreign Investors remained in net buying positions of 7.81 million shares and net value of Foreign Inflow increased by 0.26 million US Dollars. Categorically, Foreign Individual remained in net selling positions of 0.013 million shares but Foreign Corporate and Overseas Pakistanis Investors remained in net buying positions of 3.40 and 4.42 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Brokers remained in net selling positions of 4.67, 8.60, 2.09, 2.15 and 12.32 million shares but Local Individuals and Insurance Companies remained in net buying positions of 22.47 and 0.26 million shares respectively.

Analytical Review

Shares slide as Trump raises specter of longer, wider trade war

Asian shares extended their losses on Wednesday after U.S. President Donald Trump said a trade deal with China might have to wait until after the 2020 presidential election, dashing hopes for a quick preliminary agreement. Fresh U.S. tariffs on Argentina and Brazil as well as threatened duties on French goods also darkened the mood, as a trade war that appeared to be winding down a week ago now looks like ramping up. Investors turned to safe-havens, boosting bond prices and sending gold to a one-month high, while MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.9%. Japan's Nikkei .N225 dropped 1.2%, matched by falls in Hong Kong .HSI and Korea , where stock markets hit their lowest since October. Shanghai blue chips .CSI300 fell 0.2% and Australia's S&P/ASX200 tumbled 1.7%, having shed almost 4% since closing on Monday.

World's leading financial institutions have given Pakistan their vote of confidence: Hafeez Sheikh

Adviser to the Prime Minister on Finance Dr Abdul Hafeez Sheikh on Tuesday said that the world's leading financial institutions had given Pakistan their vote of confidence and acknowledged the improvement over the past five months in its economic indicators. "The World Bank president came and appreciated Pakistan's performance and instructed that better ties with Pakistan be formed. "The Asian Development Bank, the foremost entity with whom we are linked to economically right now, also recognised the improvement in the performance of Pakistan's economy and declared a $3 billion increase in its programme," said Sheikh as he held a press conference in Islamabad alongside Federal Minister of Economic Affairs Hammad Azhar, Federal Board of Revenue (FBR) Chairman Shabbar Zaidi, and special finance secretary Umar Hameed.

Oil prices edge higher as Saudi pushes for further supply cuts

Oil prices edged higher on rising expectations of deeper output cuts when OPEC and its allies meet this week, although scepticism about a deal among some analysts limited the gains. Brent futures rose 43 cents to $61.35 a barrel by 0924 GMT on Tuesday. US West Texas Intermediate crude was up 44 cents at $56.40 a barrel. The Organisation of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, are discussing a plan to increase an existing supply cut of 1.2 million barrels per day (bpd) by a further 400,000 bpd and extend the pact until June, two sources familiar with the matter said. Saudi Arabia is pushing the plan to deliver a positive surprise to the market before the initial public offering of state-owned Saudi Aramco, the sources said.

Govt to set up 120MW waste based power project in Karachi

The Federal government has decided to launch around 120 MW waste based power project in Karachi, it is learnt reliably here. The step is part of the Federal cabinet decision of implementing four new initiatives in different areas, source told The Nation. The source said that the federal cabinet in its meeting last month has decided to implement four new initiatives and directed the concerned divisions for immediate action. The first initiative is related to setting up 100-120 MW waste to energy project in Karachi. The initiative will be executed by the Maritime Affairs division and will help to utilise the waste generated by two Ports in Karachi. It is worth to add that in January 2018 National Electric Power Regulatory Authority (NEPRA) had announced the levelised tariff of US cents 10/kWh (Rs16 per unit with the current conversion rate) for Municipal Solid Waste based electricity.

Pakistan to repay Russia $93.5m debt

Russia and Pakistan signed an agreement to settle mutual financial claims and obligations on operations of the former Soviet Union, according to which Pakistan will repay the debt to Russia in the amount of $93.5 million, a Russian news correspondent reported from the signing ceremony. On the part of Russia, the agreement was signed by Deputy Finance Minister Sergey Storchak, on the part of Pakistan, Ambassador Qazi Khalilullah. The debt repayment will reportedly enable Russia to invest about $8 million in different sectors in Pakistan, including, first of all, the energy and steel industry.

Asian shares extended their losses on Wednesday after U.S. President Donald Trump said a trade deal with China might have to wait until after the 2020 presidential election, dashing hopes for a quick preliminary agreement. Fresh U.S. tariffs on Argentina and Brazil as well as threatened duties on French goods also darkened the mood, as a trade war that appeared to be winding down a week ago now looks like ramping up. Investors turned to safe-havens, boosting bond prices and sending gold to a one-month high, while MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.9%. Japan's Nikkei .N225 dropped 1.2%, matched by falls in Hong Kong .HSI and Korea , where stock markets hit their lowest since October. Shanghai blue chips .CSI300 fell 0.2% and Australia's S&P/ASX200 tumbled 1.7%, having shed almost 4% since closing on Monday.

Adviser to the Prime Minister on Finance Dr Abdul Hafeez Sheikh on Tuesday said that the world's leading financial institutions had given Pakistan their vote of confidence and acknowledged the improvement over the past five months in its economic indicators. "The World Bank president came and appreciated Pakistan's performance and instructed that better ties with Pakistan be formed. "The Asian Development Bank, the foremost entity with whom we are linked to economically right now, also recognised the improvement in the performance of Pakistan's economy and declared a $3 billion increase in its programme," said Sheikh as he held a press conference in Islamabad alongside Federal Minister of Economic Affairs Hammad Azhar, Federal Board of Revenue (FBR) Chairman Shabbar Zaidi, and special finance secretary Umar Hameed.

Oil prices edged higher on rising expectations of deeper output cuts when OPEC and its allies meet this week, although scepticism about a deal among some analysts limited the gains. Brent futures rose 43 cents to $61.35 a barrel by 0924 GMT on Tuesday. US West Texas Intermediate crude was up 44 cents at $56.40 a barrel. The Organisation of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, are discussing a plan to increase an existing supply cut of 1.2 million barrels per day (bpd) by a further 400,000 bpd and extend the pact until June, two sources familiar with the matter said. Saudi Arabia is pushing the plan to deliver a positive surprise to the market before the initial public offering of state-owned Saudi Aramco, the sources said.

The Federal government has decided to launch around 120 MW waste based power project in Karachi, it is learnt reliably here. The step is part of the Federal cabinet decision of implementing four new initiatives in different areas, source told The Nation. The source said that the federal cabinet in its meeting last month has decided to implement four new initiatives and directed the concerned divisions for immediate action. The first initiative is related to setting up 100-120 MW waste to energy project in Karachi. The initiative will be executed by the Maritime Affairs division and will help to utilise the waste generated by two Ports in Karachi. It is worth to add that in January 2018 National Electric Power Regulatory Authority (NEPRA) had announced the levelised tariff of US cents 10/kWh (Rs16 per unit with the current conversion rate) for Municipal Solid Waste based electricity.

Russia and Pakistan signed an agreement to settle mutual financial claims and obligations on operations of the former Soviet Union, according to which Pakistan will repay the debt to Russia in the amount of $93.5 million, a Russian news correspondent reported from the signing ceremony. On the part of Russia, the agreement was signed by Deputy Finance Minister Sergey Storchak, on the part of Pakistan, Ambassador Qazi Khalilullah. The debt repayment will reportedly enable Russia to invest about $8 million in different sectors in Pakistan, including, first of all, the energy and steel industry.

Market is expected to remain volatile during current trading session.

Technical Analysis

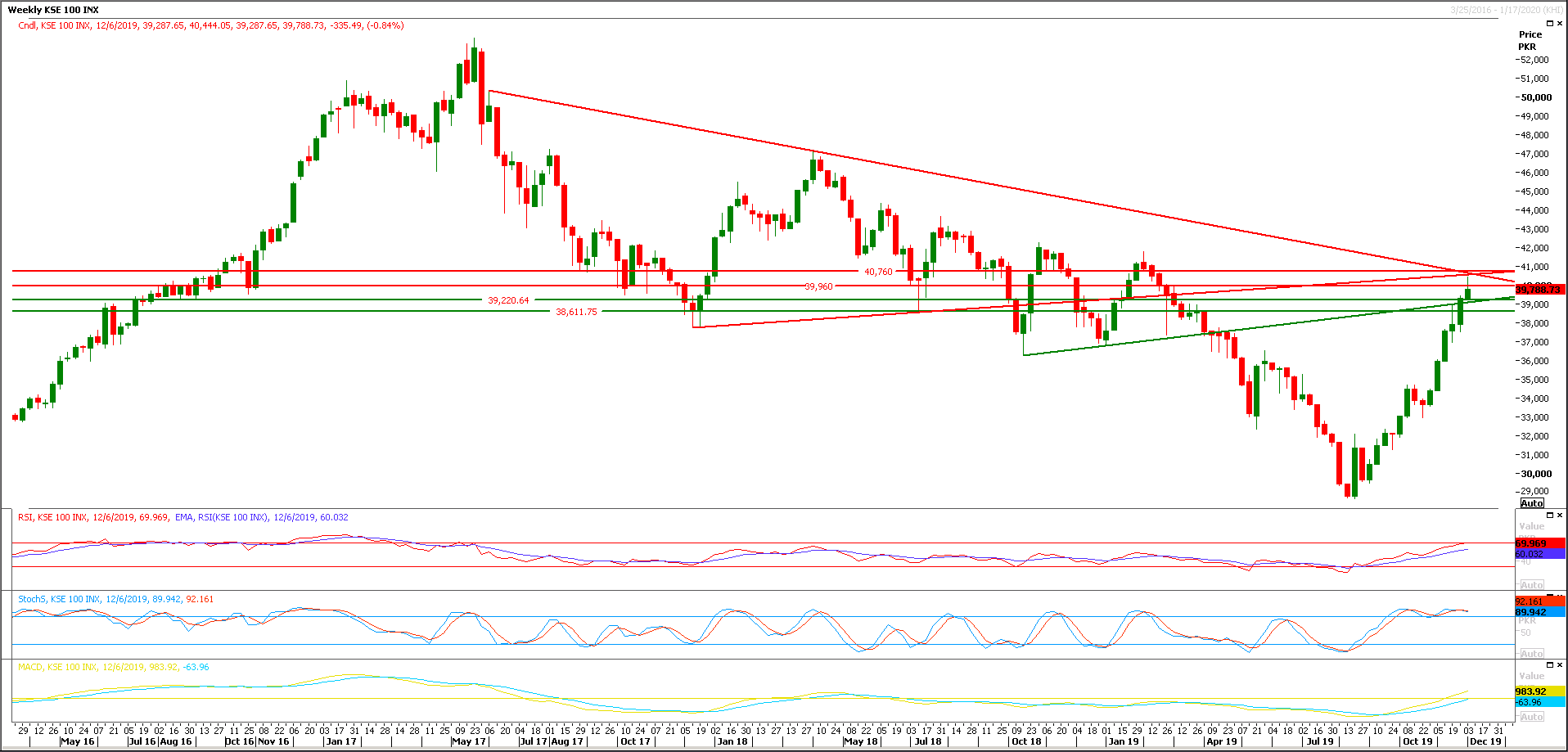

The Benchmark KSE100 index is moving downward after being rejected by crossover of a trend line with a horizontal resistant region, but current rejection would be considered a cheat pattern until index would slide below 39,000 points on weekly closing basis. where once again a crossover is taking place of an ascending trend line with a horizontal supportive region. Daily momentum indicators have changed their direction towards bearish side but index could pull back if it would find some fresh volumes between 39,200 points to 39,000points. It's recommended to stay side line until a clear breakout of either 39,200 points in bearish direction or above 40,800 points in bullish direction. This week's closing would set market direction because index is caged in a very narrow range of supports and resistances. Index seems to start a pull back on intraday basis but momentum would start losing if index would not succeed in penetration above 40,000 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.