Previous Session Recap

Trading volume at PSX floor increased by 9.27 million shares or 4.78% on DoD basis, whereas the benchmark KSE100 index opened at 41,376.72, posted a day high of 41,630.93 and a day low of 40,233.64 points during last trading session while session suspended at 41,409.38 points with net change of -1221.55 points and net trading volume of 150.11 million shares. Daily trading volume of KSE100 listed companies also increased by 9.77 million shares or 6.96% on DoD basis.

Foreign Investors remained in net selling positions of 9.81 million shares and net value of Foreign Inflow dropped by 1.66 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.016, 9.38 and 0.42 million shares respectively. While on the other side Local Individuals, Companies, NBFCs and Insurance Companies remained in net long positions of 15.68, 0.54, 0.34 and 10.27 million shares but Banks, Mutual Fund and Brokers remained in net selling positions of 5.44, 8.37 and 4.37 million shares respectively.

Analytical Review

Asia stocks find footing as China markets restore some losses

Asian stocks bounced on Tuesday with Chinese markets reversing some of their previous plunge amid official efforts to calm virus fears, although sentiment remained fragile with oil near 13-month lows. The total number of coronavirus deaths in China reached 425 as of the end of Monday, from 20,438 cases. China’s central bank has flooded the economy with cash while trimming some key lending rates, but analysts suspect more will have to be done to offset the economic fallout from the virus. MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.0%, led by gains in South Korea .KS11 and Australia . Japan's Nikkei .N225 inched up 0.1%. “Given the extent of the shutdowns in China as well as the rapid rise in the virus that is likely to continue through March or April, a significant hit to China and regional growth is very likely,” said JPMorgan economist Joseph Lupton.

Govt set to approve increase in gas price as ECC meets today

On the opening day of its two-week discussions with a staff mission of the International Monetary Fund (IMF), the government appeared set to increase gas rates from Feb 1 to placate the international lender into reducing revenue target for the current fiscal year. On Monday, the cabinet division called members of the Economic Coordination Committee (ECC) of the cabinet to meet on Tuesday to take up “natural gas sales pricing FY2019-20 with effect from Feb 1, 2020” summary moved by the petroleum division. Separately, the staff mission of the IMF had initial discussions with the Federal Board of Revenue (FBR) which reportedly sought a further downward reduction in revenue collection target for the current fiscal year in view of a massive Rs385 billion shortfall in the first seven months ending Jan 31, 2020.

IT exports jump 19pc

Pakistan’s telecommunication, computer and information services exports jumped 18.5 per cent to $517 million during the first seven months of current fiscal year. The major chunk of that came under the software consultancy services as exports of the segment rose around 12pc to around $159m during the period under review. Following closely behind software consultancy, exports of computer software also rose 8.17pc to $129m, from $119m during the same period last fiscal year. Citing provisional figures for the first half of current fiscal year, P@SHA Chairman Shahzad Shahid said, “IT and ITeS (information technology enabled services) is a sector which has continued to show impressive growth in exports year on year.”

Uncertainty grows around China imports

Confusion and uncertainty are rising in the market as the Chinese New Year ends while the government there has extended the closure of business till Feb 12 according to some announcements. Every year the Chinese New Year celebrations bring supply chains to a halt as factories in China shut down and workers head home for the holidays. This year, however, the outbreak of the 2019 Novel Coronavirus during these holidays has disrupted movements, with the Chinese authorities extending the shutdown to Feb 12 in most provinces. Talking to Dawn, some traders and businessmen in Pakistan said that loading of goods in China has come to a halt while others believe that everything is going normal.

Policies to check inflation will pay off in coming days

The government on Monday said it was increasing the amount of stipend and number of its beneficiaries as policies and efforts to ease out inflation will start bearing fruit in the ‘coming days’. In a statement, the ministry of finance tried to explain the reasons behind the continuously increasing rate of inflation that hit 14.6pc in January after almost a decade and the related public criticism. It also reported how it was increasing the number of beneficiaries of the income support and other subsidies to a part of population. Without giving a timeline, the ministry said the inflation would ease out and the economy move towards growth and productivity in the coming days as a series of factors including adverse weather conditions and disruption in supplies reverse.

Asian stocks bounced on Tuesday with Chinese markets reversing some of their previous plunge amid official efforts to calm virus fears, although sentiment remained fragile with oil near 13-month lows. The total number of coronavirus deaths in China reached 425 as of the end of Monday, from 20,438 cases. China’s central bank has flooded the economy with cash while trimming some key lending rates, but analysts suspect more will have to be done to offset the economic fallout from the virus. MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.0%, led by gains in South Korea .KS11 and Australia . Japan's Nikkei .N225 inched up 0.1%. “Given the extent of the shutdowns in China as well as the rapid rise in the virus that is likely to continue through March or April, a significant hit to China and regional growth is very likely,” said JPMorgan economist Joseph Lupton.

On the opening day of its two-week discussions with a staff mission of the International Monetary Fund (IMF), the government appeared set to increase gas rates from Feb 1 to placate the international lender into reducing revenue target for the current fiscal year. On Monday, the cabinet division called members of the Economic Coordination Committee (ECC) of the cabinet to meet on Tuesday to take up “natural gas sales pricing FY2019-20 with effect from Feb 1, 2020” summary moved by the petroleum division. Separately, the staff mission of the IMF had initial discussions with the Federal Board of Revenue (FBR) which reportedly sought a further downward reduction in revenue collection target for the current fiscal year in view of a massive Rs385 billion shortfall in the first seven months ending Jan 31, 2020.

Pakistan’s telecommunication, computer and information services exports jumped 18.5 per cent to $517 million during the first seven months of current fiscal year. The major chunk of that came under the software consultancy services as exports of the segment rose around 12pc to around $159m during the period under review. Following closely behind software consultancy, exports of computer software also rose 8.17pc to $129m, from $119m during the same period last fiscal year. Citing provisional figures for the first half of current fiscal year, P@SHA Chairman Shahzad Shahid said, “IT and ITeS (information technology enabled services) is a sector which has continued to show impressive growth in exports year on year.”

Confusion and uncertainty are rising in the market as the Chinese New Year ends while the government there has extended the closure of business till Feb 12 according to some announcements. Every year the Chinese New Year celebrations bring supply chains to a halt as factories in China shut down and workers head home for the holidays. This year, however, the outbreak of the 2019 Novel Coronavirus during these holidays has disrupted movements, with the Chinese authorities extending the shutdown to Feb 12 in most provinces. Talking to Dawn, some traders and businessmen in Pakistan said that loading of goods in China has come to a halt while others believe that everything is going normal.

The government on Monday said it was increasing the amount of stipend and number of its beneficiaries as policies and efforts to ease out inflation will start bearing fruit in the ‘coming days’. In a statement, the ministry of finance tried to explain the reasons behind the continuously increasing rate of inflation that hit 14.6pc in January after almost a decade and the related public criticism. It also reported how it was increasing the number of beneficiaries of the income support and other subsidies to a part of population. Without giving a timeline, the ministry said the inflation would ease out and the economy move towards growth and productivity in the coming days as a series of factors including adverse weather conditions and disruption in supplies reverse.

Market is expected to remain volatile during current trading session.

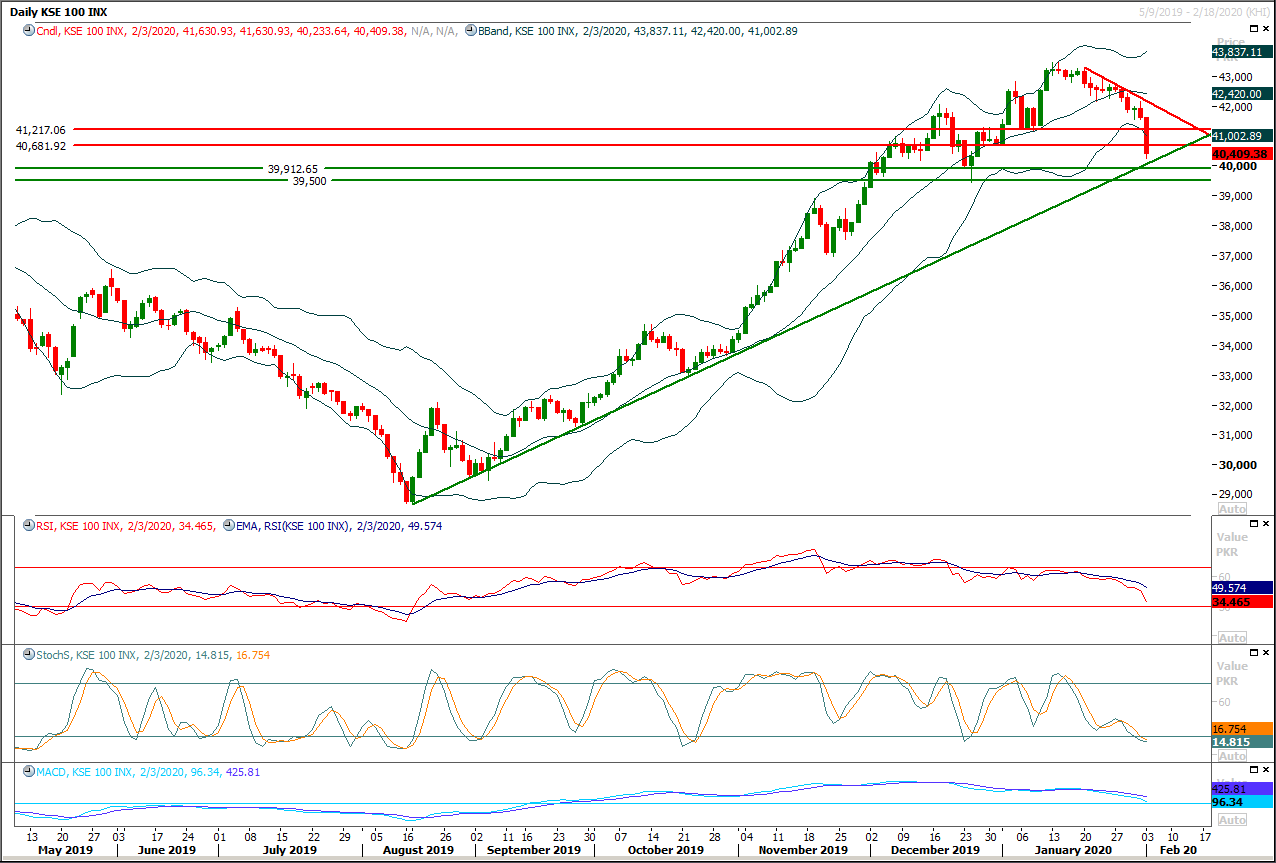

Technical Analysis

The Benchmark KSE100 index had entered into a bearish zone after sliding below its major supportive region of 42,000pts before closing of last week and now it would try to find some ground at 39,900 points and 39,500 points on temporarily basis. It's recommended to adopt swing trading during current trading session because index would try to correct after a dip and some attractive price levels could be achieved around 39,900 points for intraday buying and then short selling around 40,600pts. But on short term absis Index would remain bearish and would try to entertain its bearish trend in coming days therefore it's recommended to stay on selling side for short term basis because 39,500 points is last hope for bulls and breakout below that region would call for 37,500 points. But it's also recommended to trade with strict stop loss on both sides because if index would succeed in closing above 41,500 points then scenario would be changed completely.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.