Previous Session Recap

Trading volume at PSX floor increased by 4.24 million shares or 1.85% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41539.93, posted a day high of 41819.75 and a day low of 41289.17 during last trading session. The session suspended at 41544.27 with net change of 57.4 and net trading volume of 150.64 million shares. Daily trading volume of KSE100 listed companies increased by 13.04 million shares or 9.48% on DoD basis.

Foreign Investors remained in net buying postion of 4.24 million shares and net value of Foreign Inflow increased by 6.2 million shares. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net buying positions of 3.19 and 1.07 million shares. While on the other side Local Individuals, Banks, Brokers and Insurance Companies remained in net selling positions of 4.93, 1.93, 8.12 and 8.17 million shares respectively but Lcoal Companies, NBFCs and Mutual Funds remained in net buying positions of 8.63, 0.16 and 9.08 million shares respectively.

Analytical Review

Asian shares scaled a 10-year high on Thursday as solid economic data from the United States and Germany reinforced investors’ optimism while oil prices hovered at 2-1/2-year high with unrest in Iran stoking supply disruption concerns. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.1 percent, coming near its 2007 peak, with Australian shares hitting a decade high. Japan’s Nikkei jumped 2.0 percent on its first trading day of the year while the broader Topix hit its highest level since 1991. “The economic data published over the holiday period has been pretty good. So for those who were worried about new year profit-taking, the market would look pretty strong,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

Sazgar Engineering Works said on Wednesday it will spend Rs1.76 billion on its four-wheeler assembly greenfield project. The project will have a production capacity of 24,000 units per annum and be completed in June 2019, it said in a stock notice to the Pakistan Stock Exchange. The company has already signed a vehicle assembly cooperation agreement with a Chinese automaker for the manufacture, assembly, sales and after-sales service of passenger and off-road vehicles.

Higher cotton production by Sindh and Punjab helped the country improve its overall output by 7.16 per cent year-on-year up to Dec 31, according to the latest figures issued by the Pakistan Cotton Ginners Association on Wednesday. Yet the production level remained lower than the official revised estimate of 12.6 million bales. The country produced 11.11m bales against 10.36m bales in the corresponding period of the last season. The government initially estimated that cotton production would be 14.1m bales because of the higher acreage of land coming under cultivation. But the cotton crop faced a lot of issues as the season progressed.

The Ministry of Power has decided to engage and meet all investors under the China-Pakistan Economic Corridor (CPEC) energy projects individually to expedite projects and remove any difficulties. All stakeholders including the Private Power and Infrastructure Board, Alternative Energy Development Board and National Transmission and Despatch Company will be part of these consultations, Minister for Power Sardar Awais Ahmed Khan Leghari said during a meeting with Chinese Ambassador Yao Jing on Wednesday. After assuming charge, this was Mr Yao’s first official engagement to discuss CPEC projects. Mr Leghari appreciated the contribution of Chinese investors in the power sector.

The State Bank of Pakistan (SBP) on Monday made it clear that all arrangements for using Chinese yuan for bilateral trade as well as financing investment activity between Pakistan and China are already in place. On Dec 19, 2017, Minister for Planning and Development Ahsan Iqbal said that the government was considering a Chinese proposal to use renminbi (RMB or yuan) instead of the US dollar for payments in all bilateral trade between China and Pakistan. The decision was taken after rejecting a Chinese proposal to allow yuan as legal tender in Gwadar, Balochistan. “The SBP, in the capacity of the policy maker of financial and currency markets, has taken comprehensive policy related measures to ensure that imports, exports and financing transactions can be denominated in yuan,” said a statement issued by the SBP.

Its recommended to exercise caution while trading during current trading session.

Technical Analysis

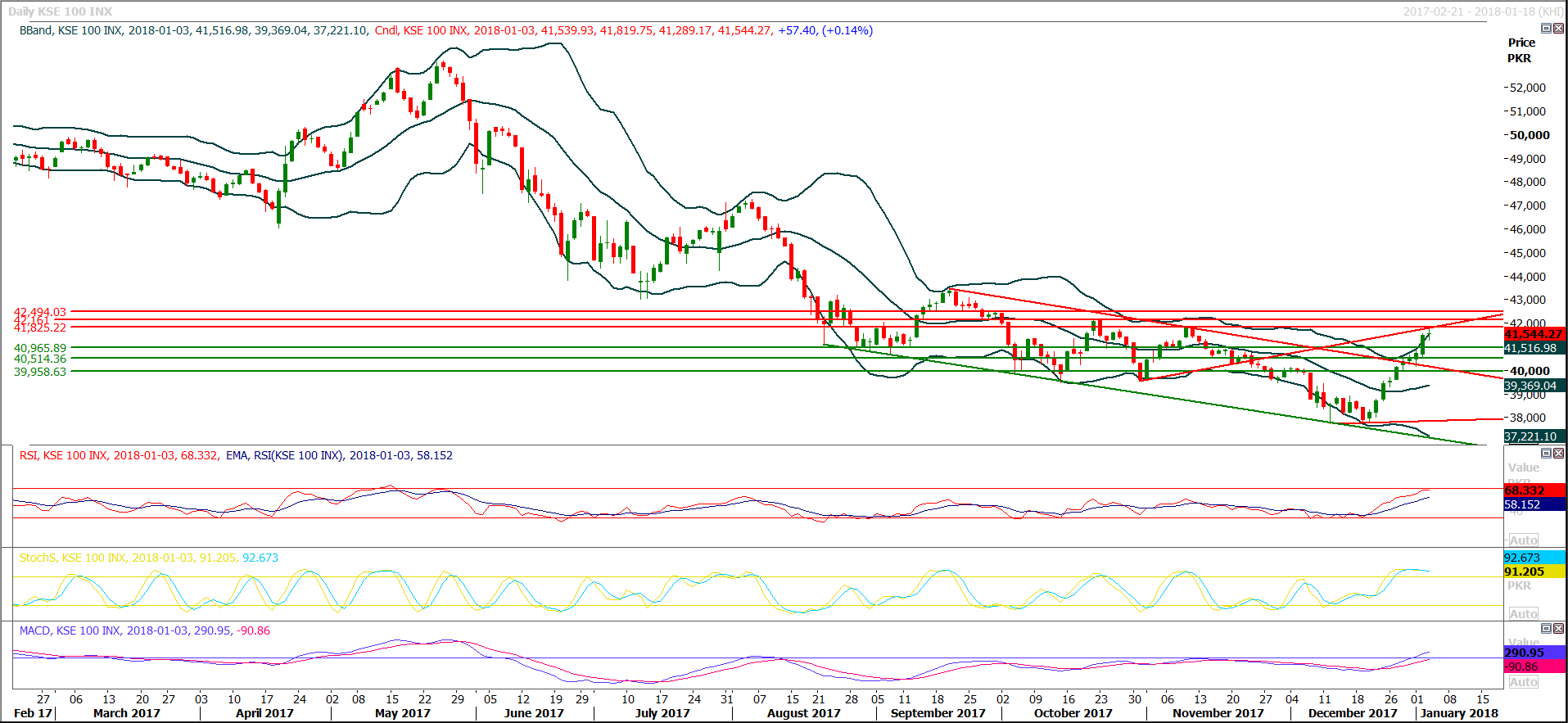

The Benchmark KSE100 Index have maintained its resistant region of 41825 during last trading session which fall over crossover of a horizontal resistant line and a trend line and reversed for daily closing with just a 57 points change. For current trading session its expected that index would get resistnace at the same region while supportive regions are standing at 40965 points. Its recommended to buy on dips with strict stop loss of 40965. Today's closing above 41825 would call for 42160 and 42500. As Hourly stochastic and MAORSI are ready for bullish crossovers therefore its expected that index would try to start the day with a spike.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.