Previous Session Recap

Trading volume at PSX floor increased by 39.27 million shares or 43.07% on DoD basis, whereas the benchmark KSE100 index opened at 34,320.93, posted a day high of 34,938.44 and a day low of 34,307.11 points during last trading session while session suspended at 34,896.55 points with net change of 589.44 points and net trading volume of 99.35 million shares. Daily trading volume of KSE100 listed companies increased by 25.44 million shares or 34.42% on DoD basis.

Foreign Investors remained in net selling positions of 2.33 million shares and net value of Foreign Inflow dropped by 0.90 million US Dollars. Categorically, Foreign Individual, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 0.06, 1.08 and 1.18 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs and Insurance Companies remained in net selling positions of 2.24, 0.65, 3.30, 0.12 and 2.61 million shares respectively but Mutual Fund and Brokers remained in net buying positions of 1.20 and 9.81 million shares.

Analytical Review

Stocks rally again on expected Fed rate cuts; euro on defensive

Asian stocks advanced on Thursday, tracking sharp gains on Wall Street as recent data from multiple sectors pointed to slowing economic growth in the United States, bolstering the prospect of rate cuts by the Federal Reserve. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.3% as did Japan's benchmark Nikkei .N225, and Australia was up 0.6%. A U.S. public holiday kept activity somewhat subdued. On Wall Street, which closed at midday Wednesday for the eve of the U.S. Independence Day, all three major stock indexes finished at a record closing highs as expectations grew that the Fed would take a more dovish turn. [.N] A report by a payrolls processor ADP showed U.S. companies added jobs in June, but fewer than what analysts had forecast, raising concerns the labor market is softening even as the current U.S. economic expansion marked a record run last month, “Stocks and bonds rallied together overnight as the markets were betting on interest rate cuts at the European Central Bank and the U.S. Federal Reserve,” said Noriko Miyoshi, head of fixed income at Simplex Asset Management in Tokyo.

ECC approves construction of 3rd LNG terminal

The Economic Coordination Committee (ECC) of the Cabinet has approved the resolution of the Port Qasim Authority (PQA) Board to allow amendment in its master plan to accommodate the prospective 3rd LNG terminal. Adviser to the Prime Minister on Finance, Revenue and Economic Affairs, Dr. Abdul Hafeez Shaikh chaired a meeting of ECC. Petroleum Division briefed the Committee about the utilization of Railways services for transportation of petroleum products to upward country. In order to enhance supply of PSO products to Pakistan Railways, the Committee directed the Petroleum Division to divert the surplus business to Pakistan Railways that offers lowest freight charges as compared to other modes of transportations.

ICCI urges govt to fix tax regimes for facilitating traders

President of Islamabad Chamber of Commerce & Industry (ICCI) Ahmed Hassan Moughal has called upon the government to make categories of traders and announce fixed tax regime for them to facilitate them in discharging tax obligations. It a statement here on Wednesday, Ahmed Hassan Moughal said that Finance Bill 2019-20 has imposed many taxes on traders due to which they were protesting against tax measures across the country.

Govt took $9.76 billion loan from international creditors in 11 months

Apart from borrowing from Saudi Arabia and United Arab Emirates, the incumbent government took loan of $9.76 billion from international creditors in eleven months (July to May) of the current fiscal year. Pakistan’s borrowing from bilateral, multilateral and banking sources stood at $9.76 billion. However, this amount had not included $5 billion that Pakistan borrowed from Saudi Arabia and United Arab Emirates. The incumbent government is taking loans to repay the loan taken by the previous governments and also on interest payment.

IMF okays $6bn package to ‘foster strong growth

The Executive Board of the International Monetary Fund (IMF) on Wednesday approved a $6 billion bailout package for Pakistan and immediately released $1bn to ease a sustained pressure on the country’s foreign exchange reserves. The package, which supports the government’s efforts to revive the country’s ailing economy, includes a phased release of the additional aid over a 39-month period. The IMF will also conduct quarterly review of Pakistan’s performance over this period. “IMF Executive Board approved today a three-year US$6 billion loan to support Pakistan’s economic plan, which aims to return sustainable growth to the country’s economy and improve the standards of living,” IMF spokesperson Gerry Rice said on Twitter.

Asian stocks advanced on Thursday, tracking sharp gains on Wall Street as recent data from multiple sectors pointed to slowing economic growth in the United States, bolstering the prospect of rate cuts by the Federal Reserve. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.3% as did Japan's benchmark Nikkei .N225, and Australia was up 0.6%. A U.S. public holiday kept activity somewhat subdued. On Wall Street, which closed at midday Wednesday for the eve of the U.S. Independence Day, all three major stock indexes finished at a record closing highs as expectations grew that the Fed would take a more dovish turn. [.N] A report by a payrolls processor ADP showed U.S. companies added jobs in June, but fewer than what analysts had forecast, raising concerns the labor market is softening even as the current U.S. economic expansion marked a record run last month, “Stocks and bonds rallied together overnight as the markets were betting on interest rate cuts at the European Central Bank and the U.S. Federal Reserve,” said Noriko Miyoshi, head of fixed income at Simplex Asset Management in Tokyo.

The Economic Coordination Committee (ECC) of the Cabinet has approved the resolution of the Port Qasim Authority (PQA) Board to allow amendment in its master plan to accommodate the prospective 3rd LNG terminal. Adviser to the Prime Minister on Finance, Revenue and Economic Affairs, Dr. Abdul Hafeez Shaikh chaired a meeting of ECC. Petroleum Division briefed the Committee about the utilization of Railways services for transportation of petroleum products to upward country. In order to enhance supply of PSO products to Pakistan Railways, the Committee directed the Petroleum Division to divert the surplus business to Pakistan Railways that offers lowest freight charges as compared to other modes of transportations.

President of Islamabad Chamber of Commerce & Industry (ICCI) Ahmed Hassan Moughal has called upon the government to make categories of traders and announce fixed tax regime for them to facilitate them in discharging tax obligations. It a statement here on Wednesday, Ahmed Hassan Moughal said that Finance Bill 2019-20 has imposed many taxes on traders due to which they were protesting against tax measures across the country.

Apart from borrowing from Saudi Arabia and United Arab Emirates, the incumbent government took loan of $9.76 billion from international creditors in eleven months (July to May) of the current fiscal year. Pakistan’s borrowing from bilateral, multilateral and banking sources stood at $9.76 billion. However, this amount had not included $5 billion that Pakistan borrowed from Saudi Arabia and United Arab Emirates. The incumbent government is taking loans to repay the loan taken by the previous governments and also on interest payment.

The Executive Board of the International Monetary Fund (IMF) on Wednesday approved a $6 billion bailout package for Pakistan and immediately released $1bn to ease a sustained pressure on the country’s foreign exchange reserves. The package, which supports the government’s efforts to revive the country’s ailing economy, includes a phased release of the additional aid over a 39-month period. The IMF will also conduct quarterly review of Pakistan’s performance over this period. “IMF Executive Board approved today a three-year US$6 billion loan to support Pakistan’s economic plan, which aims to return sustainable growth to the country’s economy and improve the standards of living,” IMF spokesperson Gerry Rice said on Twitter.

ATRL, PAEL, DGKC, PSO and LUCK would try to lead the positive momentum during current trading session.

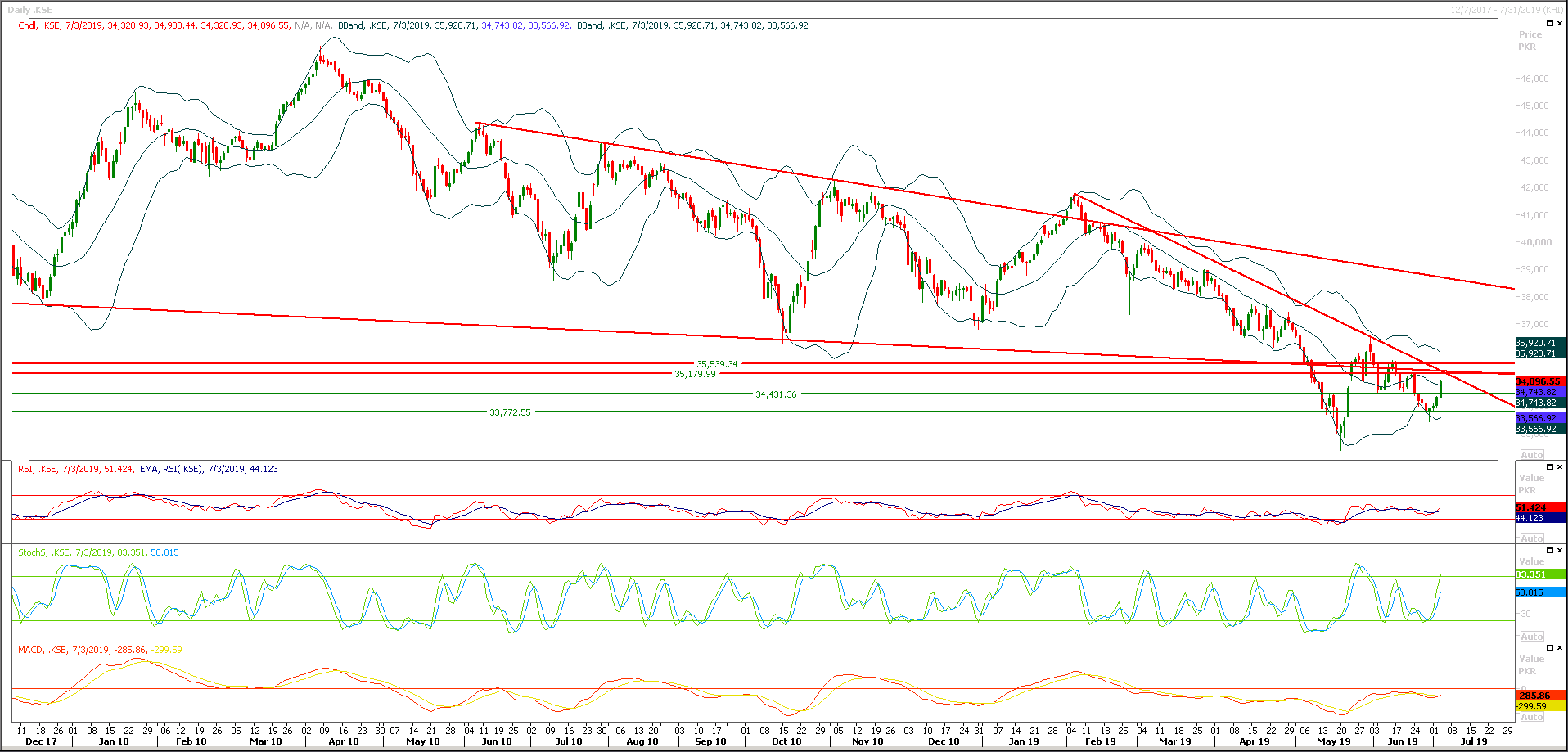

Technical Analysis

The Benchmark KSE100 index could not succeed in penetration above its major resistant region of 35,000 points during last trading session and session ended up with a positive momentum below its major resistance. As of now index would face resistances at 35,000 and 35,200 points initially but it's expected that index would try to open with a positive gap above 35,000 points which would be beneficial for bulls but if it would succeed in opening with a wide gap above 35,200 points then it may seems attractive on intraday basis but on short term and midterm basis it would create panic and discomfort among investors. Currently index would try to target 35,700 and 36,300 points in coming days and breakout above these both regions would call for 37,000 and 37,500 points while on flipside index have strong supportive regions standing at 34,400 and 33,960 points. It's recommended to start buying and hold existing long positions with trailing stop loss as index would take a sharp spike today and tomorrow.

PSO would continue its current pull back towards 181 Rs and breakout above 183 Rs will set its direction towards 200 Rs./share. While ATRL have succeeded in penetration above its resistant trend line during last trading session and it's expected that now it would continue its rally towards 87 Rs and then 94 Rs, clear breakout of 94 will call for 100 and 103 Rs./share.

PSO would continue its current pull back towards 181 Rs and breakout above 183 Rs will set its direction towards 200 Rs./share. While ATRL have succeeded in penetration above its resistant trend line during last trading session and it's expected that now it would continue its rally towards 87 Rs and then 94 Rs, clear breakout of 94 will call for 100 and 103 Rs./share.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.