Previous Session Recap

Trading volume at PSX floor dropped by 26.86 million shares or 14.60% on DoD basis, whereas the benchmark KSE100 index opened at 34,203.68, posted a day high of 34,489.51 and a day low of 34,108.10 points during last trading session while session suspended at 34,377.61 points with net change of 173.93 points and net trading volume of 106.09 million shares. Daily trading volume of KSE100 listed companies increased by 2.33 million shares or 2.25% on DoD basis.

Foreign Investors remained in net selling positions of 4.91 million shares and net value of Foreign Inflow dropped by 0.19 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis investors remained in net selling positions of 0.006, 2.61 and 2.28 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net selling positions of 6.19, 0.89 and 2.59 million shares respectively but Local Companies, Banks, NBFCs and Mutual Fund remained in net buying positions of 10.09, 0.16, 0.12 and 4.57 million shares respectively.

Analytical Review

Asian shares hit 14-week highs on trade deal hopes

Asian shares surged to more than 14-week highs on Monday as growing optimism over U.S.-China trade talks and upbeat U.S. job data boosted global investors’ appetite for riskier assets. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS jumped 1%, touching its highest level since July 25. Hong Kong's Hang Seng .HSI led gains in the region, rising 1.4%, and Seoul's Kospi .KS11 added 1.3%. In mainland China, blue chips .CSI300 were up 0.8%, and Australian shares were 0.3% higher. Markets in Japan were closed for a holiday. The United States and China both said on Friday that they had made progress in talks aimed at defusing their protracted 16-month-long trade war, and U.S. officials said a deal could be signed this month.

MYAP to focus on advancing TVET through ‘Skills for All’

Prime Minister Youth Affairs Program (PMYAP) in collaboration with National Vocational and Technical Training Center (NAVTTC) has planned to launch the program “Skills for All” for socio-economic empowerment of youth across the country. According to an official, major aim of the said program was to impart skills among the prime asset of the country-- our youth. “By creating employment opportunities for their social and economic uplift would enable them to play their pivotal role in the national development”, he remarked. He said a “`Technical Steering Committee’ would be constituted to review the progress of the project on quarterly basis, and the entire program would be made available on a digital platform to ensure merit and transparency.”

Saudi Aramco kick-starts world’s biggest IPO, offers scant details

Saudi Arabia’s giant state oil company finally kick-started its initial public offering (IPO) on Sunday, announcing its intention to float on the domestic bourse in what could be the world’s biggest listing as the kingdom seeks to diversify its economy away from oil. But in its long-awaited announcement, Aramco, the world’s most profitable company, offered few specifics on the number of shares to be sold, pricing or the date for a launch.

China keen to invest in Halal meat industry

Leader of a Chinese delegation Zhu Maa has shown interest in investing in Halal meat industry in Pakistan and exporting it to China and Middle Eastern countries. Mr Zhu said this during a meeting with Minister for States & Frontier Regions and Narcotics Control Shehryar Khan Afridi. According to a statement issued by the ministry on Sunday, the delegation from Sichuan Province has also a number of Muslims. Saying China has good equipment and services, Mr Zhu vowed to showcase Pakistani products and Halal food in Chinese markets.

Textile for restoring zero-rating facility as sales tax refund claims unpaid

Businessmen attached with the textile sector have urged the government for restoration of the zero-rated facility for the sector if it cannot release billion of rupees sales tax refunds as the industry is dying due to financial crunch. Pakistan Hosiery Manufactures & Exporters Association (PHMA) central chairman Haji Salamat Ali criticised the Federal Board of Revenue for not issuing billions of rupees refunds to exporters despite promises. He said FBR chairman Shabbar Zaidi had been reminded through a letter about the commitment the board had made with the exporters that refunds would be paid to them within 72 hours of filing of [refund] claims. For the purpose, FASTER refund module has been developed, which shall process claims of exporters for the tax period July 2019 and onwards.

Asian shares surged to more than 14-week highs on Monday as growing optimism over U.S.-China trade talks and upbeat U.S. job data boosted global investors’ appetite for riskier assets. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS jumped 1%, touching its highest level since July 25. Hong Kong's Hang Seng .HSI led gains in the region, rising 1.4%, and Seoul's Kospi .KS11 added 1.3%. In mainland China, blue chips .CSI300 were up 0.8%, and Australian shares were 0.3% higher. Markets in Japan were closed for a holiday. The United States and China both said on Friday that they had made progress in talks aimed at defusing their protracted 16-month-long trade war, and U.S. officials said a deal could be signed this month.

Prime Minister Youth Affairs Program (PMYAP) in collaboration with National Vocational and Technical Training Center (NAVTTC) has planned to launch the program “Skills for All” for socio-economic empowerment of youth across the country. According to an official, major aim of the said program was to impart skills among the prime asset of the country-- our youth. “By creating employment opportunities for their social and economic uplift would enable them to play their pivotal role in the national development”, he remarked. He said a “`Technical Steering Committee’ would be constituted to review the progress of the project on quarterly basis, and the entire program would be made available on a digital platform to ensure merit and transparency.”

Saudi Arabia’s giant state oil company finally kick-started its initial public offering (IPO) on Sunday, announcing its intention to float on the domestic bourse in what could be the world’s biggest listing as the kingdom seeks to diversify its economy away from oil. But in its long-awaited announcement, Aramco, the world’s most profitable company, offered few specifics on the number of shares to be sold, pricing or the date for a launch.

Leader of a Chinese delegation Zhu Maa has shown interest in investing in Halal meat industry in Pakistan and exporting it to China and Middle Eastern countries. Mr Zhu said this during a meeting with Minister for States & Frontier Regions and Narcotics Control Shehryar Khan Afridi. According to a statement issued by the ministry on Sunday, the delegation from Sichuan Province has also a number of Muslims. Saying China has good equipment and services, Mr Zhu vowed to showcase Pakistani products and Halal food in Chinese markets.

Businessmen attached with the textile sector have urged the government for restoration of the zero-rated facility for the sector if it cannot release billion of rupees sales tax refunds as the industry is dying due to financial crunch. Pakistan Hosiery Manufactures & Exporters Association (PHMA) central chairman Haji Salamat Ali criticised the Federal Board of Revenue for not issuing billions of rupees refunds to exporters despite promises. He said FBR chairman Shabbar Zaidi had been reminded through a letter about the commitment the board had made with the exporters that refunds would be paid to them within 72 hours of filing of [refund] claims. For the purpose, FASTER refund module has been developed, which shall process claims of exporters for the tax period July 2019 and onwards.

Market is expected to remain volatile during current trading session.

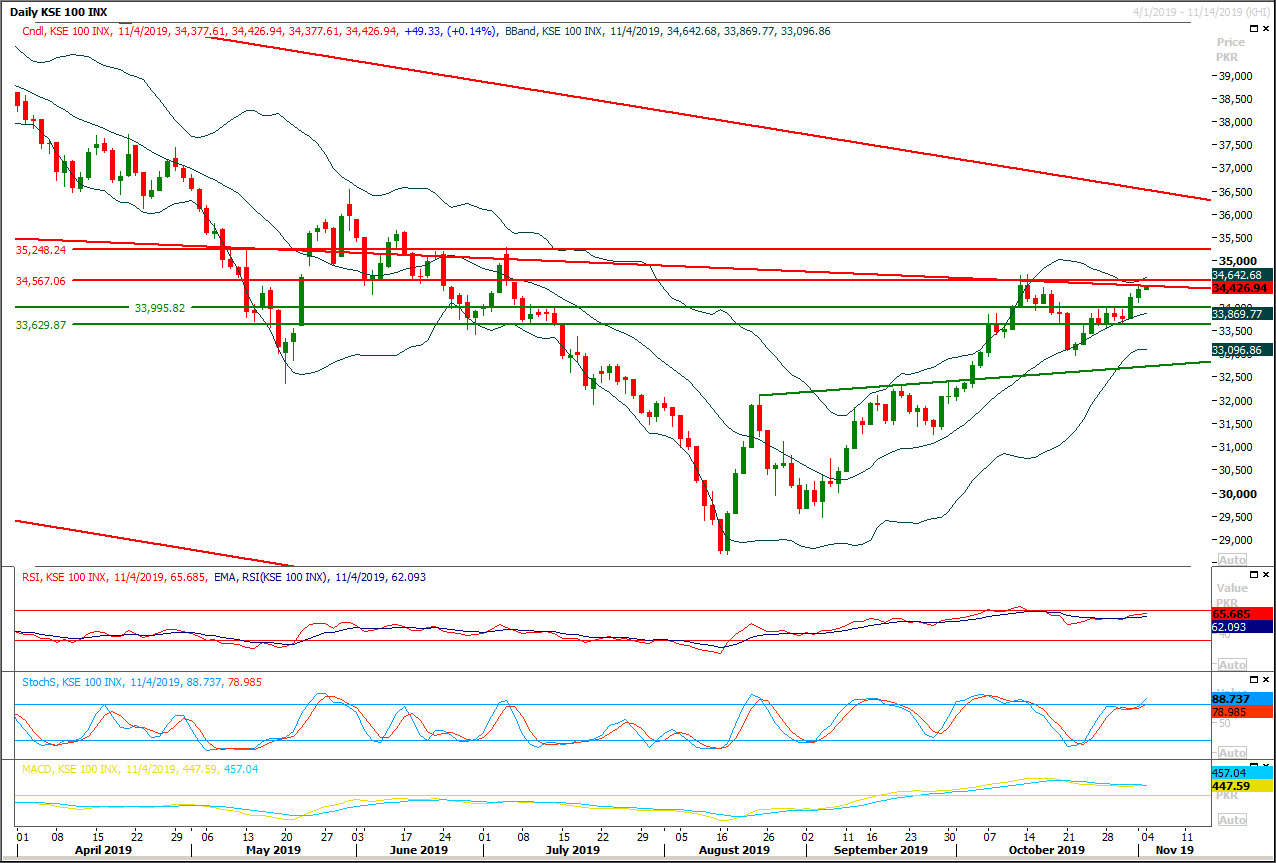

Technical Analysis

The Benchmark KSE100 index is being capped by a descending trend line on daily and weekly chart and it's expected that it would try to bounce back after posting a false breakout of said trend line on weekly chart and on due course it would face resistances at 34,600 and 34,930 points. While in case of reversal index would try to find supports at 34,000 and then at 33,700 points. It's recommended to stay cautious and post trailing stop loss on existing long positions because if index would even succeed in closing above 34,930 point even then it would remain in danger zone. As of now 35,200 points would react as a pivotal value because index would remain in danger zone below this region while breakout above this region will call for 35,700 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.