Previous Session Recap

Trading volume at PSX floor increased by 32.4 million shares or 36.46%,DoD basis, whereas the benchmark KSE100 Index opened at 42043.21, posted a day high of 42043.21 and a day low of 41025.28 during the last trading session. The session suspended at 41115.78 with a net change of -903.12 and net trading volume of 62.87 million shares. Daily trading volume of KSE100 listed companies increased by 21.64 million shares or 52.47%,DoD basis.

Foreign Investors remained in a net selling position of 0.46 million shares and net value Foreign Inflow dropped by 1.22 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.098 and 0.84 million shares but Foreign Corporate Investors remained in net selling position of 1.4 million shares. While on the other side Local Individuals, Companies and Banks remained in net buying positions of 6.1, 5.65 and 1.4 million shares respectively but NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 2.38, 3.31, 0.86 and 3.14 million shares respectively.

Analytical Review

Japanese shares climbed on Wednesday led by auto stocks as U.S. demand for cars ballooned following damage from recent hurricanes, while the dollar traded cautiously amid speculation over the next head of the Federal Reserve. Across Asia this week, trade has been generally subdued and volumes thin with China and South Korea closed for week-long holidays and analysts cautioning against reading too much into index moves. Japan's Nikkei .N225 climbed to the highest since August 2015 to 20,669.86 points, aided by strong gains in Toyota Motor (7203.T) and Mazda Motor Corp (7271.T). The rise follows buoyant U.S. shares, with the three major stock indices on Wall Street closing at record highs on Tuesday, driven by expectations of strong global growth.

Punjab Board of Investment & Trade has signed a memorandum of understanding with Meezan Bank Limited to facilitate local and foreign investors. The MoU signing ceremony was held at the offices of Punjab Board of Investment and Trade. As a direct result of Punjab Board of Investment and Trade’s relentless efforts to promote Punjab as an ideal destination for investment, an agreement was signed between Punjab Board of Investment & Trade, through its CEO Jahanzeb Burana & Meezan Bank Limited, through Syed Amir Ali, Group Head Corporate & Investment Banking.

The urea off-take for September 2017 recorded a decline of 83 percent on monthly basis and 46 percent on annually basis to clock in at 160,000 tons (excluding exports). The decline can be attributed to high base effect where Aug 2017 off-take was unusually high given heavy price discounts offered across the board. Overall in 3Q17, urea off-take clocked in at 1.45m tons which is 8% higher than 5-year average of 1.3m tons during the period under review. Interestingly, this time around 89% of the total quarterly off-take was witnessed in July-Aug period compared to 5-year average of 75%. Exports during the month remained dismal recording a dip of 63% MoM to 43,000 tons, despite significant 25% MoM rise in int’l urea prices. However, a lagged impact of increased exports can be witnessed in Oct 2017 as invoices are being recorded. DAP off-take, on the other hand, surged significantly to 375,000 tons mainly due to lower off-take during Aug 2017 unlike urea sales.

The cement industry, in the first quarter of this fiscal year, dispatched 10.348 million tons of cement, the highest ever, and it is well poised to cross the 40 million tons barrier this year. According the data released by All Pakistan Cement Manufacturers’ Association (APCMA), the sector dispatched 3.199 million tons of cement in September 2017 that was 4.61 percent higher than the commodity dispatched in September 2016. The local consumption however was 10.33 percent higher than the corresponding period of last year. The export sector continued to register a huge decline, which was down by over 23 percent in September 2017 as compared to September 2016. The local dispatches from mills based in Northern part of Pakistan stood at 2.367 million tons in September 2017, 12.05 percent higher than 2.113 million tons dispatched in September 2016. However, exports from the region fell 16.27 percent from 0.368 million tons in September 2016 to 0.308 million tons in September 2017.

Prime Minister Shahid Khaqan Abbasi on Tuesday directed the Ministry of Commerce that continuous refinements must be made to further improve the export package. Chairing a meeting on trade and exports related matters at the PM Office, the Prime Minister directed the ministry to submit the refined and finalized proposals to the Economic Coordination Committee (ECC). The meeting reviewed the impact of Prime Minister's Exports package and noted, with satisfaction, that more than 10 percent increase had been observed in country's exports during the last three months. Various options to increase the impact of Prime Minister's Export Package were considered during the meeting.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

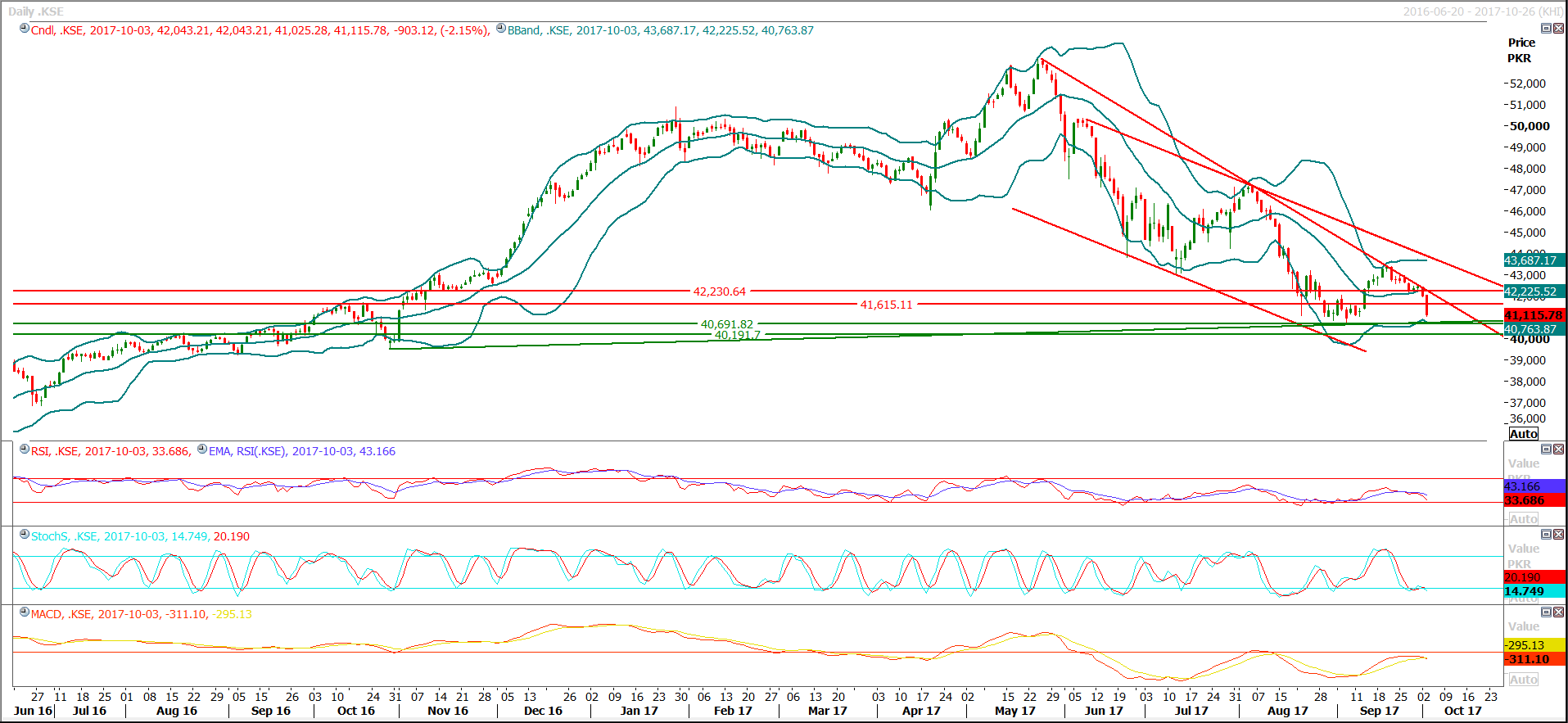

The Benchmark KSE100 Index has closed above its supportive region of 41000 and two major supports are still ahead at 40600 and 40200 which may try to support the index against its current bearish momentum, but closing below 40600 might call for a further drop down towards 39500. Daily and weekly stochastic are in bearish momentum which might push the index further downwards but an intraday pullback could be witnessed from 40600 but it is recommended to sell on strength as index has resistances around 41354 and 41700.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.