Previous Session Recap

Trading volume at PSX floor increased by 0.43 million shares or 0.62% on DoD basis, whereas the benchmark KSE100 index opened at 32,035.61, posted a day high of 32,060.58 and a day low of 31,780.92 points during last trading session while session suspended at 31,839.11 points with net change of -99.37 points and net trading volume of 55.15 million shares. Daily trading volume of KSE100 listed companies increased by 1.35 million shares or 2.51% on DoD basis.

Foreign Investors remained in net selling positions of 1.14 million shares and net value of Foreign Inflow dropped by 0.12 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.006 and 0.061 million shares but Foreign Corporate investors remained in net selling positions of 1.20 million shares. While on the other side Local Individuals, Companies and Banks remained in net long positions of 0.71, 1.21 and 0.59 million shares but NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 0.005, 0.39, 0.33 and 0.69 million shares respectively.

Analytical Review

Asia stocks hit six-month lows, bonds boom amid market shakeout

Asian shares slid to 6-1/2-month lows on Monday and the yuan slumped to a more than decade trough as a rapid escalation in the Sino-U.S. trade war sent investors stampeding to traditional safe harbors including the yen, bonds and gold. Markets have been badly spooked since U.S. President Donald Trump abruptly declared he would slap 10% tariffs on $300 billion in Chinese imports, ending a month-long trade truce. China vowed on Friday to fight back. In response, China's yuan CNH= CNY= burst beyond the psychological 7-per-dollar threshold in a move that threatened to unleash a new front in the trade hostilities - a currency war.

PM rejects ministry’s summary on Irsa federal member’s nomination

Prime Minister Imran Khan has rejected the summary of the ministry of water resource regarding the nomination of federal member of Irsa, and asked the ministry to prepare formal summary in the light of the letter of Sindh chief minister in this regard. Enclosed with the letter of Sindh Chief Minister Murad Ali Shah regarding the nomination of Federal Member Irsa from Sindh, the Prime Minister office has asked the ministry of water resource that the letter was placed before Prime Minister who has pleased to desire that the formal summary be preferred keeping in view the letter in this regard, official source told The Nation. Following the PM office directives the ministry of Water Resources has asked Irsa to provide its stance on the issue to the ministry. Irsa in its meeting with all the provincial members has deliberated on the matter and provided its input to the Ministry of Water Resource in this regard, said the source.

Reko Diq: Pakistan’s $6 billion mistake

The inevitable has come to pass. Perhaps not everyone saw it coming or simply preferred to have their heads buried in the sand. But the reality is that one did not have to gaze into a crystal ball to foresee this outcome, the World Bank’s International Center for Settlement of Investment Disputes (ICSID) arbitral tribunal’s award of approximately $6 billion in the Reko Diq case. Since the Supreme Court of Pakistan’s declaration of the gold and copper mining agreement between the Balochistan government and Tethyan Copper Company (TCC) illegal in 2013, several international law experts had deemed this ICSID decision against Pakistan a foregone conclusion. A noteworthy and rather worrisome aspect of this case is that since its initiation around 7 years ago, instead of a dispassionate and strictly legal discourse on revisiting and rectifying our approach towards international arbitration, our primary focus has been on morphing a purely legal issue into an issue about expropriation of our natural resources by an allegedly disingenuous foreign investor.

PSO, SNGPL raise red flag, ask govt to rescue gas network

The country’s gas network has raised the ‘red flag’ owing to high pressure levels, compelling the authorities to drastically scale down supplies, particularly from domestic gas fields amid lower electricity demand and better hydropower generation. Pakistan State Oil (PSO), the country’s premier importer of liquefied natural gas and largest company by revenue, and Sui Northern Gas Pipelines Limited (SNGPL) have sought intervention of the energy ministry and the Prime Minister Office to resolve an issue involving safety of the gas network, financial costs to the exchequer and international penalties. In two simultaneous communications to the federal government, the PSO and SNGPL have complained about lower than committed gas quantities by the power sector and warned of serious consequences.

Chiniot, Chagai ore steel mill project picked for Saudi investment

The country’s first-ever local iron-ore steel mill to be established in Chiniot tops the list of four potential projects selected by the government from across the country for investment by Saudi Arabia, it emerged on Sunday. It may be recalled that Pakistan has signed a Memorandum of Understanding (MoU) for economic cooperation in mineral resources. The MoU was part of the several $20 billion agreements and MoUs signed on Feb 17, 2019 for different sectors, including power production, establishment of refinery, petrochemical plant, promotion of sports and technical assistance in standardisation sector, at a ceremony held at Prime Minister House on the occasion of Saudi Crown Prince Mohammad Bin Salman’s visit.

Asian shares slid to 6-1/2-month lows on Monday and the yuan slumped to a more than decade trough as a rapid escalation in the Sino-U.S. trade war sent investors stampeding to traditional safe harbors including the yen, bonds and gold. Markets have been badly spooked since U.S. President Donald Trump abruptly declared he would slap 10% tariffs on $300 billion in Chinese imports, ending a month-long trade truce. China vowed on Friday to fight back. In response, China's yuan CNH= CNY= burst beyond the psychological 7-per-dollar threshold in a move that threatened to unleash a new front in the trade hostilities - a currency war.

Prime Minister Imran Khan has rejected the summary of the ministry of water resource regarding the nomination of federal member of Irsa, and asked the ministry to prepare formal summary in the light of the letter of Sindh chief minister in this regard. Enclosed with the letter of Sindh Chief Minister Murad Ali Shah regarding the nomination of Federal Member Irsa from Sindh, the Prime Minister office has asked the ministry of water resource that the letter was placed before Prime Minister who has pleased to desire that the formal summary be preferred keeping in view the letter in this regard, official source told The Nation. Following the PM office directives the ministry of Water Resources has asked Irsa to provide its stance on the issue to the ministry. Irsa in its meeting with all the provincial members has deliberated on the matter and provided its input to the Ministry of Water Resource in this regard, said the source.

The inevitable has come to pass. Perhaps not everyone saw it coming or simply preferred to have their heads buried in the sand. But the reality is that one did not have to gaze into a crystal ball to foresee this outcome, the World Bank’s International Center for Settlement of Investment Disputes (ICSID) arbitral tribunal’s award of approximately $6 billion in the Reko Diq case. Since the Supreme Court of Pakistan’s declaration of the gold and copper mining agreement between the Balochistan government and Tethyan Copper Company (TCC) illegal in 2013, several international law experts had deemed this ICSID decision against Pakistan a foregone conclusion. A noteworthy and rather worrisome aspect of this case is that since its initiation around 7 years ago, instead of a dispassionate and strictly legal discourse on revisiting and rectifying our approach towards international arbitration, our primary focus has been on morphing a purely legal issue into an issue about expropriation of our natural resources by an allegedly disingenuous foreign investor.

The country’s gas network has raised the ‘red flag’ owing to high pressure levels, compelling the authorities to drastically scale down supplies, particularly from domestic gas fields amid lower electricity demand and better hydropower generation. Pakistan State Oil (PSO), the country’s premier importer of liquefied natural gas and largest company by revenue, and Sui Northern Gas Pipelines Limited (SNGPL) have sought intervention of the energy ministry and the Prime Minister Office to resolve an issue involving safety of the gas network, financial costs to the exchequer and international penalties. In two simultaneous communications to the federal government, the PSO and SNGPL have complained about lower than committed gas quantities by the power sector and warned of serious consequences.

The country’s first-ever local iron-ore steel mill to be established in Chiniot tops the list of four potential projects selected by the government from across the country for investment by Saudi Arabia, it emerged on Sunday. It may be recalled that Pakistan has signed a Memorandum of Understanding (MoU) for economic cooperation in mineral resources. The MoU was part of the several $20 billion agreements and MoUs signed on Feb 17, 2019 for different sectors, including power production, establishment of refinery, petrochemical plant, promotion of sports and technical assistance in standardisation sector, at a ceremony held at Prime Minister House on the occasion of Saudi Crown Prince Mohammad Bin Salman’s visit.

Market is expected to remain volatile during current trading session.

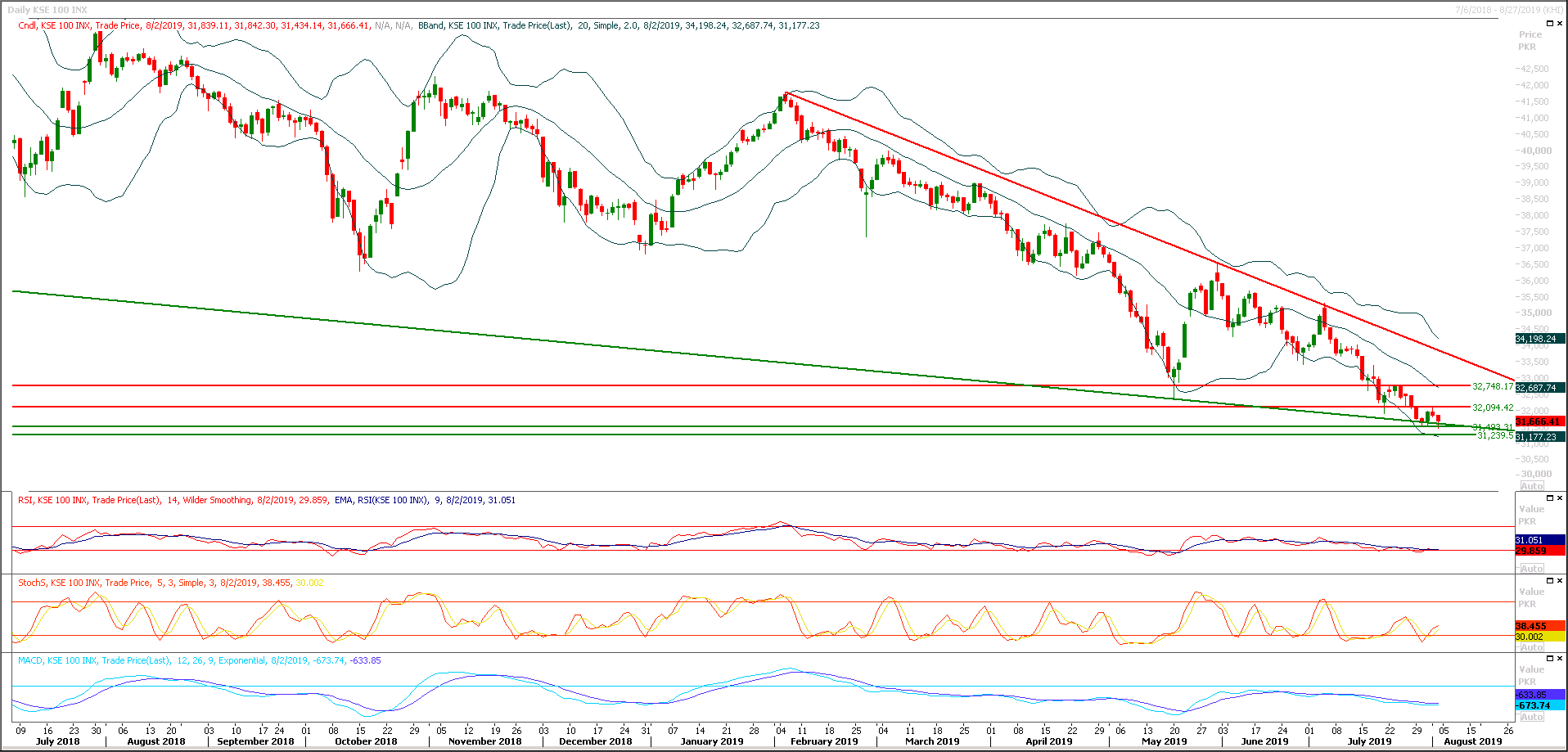

Technical Analysis

The Benchmark KSE100 index is trying to get support from a descending trend line on daily chart and it's expected that index would open with a negative gap below said trend line while on same time it would try to find supportive regions at 31,500 & 31,200 points but daily closing below 31,200 points would change market trend and serious dip would be witnessed in coming days. While on flipside index would find resistances at 32,000 and 32,500 points and some fresh volumes would be required for market to give a clear breakout of these regions. It's recommended to practice caution during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.