Previous Session Recap

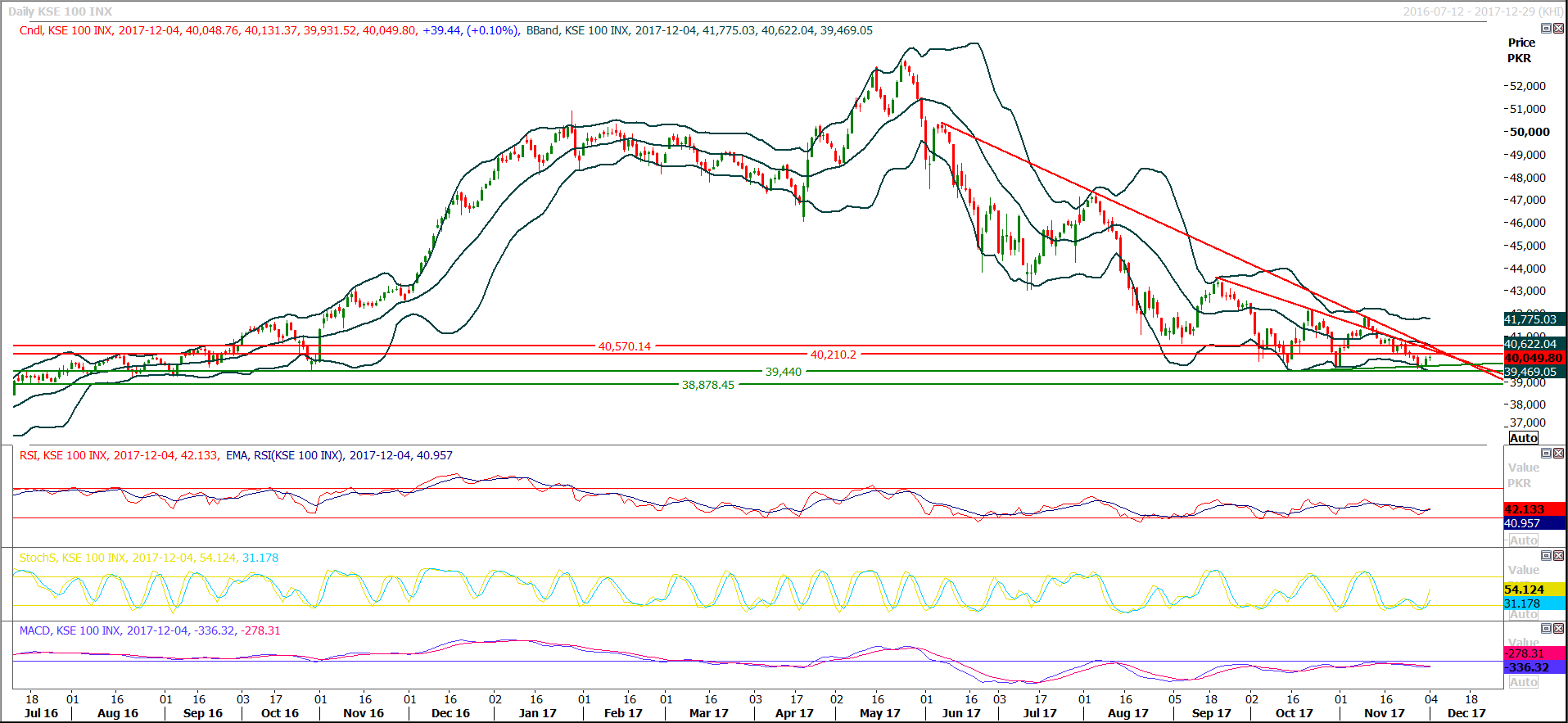

Trading volume at PSX floor dropped by 84.13 million shares or 46.53% on DoD basis, whereas, the benchmark KSE100 Index opened at 40048.76, posted a day high of 40131.37 and a day low of 39931.52 during last trading session. The session suspended at 40049.80 with net change of 39.44 and net trading volume of 47.29 million shares. Daily trading voluem of KSE100 listed companies dropped by 78.83 million shares or 62.5% on DoD basis.

Foregin Investors remained in net buying position of 0.49 million shares but net value of Foreign Inflow dropped by 1.06 million US Dollars. Categorically, Foreign Corporate Investors remained in net selling position of 2.29 million shares but Overseas Pakistanis remained in net buying position of 2.75 million shares. While on the other side Local Individuals and Brokers remained in net selling position of 1.61 and 1.06 million shares but Local Companies, Banks, NBFCs, Mutual Funds and Insurance Companies remained in net buying positions of 0.56, 0.35, 0.45, 0.05 and 0.84 million shares respectively.

Analytical Review

Asian shares were subdued on Tuesday as investors’ rotation out of technology shares took the toll on some of the region’s tech heavyweights although hopes of a major tax cut in the United States underpinned risk sentiment. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS were capped by the fall in the region’s technology shares, with Samsung Electronics (005930.KS) losing 1.5 percent. Japan's Nikkei .N225 fell 0.4 percent, with semiconductor-related shares such as Tokyo Electron (8035.T) and Shin-etsu Chemical (4063.T) leading the losses. On Wall Street, the benchmark S&P 500 .SPX finished lower on Monday after setting a record intraday high earlier as the technology sector .SPLRCT, which has led Wall Street's record-setting rally this year, tumbled 1.9 percent.

China has temporarily stopped funding of some projects particularly those related to the road network under the China-Pakistan Economic Corridor (CPEC) till further decision regarding ‘new guidelines’ to be issued from Beijing, a senior government official told Dawn on Monday. The decision could affect over Rs1 trillion road projects of the National Highway Authority (NHA). It was not clear how wide the impact of the delay will be, but initial reports confirm that at least three road projects are going to experience a delay.

The Central Development Working Party (CDWP) Monday approved 17 projects worth Rs19.2 billion and forwarded 7 mega projects of Rs.51.27 billion to Executive Committee of National Economic Council (Ecnec) for further approval. CDWP meeting was held under the chairmanship of Deputy Chairman Planning Commission Sartaj Aziz. Senior officials from federal and provincial governments participated in the meeting. The projects presented for approval included those from sectors of energy, water, transport and communication, physical planning, health, science and technology, culture, sports and tourism. Rs.18.6 billion projects related to energy, Rs.5.8 billion projects related to water resources, Rs24.2 billion projects related to transport and communication, Rs 12.2 billion projects related to science and technology, Rs 8.3 billion projects related to health, Rs3.8 billion projects related to food and agriculture, Rs66.356 million projects related to physical planning while projects worth 592 million related to culture, sports and tourism were part of the CDWP meeting.

The private sector’s credit off-take from commercial banks nearly quadrupled year-on-year in the first five months of 2017-18, according to data released by the State Bank of Pakistan (SBP) on Monday. Its monetary impact from July 1 to Nov 24 was Rs101.1 billion against Rs26.9bn a year ago. Although the lending by commercial banks and their Islamic branches to the private sector was substantially higher than last year’s, Islamic banks have shown poor performance since the beginning of 2017-18.

Rice export from the country during first 4 months (July-October) of current fiscal year increased by 16.87 per cent as compared to same period of last year. The rice export during the period under review rose to $457.66 million from $391.595 million during July-October 2016-17, according to latest data released by PBS. On month-on-month basis, the rice export also increased to $137.423 million in October 2017 from $96.306 million in September 2017, showing an increase of 42.69 per cent. However, on year-on-year basis, the rice export decreased by 7.71 per cent as the export went down $148.9 million in October 2016 to $137.42 million.

ATRL, OGDC, NML and PSO may lead the index in positive direction today.

Technical Analysis

The Benchmark KSE100 Index is trying to enter into bullish trend on daily chart but two strong resistant regions are capping its bullish move at 40210 and 40431 points. As of right now hourly momentum is bullish along with daily but weekly trend is bearish which would be changed once index would close above 40431. For current trading session index have resistances at 40210 and 40360 where its capped by a horizontal resistance and a trend line respectively. Its recommended to buy on dip and sell on strength during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.