Previous Session Recap

Trading volume at PSX floor increased by 31.48 million shares or 19.15% on DoD basis, whereas the Benchmark KSE100 Index opened at 38,889.68, posted a day high of 39,657.96 and a day low of 38,889.24 during last trading session while session suspended at 39602.87 points with net change of 442.27 points and net trading volume of 140.55 million shares. Daily trading of KSE100 listed companies increased by 37.89 million shares or 36.90% on DoD basis.

Foreign Investors remained in net selling positions of 2.39 million shares and value of Foreign Inflow dropped by 3.59 million US Dollars. Categorically, Foreign Corporate Investors remained in net selling positions of 4.34 million shares but Overseas Pakistanis remained in buying position of 1.89 million shares. While on the other side Local Individuals, Companies Banks, NBFCs, Brokers and Insurance Companies remained in net buying positions of 11.48, 1.23, 0.4, 0.52, 3.47 and 6.30 million shares respectively but Mutual Funds remained in net selling positions of 20.6 million shares.

Analytical Review

Stocks drop as falling U.S. yields, trade worries hit mood

Asian stocks slid on Wednesday, dragged down by Wall Street’s tumble as sharp declines in long-term U.S. Treasury yields and resurgent trade concerns stoked investor worries about global economic growth. Global equities have been shaken as a flattening U.S. Treasury yield curve fans worries about a recession, and on growing doubts that Washington and Beijing will be able to clinch a substantive trade deal during a temporary cease-fire agreed at the weekend. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.35 percent. Hong Kong's Hang Seng .HSI retreated 1.55 percent and the Shanghai Composite Index .SSEC dipped 0.2 percent.

Inflation rate rises to 6.5pc in November

Inflation rate was higher at 6.5 percent during November mainly due to the economic policies of enhance power and gas tariffs, depreciating currency and impact of the mini budget. Inflation measured by Consumer Price Index (CPI) was only 4 percent in the same month of previous year, according to Pakistan Bureau of Statistics (PBS). However, the inflation has ballooned to 6.5 percent in November this year as a result of the economic policies of the government. The PTI led government had taken tough decisions of increasing power and gas tariffs, petroleum products prices, depreciating the currency and announcing the mini budget during its first hundred days in office. The State Bank of Pakistan (SBP) has recently further depreciated the currency, which would fuel the inflation in the months to come. Dollar had surged to all time high Rs144 on Friday, which later settled at Rs138.

Govt to raise renewable energy share to 20pc: Bakhtyar

The Federal Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar Tuesday said that the share of renewable energy will be enhanced to 20 percent in the energy mix of the country. Bakhtyar said this while jointly chairing a meeting with Minister for Energy (Power Division) Omar Ayub Khan on integrated energy planning on Tuesday. Secretary Planning, Zafar Hasan, Project Director China Pakistan Economic Corridor Hassan Daud and senior officials from Ministry of Energy Power and Petroleum Division attended the meeting. Officials of the ministry of energy briefed the meeting about the progress on CPEC Energy projects while Member Energy, Planning Commission Tahawar Hussain briefed on integrated energy planning.

ECC relaxes conditions for sugar millers, denies freight subsidy on export

In a bid to break a deadlock, the government allowed sugar millers another 100,000 tonnes of export and relaxed the limit of 1m tonnes it had set previously. On top of that, the government also waived a requirement that millers begin crushing by Nov 15 in order to avail exports. Only a handful of millers started crushing by this date, so the Economic Coordination Committee (ECC) decided to waive it altogether. Presided over by Finance Minister Asad Umar, a meeting of the Economic Coordination Committee (ECC) of the Cabinet also ordered immediate payment of Rs2 billion outstanding freight subsidy to sugar mills to persuade them for early start of crushing season that has already been delayed and causing hardship to farmers. The funds are subsidy payments owed from last year. The ECC decided to not allow any further subsidies, saying the millers should approach the provincial governments for such payments.

Opec works on deal to cut output

Opec and its allies are working towards a deal this week to reduce oil output by at least 1.3 million barrels per day, four sources said, adding that Russia’s resistance to a major cut was so far the main stumbling block. Opec meets on Thursday in Vienna, followed by talks with allies such as Russia on Friday, amid a drop in crude prices caused by global economic weakness and fears of an oil glut due largely to a rise in US production. The producer group’s de facto leader, Saudi Arabia, has indicated a need for steep reductions in output from January but has come under pressure from US President Donald Trump to help support the world economy with lower oil prices.

Asian stocks slid on Wednesday, dragged down by Wall Street’s tumble as sharp declines in long-term U.S. Treasury yields and resurgent trade concerns stoked investor worries about global economic growth. Global equities have been shaken as a flattening U.S. Treasury yield curve fans worries about a recession, and on growing doubts that Washington and Beijing will be able to clinch a substantive trade deal during a temporary cease-fire agreed at the weekend. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.35 percent. Hong Kong's Hang Seng .HSI retreated 1.55 percent and the Shanghai Composite Index .SSEC dipped 0.2 percent.

Inflation rate was higher at 6.5 percent during November mainly due to the economic policies of enhance power and gas tariffs, depreciating currency and impact of the mini budget. Inflation measured by Consumer Price Index (CPI) was only 4 percent in the same month of previous year, according to Pakistan Bureau of Statistics (PBS). However, the inflation has ballooned to 6.5 percent in November this year as a result of the economic policies of the government. The PTI led government had taken tough decisions of increasing power and gas tariffs, petroleum products prices, depreciating the currency and announcing the mini budget during its first hundred days in office. The State Bank of Pakistan (SBP) has recently further depreciated the currency, which would fuel the inflation in the months to come. Dollar had surged to all time high Rs144 on Friday, which later settled at Rs138.

The Federal Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar Tuesday said that the share of renewable energy will be enhanced to 20 percent in the energy mix of the country. Bakhtyar said this while jointly chairing a meeting with Minister for Energy (Power Division) Omar Ayub Khan on integrated energy planning on Tuesday. Secretary Planning, Zafar Hasan, Project Director China Pakistan Economic Corridor Hassan Daud and senior officials from Ministry of Energy Power and Petroleum Division attended the meeting. Officials of the ministry of energy briefed the meeting about the progress on CPEC Energy projects while Member Energy, Planning Commission Tahawar Hussain briefed on integrated energy planning.

In a bid to break a deadlock, the government allowed sugar millers another 100,000 tonnes of export and relaxed the limit of 1m tonnes it had set previously. On top of that, the government also waived a requirement that millers begin crushing by Nov 15 in order to avail exports. Only a handful of millers started crushing by this date, so the Economic Coordination Committee (ECC) decided to waive it altogether. Presided over by Finance Minister Asad Umar, a meeting of the Economic Coordination Committee (ECC) of the Cabinet also ordered immediate payment of Rs2 billion outstanding freight subsidy to sugar mills to persuade them for early start of crushing season that has already been delayed and causing hardship to farmers. The funds are subsidy payments owed from last year. The ECC decided to not allow any further subsidies, saying the millers should approach the provincial governments for such payments.

Opec and its allies are working towards a deal this week to reduce oil output by at least 1.3 million barrels per day, four sources said, adding that Russia’s resistance to a major cut was so far the main stumbling block. Opec meets on Thursday in Vienna, followed by talks with allies such as Russia on Friday, amid a drop in crude prices caused by global economic weakness and fears of an oil glut due largely to a rise in US production. The producer group’s de facto leader, Saudi Arabia, has indicated a need for steep reductions in output from January but has come under pressure from US President Donald Trump to help support the world economy with lower oil prices.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

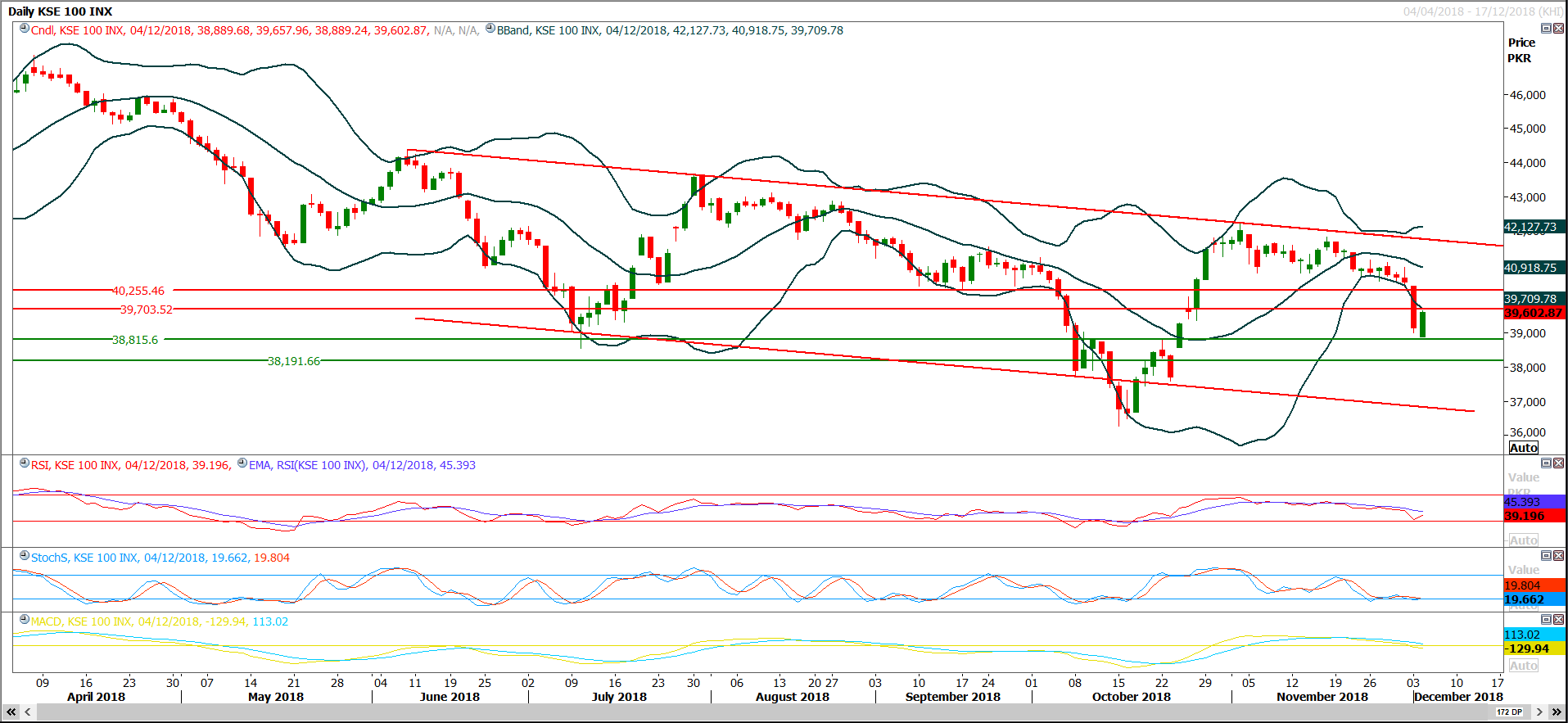

Technical Analysis

The Benchmark KSE100 Index have tried to bounce back after getting support from a horizontal supportive during last trading session for a correction of massive fall of second last trading session and it’s expected index would remain under pressure until it close above 40,250 points on daily chart, therefore it’s recommended to start selling on strength with strict stop loss of 40,500. Daily and weekly momentum indicators are still on bearish side and it’s expected that intraday momentum would also convert to bearish side in second half if index would not succeed in opening above 39,760 with a positive gap. Market is expected to remain volatile during current trading session therefore it’s recommended to stay cautious and practice swing trading strategy.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.