Previous Session Recap

Trading volume at PSX floor dropped by 18.57 million shares or 14.24% on DoD basis, whereas the benchmark KSE100 index opened at 35,132.54, posted a day high of 35,279.32 and a day low of 34,466.62 points during last trading session while session suspended at 34,570.62 points with net change of -325.93 points and net trading volume of 88.95 million shares. Daily trading volume of KSE100 listed companies dropped by 10.4 million shares or 10.47% on DoD basis.

Foreign Investors remained in net buying positions of 4.55 million shares and net value of Foreign Inflow increased by 2.95 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net buying positions of 2.16 and 2.41 million shares. While on the other side Local Individuals, Companies and Mutual Funds remained in net buying positions of 1.5, 3.7 and 0.43 million sharers respectively but Banks, Brokers and Insurance Companies remained in net selling positions of 5.05, 2.34 and 2.44 million shares.

Analytical Review

Asian shares hold near two-month highs before U.S. payrolls test

Asian shares hovered near two-month highs on Friday as investors braced for U.S. employment data, a key release that could stoke or temper market expectations about aggressive policy easing by the Federal Reserve. MSCI’s broadest index of Asia-Pacific shares outside Japan was set for its fifth straight weekly rise which took it to 534.40, the highest since early May. It was last at 532.82. Japan's Nikkei .N225 was a tad weaker. Chinese shares were mixed with the blue-chip index .CSI300 up 0.2%. Australia and New Zealand shares were slightly higher as was Hong Kong's Hang Seng index .HSI. E-Minis for the S&P500 ESc1 advanced about 0.1%. World stocks and bonds have rallied since June on hopes global central banks will keep policy easy to support growth.

IMF package to bring $38bn from other creditors

Pakistan on Thursday welcomed $6bn bailout package approved by the executive board of the International Monetary Fund (IMF), saying it would lead to inflows of $38bn from other lenders in three years. Speaking at a hurriedly called news conference, PM’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh said the approval of 39-month reform programme by the IMF executive board without opposition from any member would provide stability to Pakistan. “The board has given us trust to prove ourselves good partners and deliver on reform promises,” he said.

PM orders massive crackdown on benami assets

Prime Minister Imran Khan on Thursday directed the Federal Board of Revenue (FBR) to launch a massive crackdown on holders of benami assets. However, he asked the FBR not to harass the business community and industrialists as without their cooperation the country could not get rid of the prevailing financial crunch. Presiding over a meeting with Punjab Chief Minister Usman Buzdar, the prime minister directed FBR Chairman Shabbar Zaidi to hold meetings with chambers of commerce and industry of Lahore and Faisalabad in the next two days and take the business community into confidence on the government’s reforms plan.

Cement dealers continue strike against taxes

All Pakistan Cement Dealers Association continued strike on Thursday to protest against high taxes and FBR restrictions of documentation of sales, cutting down supply in parts of the country. Business community feared halt in construction activities if the strike prolonged. At the same time, the prevailing scenario would lead to huge loss of revenue to the government. Dealers Association and manufacturers will hold talks on Friday (today) to resolve the issue. The Association had held separate meetings with the manufacturers and Minister for Industry and Trade on last Tuesday which remained inconclusive. Office bearers of the association said that there were hopes of resolution of the issue in meeting with the manufacturers on Friday. According to estimates, the government is losing revenues of Rs350 to Rs400 million daily due to the cement crisis. The strike has gravely cut down the cement supply resulting in worst scenario for the sector as total daily dispatches slashed from 150,000 tonnes to 40,000 tonnes. The industry has already been marred with issues like gas price hike, axle load limitations, smuggling of Iranian cement, increase in FED etc.

Hafeez optimistic about IMF loan benefits, but warns of 'difficult decisions' ahead

Adviser to the Prime Minister on Finance Abdul Hafeez Shaikh on Thursday said that Pakistan by entering into an agreement with the International Monetary Fund (IMF) was sending a message to the world that its government will exhibit responsibility in controlling its expenditures and will mobilise taxes from its wealthy classes. He was addressing a press conference a day after the Executive Board of the IMF approved a $6 billion bailout package for Pakistan and immediately released $1bn to ease a sustained pressure on the country’s foreign exchange reserves. "We will take difficult decisions," Shaikh said, adding that measures will be taken to protect the vulnerable segments of society. He said the government had in its recently unveiled budget raised allocations for the poor classes and women and provided incentives for the business community.

Asian shares hovered near two-month highs on Friday as investors braced for U.S. employment data, a key release that could stoke or temper market expectations about aggressive policy easing by the Federal Reserve. MSCI’s broadest index of Asia-Pacific shares outside Japan was set for its fifth straight weekly rise which took it to 534.40, the highest since early May. It was last at 532.82. Japan's Nikkei .N225 was a tad weaker. Chinese shares were mixed with the blue-chip index .CSI300 up 0.2%. Australia and New Zealand shares were slightly higher as was Hong Kong's Hang Seng index .HSI. E-Minis for the S&P500 ESc1 advanced about 0.1%. World stocks and bonds have rallied since June on hopes global central banks will keep policy easy to support growth.

Pakistan on Thursday welcomed $6bn bailout package approved by the executive board of the International Monetary Fund (IMF), saying it would lead to inflows of $38bn from other lenders in three years. Speaking at a hurriedly called news conference, PM’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh said the approval of 39-month reform programme by the IMF executive board without opposition from any member would provide stability to Pakistan. “The board has given us trust to prove ourselves good partners and deliver on reform promises,” he said.

Prime Minister Imran Khan on Thursday directed the Federal Board of Revenue (FBR) to launch a massive crackdown on holders of benami assets. However, he asked the FBR not to harass the business community and industrialists as without their cooperation the country could not get rid of the prevailing financial crunch. Presiding over a meeting with Punjab Chief Minister Usman Buzdar, the prime minister directed FBR Chairman Shabbar Zaidi to hold meetings with chambers of commerce and industry of Lahore and Faisalabad in the next two days and take the business community into confidence on the government’s reforms plan.

All Pakistan Cement Dealers Association continued strike on Thursday to protest against high taxes and FBR restrictions of documentation of sales, cutting down supply in parts of the country. Business community feared halt in construction activities if the strike prolonged. At the same time, the prevailing scenario would lead to huge loss of revenue to the government. Dealers Association and manufacturers will hold talks on Friday (today) to resolve the issue. The Association had held separate meetings with the manufacturers and Minister for Industry and Trade on last Tuesday which remained inconclusive. Office bearers of the association said that there were hopes of resolution of the issue in meeting with the manufacturers on Friday. According to estimates, the government is losing revenues of Rs350 to Rs400 million daily due to the cement crisis. The strike has gravely cut down the cement supply resulting in worst scenario for the sector as total daily dispatches slashed from 150,000 tonnes to 40,000 tonnes. The industry has already been marred with issues like gas price hike, axle load limitations, smuggling of Iranian cement, increase in FED etc.

Adviser to the Prime Minister on Finance Abdul Hafeez Shaikh on Thursday said that Pakistan by entering into an agreement with the International Monetary Fund (IMF) was sending a message to the world that its government will exhibit responsibility in controlling its expenditures and will mobilise taxes from its wealthy classes. He was addressing a press conference a day after the Executive Board of the IMF approved a $6 billion bailout package for Pakistan and immediately released $1bn to ease a sustained pressure on the country’s foreign exchange reserves. "We will take difficult decisions," Shaikh said, adding that measures will be taken to protect the vulnerable segments of society. He said the government had in its recently unveiled budget raised allocations for the poor classes and women and provided incentives for the business community.

ATRL, PAEL, DGKC, PSO and LUCK would try to lead the positive momentum during current trading session.

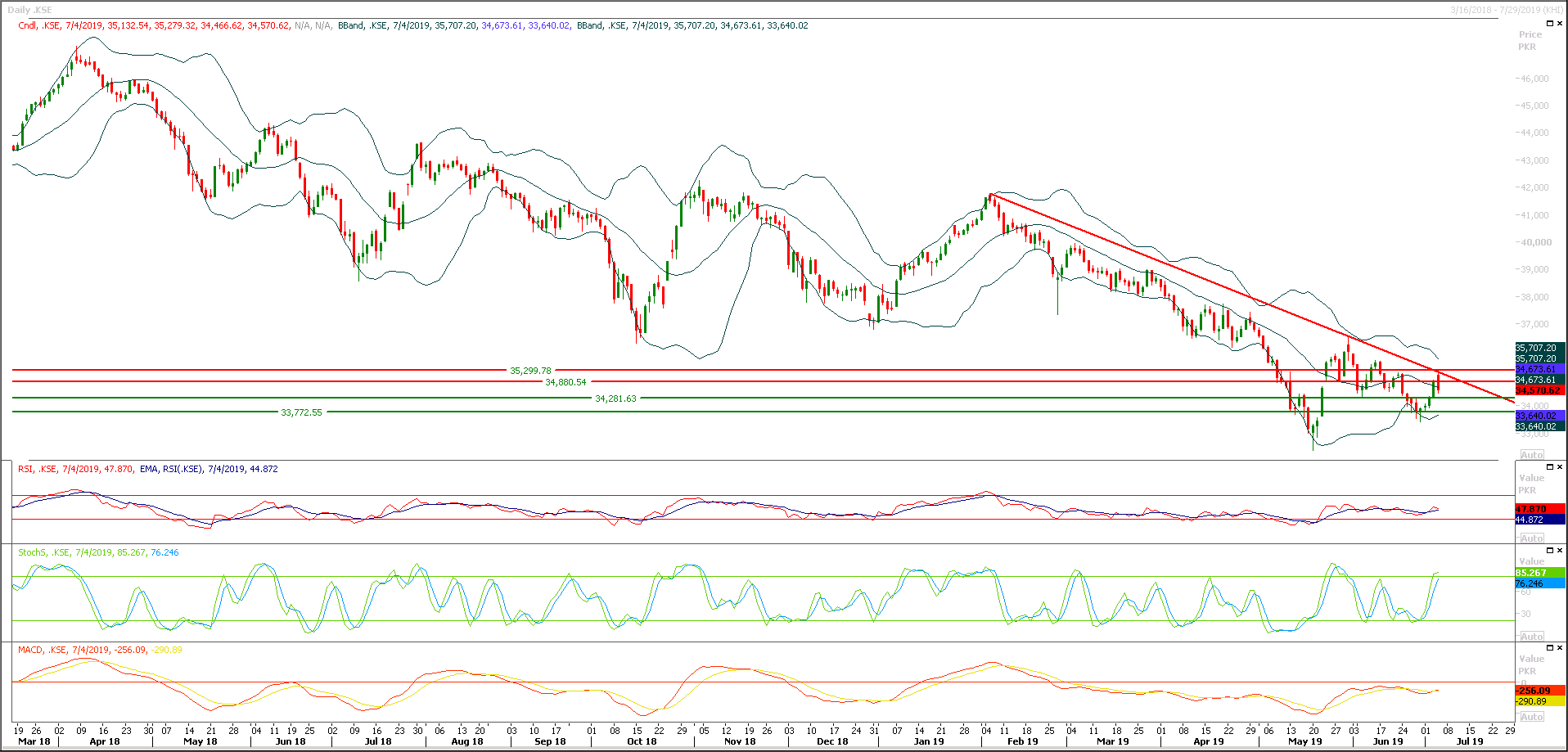

Technical Analysis

The Benchmark KSE100 index have bounced back after getting resistant from its major resistant region of 35,300 points which fall on a strong horizontal resistant region along with descending trend line, that region have pushed index backward for a retrace and now it's expected that index would try to start a pull back from 34,200 points where a strong horizontal supportive region would resist against any kind of pressure and if index would succeed in maintaining above this region then this time it would gave a breakout of 35,300 points which would results in a sharp spike towards 36,000 and 37,000 points on short term basis. While on flipside index would find supports at 34,200 and 33,760 points. It's recommended to start buying on dip with strict stop loss of 34,000 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.