Previous Session Recap

Trading volume at PSX floor increased by 17.98 million shares or 8.48% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43567.18, posted a day high of 43759.13 and a day low of 43412.47 during last trading session. The session suspended at 43740.49 with net change of 230.10 and net trading volume of 84.42 million shares. Daily trading volume of KSE100 listed companies increased by 4.59 million shares or 5.75% on DoD basis.

Foreign Investors remained in net selling position of 5.8 million shares and net value of Foreign inflow dropped by 13.19 million US Dollars. Categorically, Foreign Indivduals and Overseas Pakistanis remianed in net buying positions of 0.05 and 1.51 million shares but Foreign Corporate Investors remianed in net selling position of 7.36 million shares. While on the other side Local Individuals and Companies remained in net buying positions of 7.79 and 19.4 million shares, but Local Banks, NBFCs, Mutal Funds, Brokers and Insurance Companies remained in net selling positions of 8.26, 9.49, 0.2, 2.86 and 0.23 million shares respectively.

Analytical Review

Asian shares were on the backfoot and the safe-haven yen rose on Monday amid fears of a global trade war, while the euro was choppy as investors worried Italy’s national elections could deliver an anti-establishment government.Italian voters delivered a hung parliament on Sunday, flocking to anti-establishment and far-right parties in record numbers and casting the euro zone’s third-largest economy into a political gridlock that could take months to clear.After a see-saw start, the common currency eased back to $1.2333 from a two-week high of $1.2365 as the eurosceptic 5-star Movement saw its support soar to become the largest single party, according to projections based on early vote-counting.“There is a highly uncertain landscape that this election has thrown up,” said Ray Attrill, head of forex strategy at National Australia Bank.“It adds to a period of uncertainty and is euro negative in the near-term at least.”

When news broke this week that the chairman of CEFC China Energy, an acquisitive conglomerate, was being investigated for economic crimes, one particular group gulped — dealmakers involved with Chinese companies.Even as China’s fast-growing conglomerates have been viewed by many global investors and regulators with suspicion for their opacity and finances, they have nonetheless been lucrative business partners for dealmakers, known for paying over the odds for flashy assets.Now, more than ever before, would-be acquirers, sellers, investors and advisors are having to assess who is in and who is out in Beijing, a politically tricky question at the best of times.The probe into CEFC — which has thrown into question its $9 billion deal for a 14 per cent stake in Rosneft, Russia’s top oil producer — came less than a week after the government announced it was taking control of the insurer Anbang, an equally eye-catching acquirer of assets. Anbang’s chairman, Wu Xiaohui, is being prosecuted for economic crimes.

The cement manufacturers have posted a decline of 26 percent in their profitability during second quarter of fiscal year 2018 (2QFY18) mainly due to lower margins versus growth of 9 percent in 2QFY17.This was the fourth consecutive year-on-year fall in earnings and the second steepest in last four quarters (in 4QFY17, profits fell 30 percent annually owing to lower sales).On pretax basis, profits declined by 24 percent during the outgoing quarter. This analysis is based on a sample of 15 listed cement producers (out of a total of 18) which represents 99.7 percent of total cement companies' market capitalization.While total dispatches during 2QFY18 grew by 8 percent YoY, sector revenues contracted by 2 percent, mainly on the back of lower net retention prices, down 8-10 percent, experts said.Nabeel Khurshid of Topline securities, observed in its report that pricing pressure was noticeable in North region where cement producers were offering discount of up to Rs30/bag to Rs470-500/bag.

Fishing boats look like specks alongside Egina, which has been moored for the last month in Lagos. Even the container ships that normally dominate the port look like small boats.The floating production storage and offloading facility (FPSO), developed by the French group Total, looks a lot like a giant Lego set. Everything about it is huge: its weight (220,000 tonnes), length (330 metres/1,083 feet) and width (60 metres). At 33 metres, it's as high as a 10-storey building.The vessel is in its final stage of construction and will soon produce some 200,000 barrels of oil a day or about 10 percent of national production.In the next few months, Egina will head to the Niger Delta and link up to 44 subsea wells some 1,600 metres under the Gulf of Guinea.Up to 2.3 million barrels of crude can be stored in its hull, before being taken abroad to be refined.The cost of the project is up to $16 billion (12.8 billion euros) but according to the head of Total in Nigeria , Nicolas Terraz, the investment is justified."Nigeria is a very important country for Total. We've been here for the last 60 years," he told AFP, looking up at the huge ship. "It's the biggest FPSO ever constructed by the group."

Pakistan Water and Power Development Authority (WAPDA) achieved yet another landmark towards energy security of the country, as Tarbela 4th Extension Hydropower Project started electricity generation Monday. The first generating unit, put into operation has started providing electricity to the National Grid. To mark the significant development of electricity generation from the first unit, Wapda Chairman Muzammil Hussain visited Tarbela 4th Extension Hydropower Project . Highlighting significance of the project in economic development and social uplift of the country, he said that prime minister will formally inaugurate the project in 2nd week of March. Under the project , three electric power generating units – each of them having capacity of 470 MW – have been installed at the Tunnel 4 of Tarbela Dam. The first unit has started electricity generation. The second unit is scheduled to be commissioned by end of April, while the third unit is schedule to start electricity generation by end of May, this year. It merits a mention that the 1410 MW-Tarbela 4th Extension is a component of least-cost energy generation plan.

Market seems to remain volatile during current trading session therefore its recommended to practice caution.

Technical Analysis

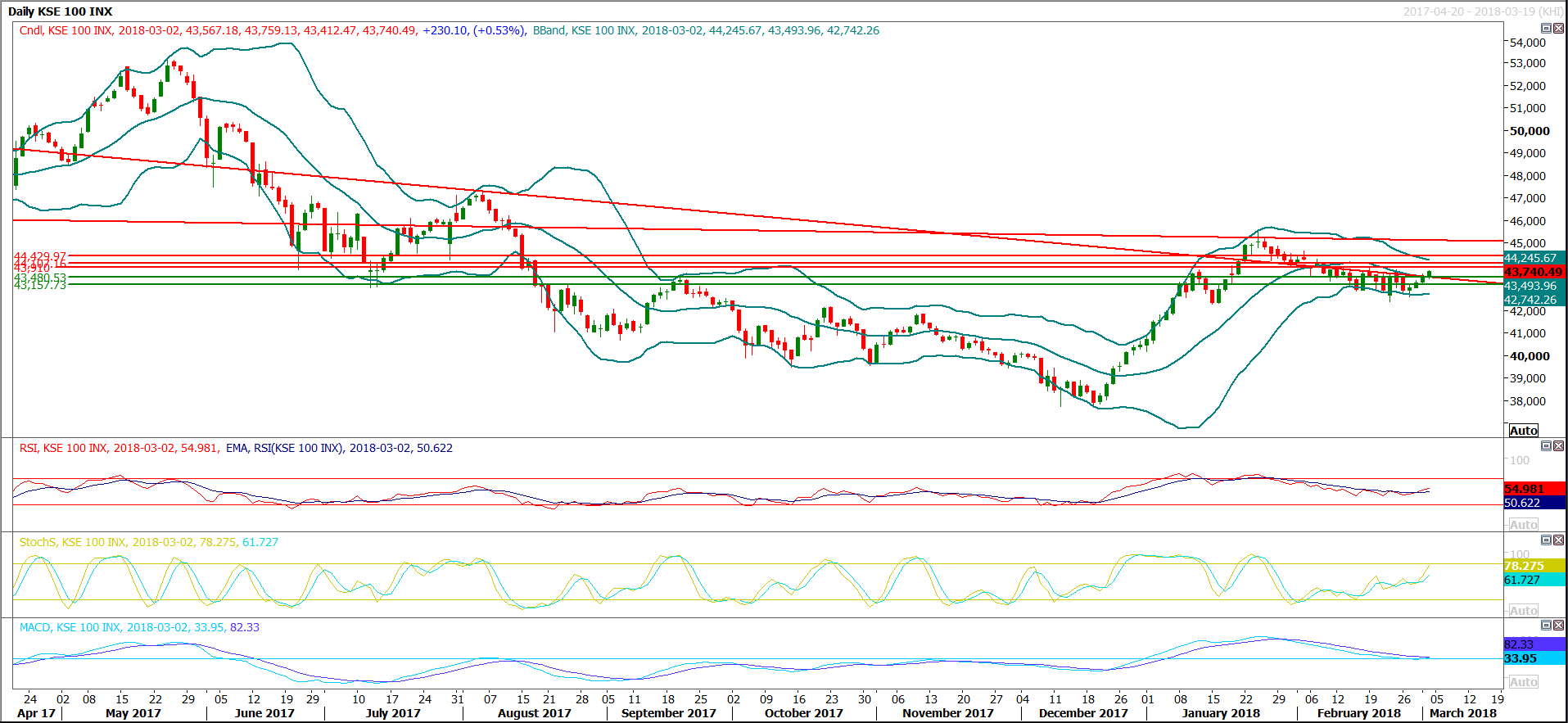

The Benchmark KSE100 Index have slided above its major resistant trend line on daily chart during last trading session and right now its capped by horizontal resistances at 43910 and 44100 points while supportive regions are standing at 43500 and 43160 points. Bullish momentum is expiring on hourly chart and previous resistances would now react as supportive region which would try to push index in positive zone from 43500 points. Its recommended to initiate new selling with strict stop loss of 43960 on intraday basis and if index would close above that region on hourly basis then a cut and reverse strategy would be favourite for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.