Previous Session Recap

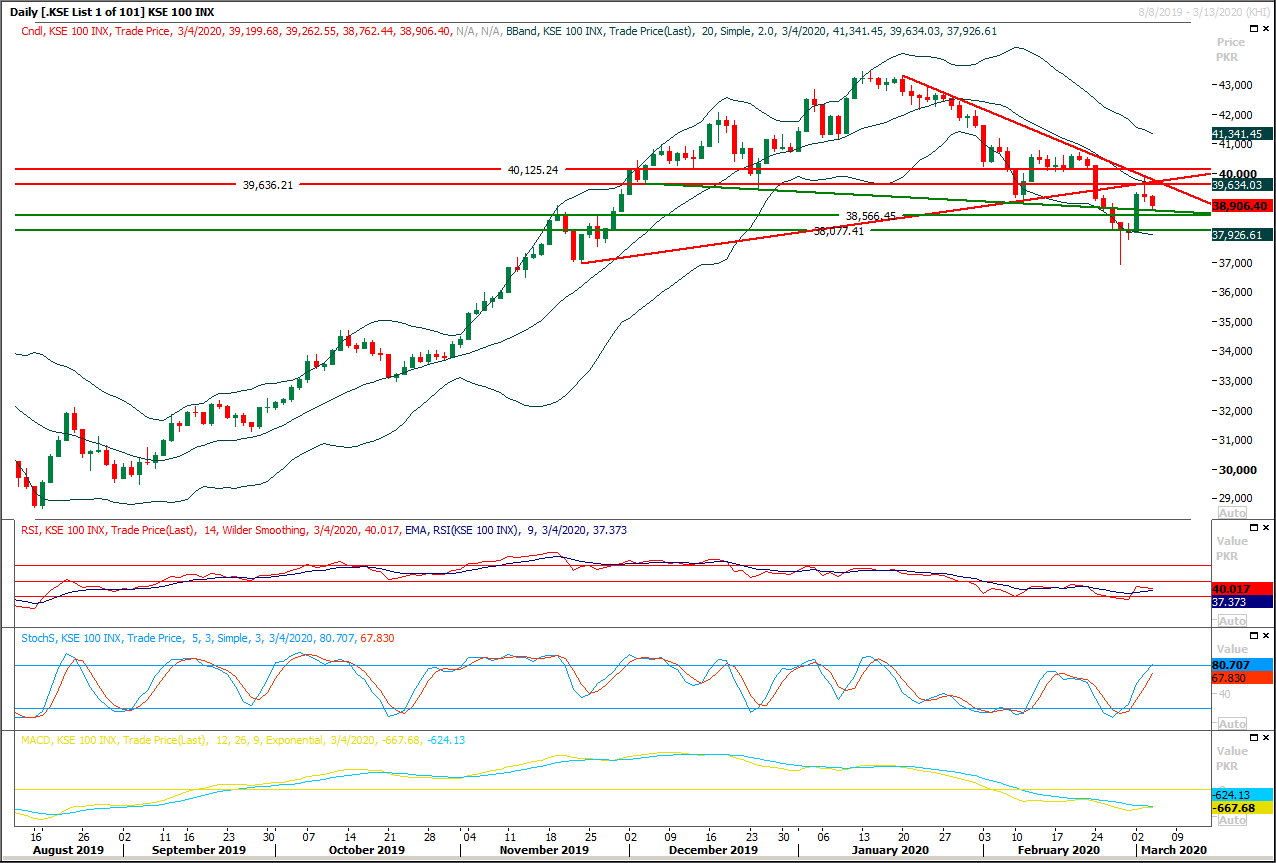

Trading volume at PSX floor dropped by 38.29 million shares or 17.0% on DoD basis, whereas the benchmark KSE100 index opened at 39,218.73, posted a day high of 39,262.55 and a day low of 38,762.44 points during last trading session while session suspended at 38,906.40 points with net change of -293.28 points and net trading volume of 148.12 million shares. Daily trading volume of KSE100 listed companies also dropped by 27.50 million shares or 15.66% on DoD basis.

Foreign Investors remained in net selling positions of 12.05 million shares and value of Foreign Inflow dropped by 3.81 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net selling positions of 9.43 and 2.64 million shares but Foreign Individuals remained in net long positions of 0.012 million shares respectively. While on the other side Local Individuals, Companies, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 2.31, 5.20, 0.26, 5.00 and 1.08 million shares but Banks and Brokers remained in net selling positions of 0.78 and 2.38 million shares respectively.

Analytical Review

Asian shares grind higher, virus risks block the way

Asian shares rallied for a fourth straight session on Thursday as U.S. markets swung sharply higher and another dose of central bank stimulus offered some salve for the global economic outlook. Wall Street seemed to find relief in the strong performance of former Vice President Biden in the Democratic nomination campaign. Biden is considered less likely to raise taxes and impose new regulations than rival Bernie Sanders. The U.S. House of Representatives also approved an $8.3 billion funding bill to combat the spread of the virus, sending the emergency legislation to the Senate. In another wild swing, the Dow .DJI surged 4.53%, while the S&P 500 .SPX gained 4.22% and the Nasdaq .IXIC 3.85%.

PM orders immediate decision as ECC dithers on tariff for exporters

Irked by procedural and institutional delays, Prime Minister Imran Khan on Wednesday ordered immediate implementation of subsidised electricity tariff for export industry to ensure predictability and business confidence. The orders came after a meeting of the Economic Coordination Committee (ECC) of the cabinet deferred formal approval to an agreement reached last week between export industries and a ministerial committee over energy tariffs. Informed sources said Federal Minister for Power and Petroleum Omar Ayub Khan and Federal Minister for Economic Affairs Hammad Azhar had different estimates over the amount of subsidy and the definition of industries to benefit from the subsidy scheme. The sources said the Power Division had estimated about Rs28 billion worth of additional subsidy while some other members of the ECC believed the true cost of subsidy would be somewhere between Rs50-60bn.

Govt caught in twin power tariff conundrum: Karachi residents could be jolted with large looming adjustments

The tariff adjustments for consumers of K-Electric involving more than Rs6 per unit has become a daunting challenge for all the stakeholders — the government, the power regulator and the Karachi based private power utility and its consumers. While the government could not take a decision on Wednesday as to how to pass on or subsidise about Rs4.87 per unit increase in KE tariff on account of past 11 quarters (July 2016 to March 2019), the National Electric Power Regulatory Authority (Nepra) reserved the same day KE’s request for tariff adjustments for two subsequent quarters (April-September 2019) involving Rs1.37 and Rs1.44 per unit increase respectively. Amid this indecisiveness on part of the government and the power regulator, the Karachiites are at the risk of an unpredictable increase in tariff for electricity they might have consumed three years ago and produced products already sold in the international or local market. The amounts involved are estimated to be well over Rs80bn and may require a lot of reconciliation and auditing.

Trade deficit shrinks 26.5pc

Pakistan’s trade deficit fell by 26.5 per cent to $15.77 billion in the first eight months of this fiscal year from $21.46bn over the corresponding period of last year, Pakistan Bureau of Statistics said on Tuesday. The decline came mainly on the back of double-digit decline in imports following government’s corrective measures to reduce pressures on foreign exchange reserves and slump in overall demand. On a monthly basis, the deficit fell by 14.6pc to $1.9bn in February from $2.26bn during the same month last year. The commerce ministry estimates the annual trade deficit to decrease by around $12bn to $19bn in the ongoing fiscal year from $31bn during the last fiscal year.

Cars sale, production fell by 43.92pc, 46.08pc respectively during 7 months

The sale and production of cars dipped by 43.92 percent and 46.08 percent respectively during first seven months of financial year 2019-20 compared to corresponding period of last year. During the period under review, as many as 69,192 cars were sold against the sale of 123,391 units while the production of cars decreased from 134,177 units to 72,337 units, showing negative growth of 43.92 and 46.08 percent respectively, according to Pakistan Automobile Manufacturing Association (PAMA). Among cars, the sale of Honda cars went down by 65.91 percent from 25,810 units in last year to 8,797 units during current year while Suzuki Swift sale also dipped by 55.55 percent from 2,880 units to 1,280 units during this year. The sale of Toyota Corolla went down from 33,303 units to 15,187 units, showing decreased of 54.39 percent, the data revealed. Similarly, the sale of Suzuki Cultus also went down from 12,942 units to 8,310 units, witnessing decreased of 35.79 percent while the sale of Suzuki Wagon-R witnessed a sharp decline of 73.34 percent from 19,181 units to 5,113 units during the period under review.

Asian shares rallied for a fourth straight session on Thursday as U.S. markets swung sharply higher and another dose of central bank stimulus offered some salve for the global economic outlook. Wall Street seemed to find relief in the strong performance of former Vice President Biden in the Democratic nomination campaign. Biden is considered less likely to raise taxes and impose new regulations than rival Bernie Sanders. The U.S. House of Representatives also approved an $8.3 billion funding bill to combat the spread of the virus, sending the emergency legislation to the Senate. In another wild swing, the Dow .DJI surged 4.53%, while the S&P 500 .SPX gained 4.22% and the Nasdaq .IXIC 3.85%.

Irked by procedural and institutional delays, Prime Minister Imran Khan on Wednesday ordered immediate implementation of subsidised electricity tariff for export industry to ensure predictability and business confidence. The orders came after a meeting of the Economic Coordination Committee (ECC) of the cabinet deferred formal approval to an agreement reached last week between export industries and a ministerial committee over energy tariffs. Informed sources said Federal Minister for Power and Petroleum Omar Ayub Khan and Federal Minister for Economic Affairs Hammad Azhar had different estimates over the amount of subsidy and the definition of industries to benefit from the subsidy scheme. The sources said the Power Division had estimated about Rs28 billion worth of additional subsidy while some other members of the ECC believed the true cost of subsidy would be somewhere between Rs50-60bn.

The tariff adjustments for consumers of K-Electric involving more than Rs6 per unit has become a daunting challenge for all the stakeholders — the government, the power regulator and the Karachi based private power utility and its consumers. While the government could not take a decision on Wednesday as to how to pass on or subsidise about Rs4.87 per unit increase in KE tariff on account of past 11 quarters (July 2016 to March 2019), the National Electric Power Regulatory Authority (Nepra) reserved the same day KE’s request for tariff adjustments for two subsequent quarters (April-September 2019) involving Rs1.37 and Rs1.44 per unit increase respectively. Amid this indecisiveness on part of the government and the power regulator, the Karachiites are at the risk of an unpredictable increase in tariff for electricity they might have consumed three years ago and produced products already sold in the international or local market. The amounts involved are estimated to be well over Rs80bn and may require a lot of reconciliation and auditing.

Pakistan’s trade deficit fell by 26.5 per cent to $15.77 billion in the first eight months of this fiscal year from $21.46bn over the corresponding period of last year, Pakistan Bureau of Statistics said on Tuesday. The decline came mainly on the back of double-digit decline in imports following government’s corrective measures to reduce pressures on foreign exchange reserves and slump in overall demand. On a monthly basis, the deficit fell by 14.6pc to $1.9bn in February from $2.26bn during the same month last year. The commerce ministry estimates the annual trade deficit to decrease by around $12bn to $19bn in the ongoing fiscal year from $31bn during the last fiscal year.

The sale and production of cars dipped by 43.92 percent and 46.08 percent respectively during first seven months of financial year 2019-20 compared to corresponding period of last year. During the period under review, as many as 69,192 cars were sold against the sale of 123,391 units while the production of cars decreased from 134,177 units to 72,337 units, showing negative growth of 43.92 and 46.08 percent respectively, according to Pakistan Automobile Manufacturing Association (PAMA). Among cars, the sale of Honda cars went down by 65.91 percent from 25,810 units in last year to 8,797 units during current year while Suzuki Swift sale also dipped by 55.55 percent from 2,880 units to 1,280 units during this year. The sale of Toyota Corolla went down from 33,303 units to 15,187 units, showing decreased of 54.39 percent, the data revealed. Similarly, the sale of Suzuki Cultus also went down from 12,942 units to 8,310 units, witnessing decreased of 35.79 percent while the sale of Suzuki Wagon-R witnessed a sharp decline of 73.34 percent from 19,181 units to 5,113 units during the period under review.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is once again trying to find support from supportive trend line of its descending wedge on daily chart along with a strong horizontal supportive region at 38,550 points. It's expected that index would try to recover after a dip and would try to retest its resistant regions at 39,400 points and 39,640 points. It's recommended to stay cautious because if index would not succeed in maintaining above its supportive regions then it would slide towards 38,000 points. Index would remain caged between 37,000-41500 points until unless a clear breakout of either side would took place. It's recommended to stay cautious and for short term trading it's recommended to stay on selling side but for intraday long positions could be initiated with strict stop loss of 38,560 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.