Previous Session Recap

Trading volume at PSX floor increased by 50.66 million shares or 32.25% on DoD basis, whereas the benchmark KSE100 index opened at 34,377.61, posted a day high of 35,309.01 and a day low of 34,377.61 points during last trading session while session suspended at 35,277.46 points with net change of 899.85 points and net trading volume of 138.20 million shares. Daily trading volume of KSE100 listed companies increased by 32.11 million shares or 30.26% on DoD basis.

Foreign Investors remained in net selling positions of 2.74 million shares and net value of Foreign Inflow dropped by 3.27 million US Dollars. Categorically, Foreign Individuals and Corporate investors remained in net selling positions of 0.61 and 2.12 million shares. While on the other side Local Individuals, Companies and NBFCs remained in net buying positions of 5.49, 7.82 and 0.83 million shares respectively but Banks, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 4.45, 0.05, 3.99 and 1.53 million shares respectively.

Analytical Review

Asian shares near July peak as optimism grows on trade, economy

Asian shares approached their July peak on Tuesday on signs the United States and China are inching closer to a truce in their trade war and on optimism the U.S. economy is poised for solid, consumer-driven growth. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up 0.1% after hitting a four-month high the previous day. China's mainland shares were little changed .SSEC while Japan's Nikkei .N225 rose 1.34% to one-year high after a market holiday on Monday. On Wall Street, the S&P 500 .SPX gained 0.37% to a record high of 3,078.27 on Monday while the Dow Jones .DJI and the Nasdaq .IXIC also clinched all-time highs. In Europe, shares rallied more than 1%, with many reaching their highest level since January 2018. The STOXX 600 index of small, mid-sized and large companies across Europe surged to highs last seen in July 2015.

Ministry to initiate bidding process for 35 new O&G exploration blocks

Petroleum Division of the Energy Ministry is finalising arrangements to initiate a three-round bidding process for award of around 35 new oil and gas exploration blocks in December, which would be completed during next 12 months. “As many as 10-12 blocks will be put up for the open bidding in each round that will be held in next month, upcoming summer season and December 2020,” a senior official privy to petroleum sector developments told APP. For the purpose, he said road shows had been arranged in Canada and America, besides “Our teams visited Russia. Now, we are planning to visit Middle Eastern countries in the coming days.” He said Chinese investors were also being attracted to participate in oil and gas exploration activities in Pakistan.

Industrial, Economic Zones to be established in GB under CPEC

Industrial and Economics Zones would be established in Gilgit-Baltistan under the China Pakistan Economic Corridor (CPEC) project to uplift the area and bring it at par with developed parts of the country. Due to tax exemptions, the zones would be more beneficial for the whole country especially locals, a senior official of Ministry of Kashmir Affairs and Gilgit Baltistan told APP. He said work on the Babusar top tunnel would be started during next financial year, adding the federal government was determined to remove the 72 years deprivation of the local people.

Punjab lifts ban on flour supply to KP

The Punjab government has lifted ban on the supply of flour to Khyber Pakhtunkhwa (KP). A decision to the effect was taken by Chief Minister Usman Buzdar at a meeting, attended by food ministers and secretaries of both provinces, on Monday. Mr Buzdar said Punjab would fulfill flour needs of the KP and that the decision to restore the flour supply has been as a goodwill gesture for the people of the KP. The flour supply to the KP would regularly be monitored and the chief minister also ordered the establishment of a joint body of two provinces to monitor the steps taken.

Cotton crop suffers major losses

Climate change resulting in high temperatures, heavy rains and gusty winds has taken its toll on cotton crop production which reduced by 21 per cent to 6.097 million bales as against 7.706m bales produced in the same period last year. According to Pakistan Cotton Ginners Association (PCGA) figures till Nov 1, 2019 released on Monday, Punjab suffered cotton production losses by up to 34.5 per cent and Sindh by 18.15pc. Last year’s cotton production was itself highly dismal at 10.07m bales. Comparing current season’s cotton production with 2018-19 cotton season would not give a fair picture, particularly when the country produced 14.96m bales in 2013-14. Apart from harsh weather, recent locust attack in some cotton growing areas of Punjab and second spell of rains last week in upper Sindh has further deteriorated the situation, observed cotton analyst Naseem Usman.

Asian shares approached their July peak on Tuesday on signs the United States and China are inching closer to a truce in their trade war and on optimism the U.S. economy is poised for solid, consumer-driven growth. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up 0.1% after hitting a four-month high the previous day. China's mainland shares were little changed .SSEC while Japan's Nikkei .N225 rose 1.34% to one-year high after a market holiday on Monday. On Wall Street, the S&P 500 .SPX gained 0.37% to a record high of 3,078.27 on Monday while the Dow Jones .DJI and the Nasdaq .IXIC also clinched all-time highs. In Europe, shares rallied more than 1%, with many reaching their highest level since January 2018. The STOXX 600 index of small, mid-sized and large companies across Europe surged to highs last seen in July 2015.

Petroleum Division of the Energy Ministry is finalising arrangements to initiate a three-round bidding process for award of around 35 new oil and gas exploration blocks in December, which would be completed during next 12 months. “As many as 10-12 blocks will be put up for the open bidding in each round that will be held in next month, upcoming summer season and December 2020,” a senior official privy to petroleum sector developments told APP. For the purpose, he said road shows had been arranged in Canada and America, besides “Our teams visited Russia. Now, we are planning to visit Middle Eastern countries in the coming days.” He said Chinese investors were also being attracted to participate in oil and gas exploration activities in Pakistan.

Industrial and Economics Zones would be established in Gilgit-Baltistan under the China Pakistan Economic Corridor (CPEC) project to uplift the area and bring it at par with developed parts of the country. Due to tax exemptions, the zones would be more beneficial for the whole country especially locals, a senior official of Ministry of Kashmir Affairs and Gilgit Baltistan told APP. He said work on the Babusar top tunnel would be started during next financial year, adding the federal government was determined to remove the 72 years deprivation of the local people.

The Punjab government has lifted ban on the supply of flour to Khyber Pakhtunkhwa (KP). A decision to the effect was taken by Chief Minister Usman Buzdar at a meeting, attended by food ministers and secretaries of both provinces, on Monday. Mr Buzdar said Punjab would fulfill flour needs of the KP and that the decision to restore the flour supply has been as a goodwill gesture for the people of the KP. The flour supply to the KP would regularly be monitored and the chief minister also ordered the establishment of a joint body of two provinces to monitor the steps taken.

Climate change resulting in high temperatures, heavy rains and gusty winds has taken its toll on cotton crop production which reduced by 21 per cent to 6.097 million bales as against 7.706m bales produced in the same period last year. According to Pakistan Cotton Ginners Association (PCGA) figures till Nov 1, 2019 released on Monday, Punjab suffered cotton production losses by up to 34.5 per cent and Sindh by 18.15pc. Last year’s cotton production was itself highly dismal at 10.07m bales. Comparing current season’s cotton production with 2018-19 cotton season would not give a fair picture, particularly when the country produced 14.96m bales in 2013-14. Apart from harsh weather, recent locust attack in some cotton growing areas of Punjab and second spell of rains last week in upper Sindh has further deteriorated the situation, observed cotton analyst Naseem Usman.

Market is expected to remain volatile during current trading session.

Technical Analysis

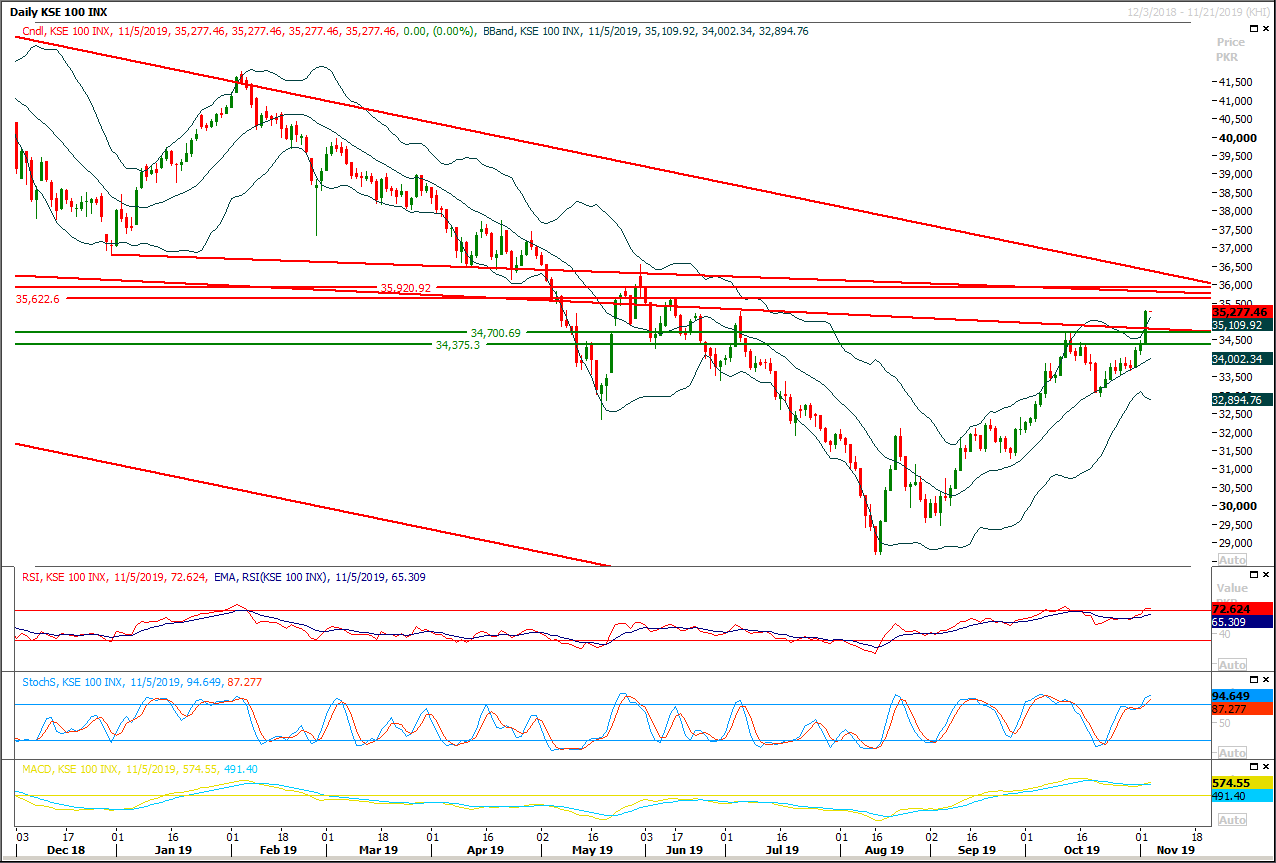

The Benchmark KSE100 index is moving in an upward price channel on daily chart but right now it's being capped by a resistant trend line at 35,800 points along with a strong horizontal resistant region at 35,600 points. As of now it's expected that index would get a push back from any of these both regions therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. Along with all these elements index is also about to complete its mid-term corrections at 36,200 and 36,700 points therefore these also would try to push index downward. While on flipside if index would succeed in penetration above 35,800 points then it would try to target 36,200 and 36,700 points where it would face strong resistances again.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.