Previous Session Recap

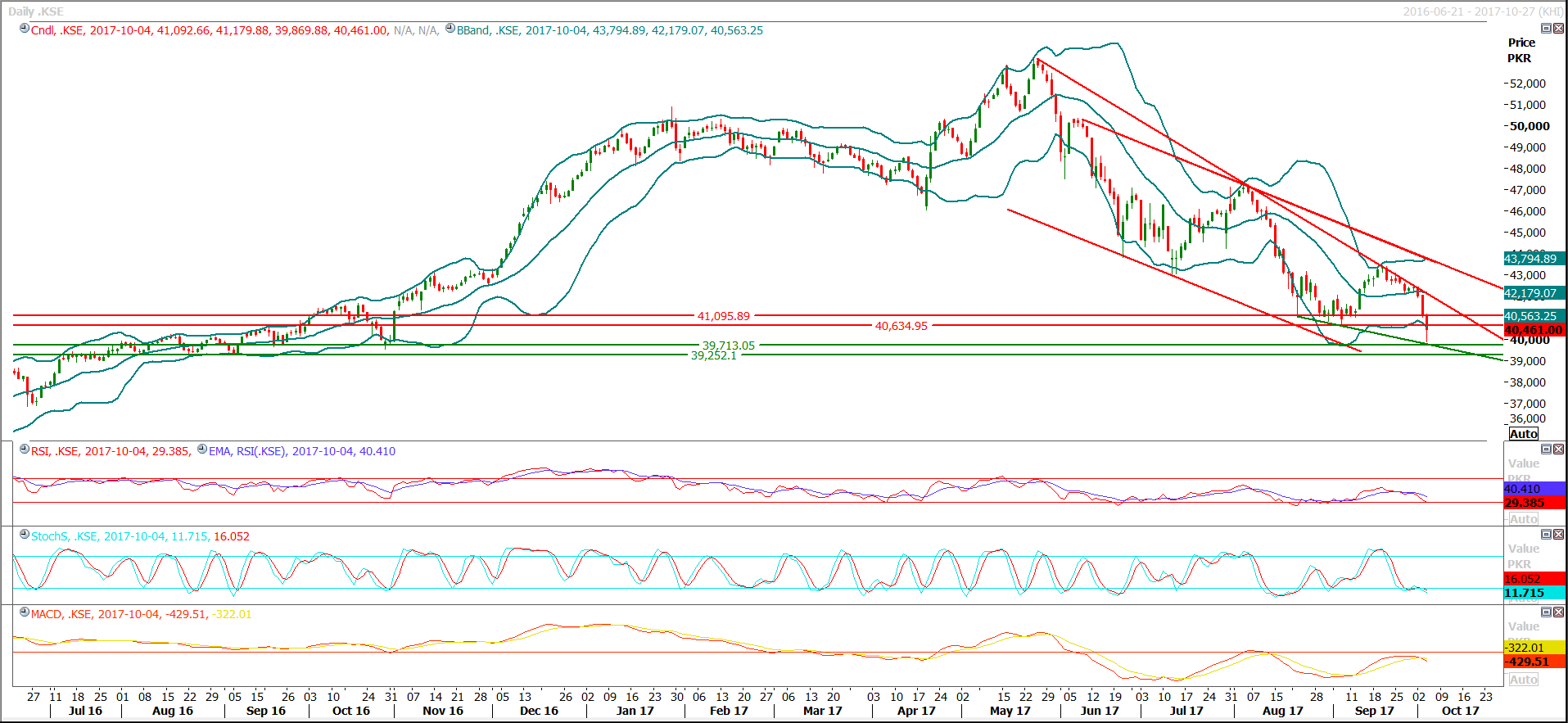

Trading volume at PSX floor increased by 70.72 million shares or 58.31%,DoD basis, whereas, the benchmark KSE100 Index opened at 41092.66, posted a day high of 41179.88 and a day low of 39869.88 during the last trading session. The session suspended at 40461.00 with a net change of -654.78 and net trading volume of 192 million shares. Daily trading volume of KSE100 listed companies increased by 34.39 million shares or 54.7%, DoD basis.

Foreign Investors remained in net selling position of 12.57 million shares and net value of Foreign Inflow dropped by 3.01 million US Dollars. Categorically, Foreign Coporate investors remained in net selling position of 16.61 million shares but Overseas Pakistanis remained in net buying position of 4.05 million shares. While on the other side Local Individuals, Companies and Banks remained in net buying positions of 12.23, 7.14 and 1.97 million shares but NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net selling position of 0.27, 4.48, 5.15 and 1.98 million shares respectively.

Analytical Review

Asian shares were a tad firmer on Thursday, taking their cues from strong U.S. data although holiday-thinned trade and uncertainty about the impact of recent hurricanes on the U.S. economy are likely to keep investors cautious. Japan’s Nikkei was almost flat while Australian shares ticked up 0.2 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was almost flat with Hong Kong and South Korea, as well as mainland China, closed for public holidays. Wall Street’s three major stock indexes hit fresh highs on Wednesday as did MSCI’s all-country world stock index .MIWD00000PUS.

The opening of a branch by National Bank of Pakistan (NBP) in China has run into snags due to a recent decision by the apex court, which requires one-time capital adjustment of Rs47.5 billion on the bank’s balance sheet. NBP President Saeed Ahmad told the Senate Standing Committee on Finance on Wednesday that the bank is all set to open its branch in China next year after getting licences from the regulator concerned. However, the bank will not be able to meet the criterion if Rs47.5bn is eroded from the balance sheet, Mr Ahmad said.

Pre-empting a sugar glut in domestic market, the government on Wednesday allowed export of 0.5 million tonnes of the commodity and set down conditions for availing cash subsidy. The most striking condition for sugar export eligibility is for mills to start crushing after November at full capacity throughout the crushing season. A cash freight subsidy at the rate of Rs10.70 per kg will be given to sugar millers on the export of sugar. The federal government and provinces will share the cash support subsidy on 50:50 basis. No time limit or deadline has been attached with the export of sugar.

State Minister for Power Abid Sher Ali informed the Senate Standing Committee on Power on Wednesday that loadshedding had been reduced by 52 per cent while recoveries increased to 94pc in the past four years. However, Senator Mir Israr Ahmed Khan Zehri, Chairman of the committee, expressed concerns over lack of gas and electricity to vast areas in Balochistan. The minister said that power situation had improved significantly and several new projects were in the pipeline to provide gas connections as well as electricity to remote parts of the country. The electricity production has been increased to 18,658MW from 11,800 megawatts in 2013, the minister said, adding that another 11,514MW will be added to the system by June 2018.

Fertilizers Manufacturers of Pakistan Advisory Council (FMPAC) Executive Director Brigadier Sher Shah on Wednesday called on the newly appointed federal secretary of the Ministry of National Food Security & Research (MNFSR), Fazal Abbas Maken, and briefed him on the protracted delays in payments. The secretary was apprised of the issues related to subsidy payments causing cash flow challenges to the industry. During the meeting, the secretary acknowledged that the government's commitment to the industry has to be fulfilled and assured the fertiliser industry of facilitating in future payments and also sorting out the huge pending claims at the earliest. He promised that the government will release the available funds to the tune of Rs9 billion within a week, which will redress the cash flow problems faced on account of significant delays in disbursement of the subsidy.

Today GAIL, NML and TRG may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index has bounced back after getting support from a supportive trend line during last trading session but it has closed below its previous support which might try to react as a resistance now. For the current trading session index has supportive region around 37660 but resistant region is standing at 40700 and 41000. Index might remain volatile between these two levels, therefore a cautious trading strategy is recommended. For new buying below 40000 points region is an attractive area..

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.