Previous Session Recap

Trading Volume at PSX floor dropped by 61.54 million shares or 46.59%, DoD basis, whereas, the benchmark KSE100 Index opened at 41323.65, posted a day high of 41362.87 and day low of 40842.50 during the last trading session. While the session suspended at 41206.99 with a net change of -116.66 points and a net trading volume of 43.98 million shares. Daily trading volume of KSE100 listed companies dropped by 25.30 million shares or 36.52%, DoD basis.

Foreign Investors remained in a net selling position of 3.37 million shares and the net value of Foreign Inflow dropped by 5.52 million US Dollars. Categorically, Foreign Corporate Investors remained in a net selling position of 6.53 million shares but Overseas Pakistanis remained in a net buying positions of 3.14 million shares. While on the other side, Local Individuals and Mutual Funds remained in net selling positions of 6.66 and 4.28 million shares but Local Companies and Banks remained in net buying positions of 10.89 and 1.6 million shares, respectively.

Analytical Review

Stock markets were under pressure on Tuesday after a global selloff the previous day in the wake of North Korea’s most powerful nuclear test at the weekend, while safe havens such as gold remained firm. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was off 0.05 percent having shed 0.8 percent the previous day, with South Korea's Kospi .KS11 was off 0.1 percent after sliding to three-week lows on Monday. Japan's Nikkei .N225 ticked down 0.2 percent. S&P500 mini futures ESc1 maintained small losses following Pyongyang’s nuclear test and last stood at 2,469, 0.2 percent below their official close on Friday. U.S. markets were closed on Monday for labor day, and in European stocks extended a selloff that started in Asia.

The government is exploring new markets for export of meat and dairy products with focus on Global Halal Food Trade. The official sources told Radio Pakistan that many Muslim countries are dependent on imported meat and Pakistan can significantly increase its exports by focusing on modern and hygienic slaughter houses that can meet international standards for frozen or chilled red meat. They said efforts are being made for market access in Russia, China, South Africa, Egypt, Hong Kong and Indonesia besides Middle-East countries for meat and meat products. The sources said the United Arab Emirates has lifted ban on import of poultry and poultry products from Pakistan. This would go a long way in promoting export of poultry products. They said Netherlands-based multinational company Friesland has acquired 51 percent share of Engro Food Pakistan, which is one of the largest private sector Foreign Direct Investment in dairy sector of Pakistan amounting to $450 million.

The Federation of Pakistan Chamber of Commerce and Industry (FPCCI) on Monday said the corporate tax is discouraging investment and industrial expansion; therefore, it should be reduced to match the global average. Corporate tax in Vietnam is 22 percent, 25 percent in Bangladesh, 17 percent in Singapore, 15 percent in Sri Lanka while the same is 38 percent in Pakistan, it said. The corporate tax should be slashed to the global average of 22 percent to improve competitiveness and boost exports, said FPCCI Regional Committee on Industries Chairman Atif Ikram Sheikh. He said that corporate tax continues to discourage investment while the shareholders have to pay 47 to 55 percent tax which dismays them. Sheikh said that the cost of energy and labour in Pakistan is more than the competing nations while political instability, law and order and the image of the country is also a problem. Moreover, he said, dozens of departments are always after industrial sector, which results in disappointment and frustration among the investors.

Islamabad Chamber of Small Traders (ICST) on Monday said CPEC is an important step towards new global economic order which will trigger growth in the third world; therefore, it is not acceptable to the developed western world. The western economic model has failed to provide relief to the masses rather it has shifted the resources of poor countries to the western countries, while the Chinese economic model will ensure the development of the third world, it said. The CPEC is an important step towards new economic order dominated by China which will strengthen the Pakistani economy by boosting GDP, increase exports and provide employment, said Islamabad Chamber of Small Traders Patron Shahid Rasheed Butt.

The Pakistan Furniture Council (PFC) is all set to hold the 9th Interiors Pakistan Expo 2017 from December 15 to promote and introduce Pakistani interiors, furniture and accessories in and outside Pakistan. “This exhibition has now opened new vistas and venues to the amazing potential and calibre of Pakistani furniture, fixtures and respective furnishing goods that we produce with high quality,” he said. PFC Chief Executive Mian Kashif Ashfaq said the essence of this mega furniture exhibition is to promote the furniture at local and international level. He said that China, Italy, United Kingdom, Turkey, Hong Kong, Bulgaria, Denmark, Thailand and, Bangkok have been invited for participation while delegations from other countries are too be expected.

Today ATRL, BYCO and TRG may lead the market in the positive direction.

Technical Analysis

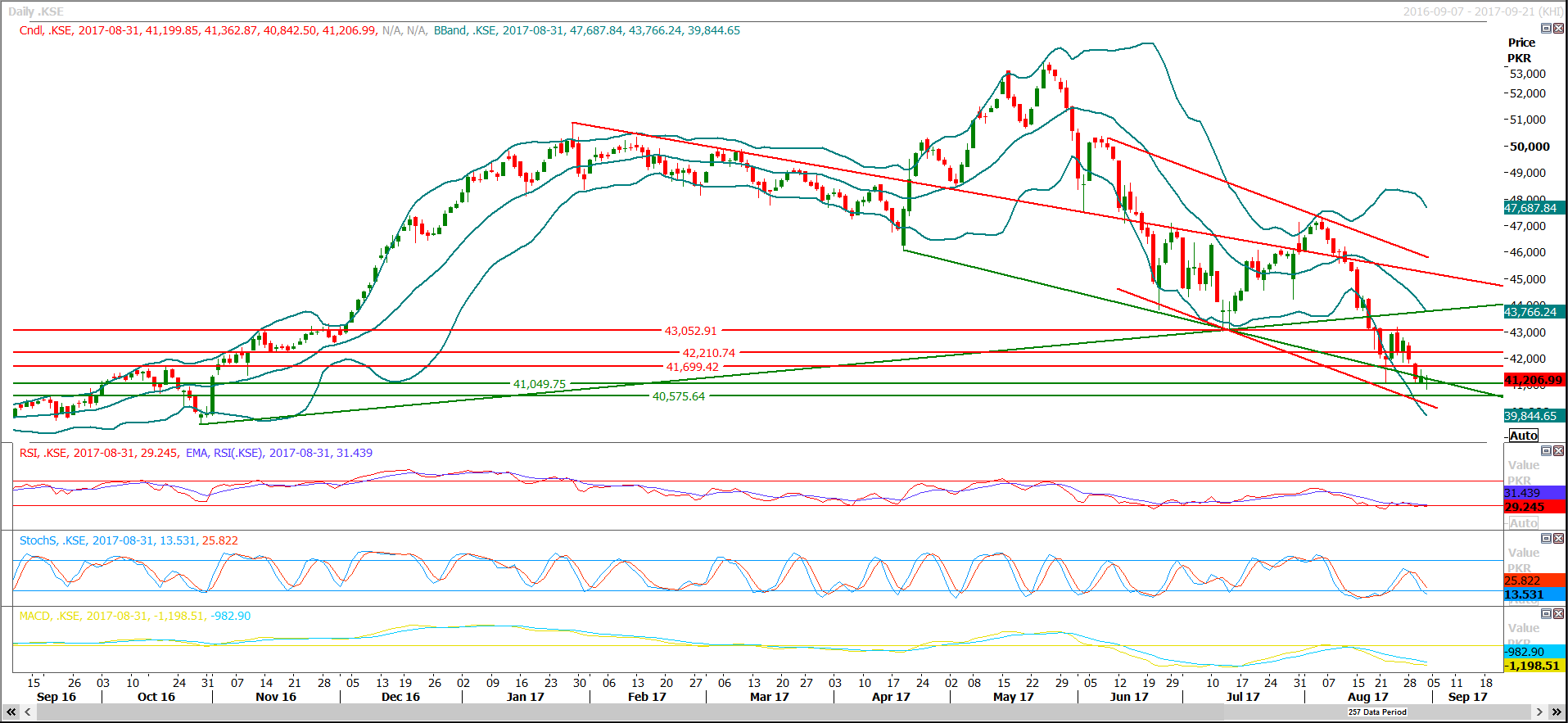

The Benchmark KSE100 Index is attempting to recover for a correction after finding support at a supportive trend line of its bearish channel along with a horizontal supportive region. An Intra-day pull back is expected as Stochastic and MAORSI on hourly chart have formed bullish crossover which may try to push index towards 41700, but daily and weekly momentum is still bearish which indicates that supportive regions are still below current level and index may find some ground around 40500. Therefore, buying on dip with a strict stop loss of 40500 could be beneficial. Index will face resistances around 41700 and 42210 on its way towards a correction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.