Previous Session Recap

Trading volume at PSX floor dropped by 32.64 million shares or 20.50% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,594.98, posted a day high of 41,790.77 and a day low of 41,557.81 during last trading session. The session suspended at 41,753.89 with net change of 171.93 and net trading volume of 65.13 million shares. Daily trading volume of KSE100 listed companies dropped by 15.71 million shares or 19.43% on DoD basis.

Foreign Investors remain in net selling positions of 1.05 million shares but net value of Foreign Inflow dropped by 0.78 million US Dollars. Categorically Overseas Pakistanis remained in net selling positions of 1.12 million shares but Foreign Corporate investors remained in net buying positions of 0.08 million shares. While on the other side Local Individuals and Insurance Companies remained in net buying positions of 3.35 and 1.63 million shares respectively but Local Companies, Banks, Mutual Fund and Brokers remained in net selling positions of 0.54, 1.05, 2.55 and 0.43 million shares.

Analytical Review

Stocks fall, dollar supported as trade woes in spotlight

Stock markets in Asia tracked their global peers lower while the safe-haven dollar hovered near a two-week high on Wednesday as heightened worries over international trade conflicts curbed investor appetite for riskier assets. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.5 percent. The Shanghai Composite Index .SSEC retreated 0.4 percent. Australian stocks lost 0.75 percent, South Korea's KOSPI .KS11 dropped 0.1 percent and Japan's Nikkei .N225 shed 0.35 percent.

Govt gives green signal to gas price hike

Prime Minister Imran Khan Tuesday has given a green signal to the gas price hike for the two government-owned gas utilities of Sui Northern Gas Pipeline Limited (SNGPL) and Sui Southern Gas Company (SSGC). After the PM approval the summary for the gas price increase will be presented to the next meeting of the Economic Coordination Committee (ECC) of the Cabinet, official sources told The Nation. Chairing a briefing on the oil and gas sector the PM was informed that there is no other way except the price increase to bridge the revenue gap of the SNGPL and SSGCL.

Saqib takes charge of PIACL chairman

Secretary Aviation, Muhammad Saqib Aziz has taken over the charge of chairman PIACL, the decision was taken by the airline's Board of Directors at a meeting held at PIA Head Office. A spokesman for the airline said that Aziz holds a vast experience of administration in the Civil Services of Pakistan. Before joining as Secretary Aviation, he served as Secretary Capital Administration and Development Division. The position of Chairman PIACL was lying vacant after Ijaz Munir's transfer as Secretary Establishment Division.

Union threatens to stop PIA operations

PIA employees' union leaders have threatened to stop flight operation if acting Chief Executive Officer (CEO) is chosen from amongst the blue-eyed of sacked airline head Musharraf Rasool Cyan. Peoples Unity President Hidayat Ullah said, "We will lock down PIA Headquarter if the acting CEO was chosen from Cyan's remnants". While talking to this scribe, he said that employees were out to save PIA and those involved in ruining airline will never be accepted as CEO.

Pakistan’s third LNG terminal expected to rack up $5bln in annual turnover

Pakistan’s upcoming liquefied natural gas (LNG) terminal is expected to rack up five billion dollars in annual turnover as there is an immense demand of the fuel for power generation and transportation sector in the country, people with knowledge of the development said on Tuesday. The country is to have its one-of-a-kind third LNG terminal – a joint venture of Shell, Engro, Gunvor and Fatima Group – by the 2nd quarter of 2020, they said. The terminal will have the re-gasification capacity of 750 million metric cubic feet/day.

Stock markets in Asia tracked their global peers lower while the safe-haven dollar hovered near a two-week high on Wednesday as heightened worries over international trade conflicts curbed investor appetite for riskier assets. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 0.5 percent. The Shanghai Composite Index .SSEC retreated 0.4 percent. Australian stocks lost 0.75 percent, South Korea's KOSPI .KS11 dropped 0.1 percent and Japan's Nikkei .N225 shed 0.35 percent.

Prime Minister Imran Khan Tuesday has given a green signal to the gas price hike for the two government-owned gas utilities of Sui Northern Gas Pipeline Limited (SNGPL) and Sui Southern Gas Company (SSGC). After the PM approval the summary for the gas price increase will be presented to the next meeting of the Economic Coordination Committee (ECC) of the Cabinet, official sources told The Nation. Chairing a briefing on the oil and gas sector the PM was informed that there is no other way except the price increase to bridge the revenue gap of the SNGPL and SSGCL.

Secretary Aviation, Muhammad Saqib Aziz has taken over the charge of chairman PIACL, the decision was taken by the airline's Board of Directors at a meeting held at PIA Head Office. A spokesman for the airline said that Aziz holds a vast experience of administration in the Civil Services of Pakistan. Before joining as Secretary Aviation, he served as Secretary Capital Administration and Development Division. The position of Chairman PIACL was lying vacant after Ijaz Munir's transfer as Secretary Establishment Division.

PIA employees' union leaders have threatened to stop flight operation if acting Chief Executive Officer (CEO) is chosen from amongst the blue-eyed of sacked airline head Musharraf Rasool Cyan. Peoples Unity President Hidayat Ullah said, "We will lock down PIA Headquarter if the acting CEO was chosen from Cyan's remnants". While talking to this scribe, he said that employees were out to save PIA and those involved in ruining airline will never be accepted as CEO.

Pakistan’s upcoming liquefied natural gas (LNG) terminal is expected to rack up five billion dollars in annual turnover as there is an immense demand of the fuel for power generation and transportation sector in the country, people with knowledge of the development said on Tuesday. The country is to have its one-of-a-kind third LNG terminal – a joint venture of Shell, Engro, Gunvor and Fatima Group – by the 2nd quarter of 2020, they said. The terminal will have the re-gasification capacity of 750 million metric cubic feet/day.

Market is expected to remain volatile therefore its recommended to trade cautiously.

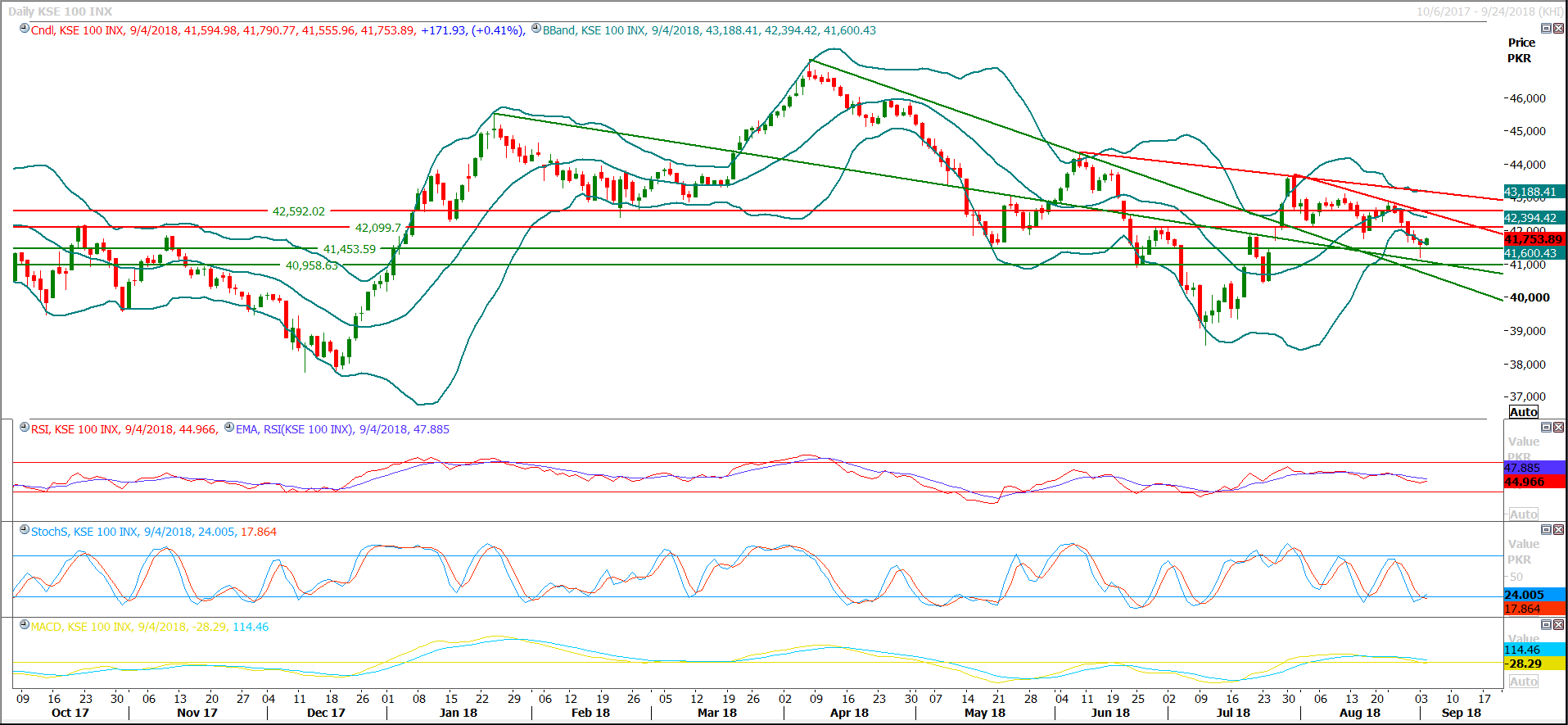

Technical Analysis

The Benchmark KSE100 Index is trying to bounce back since last two trading sessions after getting support from a supportive trend line, but it’s unable to create a clear reversal sign because daily Bollinger band is still squeezed and momentum indicators have failed to create bullish crossovers simultaneously. Therefore it’s expected that current bullish momentum would not prolong on longer run and index would be pushed back in negative zone after a correction of last bearish rally in coming days. As on now index would try to take a spike towards 41,960 or 42,100 points where it would face strong resistances and these regions would try to push index back in negative zone, therefore it’s recommended to adopt swing trading strategy until index close above 42,300 points.

Cement and Steel Sectors would initially support index for a positive opening but they their positive move would start exhausting before day end as major stocks of these both sectors have strong resistances ahead before today’s upper circuit breakers therefore it can’t be stated that market would perform extraordinary during current trading session. Especially DGKC and MLCF have strong resistances ahead at 116.54, 118 and 57.30 Rs respectively. PSO would remain under pressure until it close above 345 and 347 Rs areas while ATRL would try to gain momentum because bears are not becoming able to push it below 204 since last two trading session therefore today it would try to strike back with good volume figures. ISL have some roam till 109 and if it would succeed in closing above 109 on hourly basis then it can target 112 where its bullish momentum would start expiring.

Cement and Steel Sectors would initially support index for a positive opening but they their positive move would start exhausting before day end as major stocks of these both sectors have strong resistances ahead before today’s upper circuit breakers therefore it can’t be stated that market would perform extraordinary during current trading session. Especially DGKC and MLCF have strong resistances ahead at 116.54, 118 and 57.30 Rs respectively. PSO would remain under pressure until it close above 345 and 347 Rs areas while ATRL would try to gain momentum because bears are not becoming able to push it below 204 since last two trading session therefore today it would try to strike back with good volume figures. ISL have some roam till 109 and if it would succeed in closing above 109 on hourly basis then it can target 112 where its bullish momentum would start expiring.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.