Previous Session Recap

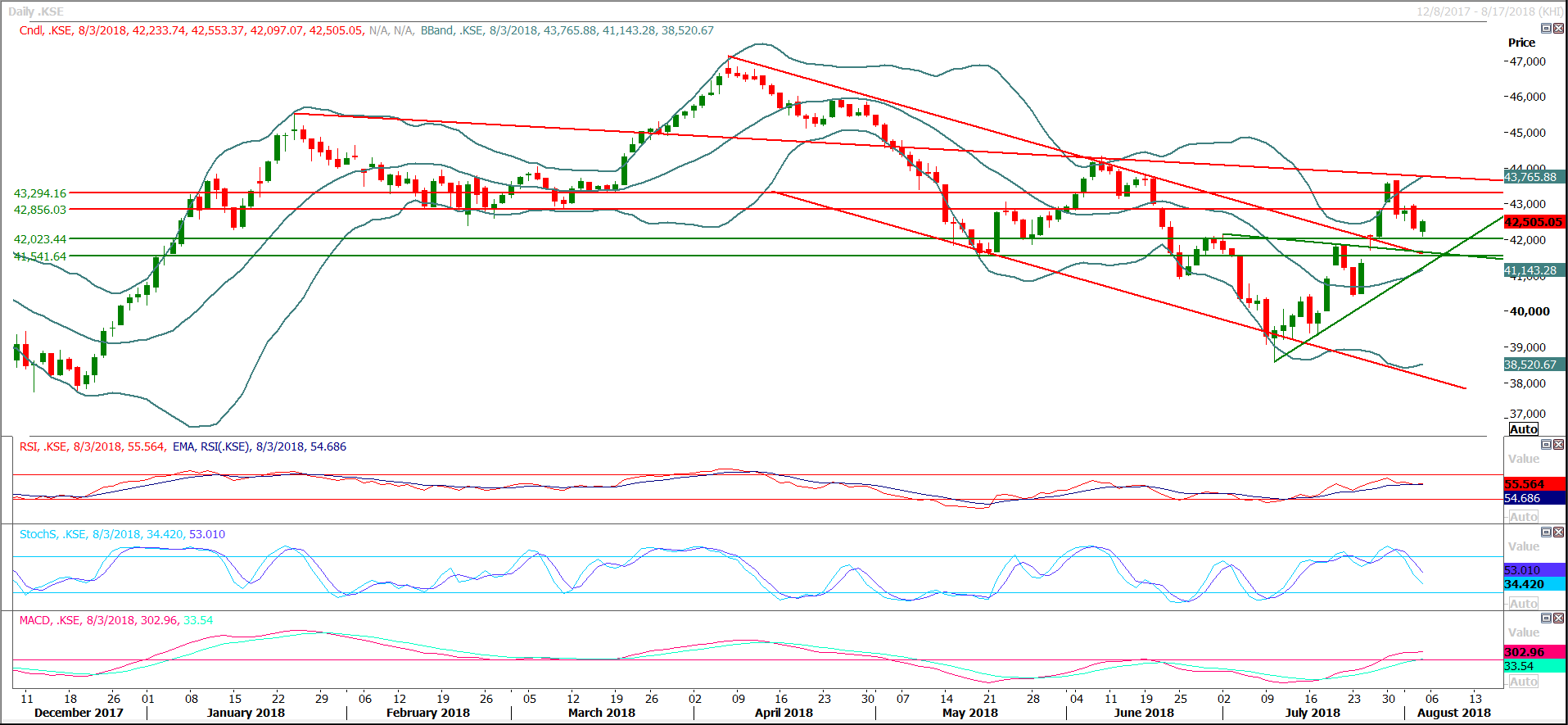

Trading volume at PSX floor dropped by 81.49 million shares or 28.64% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,233.74, posted a day high of 42,553.37 and a day low of 42,097.07 during last trading session. The session suspended at 42,505.05 with net change of 174.73 and net trading volume of 141.14 million shares. Daily trading volume of KSE100 listed companies dropped by 55.98 million shares or 32.91% on DoD basis.

Foreign Investors remained in net buying position of 0.17 million shares but net value of Foreign Inflow dropped by 3.72 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.15 and 1.70 million shares but Foreign Corporate investors remained in net selling positions of 1.68 million shares. While on the other side Local Individuals, NBFCs and Mutual Fund remained in net buying positions of 4.93, 1.50 and 5.16 million shares but Local Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 3.82, 2.82, 1.49 and 0.42 million shares respectively.

Analytical Review

Asian stocks gain on move by China's central bank, but trade war weighs

Asian stocks rose on Monday after China’s central bank took steps to try to drag the yuan away from 14-month lows, but the tit-for-tat conflict over Sino-U.S. trade hung heavily on markets. The People’s Bank of China late on Friday raised the reserve requirement on foreign exchange forward positions, making it more expensive to bet against the Chinese currency. The move boosted the Australian dollar, which is often played as a liquid proxy for the yuan. The Aussie came off two-week lows to climb as high as $0.7412 after the announcement, and was last at $0.7396. Analysts say the step by the PBOC will be generally positive for Asian assets. “Leaning against bearish CNY sentiment is important because a rapidly weakening currency risks triggering residential outflows and destabilizing domestic asset prices,” JPMorgan analysts said in a note. “Our economists think that PBOC likely will take further action if CNY depreciation continues or capital outflow pressure increases.”

Cotton Crop Assessment Committee to meet next week

Cotton Crop Assessment Committee (CCAC) will meet next week in order to take stock of the output of major cash crop of the county during current season. Restructuring of the committee has also been completed after the devolution of CCAC from the Ministry of Commerce to Ministry of National Food Security and Research, said Cotton Commissioner in the Ministry of National Food Security and Research Dr Khalid Abdullah. Talking to APP, he said that formulation of new committee had been finalised and all the relevant stakeholders were taken on board in order to sensitize the issues and challenges being faced by the cotton growers across the crop sowing areas of the country. He said that representation of all four provinces, federal government and allied departments working under the respective governments had also be alined for streamlining the matters related to enhance the output of the crop by facilitating the farmers and field extension departments.

Negotiations on Pak-Iran gas project likely next month

Iran and Pakistan may start a new round of talks on how to advance on the IP gas line project in September. An Iranian delegation was ready to visit Pakistan for resuming the negotiations, but the Pakistani caretaker government believed that the decisions on the IP project should be made by the next elected government. “Now elections in Pakistan are over, and most likely the Pakistan Tehreek-e-Insaf (PTI) headed government is going to take the charge.” The official noted. He said: “Both sides would put their heads together to find out the way out how to proceed for implementation of the project in the presence of the US sanctions. President Trump is hell bent upon the deviating from the U.S.-Iran nuclear deal earlier done during Obama regime. So under the new scenario, the top mandarins of both the countries would also work out new timelines for the project’s completion.”

New govt to face uncertain economic situation

he new government is likely to face a tricky and uncertain economic situation and will have to decide the means to pull out the country from prevailing severe crisis. Pakistan’s finance minister-in-waiting Asad Umar estimates an immediate injection of more than $12billion to halt a looming financial crisis but he is not yet sure about the sources the new government will go for to arrange such a money. The economists insist that Pakistan need an immediate bailout plan from IMF or neighboring China. But the business community fears that by going to the IMF, the problems of the country would increase manifolds. “If we go to the IMF, we would have to implement their recommendations, which means our cost of doing business would escalate further and we would be more uncompetitive in international market,” said Ghazanfar Bilour, President of the Federation of Pakistan Chambers of Commerce.

Pakistan earns over $3.630 billion from export of transport services

The transport services by Pakistan in other countries increased by 3.29 percent during the first eleven months of financial year 2017-18 compared to the corresponding period of last year. Pakistan exported transport services worth $3630.695 million in July-May (2017-18) against the exports of services worth $3514.894 million in July-May (2016-17), showing 3.29 percent growth, according to PBS. Among these, the air transport services export increased by 3.93 percent and reached to $791.260 million during the period under review against $761.350 million last year. Among the air transport services, exports of passenger services surged by 14.55 percent, from $433.980 million to $497.140 million, the data revealed. However, the freight service exports witnessed decline of 2.51 percent by going down from $17.950 million to $17.500 million while the exports of all other air transport services also declined by 10.60 percent by slipping from exports of $309.420 million last year to $276.620 million in 2017-18.

Asian stocks rose on Monday after China’s central bank took steps to try to drag the yuan away from 14-month lows, but the tit-for-tat conflict over Sino-U.S. trade hung heavily on markets. The People’s Bank of China late on Friday raised the reserve requirement on foreign exchange forward positions, making it more expensive to bet against the Chinese currency. The move boosted the Australian dollar, which is often played as a liquid proxy for the yuan. The Aussie came off two-week lows to climb as high as $0.7412 after the announcement, and was last at $0.7396. Analysts say the step by the PBOC will be generally positive for Asian assets. “Leaning against bearish CNY sentiment is important because a rapidly weakening currency risks triggering residential outflows and destabilizing domestic asset prices,” JPMorgan analysts said in a note. “Our economists think that PBOC likely will take further action if CNY depreciation continues or capital outflow pressure increases.”

Cotton Crop Assessment Committee (CCAC) will meet next week in order to take stock of the output of major cash crop of the county during current season. Restructuring of the committee has also been completed after the devolution of CCAC from the Ministry of Commerce to Ministry of National Food Security and Research, said Cotton Commissioner in the Ministry of National Food Security and Research Dr Khalid Abdullah. Talking to APP, he said that formulation of new committee had been finalised and all the relevant stakeholders were taken on board in order to sensitize the issues and challenges being faced by the cotton growers across the crop sowing areas of the country. He said that representation of all four provinces, federal government and allied departments working under the respective governments had also be alined for streamlining the matters related to enhance the output of the crop by facilitating the farmers and field extension departments.

Iran and Pakistan may start a new round of talks on how to advance on the IP gas line project in September. An Iranian delegation was ready to visit Pakistan for resuming the negotiations, but the Pakistani caretaker government believed that the decisions on the IP project should be made by the next elected government. “Now elections in Pakistan are over, and most likely the Pakistan Tehreek-e-Insaf (PTI) headed government is going to take the charge.” The official noted. He said: “Both sides would put their heads together to find out the way out how to proceed for implementation of the project in the presence of the US sanctions. President Trump is hell bent upon the deviating from the U.S.-Iran nuclear deal earlier done during Obama regime. So under the new scenario, the top mandarins of both the countries would also work out new timelines for the project’s completion.”

he new government is likely to face a tricky and uncertain economic situation and will have to decide the means to pull out the country from prevailing severe crisis. Pakistan’s finance minister-in-waiting Asad Umar estimates an immediate injection of more than $12billion to halt a looming financial crisis but he is not yet sure about the sources the new government will go for to arrange such a money. The economists insist that Pakistan need an immediate bailout plan from IMF or neighboring China. But the business community fears that by going to the IMF, the problems of the country would increase manifolds. “If we go to the IMF, we would have to implement their recommendations, which means our cost of doing business would escalate further and we would be more uncompetitive in international market,” said Ghazanfar Bilour, President of the Federation of Pakistan Chambers of Commerce.

The transport services by Pakistan in other countries increased by 3.29 percent during the first eleven months of financial year 2017-18 compared to the corresponding period of last year. Pakistan exported transport services worth $3630.695 million in July-May (2017-18) against the exports of services worth $3514.894 million in July-May (2016-17), showing 3.29 percent growth, according to PBS. Among these, the air transport services export increased by 3.93 percent and reached to $791.260 million during the period under review against $761.350 million last year. Among the air transport services, exports of passenger services surged by 14.55 percent, from $433.980 million to $497.140 million, the data revealed. However, the freight service exports witnessed decline of 2.51 percent by going down from $17.950 million to $17.500 million while the exports of all other air transport services also declined by 10.60 percent by slipping from exports of $309.420 million last year to $276.620 million in 2017-18.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index have tried to find some ground around 42,089 points during last trading session which falls at 50% correction of its last bullish rally but bulls are losing hopes as index is not recovering from bearish momentum on daily chart. Daily Stochastic and MAORSI also have generated bearish crossover and these both would try to add pressure on index. If index would slide below 42,000 points then the bearish momentum would convert towards a sharp bearish rally. For current trading session index have supportive regions ahead at 42,030 and 41,800 points while resistant regions are standing at 42,860 and 43,330 points.

On Weekly basis index is coming downward after posting a double top on weekly chart and would try to retest that region during current week if it would not succeed in penetration of that region then a downward rally could be witnessed in coming days in PSX.

On Weekly basis index is coming downward after posting a double top on weekly chart and would try to retest that region during current week if it would not succeed in penetration of that region then a downward rally could be witnessed in coming days in PSX.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.