Previous Session Recap

Trading volume at PSX floor increased by 50.65 million shares or 52.4% on DoD basis, whereas, the benchmark KSE100 Index opened at 40072.17, posted a day high of 40084.97 and a day low of 39892.34 during last trading session. The session suspended at 39945.41 with net change of -104.40 and net trading volume of 67.87 million shares. Daily trading volume of KSE100 listed companies increased by 20.58 million shares or 43.51% on DoD basis.

Foreign Investors remained in net buying position of 1.68 million shares and net value of Foreign Inflow increased by 0.52 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net buying positions of 1.61 and 0.069 million shares. While on the other side Local Individuals, Companies, Brokers and Insurance Companies remained in net selling positions of 1.57, 2.62, 0.35 and 1.87 million shares respectively but Banks and Mutual Funds remained in net buying position of 1.51 and 2.27 million shares.

Analytical Review

Asian stocks slipped on Wednesday, pressured by losses on Wall Street as the technology sector stuttered yet again after a brief rebound, while the dollar sagged on lower long-term U.S. yields. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched down 0.2 percent. Australian stocks and South Korea's KOSPI .KS11 were down 0.2 percent, respectively. Japan's Nikkei .N225 lost 0.5 percent. The S&P 500 information technology index .SPLRCT barely rose overnight as it gave up much of the 1.4 percent intraday gains. The year’s top-performing sector was still down nearly 4 percent over the past week, with investors shifting money to banks, retailers and other stocks seen as likely to benefit the most from tax cuts promised by U.S. President Donald Trump. As a result the S&P 500 .SPX fell for the third straight session overnight. The Dow .DJI and Nasdaq .IXIC also retreated.

The government and Engro Elengy Terminal Pakistan Ltd (EETPL) have reached an agreement for the supply of about 230 million cubic feet per day (mmcfd) of additional liquefied natural gas (LNG) at a re-gasification tolling rate of 17 cents per million British thermal unit (mmBtu). This brings down the average tolling tariff at 47 cents per unit for firm LNG supplies of 630mmcfd through Engro’s floating storage and re-gasification unit (FSRU) that is now the largest source to the national transmission system, said EETPL Chief Executive Officer Jahangir Piracha on Tuesday.

The State Bank of Pakistan (SBP) expressed concerns on Tuesday over the skimming of debit cards that caused a total loss of Rs10.2 million to 559 customers recently. The SBP asked banks to go for the Europay Mastercard Visa (EMV) standards, which are safe and protected, according to a press release. The SBP said only 296 customers have confirmed disputed transactions and Habib Bank Ltd (HBL) is trying to limit the impact of hacking activities. The SBP statement did not say who the hackers were. It said the hackers withdrew depositors’ money from various locations within and outside the country.

The Sindh Agriculture Department notified on Tuesday the sugarcane price of Rs182 per 40 kilograms for 2017-18. Mills are supposed to commence crushing on Dec 1 as per another notification issued on the same day. The Sindh government will also give a subsidy of Rs9.30 per kg on sugar exports, according to a cabinet decision taken on Monday in Karachi. Originally, the Sindh Sugarcane Control Board, which met on Nov 28 under the chairmanship of Sindh Agriculture Minister Sohail Anwar Siyal, had decided to fix the price of Rs182 per 40kg for the 2017-18 crushing season. It also decided to notify the rate on Nov 29.

The consumer price index (CPI) went up four per cent year-on-year in November on the back of a slight increase in the prices of perishable and non-perishable products. Inflation rose 0.4pc month-on-month in November compared to 0.7pc in the preceding month and 0.2pc in November 2016. In the first five months of 2017-18, main inflation measured through the CPI has steadily been on the rise, according to data released by the Pakistan Bureau of Statistics on Tuesday. The CPI tracks prices of around 480 commodities every month in urban centres across the country.

Market is expected to remain volatile today therefore a cautios trading strategy is recommended for current trading session.

Technical Analysis

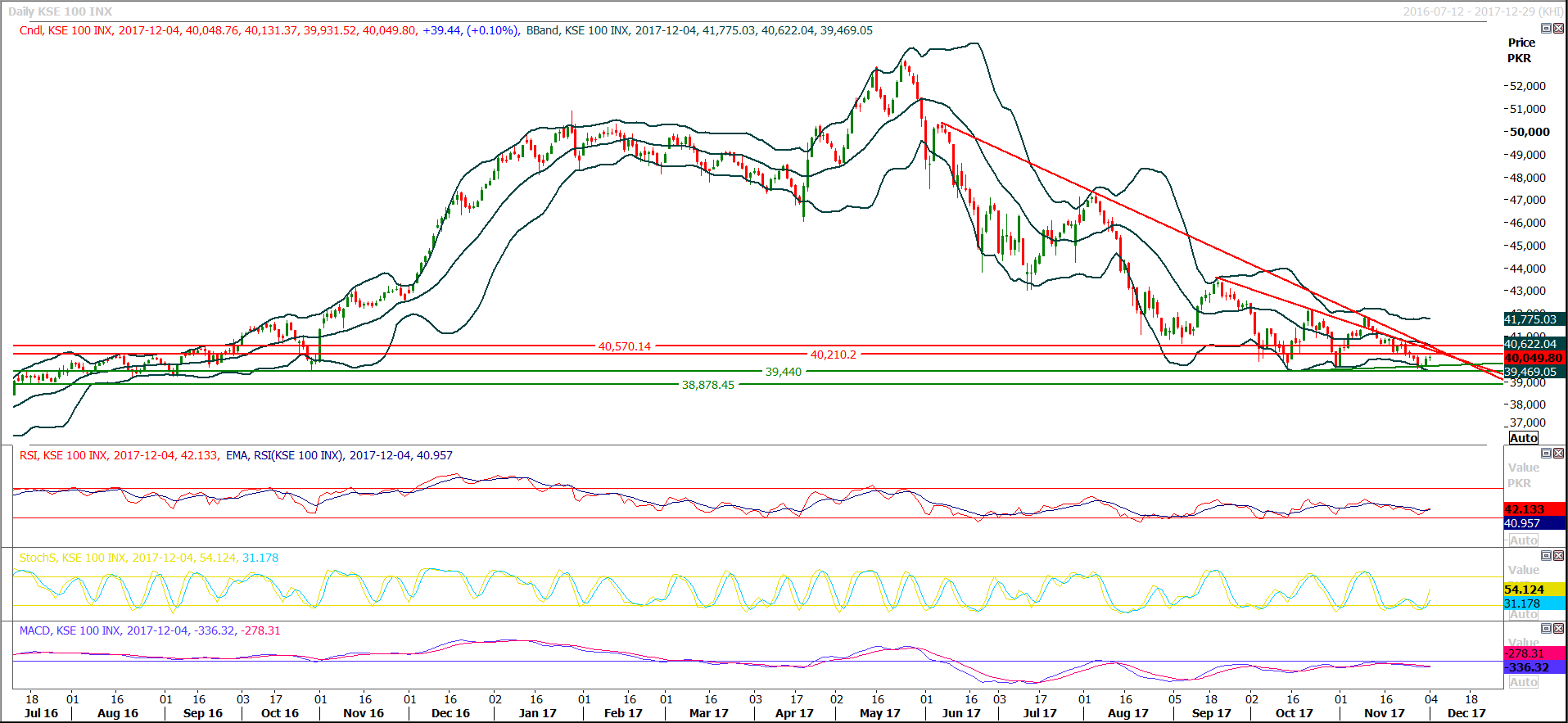

The Benchmark KSE100 Index is capped by two strong resistances at 40210 and 40431 as of right now and with every passing day its becoming difficult for it to cross these levels. But if index would become able to close above these two levels in this week then next target would 42800 points otherwise index would try to target 38680 points which falls on 61.8% correction of its last bullish run since Feb. 2016. For current trading session index have supportive region at 39680 where new buying could be initiated with strict stop loss of 39440.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.