Previous Session Recap

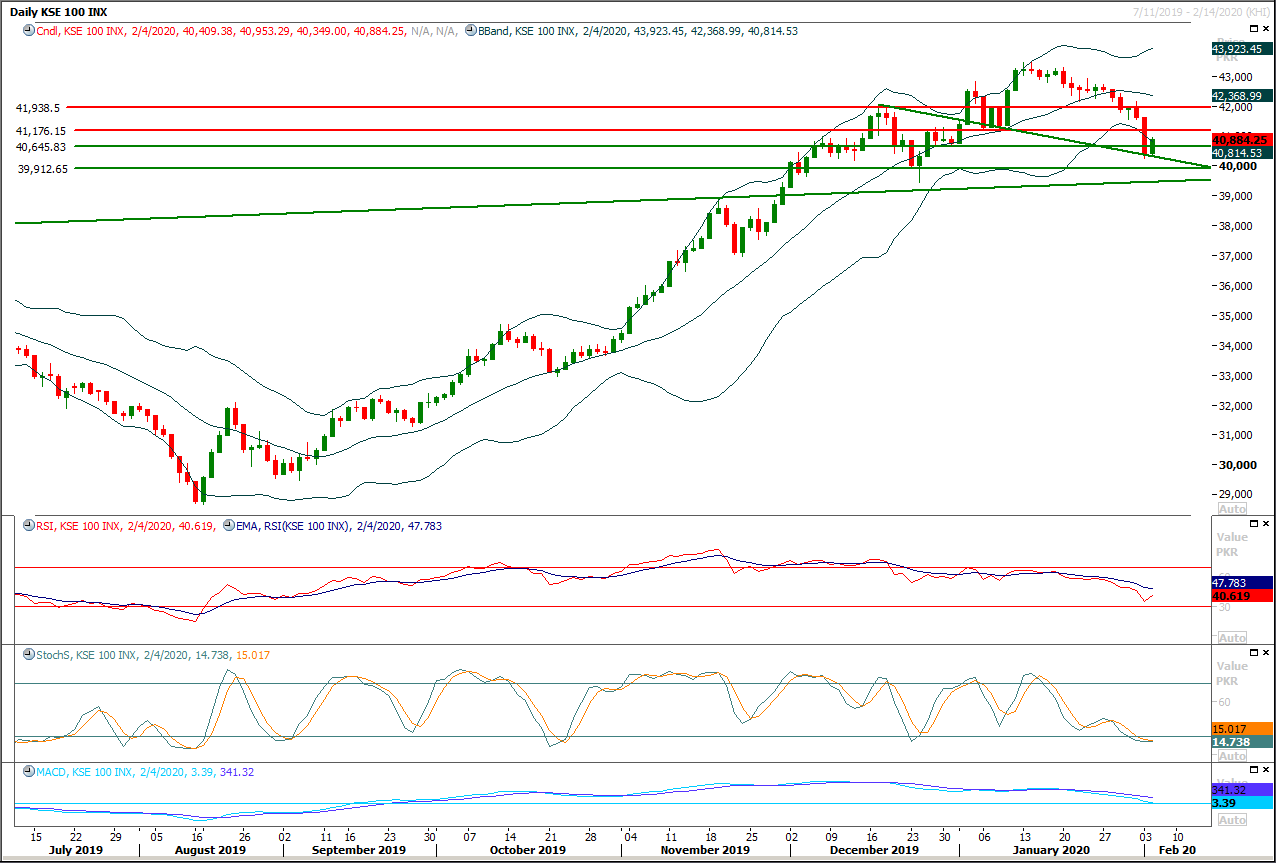

Trading volume at PSX floor dropped by 57.05 million shares or 28.08% on DoD basis, whereas the benchmark KSE100 index opened at 40,409.38, posted a day high of 40,953.29 and a day low of 40,349.00 points during last trading session while session suspended at 40,884.25 points with net change of 474.87 points and net trading volume of 106.37 million shares. Daily trading volume of KSE100 listed companies also dropped by 43.75 million shares or 29.14% on DoD basis.

Foreign Investors remained in net selling positions of 8.64 million shares and net value of Foreign Inflow dropped by 3.93 million US Dollars. Categorically, Foreign Individual and Corporate remained in net selling positions of 0.17 and 8.68 million shares but Overseas Pakistani Investors remained in net long positions of 0.21 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 1.31, 1.71, 0.02, 0.71 and 5.87 million shares but Local Companies and Brokers remained in net selling positions of 0.91 and 1.18 million shares respectively.

Analytical Review

Asian shares gain after solid U.S. data, focus on virus

Asian stocks edged up on Thursday, a day after U.S. S&P 500 hit a record peak following encouraging economic data, while investors keep a wary eye on the impact of the coronavirus outbreak. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.39% while Japan's Nikkei .N225 rose 1.63%. On Wednesday, the S&P 500 .SPX gained 1.13% to a record close of 3,334.69 while the Nasdaq Composite .IXIC added 0.43% to 9,508.68, also a record high. The ADP National Employment Report showed private payrolls jumped 291,000 jobs in January, the most since May 2015, while a separate report showed U.S. services sector activity picked up last month. Both indicators suggest the economy could continue to grow moderately this year even as consumer spending slows.

Mystery surrounds export of wheat, flour despite ban

Mystery prevails over the export of wheat and wheat flour — said to be responsible for the wheat flour price crisis — until the end of October despite a ban imposed in July and the ministries concerned are reluctant to offer any explanation. In June last year, the Economic Coordination Committee (ECC) of the cabinet had noted that wheat and wheat flour would be in short supply in the country, but did not halt their export as well as other processed products like suji and maida and put the issue on the back burner. Over the next few months — from end of July to first week of November — a number of notifications were issued by the ministries of food security and commerce to ban export of these products, but somehow these were reported in the data compiled by the Pakistan Bureau of Statistics (PBS).

Power, finance divisions blame each other for hike in electricity price for exporters

Amid threats by exporters and the business community to close down their factories and businesses, the National Assembly’s Standing Committee on Finance and Revenue on Tuesday ordered suspension of increased power rates for export industries and its retrospective recovery from January 1, 2019. The meeting of the panel, presided over by Faizullah, noted that Power Division’s notification of Jan 13 this year appeared to be unauthorised that increased electricity rates for export sector from 7.5 cents per unit to about 13 cents. Members of the committee were unanimous that the Power Division had misused its authority in issuing the notification and had in fact unilaterally exercised the mandate of the Economic Coordination Committee (ECC) and the federal cabinet.

Oil sales dip 10pc

Country’s total oil sales in the first seven months of the current fiscal year (7MFY20) plunged by 10 per cent to 10.139 million tonnes, mirroring a slowdown of economic activities. Furnace oil sales in the last seven months shrank by 32pc to 1.395m tonnes followed by 10pc drop in high speed diesel (HSD) to 3.837m tonnes. Petrol sales in 7MFY20 grew by 3pc to 4.455m tonnes. In Jan 2020, total oil sales came down to 1.349m tonnes from 1.558m tonnes in the same period a year ago. Furnace oil (FO) sales in Jan 2020 fell to 212,000 tonnes from 360,000 tonnes in same month a year ago while HSD sales dropped to 478,000 tonnes from 537,000 tonnes in Jan 2019. According to Top Line Securities, furnace oil sales plunged due to government’s policy of moving away from FO-based power generation while HSD sales remained depressed amidst slow economic activities.

Govt faces ‘very tough’ IMF review of fiscal deficit slippages

Pakistani authorities are undergoing a “very tough” second quarterly review with visiting staff of the International Monetary Fund (IMF) as the country’s fiscal deficit breached 2.3 per cent of GDP in the first half of 2019-20 despite a tight control on the government’s expenditure. Informed sources told Dawn on Wednesday that fiscal deficit in July-December 2019 amounted to about Rs995 billion (2.3pc of GDP) — up from just 0.6pc in the first quarter ending in September — owing to a massive revenue shortfall of about Rs290bn in corresponding period. This is despite the fact that the federal government was able to restrict its expenditure at Rs183bn in July-December. This worked out at about 42pc of the annual target of about Rs440bn set in the budget. “There was not a single supplementary grant allowed in first six months on the civil expenditure and austerity was religiously followed,” a senior official is said to have reported to the IMF.

Asian stocks edged up on Thursday, a day after U.S. S&P 500 hit a record peak following encouraging economic data, while investors keep a wary eye on the impact of the coronavirus outbreak. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.39% while Japan's Nikkei .N225 rose 1.63%. On Wednesday, the S&P 500 .SPX gained 1.13% to a record close of 3,334.69 while the Nasdaq Composite .IXIC added 0.43% to 9,508.68, also a record high. The ADP National Employment Report showed private payrolls jumped 291,000 jobs in January, the most since May 2015, while a separate report showed U.S. services sector activity picked up last month. Both indicators suggest the economy could continue to grow moderately this year even as consumer spending slows.

Mystery prevails over the export of wheat and wheat flour — said to be responsible for the wheat flour price crisis — until the end of October despite a ban imposed in July and the ministries concerned are reluctant to offer any explanation. In June last year, the Economic Coordination Committee (ECC) of the cabinet had noted that wheat and wheat flour would be in short supply in the country, but did not halt their export as well as other processed products like suji and maida and put the issue on the back burner. Over the next few months — from end of July to first week of November — a number of notifications were issued by the ministries of food security and commerce to ban export of these products, but somehow these were reported in the data compiled by the Pakistan Bureau of Statistics (PBS).

Amid threats by exporters and the business community to close down their factories and businesses, the National Assembly’s Standing Committee on Finance and Revenue on Tuesday ordered suspension of increased power rates for export industries and its retrospective recovery from January 1, 2019. The meeting of the panel, presided over by Faizullah, noted that Power Division’s notification of Jan 13 this year appeared to be unauthorised that increased electricity rates for export sector from 7.5 cents per unit to about 13 cents. Members of the committee were unanimous that the Power Division had misused its authority in issuing the notification and had in fact unilaterally exercised the mandate of the Economic Coordination Committee (ECC) and the federal cabinet.

Country’s total oil sales in the first seven months of the current fiscal year (7MFY20) plunged by 10 per cent to 10.139 million tonnes, mirroring a slowdown of economic activities. Furnace oil sales in the last seven months shrank by 32pc to 1.395m tonnes followed by 10pc drop in high speed diesel (HSD) to 3.837m tonnes. Petrol sales in 7MFY20 grew by 3pc to 4.455m tonnes. In Jan 2020, total oil sales came down to 1.349m tonnes from 1.558m tonnes in the same period a year ago. Furnace oil (FO) sales in Jan 2020 fell to 212,000 tonnes from 360,000 tonnes in same month a year ago while HSD sales dropped to 478,000 tonnes from 537,000 tonnes in Jan 2019. According to Top Line Securities, furnace oil sales plunged due to government’s policy of moving away from FO-based power generation while HSD sales remained depressed amidst slow economic activities.

Pakistani authorities are undergoing a “very tough” second quarterly review with visiting staff of the International Monetary Fund (IMF) as the country’s fiscal deficit breached 2.3 per cent of GDP in the first half of 2019-20 despite a tight control on the government’s expenditure. Informed sources told Dawn on Wednesday that fiscal deficit in July-December 2019 amounted to about Rs995 billion (2.3pc of GDP) — up from just 0.6pc in the first quarter ending in September — owing to a massive revenue shortfall of about Rs290bn in corresponding period. This is despite the fact that the federal government was able to restrict its expenditure at Rs183bn in July-December. This worked out at about 42pc of the annual target of about Rs440bn set in the budget. “There was not a single supplementary grant allowed in first six months on the civil expenditure and austerity was religiously followed,” a senior official is said to have reported to the IMF.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is trying to bounce back after getting support from a supportive trend line along with a horizontal supportive region to complete correction of its bearish rally and it's expected that index would remain bearish until it would succeed in closing above 41,960 points on daily closing basis but a correction towards 41,170 or 41,400 points could be witnessed. These both regions would react as major resistances against current bullish pullback therefore it's recommended to stay cautious and start profit taking around these regions from long positions. In case of reversal index would try to find its initial support at 40,645pts on intraday basis while 41,200 and 39,900 points would try to react as strong supportive regions in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.