Previous Session Recap

Trading volume at PSX floor increased by 56.06 million shares or 24.55% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44341.88, posted a day high of 44637.02 and a day low of 44252.88 during last trading session. The session suspended at 44301.20 with net change of 45.72 and net trading volume of 93.17 million shares. Daily trading volume of KSE100 listed companies increased by 22.47 million shares or 31.79% on DoD basis.

Foreign Investors remained in net selling position of 2.72 million shares but net value of Foreign Inflow increased by 0.74 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling postions of 0.12, 1.08 and 1.53 million shares respectively. While on the other side Local Individuals, NBFCs, Mutual Funds and Brokers remained in net buying positions of 6.49, 0.43, 1.57 and 3.8 million shares but Local Companies, Banks and Insurance Companies remained in net selling postions of 6.07, 2.0 and 2.91 million shares respectively.

Analytical Review

Asian shares fell sharply on Tuesday after Wall Street suffered its biggest decline since 2011 as investors’ faith in factors underpinning a bull run in markets began to crumble. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 2.8 percent to one-month low, which would be its biggest fall in more than a year and a half, a day after it had fallen 1.6 percent. Japan’s Nikkei dropped 4.6 percent. Australian shares dropped 3.0 percent to their lowest level since October while South Korean shares dropped 2.0 percent. All three broke below their 100-day moving average, a major support. U.S. stocks plunged in highly volatile trading on Monday, with the Dow industrials falling nearly 1,600 points during the session, its biggest intraday decline in history, as investors grappled with rising bond yields and potentially higher inflation.

Pakistan’s exports of non-textile products posted a robust growth of nearly 19 per cent to $4.4 billion in the first six months of this fiscal year. The exports of these products, which were faced with a steady decline, rebounded in 2017-18 owing to the government’s support, suggested data compiled by the Pakistan Bureau of Statistics (PBS). The export proceeds from the sectors had been falling persistently since July 2014. Recently, the government extended cash support package to non-textile products leather manufacturers, footwear, sports goods, surgical, engineering goods, furniture, meat and meat products, fish products and cutlery.

THE government’s decision to allow drug makers and importers to adjust prices on their own in line with inflation is expected to put burden on low-income households. In contrast, the pharmaceutical industry naturally thinks it’s a step in the right direction. The decision means there will be an automatic increase in drug prices on July 1 every year based on annual growth in the headline Consumer Price Index of the previous financial year. Although the Drug Pricing Policy of 2015 links increase in domestic drug prices with inflation, manufacturers could not increase prices without federal government approval. However, the government has now amended the policy to let them increase or adjust prices to inflation without an official notification. The decision was made by the federal cabinet at a meeting early last month, according to a newspaper report.

FOOD exports are growing faster this fiscal year, but the quality of exports is not such that it can make enough and immediate impact on stubbornly high food trade deficit. The food trade deficit was $1.31 billion in the first half of this fiscal year compared to $1.21bn a year ago, as food imports jumped to $3.24bn from $2.86bn but exports rose somewhat slower to $1.93bn from $1.65bn. In the July-December period, additional earnings of $181 million came from sugar and $130m from rice exports. The exports of the two commodities are expected to grow in the second half too.

The Asian Development Bank says that the upcoming 10 gigawatts generation capacity under the China-Pakistan Economic Corridor which is expected to be commissioned before 2019, will increase greenhouse gas emissions substantially that will worsen the climate change mitigation concerns. Moreover, ash handling and disposal problems will also exacerbate negative impacts on the environment, says an evaluation report of the power sector of Pakistan released by ADB. The report says that future increase in fossil-fuel power generation will contribute to climate change and environmental degradation.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

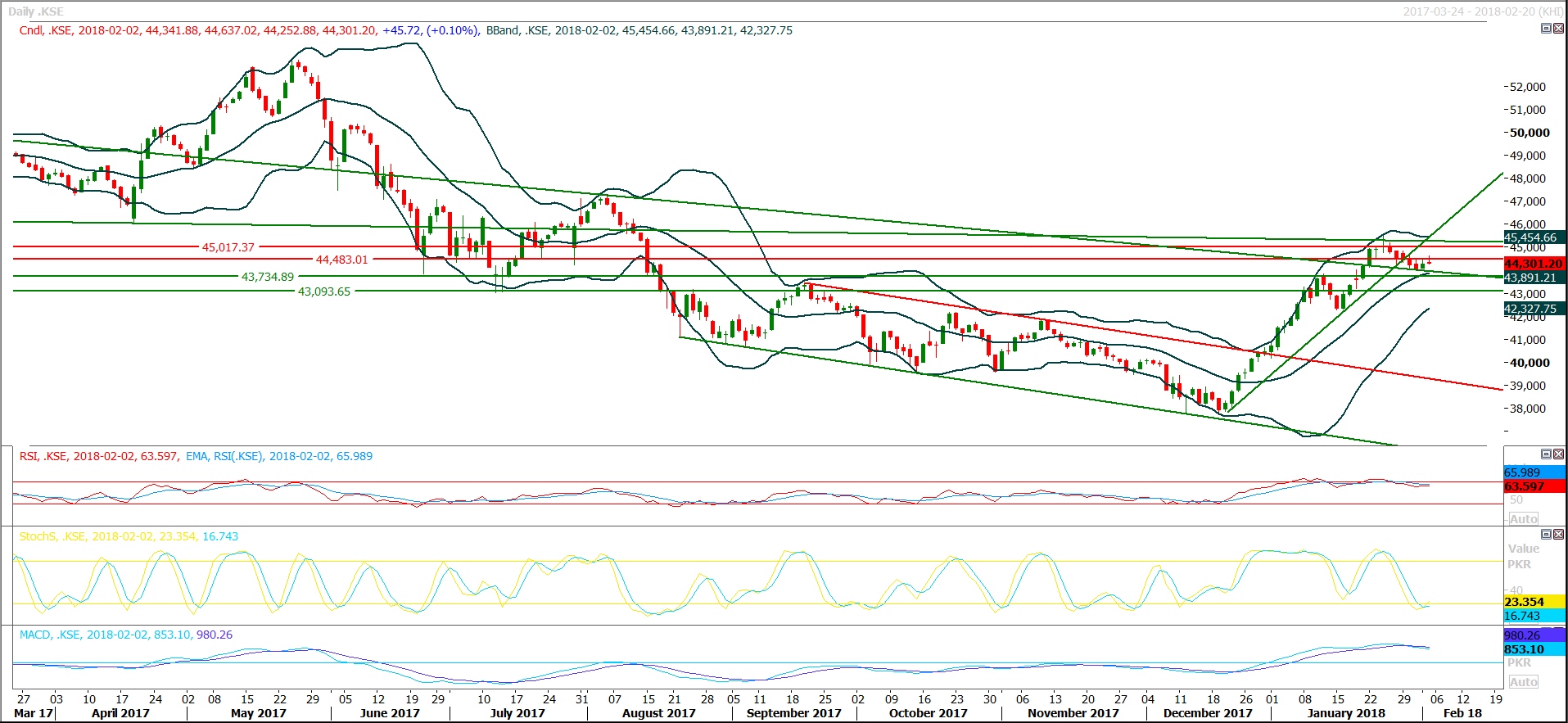

The Benchmark KSE100 Index have generated a bearish crossover on weekly Stochastic while weekly MAORSI is ready for that. But daily chart have a slight bullish momentum. As of right now index is beign supported by a decending trend line which is trying to push index in bullish direction and during the whole last week index have got support from that line multiple times. For current trading session that line is goint to support index again around 43947 and it would again found a strong support from a horizontal supportive region around 43760 points. Its recommended to practice caution as index is capped by resistances at 44483 and 45017 while supportive regions are standing at 43760 and 43100 points. If index would become able to slip below 43760 during this weeky then trend would be change which could push index downward for a further 1000 points in coming trading sessions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.