Previous Session Recap

Trading volume at PSX floor dropped by 89.47 million shares or 21.70% on DoD basis, whereas the benchmark KSE100 index opened at 42,480.76, posted a day high of 42,835.08 and a day low of 42,077.45 points during last trading session while session suspended at 42,323.30 points with net change of -157.46 points and net trading volume of 227.98 million shares. Daily trading volume of KSE100 listed companies dropped by 54.96 million shares or 19.42% on DoD basis.

Foreign Investors remained in net selling positions of 3.11 million shares and value of Foreign Inflow dropped by 0.91 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.18 and 0.19 million shares but Foreign Corporate remained in net selling positions of 3.47 million shares. While on the other side Local Individuals, Companies, Banks and NBFCs remained in net buying positions of 6.60, 3.63, 1.97 and 0.27 million shares but Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 2.12, 5.12 and 0.24 million shares respectively.

Analytical Review

Gold, oil soar, shares slip as U.S. and Iran trade threats

A gauge of Asian shares was toppled from an 18-month top on Monday as heightened Middle East tensions sent investors scurrying for the safety of gold, which hit a near seven-year high while oil jumped to four-month peaks. The United States detected a heightened state of alert by Iran’s missile forces, as President Donald Trump warned the U.S. would strike back, “perhaps in a disproportionate manner,” if Iran attacked any American person or target. Iraq’s parliament on Sunday recommended all foreign troops be ordered out of the country after the U.S. killing of a top Iranian military commander and an Iraqi militia leader. Spot gold XAU= surged 1.5% to $1,579.55 per ounce in jittery trade and reached its highest since April 2013. Oil prices added to their gains on fears any conflict in the region could disrupt global supplies.

Consumers to pay for power losses under fresh proposal

To ensure a belated compliance with the targets of International Monetary Fund (IMF), the government is set to recover additional cost of losses from consumers by imposing new surcharges aimed at financing power sector loans and generate more than Rs250 billion in annual revenue. As a first step, a meeting of the Economic Coordination Committee (ECC) of the Cabinet has been convened on Monday (today) to seek approval for introduction in parliament amendments to the Regulation of Generation, Transmission and Distribution of Electric Power Act, 1997 to address about Rs1.72 trillion worth of circular debt as of end-December 2019. The IMF estimates put the increase in circular debt for FY2019 at Rs465bn.

Govt borrows Rs1.1tr from banks in six months

Government borrowing from the scheduled banks in the last week of December jumped by 55 per cent. For the first time in the last three years, the government borrowing from scheduled banks crossed Rs1 trillion-mark within six months. The latest data released by the State Bank of Pakistan (SBP) shows that government borrowed Rs1.116tr from the banks till Dec 27. The borrowing amount was Rs717 billion on Dec 22 which means the government borrowed massive Rs400bn within a week; an increase of over 55pc.

Decline in imports behind massive revenue loss: FBR

The national tax collecting body has acknowledged that collections remained behind the target by Rs114 billion during the six months of the current fiscal, despite the fact that the revenue collection was 16.3 per cent higher than the corresponding period of last year. In a statement, the Federal Board of Revenue (FBR) said that massive revenue loss occurred in July-December 2019 due to reduction in imports. The statement says that compression in imports by more than $5bn has on the one hand improved the current account situation, but on the other adversely affected the usual revenue resources of the government. “An estimated loss of Rs56bn of taxes has been incurred on every $1bn of import compression,” it says. Upon calculation, the total loss will reach Rs280bn.

2nd phase of CPEC starts with establishment of SEZs in various parts of country

The second phase of the China Pakistan Economic Corridor (CPEC), a flagship project of Belt and Road Initiative has started with the establishment of special economic zones in various parts of the country, Pakistan Ambassador to China, Naghmana Alamgir Hashmi said on Saturday. "The second phase of CPEC has now started, which is actually the establishment of special economic zones in various parts of the country,"she said in an interview with China Economic Net. Ambassador Hashmi remarked that with the establishment of these special economic zones and the signing of agreements between the Chinese and Pakistani agricultural sectors and with increased cooperation, agriculture was a field with great potential for investment and re-export. She said that with the China-Pakistan Free Trade Agreement becoming operational, the price would in any way go down, because the import duties would not apply.

A gauge of Asian shares was toppled from an 18-month top on Monday as heightened Middle East tensions sent investors scurrying for the safety of gold, which hit a near seven-year high while oil jumped to four-month peaks. The United States detected a heightened state of alert by Iran’s missile forces, as President Donald Trump warned the U.S. would strike back, “perhaps in a disproportionate manner,” if Iran attacked any American person or target. Iraq’s parliament on Sunday recommended all foreign troops be ordered out of the country after the U.S. killing of a top Iranian military commander and an Iraqi militia leader. Spot gold XAU= surged 1.5% to $1,579.55 per ounce in jittery trade and reached its highest since April 2013. Oil prices added to their gains on fears any conflict in the region could disrupt global supplies.

To ensure a belated compliance with the targets of International Monetary Fund (IMF), the government is set to recover additional cost of losses from consumers by imposing new surcharges aimed at financing power sector loans and generate more than Rs250 billion in annual revenue. As a first step, a meeting of the Economic Coordination Committee (ECC) of the Cabinet has been convened on Monday (today) to seek approval for introduction in parliament amendments to the Regulation of Generation, Transmission and Distribution of Electric Power Act, 1997 to address about Rs1.72 trillion worth of circular debt as of end-December 2019. The IMF estimates put the increase in circular debt for FY2019 at Rs465bn.

Government borrowing from the scheduled banks in the last week of December jumped by 55 per cent. For the first time in the last three years, the government borrowing from scheduled banks crossed Rs1 trillion-mark within six months. The latest data released by the State Bank of Pakistan (SBP) shows that government borrowed Rs1.116tr from the banks till Dec 27. The borrowing amount was Rs717 billion on Dec 22 which means the government borrowed massive Rs400bn within a week; an increase of over 55pc.

The national tax collecting body has acknowledged that collections remained behind the target by Rs114 billion during the six months of the current fiscal, despite the fact that the revenue collection was 16.3 per cent higher than the corresponding period of last year. In a statement, the Federal Board of Revenue (FBR) said that massive revenue loss occurred in July-December 2019 due to reduction in imports. The statement says that compression in imports by more than $5bn has on the one hand improved the current account situation, but on the other adversely affected the usual revenue resources of the government. “An estimated loss of Rs56bn of taxes has been incurred on every $1bn of import compression,” it says. Upon calculation, the total loss will reach Rs280bn.

The second phase of the China Pakistan Economic Corridor (CPEC), a flagship project of Belt and Road Initiative has started with the establishment of special economic zones in various parts of the country, Pakistan Ambassador to China, Naghmana Alamgir Hashmi said on Saturday. "The second phase of CPEC has now started, which is actually the establishment of special economic zones in various parts of the country,"she said in an interview with China Economic Net. Ambassador Hashmi remarked that with the establishment of these special economic zones and the signing of agreements between the Chinese and Pakistani agricultural sectors and with increased cooperation, agriculture was a field with great potential for investment and re-export. She said that with the China-Pakistan Free Trade Agreement becoming operational, the price would in any way go down, because the import duties would not apply.

Market is expected to remain volatile during current trading session.

Technical Analysis

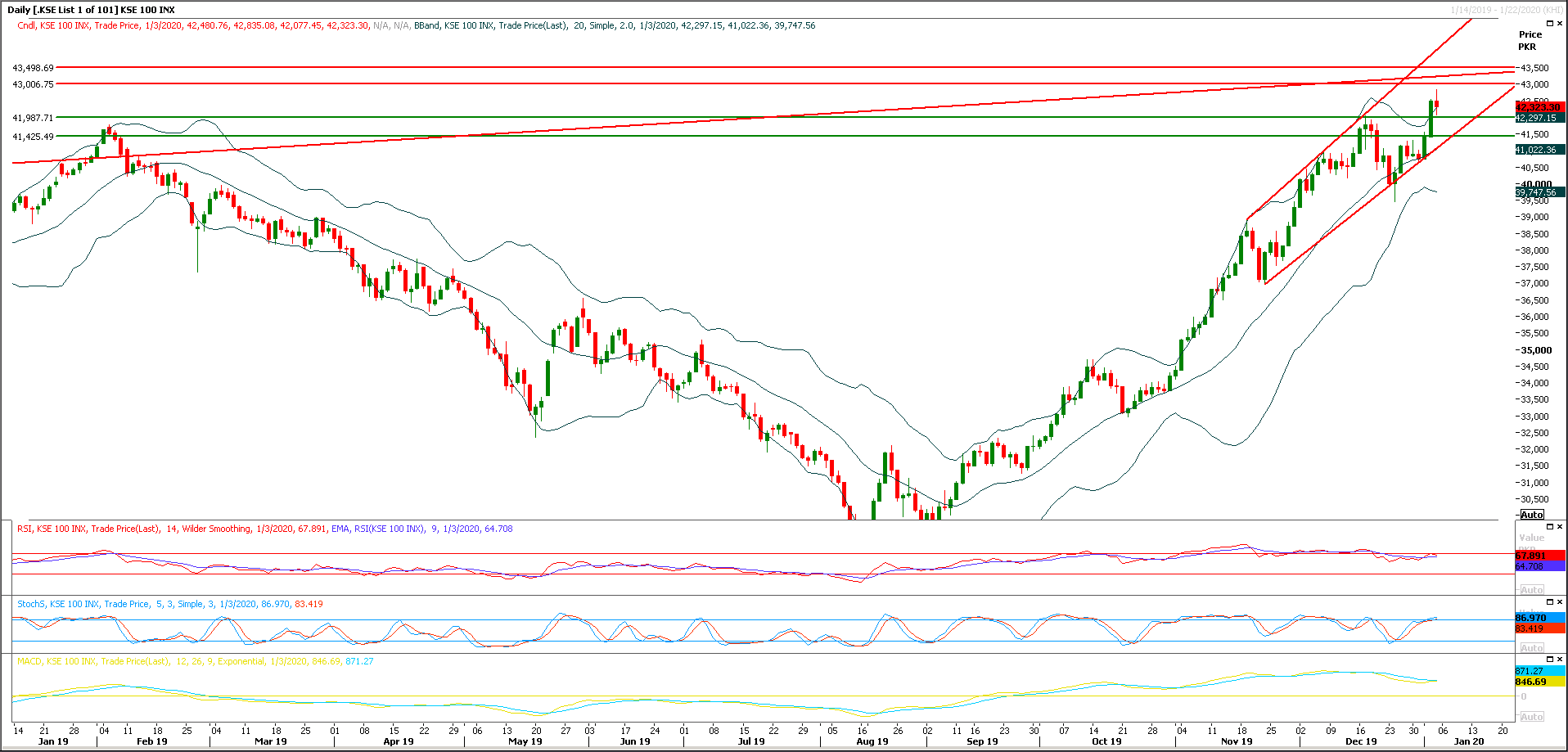

The Benchmark KSE100 index is being caged in a rising wedge once again , while inside that wedge its being capped by a resistant trend line along with a horizontal resistant region at 43,000 points. It's expected that index would face some serious pressure from these regions and if it would not succeed in penetration above its resistant regions then it would try to format an evening shooting star on daily chart and this would try to lead index below 41,980 points, while closing below 41,500 points would call for a correction which may lead index towards 40,500 points. While on flip side in case index would succeed in continuing its bullish momentum then it would face some serious pressure between 43,000-43,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.