Previous Session Recap

Trading volume at PSX floor increased by 58.81 million shares or 99.30% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,903.41, posted a day high of 43,293.00 and a day low of 42,832.94 during last trading session. The session suspended at 43,268.29 with net change of 355.48 and net trading volume of 73.12 million shares. Daily trading volume of KSE100 listed companies increased by 34.57 million shares or 89.69% on DoD basis.

Foreign Investors remained in net selling position of 8.44 million shares and net value of Foreign Inflow dropped by 12.81 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.08 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 8.37 and 0.14 million shares. While on the other side Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 4.10, 3.44, 1.81 and 4.30 million shares but Local Individuals, NBFCs and Brokers remained in net selling positions of 2.85, 1.75 and 0.1 million shares respectively.

Analytical Review

Asia stocks edge up as techs lift Wall Street, Italy still a worry

Asian stocks edged up on Wednesday after tech sector strength lifted Wall Street shares, while concerns about Italy’s debt prompted investors to move into lower-risk government debt elsewhere, pushing U.S. Treasury yields down from recent highs. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent, while Japan's Nikkei .N225 edged down 0.1 percent. Australian stocks rose 0.3 percent. The Nasdaq .IXIC closed at a record high for the second day in a row on Tuesday with help from the technology and consumer discretionary sectors amid an upbeat outlook for the U.S. economy.

Experts see serious balance of payments problems ahead

The country is likely to face serious balance of payments problems due to depleting foreign exchange reserves and weakening local currency against the US dollar, which will force the new government to approach the international lenders, especially IMF, for financial assistance. Noted economist Dr Ashfaq Hassan Khan and other experts warned that the widening current account deficit would worsen the financial condition by the end of current fiscal year 2018-19 and force the next elected government to approach the International Monetary Fund again for another bailout package. He said that the government measures would not have sufficient impact to wipe out the growing deficit and not a proper substitute to address the structural problems. He said that concerns have already been expressed by the central bank and multilateral institutions about the deteriorating situation in the external sector.

Pak-China currency deal to cut dependence on dollar

The business community on Tuesday welcomed extension in the currency swap agreement between Pakistan and China terming it beneficial for the local economy facing multiple challenges. The rupee-yuan swap amount has been doubled from 10 billion yuan to 20 billion yuan which will reduce the dependence of Pakistan on US dollar at a time when forex reserves and rupee are under pressure, an official of FPCCI said. The deal was signed five years ago but it didn’t work but now the situation has changed, said Malik Sohail, chairman Coordination FPCCI. He said, “Now China is our biggest trading partner, bilateral trade is growing, CPEC has become a reality, therefore, doubling the swap size to 351 billion Pakistani rupees is a good move.”

Seafood exports up by 17pc in 10 months

The exports of fish and fish preparations from the country witnessed increase of 17.41 percent during the first ten months of the current fiscal year as against the corresponding period of last year. The fish exports from the country were recorded at $371.565 million in July-April (2017-18) against the exports of $316.469 million in July-April (2016-17), showing growth of 17.41 percent, according to the data of Pakistan Bureau of Statistics (PBS). In terms of quantity, the fish exports increased by 26.91 percent during the period under review by growing from exports of 122,993 metric tons last year to 156,093 metric tons.

Gas companies to give over 1m new connections

Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) will provide over one million new gas connections in their respective areas during the fiscal year 2018-19. “Both the companies have planned to add 1,121,295 new connections and lay 12,898 kms of transmission and distribution pipelines in their respective networks,” official sources told APP. Answering a question, they said the companies have so far gasified around 231 villages and towns in their respective areas during the current fiscal year. During the period, the two utility companies have laid approximately 328-kilometer gas transmission network, 8,861 km distribution and 1,216 km service lines for gasification of the villages, official sources told APP. Replying to another question, they said, the companies had invested Rs 1,351 million on transmission projects, Rs 10,202 million on distribution projects and Rs 11,198 million on other projects bringing total investment to about Rs 22,751 million.

Asian stocks edged up on Wednesday after tech sector strength lifted Wall Street shares, while concerns about Italy’s debt prompted investors to move into lower-risk government debt elsewhere, pushing U.S. Treasury yields down from recent highs. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1 percent, while Japan's Nikkei .N225 edged down 0.1 percent. Australian stocks rose 0.3 percent. The Nasdaq .IXIC closed at a record high for the second day in a row on Tuesday with help from the technology and consumer discretionary sectors amid an upbeat outlook for the U.S. economy.

The country is likely to face serious balance of payments problems due to depleting foreign exchange reserves and weakening local currency against the US dollar, which will force the new government to approach the international lenders, especially IMF, for financial assistance. Noted economist Dr Ashfaq Hassan Khan and other experts warned that the widening current account deficit would worsen the financial condition by the end of current fiscal year 2018-19 and force the next elected government to approach the International Monetary Fund again for another bailout package. He said that the government measures would not have sufficient impact to wipe out the growing deficit and not a proper substitute to address the structural problems. He said that concerns have already been expressed by the central bank and multilateral institutions about the deteriorating situation in the external sector.

The business community on Tuesday welcomed extension in the currency swap agreement between Pakistan and China terming it beneficial for the local economy facing multiple challenges. The rupee-yuan swap amount has been doubled from 10 billion yuan to 20 billion yuan which will reduce the dependence of Pakistan on US dollar at a time when forex reserves and rupee are under pressure, an official of FPCCI said. The deal was signed five years ago but it didn’t work but now the situation has changed, said Malik Sohail, chairman Coordination FPCCI. He said, “Now China is our biggest trading partner, bilateral trade is growing, CPEC has become a reality, therefore, doubling the swap size to 351 billion Pakistani rupees is a good move.”

The exports of fish and fish preparations from the country witnessed increase of 17.41 percent during the first ten months of the current fiscal year as against the corresponding period of last year. The fish exports from the country were recorded at $371.565 million in July-April (2017-18) against the exports of $316.469 million in July-April (2016-17), showing growth of 17.41 percent, according to the data of Pakistan Bureau of Statistics (PBS). In terms of quantity, the fish exports increased by 26.91 percent during the period under review by growing from exports of 122,993 metric tons last year to 156,093 metric tons.

Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) will provide over one million new gas connections in their respective areas during the fiscal year 2018-19. “Both the companies have planned to add 1,121,295 new connections and lay 12,898 kms of transmission and distribution pipelines in their respective networks,” official sources told APP. Answering a question, they said the companies have so far gasified around 231 villages and towns in their respective areas during the current fiscal year. During the period, the two utility companies have laid approximately 328-kilometer gas transmission network, 8,861 km distribution and 1,216 km service lines for gasification of the villages, official sources told APP. Replying to another question, they said, the companies had invested Rs 1,351 million on transmission projects, Rs 10,202 million on distribution projects and Rs 11,198 million on other projects bringing total investment to about Rs 22,751 million.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

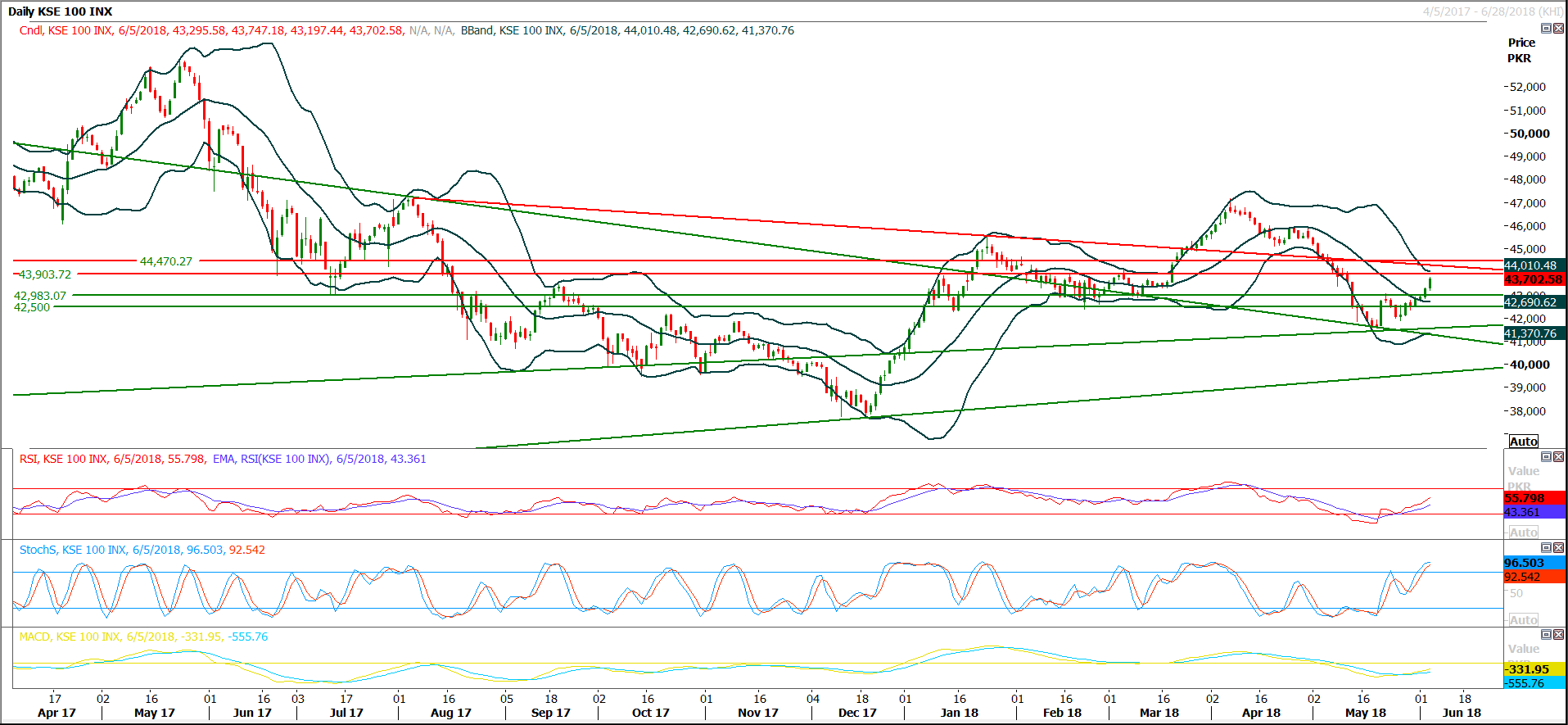

Technical Analysis

The Benchmark KSE100 Index have its major resistance of 43,330 points during last trading session and now its heading towards 43,900 points where its being capped by another horizontal resistance which have reacted as very strong pivotal point previously. Momentum indicators on hourly, daily and weekly basis have turned to bullish side but this weekly closing would confirm either this bullish sentiment would sustain or not, because closing above 43,360 would call for 44,230 points on daily chart where correction of recent bearish rally would be completed. For current trading session it’s recommended to adopt swing trading strategy with strict stop loss

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.