Previous Session Recap

Trading volume at PSX floor dropped by 92.89 million shares or 40.39% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43797.53, posted a day high of 43875.00 and a day low of 43654.69 during last trading session. The session suspended at 43829.07 with net change of 88.58 and net trading volume of 44.75 million shares. Daily trading volume of KSE100 listed companies dropped by 39.67 million shares or 46.99% on DoD basis.

Foreign Investors remained in net buying position of 1.2 million shares but net value of Foreign Inflow dropped by 0.85 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.03 and 1.4 million shares but Foreign Corporate Investors remained in net selling position of 0.24 million shares. While on the other side Local Individuals and Mutual Funds remained in net buying positions of 2.79 and 3.69 million shares, but Local Comapnies, Banks, Brokers and Insurance Companies remained in net selling positions of 2.68, 2.74, 0.62 and 2.58 million shares respectively.

Analytical Review

Asian share regained some ground on Tuesday after U.S. President Donald Trump faced growing pressure from political allies to pull back from proposed steel and aluminum tariffs, easing investor worries about an imminent trade war.Sentiment was also supported by receding risk aversion in Europe with the euro gaining support from the creation of a coalition government in Germany and the impact of Italy’s inconclusive election results limited to a mild sell-off in domestic bonds and stocks.MSCI’s broadest index of Asia-Pacific shares outside Japan rose 1.3 percent while Japan’s Nikkei jumped 2.3 percent, a day after it hit a five-month low.Korean shares have erased all the losses they had taken after Trump’s announcement even though the country is seen as being among the worst affected in region by the tariffs due to its big steel exports to the United States.MSCI’s broadest gauge of the world’s stock markets rose 0.3 percent after having snapped a four-day losing streak on Monday with a gain of 0.7 percent.

The ministry of commerce on Monday issued notification to impose ban on the import of Ajinomoto, also known as ‘Chinese salt’, on the direction of Supreme Court of Pakistan. “The ministry of commerce has imposed ban on the import of Ajinomoto salt , as directed by the Supreme Court,” said an official of the ministry. He further said that Pakistan imports Ajinomoto salt worth around $25,000 every year.CJP had recently banned the sale of Chinese salt Ajinomoto, observing that it is hazardous for health. He said that the prime minister should take up the issue in the cabinet. The prime minister directed the ministry of commerce to impose ban on the import of Ajinomoto.Earlier, the Punjab government had imposed a ban on the sale, import and export of Ajinomoto salt in January. Khyber Pakhtunkhwa and Sindh had followed suit and banned the condiment for its “hazardous effects on human health” in February.

Amid delays in the commercial operations of three mega projects of about 3,600 megawatts in Punjab, the government on Monday directed scaling down supplies of Liquefied Natural Gas (LNG) from both specialised import terminals as fuel demand faded.Pakistan LNG Ltd (PLL) and Pakistan State Oil (PSO) have been directed to reduce their supplies by one-third and about 17 per cent, respectively, as domestic gas demand has dropped with higher temperatures, a senior official at the Petroleum Division told Dawn on Monday.As a consequence, the LNG throughput handled by PLL from Gasport Terminal would be reduced from 300 million cubic feet per day (mmcfd) to 200mmcfd while PSO would reduce supply from Engro Elengy Terminal from 600mmcfd to 500mmcfd.The official said the adjustments in LNG supplies had been made on the directives of the Prime Minister Office and would have a cost to PSO and PLL but would ensure that three signature plants do not look bad financially.

Fishing boats look like specks alongside Egina, which has been moored for the last month in Lagos. Even the container ships that normally dominate the port look like small boats.The floating production storage and offloading facility (FPSO), developed by the French group Total, looks a lot like a giant Lego set. Everything about it is huge: its weight (220,000 tonnes), length (330 metres/1,083 feet) and width (60 metres). At 33 metres, it's as high as a 10-storey building.The vessel is in its final stage of construction and will soon produce some 200,000 barrels of oil a day or about 10 percent of national production.In the next few months, Egina will head to the Niger Delta and link up to 44 subsea wells some 1,600 metres under the Gulf of Guinea.Up to 2.3 million barrels of crude can be stored in its hull, before being taken abroad to be refined.The cost of the project is up to $16 billion (12.8 billion euros) but according to the head of Total in Nigeria , Nicolas Terraz, the investment is justified."Nigeria is a very important country for Total. We've been here for the last 60 years," he told AFP, looking up at the huge ship. "It's the biggest FPSO ever constructed by the group."

Pakistan Water and Power Development Authority (WAPDA) achieved yet another landmark towards energy security of the country, as Tarbela 4th Extension Hydropower Project started electricity generation Monday. The first generating unit, put into operation has started providing electricity to the National Grid. To mark the significant development of electricity generation from the first unit, Wapda Chairman Muzammil Hussain visited Tarbela 4th Extension Hydropower Project . Highlighting significance of the project in economic development and social uplift of the country, he said that prime minister will formally inaugurate the project in 2nd week of March. Under the project , three electric power generating units – each of them having capacity of 470 MW – have been installed at the Tunnel 4 of Tarbela Dam. The first unit has started electricity generation. The second unit is scheduled to be commissioned by end of April, while the third unit is schedule to start electricity generation by end of May, this year. It merits a mention that the 1410 MW-Tarbela 4th Extension is a component of least-cost energy generation plan.

Market seems to remain volatile during current trading session therefore its recommended to practice caution.

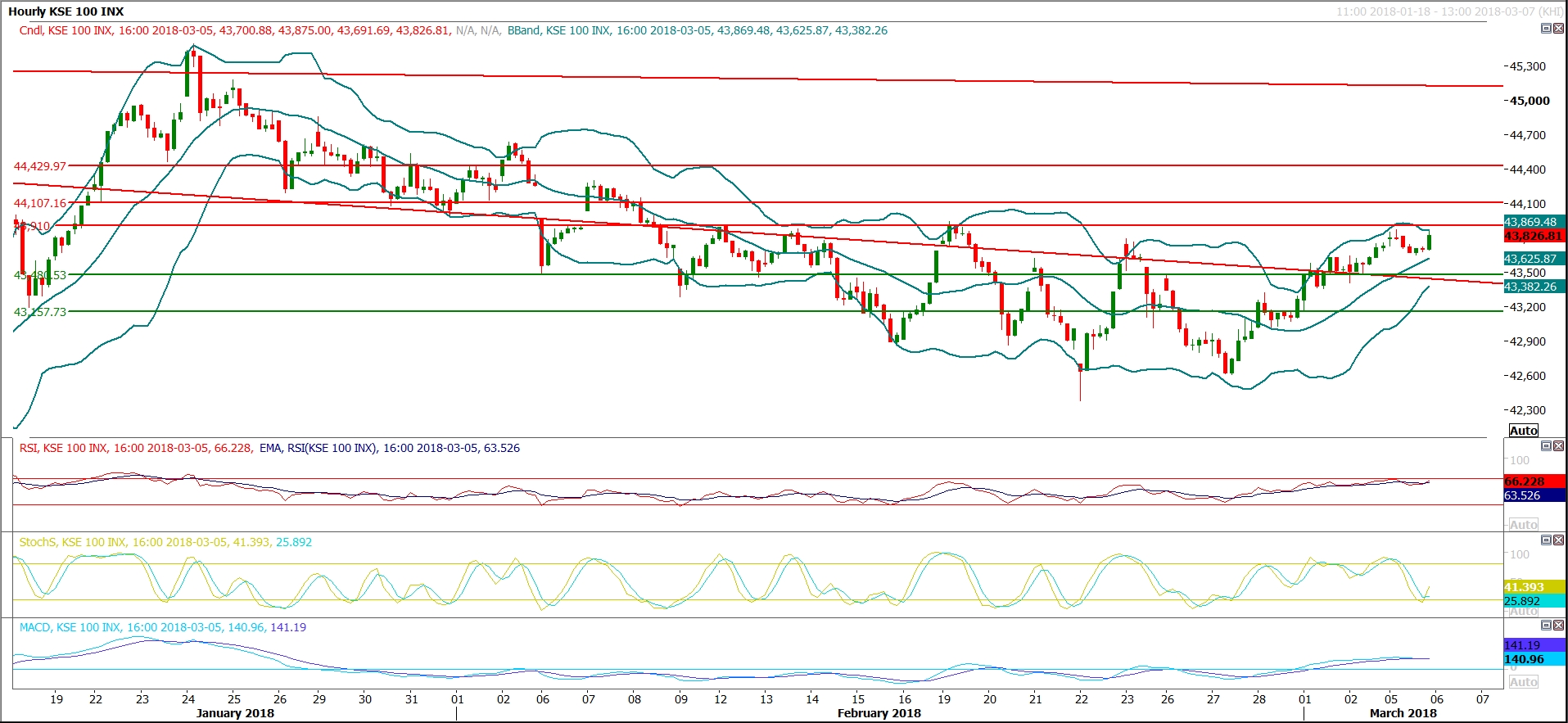

Technical Analysis

The Benchmark KSE100 Index is capped by a horizontal resistance at 43960 points which would try to push index back in negative zone if would not breached. Hourly and Daily momentum is in bullish mode which would lead index towards 44465 if closed above 43960 points. On the other side supportive regions are standing at 43500 and 43100 points. For current trading session index would try to hit 44100 point after sliding above 43960 where it would face a strong resistance as on hourly chart that region have reacted as major support previously.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.