Previous Session Recap

Trading volume at PSX floor dropped by 1.06 million shares or 0.91%, DoD basis, whereas, the benchmark KSE100 Index opened at 40506.92, posted a day high of 41115.50 and a day low of 40453.03 during the last trading session. The session suspended at 41064 with a net change of 565.13 and net trading volume of 60.90 million shares. Daily trading volume of KSE100 listed companies dropped by 6.06 million shares or 9.05%, DoD basis.

Foreign Investors remained in a net selling position of 10.4 million shares and net value of Foreign Inflow dropped by 0.84 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.22, 5.14 and 5.04 million shares respectively. While on the other side Local Individuals, Companies, Mutual Funds and Insurance Companies remained in net buying positions of 5.21, 1.73, 3.39 million shares respectively but Banks and Brokers remained in net selling positions of 1.16 and 0.39 million shares.

Analytical Review

Asian shares stepped away from recent decade highs on Monday while the U.S. dollar staged a broad-based rally and oil jumped to a more than two-year peak as Saudi Arabia’s crown prince cemented his power through an anti-corruption crackdown. With traders on edge about the outcome of these high-stake meetings, MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipped 0.7 percent to 552.8 from Friday’s top of 557.9 which was the highest since Nov. 2007. South Korea's KOSPI .KS11 fell 0.5 percent. Australian shares were off 0.1 percent but stayed within striking distance of a more than two-year peak set on Friday. Hong Kong's Hang Seng Index .HSI skidded 1 percent. Japan's Nikkei .N225 was a tad softer too but hovered around a 21-year peak.

The cement industry is performing in stiff regulatory environment and is only surviving because it has upgraded its technology, providing it the strength to take any challenge. The industry stakeholders said, “Our quality is the best in the region and our efficiency is second to none. No cement could compete with Pakistani cement if imported at real and fair value after paying all government levies. However, weak border controls and lax customs vigilance allow entry of cement from across our borders at unfair valuations hurting the local cement industry .” They said that the government should lower excise duty on the sector to further boost demand. Similarly, import duty on coal imported by the sector should be brought at par with other sectors. The industry representatives said that the exports still remain below par and they have been pointing out the reasons for decline in exports that is worrisome as the industry still has idle capacity. They said that almost all decline in exports is via sea. Exports to India are also affected but not to that extent, they added.

Fuel suppliers said on Friday that gasoline sold locally meets regulatory requirements following a complaint filed by Honda Motor Co''s Pakistan subsidiary accusing suppliers of adding a manganese-based additive to improve the octane rating. Honda Atlas Cars (Pakistan) Ltd., filed the complaint with oil and gas industry regulator, saying the additive appeared to be damaging engines in its vehicles. "Fuel being sold in the country is strictly in accordance with the approved specifications issued by the Ministry of Energy, Petroleum Division," a body representing Pakistan’s fuel suppliers said in a statement. "The question of sale of poor quality fuel does not arise," the statement issued by Pakistan’s Oil Companies Advisory Council (OCAC) added.

The government has released Rs 14 billion for the implementation of phase-I of the Prime Minister’s Export Incentives Package against the exporters'' claims of Rs 21.5 billion submitted to the State Bank of Pakistan (SBP) so far, it is learnt. Sources revealed to Business Recorder that the 7th meeting of the reconstituted Federal Textile Board was held here under the chairmanship of Federal Minister for Commerce and Textile, Pervaiz Malik and State Minister for Commerce and Textile Haji Akram Ansari. The textile associations requested the government that in order to devise medium to long- term plan for textile sector, it has to consider a number of recommendations such as reduction in tariffs by withdrawing tariff rationalization surcharge, GIDC and importantly disparity in gas prices across Pakistan, sales tax & customs refunds and extending zero rating facility to packing material and power looms.

Today ATRL, ENGRO , LUCK and SSGC may lead the market in the positive direction.

Technical Analysis

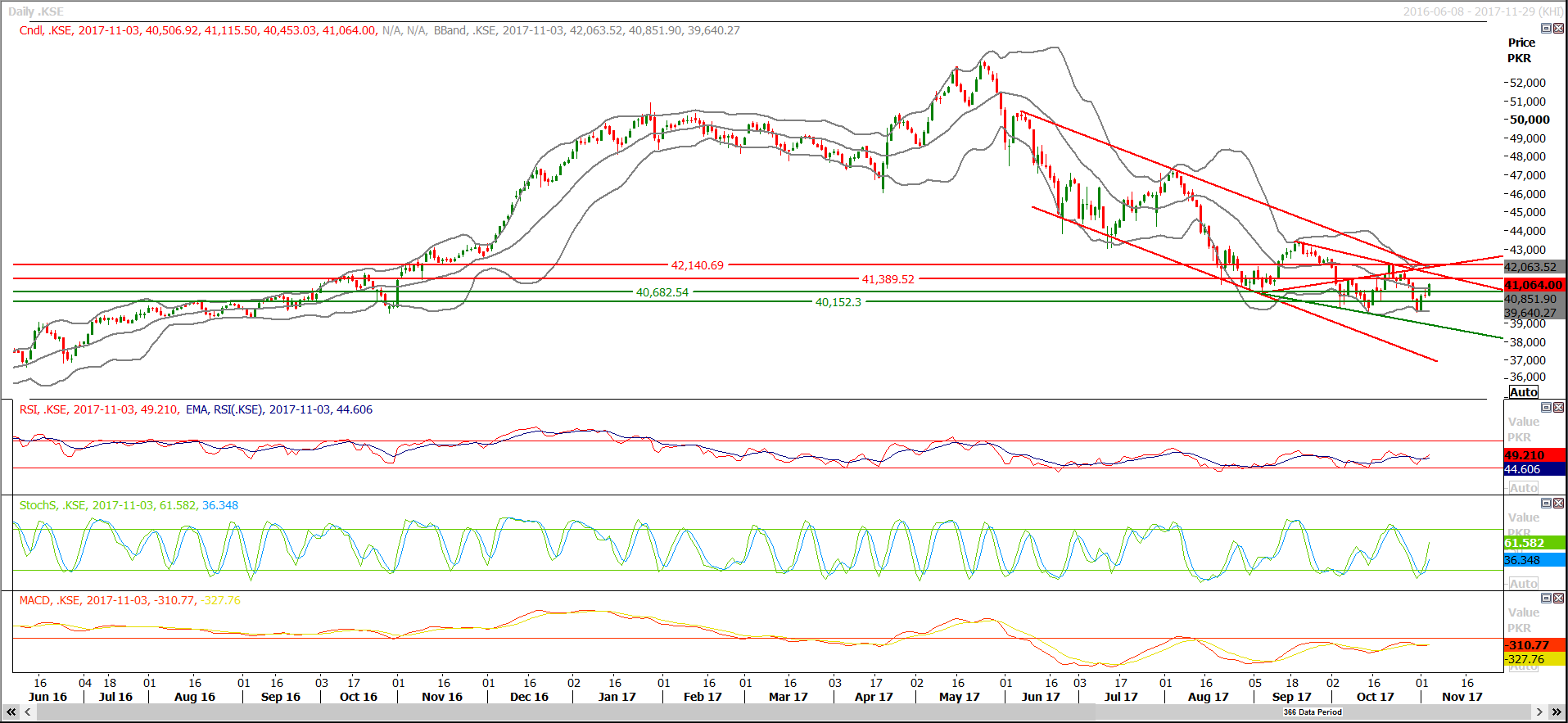

The Benchmark KSE100 Index has penetrated its major resistant region of 40900 in bullish direction and right now it is in short term momentum has been changed to positive. As of now Index has resistance at 41400 while supportive regions are standing at 40660 and 40150. Index may complete 61.8% correction of its last bearish rally at 41170 therefore it is recommended to buy on dips and sell on strength for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.