Previous Session Recap

Trading volume at PSX floor dropped by 78.30 million shares or 26.78% on DoD basis, whereas the Benchmark KSE100 index opened at 41,892.22, posted a day high of 41,892.22 and day low of 41,033.87 points during last trading session while session suspended at 41,493.96 with net change of -510.13 points and net trading volume of 145.50 million shares. Daily trading volume of KSE100 listed companies dropped by 64.22 million shares or 30.62% on DoD basis.

Foreign Investors remained in net selling position of 0.11 million shares but net value of Foreign Inflow increased by 0.19 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net selling positions of 0.03 and 2.50 million shares but Foreign Corporate investors remained in net buying positions of 2.43 million shares respectively. While on the other side Local Individuals, Banks, NBFCs and Insurance Companies remained in net buying positions of 10.00, 1.38, 0.39 and 0.67 million shares respectively but Local Companies, Mutual Fund and Brokers remained in net selling positions of 0.56, 9.56 and 0.86 million shares respectively.

Analytical Review

Asian shares inch up, investors brace for U.S. elections

Asian shares ticked up in early Tuesday trade, supported by Wall Street gains although sentiment was tempered ahead of the U.S. midterm elections, the first major electoral test of President Donald Trump’s big tax cuts and hostile trade policies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.15 percent while Japan's Nikkei .N225 gained 0.5 percent, a day after both fell more than one percent. On Wall Street, the S&P 500 .SPX gained 0.56 percent, with financials such as Berkshire Hathaway (BRKa.N) supported by strong earnings. In oil markets, crude prices wobbled near multi-month lows after the United States granted eight countries temporary waivers allowing them to continue buying oil from Iran as Washington formally imposed punitive sanctions on the Islamic republic.

Aptma for directing SNGPL to issue revised gas bills

The All Pakistan Textile Mills Association (APTMA) Punjab Chairman Adil Bashir has urged the government to direct the Sui Northern Gas Pipelines Ltd (SNGPL) to issue revised gas bills to the eligible industry @ $6.5/MMBTU all inclusive on gas consumption for both captive and processing use. Also, he stressed in the same breath that notification for providing electricity at 7.5 cents/kWh be immediately issued. This will enable the exporting industry to focus on increasing exports and undertaking new investment initiatives, he added.

ICCI calls for improving trade balance with China

The Islamabad Chamber of Commerce & Industry has called upon the government to take concrete measures for improving trade balance with China as Pakistan was facing huge trade deficit of over $10 billion with China and the only best way to reduce it was to promote exports to China. Ahmed Hassan Moughal, president Islamabad Chamber of Commerce & Industry, said that Pakistan today faced very high trade deficit and one way to get out of this large trade deficit was to find ways of expanding and diversifying exports.

PDWP approves five development schemes

The Punjab Provincial Development Working Party (PDWP) has approved five development schemes of various development sectors with an estimated cost of 3183.919 million rupees. The said schemes were approved in the 2nd meeting of PDWP of current fiscal year 2018-19, presided over by Chairman Planning and Development (P&D) Habib ur Rehman Gilani. Secretary P&D Iftikhar Ali Sahoo, all members of the Planning & Development Board, provincial secretaries concerned, Assistant Chief P&D Coordination-II Hafiz Muhammad Iqbal and other senior representatives of the relevant provincial departments also attended the meeting.

SNGPL initiates upgradation of gas transmission line project

The Sui Northern Gas Pipeline Limited (SNGPL) on Monday announced that up-gradation of gas transmission line project has been initiated to overcome with the low gas pressure issue as well as to ensure availability of sufficient gas to domestic consumers in Peshawar during winter season. While briefing media persons at Peshawar Press Club about various gas infrastructure development schemes worth Rs1 billion in the provincial metropolis Peshawar, the SNGPL General Manager Saqib Arbab said that a comprehensive strategy had been devised to address the low gas pressure issue in city areas. For this purpose, he said five different schemes of gas transmission line expansion have been approved that would be completed at the cost of Rs1 billion. He also informed that special feeding station will also be constructed for Peshawar region which would end low pressure of natural gas in the city areas.

Asian shares ticked up in early Tuesday trade, supported by Wall Street gains although sentiment was tempered ahead of the U.S. midterm elections, the first major electoral test of President Donald Trump’s big tax cuts and hostile trade policies. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.15 percent while Japan's Nikkei .N225 gained 0.5 percent, a day after both fell more than one percent. On Wall Street, the S&P 500 .SPX gained 0.56 percent, with financials such as Berkshire Hathaway (BRKa.N) supported by strong earnings. In oil markets, crude prices wobbled near multi-month lows after the United States granted eight countries temporary waivers allowing them to continue buying oil from Iran as Washington formally imposed punitive sanctions on the Islamic republic.

The All Pakistan Textile Mills Association (APTMA) Punjab Chairman Adil Bashir has urged the government to direct the Sui Northern Gas Pipelines Ltd (SNGPL) to issue revised gas bills to the eligible industry @ $6.5/MMBTU all inclusive on gas consumption for both captive and processing use. Also, he stressed in the same breath that notification for providing electricity at 7.5 cents/kWh be immediately issued. This will enable the exporting industry to focus on increasing exports and undertaking new investment initiatives, he added.

The Islamabad Chamber of Commerce & Industry has called upon the government to take concrete measures for improving trade balance with China as Pakistan was facing huge trade deficit of over $10 billion with China and the only best way to reduce it was to promote exports to China. Ahmed Hassan Moughal, president Islamabad Chamber of Commerce & Industry, said that Pakistan today faced very high trade deficit and one way to get out of this large trade deficit was to find ways of expanding and diversifying exports.

The Punjab Provincial Development Working Party (PDWP) has approved five development schemes of various development sectors with an estimated cost of 3183.919 million rupees. The said schemes were approved in the 2nd meeting of PDWP of current fiscal year 2018-19, presided over by Chairman Planning and Development (P&D) Habib ur Rehman Gilani. Secretary P&D Iftikhar Ali Sahoo, all members of the Planning & Development Board, provincial secretaries concerned, Assistant Chief P&D Coordination-II Hafiz Muhammad Iqbal and other senior representatives of the relevant provincial departments also attended the meeting.

The Sui Northern Gas Pipeline Limited (SNGPL) on Monday announced that up-gradation of gas transmission line project has been initiated to overcome with the low gas pressure issue as well as to ensure availability of sufficient gas to domestic consumers in Peshawar during winter season. While briefing media persons at Peshawar Press Club about various gas infrastructure development schemes worth Rs1 billion in the provincial metropolis Peshawar, the SNGPL General Manager Saqib Arbab said that a comprehensive strategy had been devised to address the low gas pressure issue in city areas. For this purpose, he said five different schemes of gas transmission line expansion have been approved that would be completed at the cost of Rs1 billion. He also informed that special feeding station will also be constructed for Peshawar region which would end low pressure of natural gas in the city areas.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

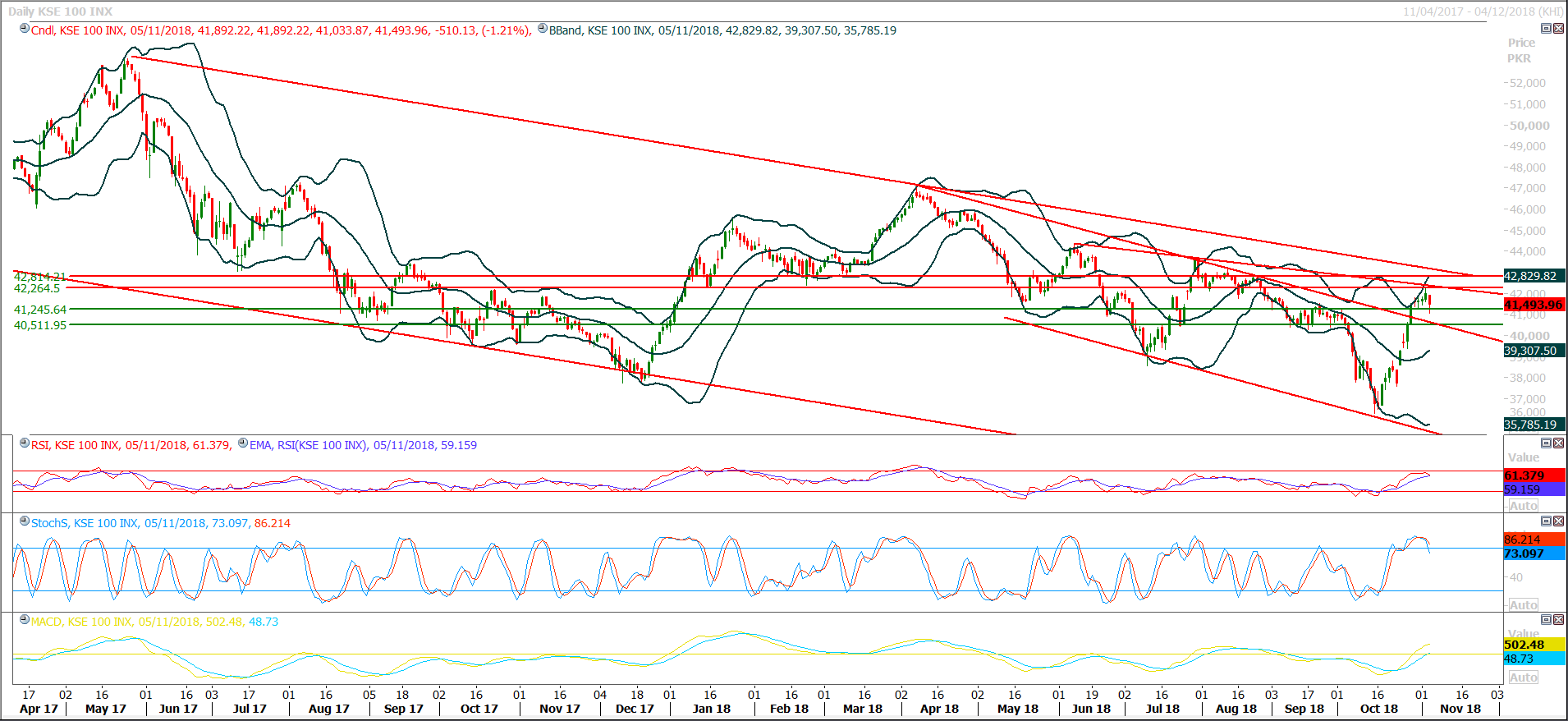

Technical Analysis

The Benchmark KSE100 Index have bounced back after getting resistance from a major resistance of 42,300 points during last two trading session and have tried to penetrate its support region of 41,250 during last trading session but pulled back before day end. As of now daily momentum indicators have generated bearish crossovers which indicates start of a correction in coming days and index would try to find support at 41,000 points during current trading session, penetration of that region would push index further downward and resistant trend line of previous bearish trend channel would try to provide a little bit oxygen against bearish rally at 40,500 and then 40,000 points. It’s recommended to continue selling on strength until index close above 42,300 points in upward direction as closing below 40,500 points would push index for a further dip towards 39,000 points.

PAEL is moving back after getting resistance from its major resistant region of 34 Rs and today’s closing below 30 Rs would add further pressure on it and chances of formation of an evening start would be widened which may lead index towards 28.60 and more on. TRG have a major resistant region ahead between 32-32.50 Rs which fall on a horizontal resistance and a descending trend line and these regions would try to cap its current bullish rally, in case of reversal initially 29 Rs would be target price for TRG and breakout of that region would call for a new low in TRG. PSO have major resistance ahead between 287-296 Rs and its recommended to initiate selling on strength with strict stop loss of 299 Rs. DGKC have bounced back after getting resistance of from its major resistant region of 112 Rs and it would remain bearish towards 97.60 and 95 Rs until it would succeed in closing above 112 and breakout of 112 would call for 117 Rs. ATRL would face a strong resistance between 207 and 212 Rs therefore profit taking would be recommended around these regions.

PAEL is moving back after getting resistance from its major resistant region of 34 Rs and today’s closing below 30 Rs would add further pressure on it and chances of formation of an evening start would be widened which may lead index towards 28.60 and more on. TRG have a major resistant region ahead between 32-32.50 Rs which fall on a horizontal resistance and a descending trend line and these regions would try to cap its current bullish rally, in case of reversal initially 29 Rs would be target price for TRG and breakout of that region would call for a new low in TRG. PSO have major resistance ahead between 287-296 Rs and its recommended to initiate selling on strength with strict stop loss of 299 Rs. DGKC have bounced back after getting resistance of from its major resistant region of 112 Rs and it would remain bearish towards 97.60 and 95 Rs until it would succeed in closing above 112 and breakout of 112 would call for 117 Rs. ATRL would face a strong resistance between 207 and 212 Rs therefore profit taking would be recommended around these regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.