Previous Session Recap

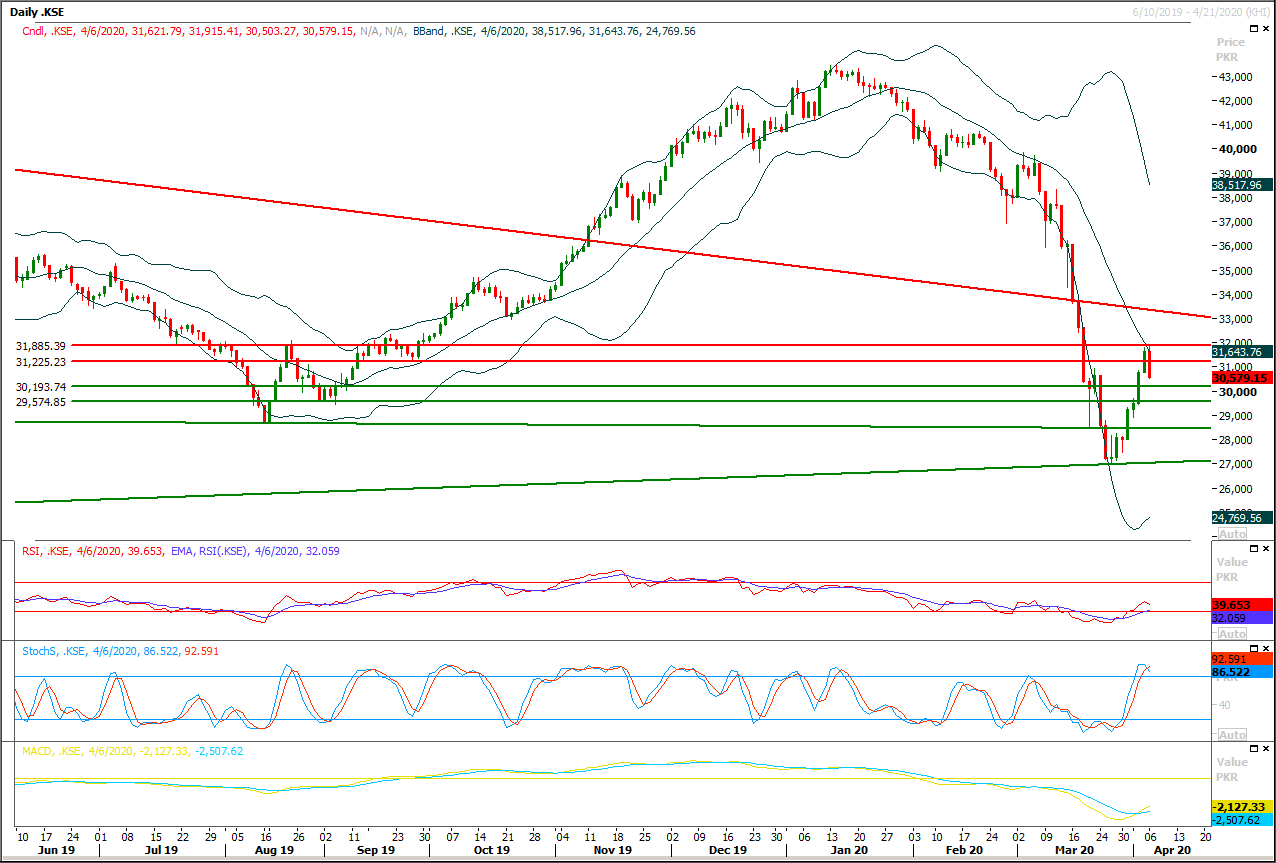

Trading volume at PSX floor dropped by 18.61 million shares or 7.39% on DoD basis, whereas the benchmark KSE100 index opened at 31,621.79, posted a day high of 31,915.41 and a day low of 30,503.27 points during last trading session while session suspended at 30,579.15 points with net change of -1042.64 points and net trading volume of 181.22 million shares. Daily trading volume of KSE100 listed companies also dropped by 5.27 million shares or 2.83% on DoD basis.

Foreign Investors remained in net selling positions of 10.11 million shares and value of Foreign Inflow dropped by 5.72 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.007 and 11.21 million shares respectively but and Overseas Pakistani remained in net long positions of 1.11 million shares respectively. While on the other side Local Individuals, Banks, NBFCs and Insurance Companies remained in net long positions of 13.28, 4.39, 0.14 and 2.27 million shares but Local Companies, Mutual Fund and Brokers remained in net selling positions of 1.08, 1.85 and 8.04 million shares respectively.

Analytical Review

Asian shares cautiously gain on virus hopes, dollar slips

Asian stock markets rallied for a second day on Tuesday, and riskier currencies rose, buoyed by tentative signs the coronavirus crisis may be levelling off in New York and receding in Europe. Gains lacked Monday’s momentum, but were broad, even though global coronavirus cases kept rising and an economic crash on a scale not seen for generations looms large. The United States is bracing for its toughest week yet as the death toll climbs above 10,000 while across the Atlantic, British Prime Minister Boris Johnson has entered intensive care after his COVID-19 symptoms worsened. Japan’s Nikkei rose 2% and has erased most of last week’s losses after Prime Minister Shinzo Abe promised a massive $991 billion economic stimulus package - equal to 20% of GDP.

Pulses, edible oil imports stuck at port awaiting SRO

Importers of pulses and representatives of the edible oil industry said on Monday that they are unable to clear their consignments from the port because duty and tax relief related Statutory Regulatory Orders (SROs) have still not been issued. On March 30, the government had decided on to bring advance tax on import of pulses to zero from two per cent and exemption of two per cent additional customs duty on oil seeds and palm oil imports. The government had reduced different taxes and duties on import and supply of different food items for alleviating the adverse impact of Covid-19 and lockdown. “Our members are waiting for the SRO so that they can get duty relief on pulses imports,” Patron in Chief, Karachi Wholesalers Grocers Association (KWGA), Anis Majeed said.

FATF to review steps taken by Pakistan in June

Pakistan’s performance to meet international commitments and standards in the fight against money laundering and terror financing will be reviewed by the Financial Action Task Force (FATF) at its meeting slated to be held in Beijing on June 21-26. In February, the Paris-based global watchdog against financial crimes gave Pakistan a four-month grace period to complete its 27-point action plan against money laundering and terror financing committed with the international community when it noted that Pakistan had delivered on 14 points and missed 13 other targets.

Govt slashes prices of RLNG for SSGC, SNGPL consumers by nearly 16pc

The government Monday decreased the prices of re-gasified liquefied natural gas (RLNG) by 15.92 percent for the consumers of the Sui Southern Gas Company (SSGC) and 15.69 percent for the consumers of Sui Northern Gas Company (SNGPL). As per the notification issued by the Oil and Gas Regulatory Authority (OGRA), the RLNG prices were decreased for the consumers of both the state owned gas distribution companies for the month of April. According the notification, the price of RLNG was decreased by $1.8099 per mmbtu or 15.92 percent for the consumers of SSGC and $ 1.7836 per mmbtu or 15.69 percent for the consumers of SNGPL.

Pakistan to intensify efforts for debt restructuring, relief

Pakistan on Monday decided to intensify efforts for debt restructuring and relief amid growing economic challenges because of the Covid-19 pandemic. Foreign Minister Shah Mehmood Qureshi presided over a consultative session on the economic impact of the contagion at the Foreign Office, which was attended by Federal Minister for Planning and the government’s focal person on Covid-19 Asad Umar, Minister for Economic Affairs Hammad Azhar, and Adviser to PM on Finance Hafeez Sheikh. The Covid-19 pandemic has put significant amount of additional pressure on Pakistan’s struggling economy. The major setback is expected from the fall in exports due to the scaling down of international demand and the reduction in remittances from overseas. Contraction in large-scale industrial production, and services and agriculture sector is also being expected, which would significantly bring down the projected growth rate of the economy. Moreover, the government has announced a massive relief package of nearly Rs1.13 trillion.

Asian stock markets rallied for a second day on Tuesday, and riskier currencies rose, buoyed by tentative signs the coronavirus crisis may be levelling off in New York and receding in Europe. Gains lacked Monday’s momentum, but were broad, even though global coronavirus cases kept rising and an economic crash on a scale not seen for generations looms large. The United States is bracing for its toughest week yet as the death toll climbs above 10,000 while across the Atlantic, British Prime Minister Boris Johnson has entered intensive care after his COVID-19 symptoms worsened. Japan’s Nikkei rose 2% and has erased most of last week’s losses after Prime Minister Shinzo Abe promised a massive $991 billion economic stimulus package - equal to 20% of GDP.

Importers of pulses and representatives of the edible oil industry said on Monday that they are unable to clear their consignments from the port because duty and tax relief related Statutory Regulatory Orders (SROs) have still not been issued. On March 30, the government had decided on to bring advance tax on import of pulses to zero from two per cent and exemption of two per cent additional customs duty on oil seeds and palm oil imports. The government had reduced different taxes and duties on import and supply of different food items for alleviating the adverse impact of Covid-19 and lockdown. “Our members are waiting for the SRO so that they can get duty relief on pulses imports,” Patron in Chief, Karachi Wholesalers Grocers Association (KWGA), Anis Majeed said.

Pakistan’s performance to meet international commitments and standards in the fight against money laundering and terror financing will be reviewed by the Financial Action Task Force (FATF) at its meeting slated to be held in Beijing on June 21-26. In February, the Paris-based global watchdog against financial crimes gave Pakistan a four-month grace period to complete its 27-point action plan against money laundering and terror financing committed with the international community when it noted that Pakistan had delivered on 14 points and missed 13 other targets.

The government Monday decreased the prices of re-gasified liquefied natural gas (RLNG) by 15.92 percent for the consumers of the Sui Southern Gas Company (SSGC) and 15.69 percent for the consumers of Sui Northern Gas Company (SNGPL). As per the notification issued by the Oil and Gas Regulatory Authority (OGRA), the RLNG prices were decreased for the consumers of both the state owned gas distribution companies for the month of April. According the notification, the price of RLNG was decreased by $1.8099 per mmbtu or 15.92 percent for the consumers of SSGC and $ 1.7836 per mmbtu or 15.69 percent for the consumers of SNGPL.

Pakistan on Monday decided to intensify efforts for debt restructuring and relief amid growing economic challenges because of the Covid-19 pandemic. Foreign Minister Shah Mehmood Qureshi presided over a consultative session on the economic impact of the contagion at the Foreign Office, which was attended by Federal Minister for Planning and the government’s focal person on Covid-19 Asad Umar, Minister for Economic Affairs Hammad Azhar, and Adviser to PM on Finance Hafeez Sheikh. The Covid-19 pandemic has put significant amount of additional pressure on Pakistan’s struggling economy. The major setback is expected from the fall in exports due to the scaling down of international demand and the reduction in remittances from overseas. Contraction in large-scale industrial production, and services and agriculture sector is also being expected, which would significantly bring down the projected growth rate of the economy. Moreover, the government has announced a massive relief package of nearly Rs1.13 trillion.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have created a bearish engulfing patter after facing rejection from a strong horizontal resistance region at 38% correction of its bearish rally it's recommended to stay cautious because if index would succeed in confirmation of this bearish engulfing by closing below 32,000pts during current trading session then some kind of serious pressure would be witnessed in coming days. Mean while on intraday basis index would try to find some ground at 30,190pts and breakout below that region would call for 29,570pts where a daily gap also would complete and bulls would try to push index again in upward direction. If index would succeed in finding some ground at its supportive regions then on intraday basis its initial resistant region is standing at 31,220pts.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.