Trading volume at the PSX floor clocked in at 346 Million shares in the red zone. The Benchmark KSE-100 Index closed at 46877.40 losing 206 Points in the session, with the net trading volume totaling to 137 Million shares. Foreign Investors sold equity worth $5.91M followed by Brokers who remained in a net selling position of $4.42M. Other sellers included Companies, NBFCs and Insurance Companies. On the other hand, Mutual funds remained in a net buying position of $7.55M, whereas Individuals followed with a net buying of $4.53M. Banks remained in a net buying of $0.29M.

Asian equities returned to the highest in almost 10 years after strong U.S. hiring data bolstered optimism about economic growth in the world’s largest economy. apan’s Topix index rose 0.6 percent. Toyota jumped 2.3 percent after it beat first-quarter profit estimates and raised its full-year forecast on Friday. The S&P/ASX 200 Index in Sydney was up 0.8 percent with miners and banks advancing. South Korea’s Kospi index gained 0.4 percent. In Hong Kong, the Hang Seng Index rose at the open. The MSCI Asia-Pacific Index added 0.6 percent to trade close to its highest since December 2007.

The Engineering, Procurement & Construction Contractor for 102MW Gulpur Hydropower Project has stopped construction activities and evacuated the project site due to recent security threats posed by Indian Border Action Team. Daelim Industrial Co Ltd of South Korea leading the joint venture for the construction left the project site Sunday morning by evacuating all the foreigners and local employees for their safety and security. The 102MW Gulpur Hydropower Project is located in district Kotli of Azad Jammu & Kashmir and so far forty percent of the project progress has been achieved.

A Chinese expert has admitted that the recent political developments in Pakistan would affect the $50 billion China Pakistan Economic Corridor (CPEC) because some "variable factors" would come into play. The expert also said that some political parties in Pakistan have cast doubt on some specific items in their economic cooperation with China.

The cement sector posted a remarkable growth in the first month of the current fiscal year with cumulative numbers jumping 45% compared to the corresponding month of previous fiscal year. Domestic consumption surged a whopping 55% while exports edged up 2.28%. The turnaround after a dismal performance in June 2017 took the industry by surprise and the sharp increase in sales in July revived hopes for the sector.

The share of Pakistan’s textile industry in domestic commerce has surpassed the sector’s export figures, according to data compiled by the All Pakistan Textile Mills Association (APTMA) – an umbrella organization of textile manufacturers. Textile sales in the local market currently stand at $13.7 billion out of the combined local and foreign sales of $26 billion, APTMA revealed. Textile exports for the year 2016-17 stood at $12.3 billion.

Today BYCO, EFERT and HBL may lead the market in the positive direction.

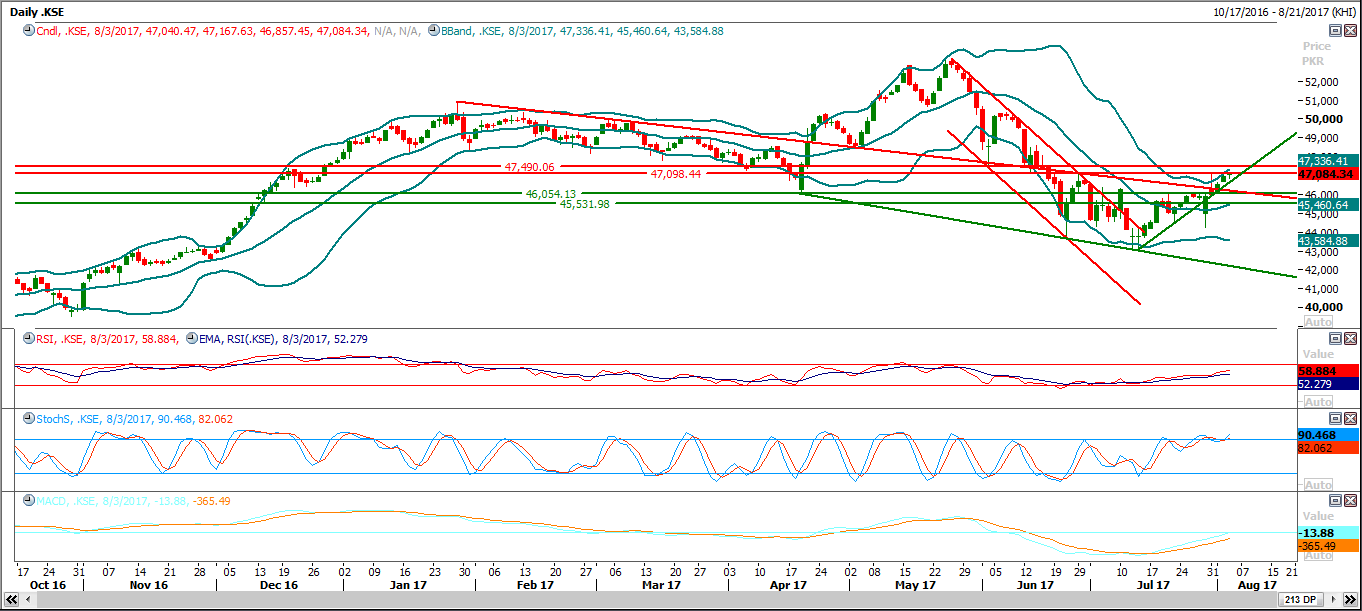

The KSE-100 Index attempted to test the 200 Days Moving Average at 47296 on Friday, closing at 46877 with a shooting star candlestick. The immediate support stands at the 9 Days Moving Average at 46344, coinciding with a Horizontal supportive region slightly lower at 46215 and 46050 regions. With Stochastic generating a clear sell signal and RSI almost approaching the overbought territory, we advise traders to exercise caution. Partial accumulation on the mentioned supportive regions is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.