Previous Session Recap

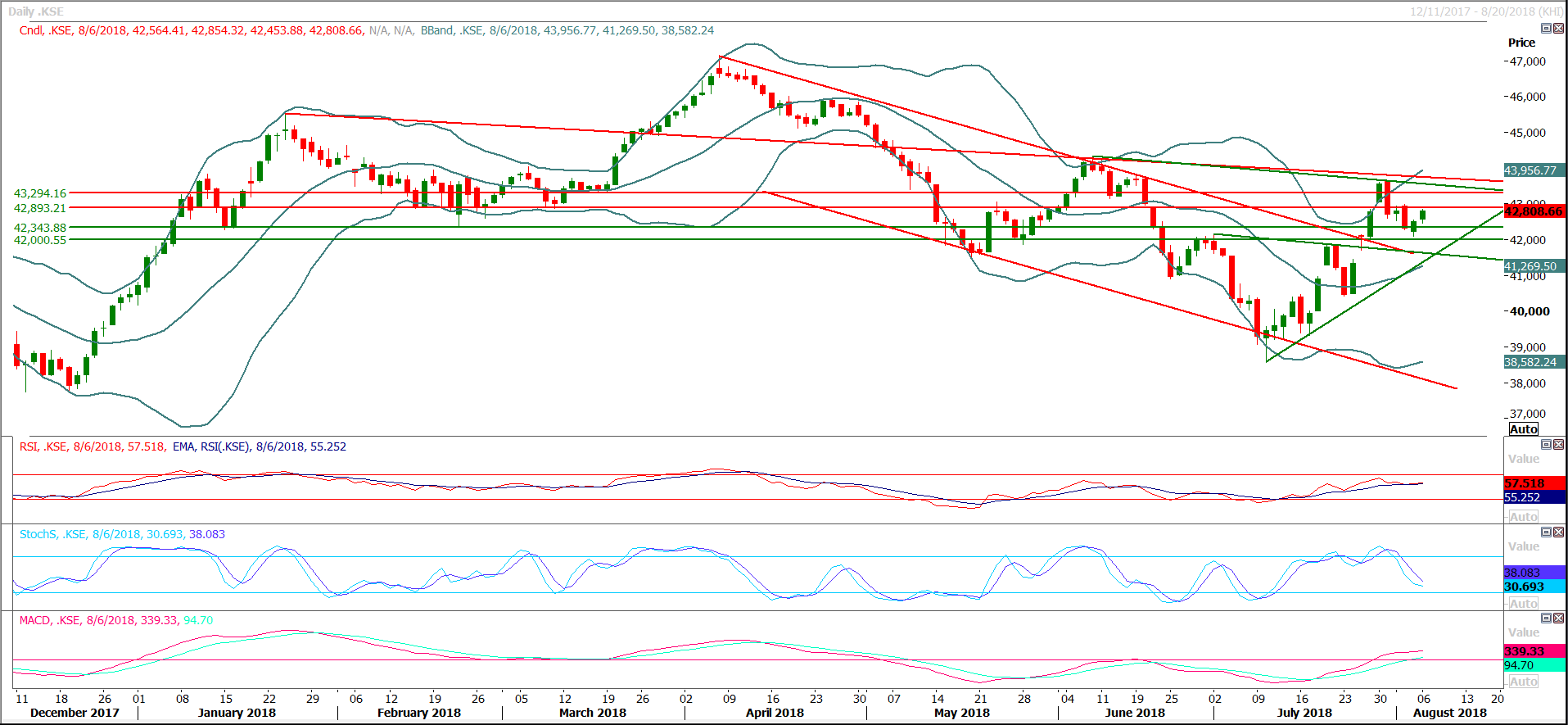

Trading volume at PSX floor dropped by 99.13 million shares or 48.83% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,564.41, posted a day high of 42,854.32 and a day low of 42,458.67 during last trading session. The session suspended at 42,808.66 with net change of 303.61 and net trading volume of 76.54 million shares. Daily trading volume of KSE100 listed companies dropped by 38.28 million shares or 33.53% on DoD basis.

Foreign Investors remained in net selling position of 2.81 million shares and net value of Foreign Inflow dropped by 2.54 million US Dollars. Categorically, Foreign Individuals, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 0.10, 2.70 and 0.01 million shares. While on the other side Local Individuals and Mutual Fund remained in net buying positions of 6.07 and 2.74 million shares but Local Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 1.16, 1.71, 2.12 and 1.24 million shares respectively.

Analytical Review

Asian stocks struggle as trade anxiety weighs

Asian stocks wobbled on Tuesday as simmering worries over the U.S.-China trade conflict offset positive leads from earnings-led gains on Wall Street. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.05 percent. The index dipped early and struggled to gain traction amid volatility in Chinese stocks. The Shanghai Composite Index .SSEC rose over 0.6 percent in early trade following a four-day losing run. It was last up 0.1 percent. Australian stocks dipped 0.25 percent, South Korea's KOSPI .KS11 rose 0.2 percent and Japan's Nikkei .N225 added 0.25 percent.

Discos blamed for piling of circular debt

The Senate Special Committee on Circular Debt was informed Monday that delay in filing of tariff petitions by the power distribution companies (Discos) and their determination by the regulatory authority was one of the main reasons of piling of circular debt . The committee, which met here under the chairmanship of Senator Shibli Faraz was informed by National Electric Power Regulatory Authority (Nepra) Chairman Tariq Sadozai that Discos had failed to file their tariff petition with Nepra. He informed the committee that despite reminders during the year 2015-16, the petitions which should have been filed in January 2015 were received as last as February 2016, which was causing delay in determination of electricity tariffs by the regulator.

Hundreds of textile machinery containers stuck up at port

Hundreds of containers of state of the art textile machinery worth hundreds of millions of rupees have been stuck up at Karachi Port, as the Federal Board of Revenue is using delaying tactics to issue the Sales Tax Exemption Notification though it has already been approved by the federal cabinet as well as Economic Coordination Committee of the last government. Pakistan Hosiery Manufacturers & Exporters Association (PHMA) Central Chairman Dr. Khurram Anwar Khawaja said that the previous government had extended zero-rating facility on sales tax on machinery not manufactured locally and imported by the textile industry registered with Ministry of Textile, as specified in part IV of 5th schedule to the Customs Act 1959, effective from Jan 16, 2017 until June 30, 2018. The federal cabinet as well as the Economic Coordination Committee had also given approval in this regard, he added. But this facility had now expired on June 30 which needs extension through notification, as issuance of the SRO has already been approved.

FBR plans action against UK assets holders

The Federal Board of Revenue (FBR) has stated issuing notices to Pakistanis for not disclosing their properties and assets in United Kingdom (UK) under the Tax Amnesty Scheme. "We have received information of those Pakistanis who illegally own property in the United Kingdom," said FBR chairperson Rukhsana Yasmin on Monday. "The data was received from UK Tax Authorities". She further said that FBR would take action those Pakistanis who did not disclose their properties under the recent tax amnesty scheme, which given an opportunity to whiten the black money by paying nominal tax. The UK tax authority, HMRC, has shared with FBR full details of Pakistanis owning properties and earning rental incomes, she added.

Petroleum one-fourth of total imports

The imports of petroleum group constituted around 23.7 percent of the total import bill during the fiscal year 2017-18, official data revealed. The import bill of petroleum group was recorded at $14.430 billion compared to the total merchandise imports of $60.867 billion during July-June (2017-18), according to Pakistan Bureau of Statistics (PBS). The imports of petroleum group during the year under review increased by 32.10 percent when compared to the imports of $10.923 billion during the corresponding period of last fiscal year (2016-17). Among the petroleum products, the highest increase of 86.94 percent was registered in the imports of liquefied natural gas, which grew from $1.312 billion during 2016-17 to $2.453 billion in 2017-18. The imports of crude petroleum surged by 66.05 percent by going up from $2.547 billion to $4.229 billion while the imports of liquefied petroleum gas increased by 20.08 percent, from $0.225 billion to $0.270 billion. The imports of petroleum products increased from $6.837 billion to $7.476 billion, showing growth of 9.33 percent. However, the imports of all other petroleum group decreased by 42.25 percent.

Asian stocks wobbled on Tuesday as simmering worries over the U.S.-China trade conflict offset positive leads from earnings-led gains on Wall Street. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.05 percent. The index dipped early and struggled to gain traction amid volatility in Chinese stocks. The Shanghai Composite Index .SSEC rose over 0.6 percent in early trade following a four-day losing run. It was last up 0.1 percent. Australian stocks dipped 0.25 percent, South Korea's KOSPI .KS11 rose 0.2 percent and Japan's Nikkei .N225 added 0.25 percent.

The Senate Special Committee on Circular Debt was informed Monday that delay in filing of tariff petitions by the power distribution companies (Discos) and their determination by the regulatory authority was one of the main reasons of piling of circular debt . The committee, which met here under the chairmanship of Senator Shibli Faraz was informed by National Electric Power Regulatory Authority (Nepra) Chairman Tariq Sadozai that Discos had failed to file their tariff petition with Nepra. He informed the committee that despite reminders during the year 2015-16, the petitions which should have been filed in January 2015 were received as last as February 2016, which was causing delay in determination of electricity tariffs by the regulator.

Hundreds of containers of state of the art textile machinery worth hundreds of millions of rupees have been stuck up at Karachi Port, as the Federal Board of Revenue is using delaying tactics to issue the Sales Tax Exemption Notification though it has already been approved by the federal cabinet as well as Economic Coordination Committee of the last government. Pakistan Hosiery Manufacturers & Exporters Association (PHMA) Central Chairman Dr. Khurram Anwar Khawaja said that the previous government had extended zero-rating facility on sales tax on machinery not manufactured locally and imported by the textile industry registered with Ministry of Textile, as specified in part IV of 5th schedule to the Customs Act 1959, effective from Jan 16, 2017 until June 30, 2018. The federal cabinet as well as the Economic Coordination Committee had also given approval in this regard, he added. But this facility had now expired on June 30 which needs extension through notification, as issuance of the SRO has already been approved.

The Federal Board of Revenue (FBR) has stated issuing notices to Pakistanis for not disclosing their properties and assets in United Kingdom (UK) under the Tax Amnesty Scheme. "We have received information of those Pakistanis who illegally own property in the United Kingdom," said FBR chairperson Rukhsana Yasmin on Monday. "The data was received from UK Tax Authorities". She further said that FBR would take action those Pakistanis who did not disclose their properties under the recent tax amnesty scheme, which given an opportunity to whiten the black money by paying nominal tax. The UK tax authority, HMRC, has shared with FBR full details of Pakistanis owning properties and earning rental incomes, she added.

The imports of petroleum group constituted around 23.7 percent of the total import bill during the fiscal year 2017-18, official data revealed. The import bill of petroleum group was recorded at $14.430 billion compared to the total merchandise imports of $60.867 billion during July-June (2017-18), according to Pakistan Bureau of Statistics (PBS). The imports of petroleum group during the year under review increased by 32.10 percent when compared to the imports of $10.923 billion during the corresponding period of last fiscal year (2016-17). Among the petroleum products, the highest increase of 86.94 percent was registered in the imports of liquefied natural gas, which grew from $1.312 billion during 2016-17 to $2.453 billion in 2017-18. The imports of crude petroleum surged by 66.05 percent by going up from $2.547 billion to $4.229 billion while the imports of liquefied petroleum gas increased by 20.08 percent, from $0.225 billion to $0.270 billion. The imports of petroleum products increased from $6.837 billion to $7.476 billion, showing growth of 9.33 percent. However, the imports of all other petroleum group decreased by 42.25 percent.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index have bounced back after completing its 50% correction on daily chart during last two trading session, but it’s being capped by a horizontal resistant region on its way back towards a bullish pull back and said trend line falls on 50% correction of recent bearish rally. As of now index have resistant regions ahead at 42,880 points and 43,330 points during current trading session and it’s expected that index would try to open with a positive gap above 42,880 points to take a spike on intraday basis. In case of reversal index would find ground at 42,340 and 42,000 points during current trading session. It’s recommended to stay cautious while trading during current trading session and swing trading could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.