Previous Session Recap

Trading volume at PSX floor increased by 2.27 million shares or 1.54% on DoD basis, whereas, the benchmark KSE100 Index opened at 39960.06, posted a day high of 40062.62 and a day low of 39825.23 during last trading session. The session suspended at 39907.32 with net change of -38.07 and net trading volume of 49.27 million shares. Daily trading volume of KSE100 listed companies dropped by 18.59 million shares or 27.4% on DoD basis.

Foreign Investors remained in net buying position of 5.93 million shares and net value of Foreign Inflow increased by 2.01 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net buying positions of 3.92 and 2.01 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs, Mutual Funds and Insurance Companies remained in net selling positions of 1.28, 5.28, 0.4, 0.25, 0.29 and 1.79 million shares respectively but Brokers remained in net buying position of 2.03 million shares.

Analytical Review

Asian shares hovered near two-month lows on Thursday as softer oil and copper prices and uncertainty over U.S. policy kept many investors on the sidelines, even as some high-tech bellwethers bounced back after a searing sell-off. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was barely changed. It has slipped 4.7 percent from a 10-year peak hit on Nov. 23 as investors booked profits after robust gains this year. While some technology bellwethers such as Tencent (0700.HK) and Alibaba (BABA.K) rebounded, many others including materials shares, such as Korea’s Posco (005490.KS), were sluggish. In Japan, the Nikkei .N225 gained 1.3 percent after having suffered its biggest fall since late March on Wednesday.

Pakistan’s second liquefied natural gas (LNG) re-gasification terminal at Port Qasim inaugurated by Prime Minister Shahid Khaqan Abbasi a fortnight ago suffered a serious technical fault at an underground pipeline, resulting in a failure to inject re-gasified LNG into the system. This may lead to the cancellation of a few lined-up cargoes over the next few weeks, industry sources told Dawn on Wednesday. Two ships carrying LNG were waiting for delivery at the floating storage and re-gasification unit (FSRU) when the incident ruptured an underwater pipeline while building gas pressure from LNG from the third shipment.

Federal Minister for Power Division Sardar Awais Ahmed Khan Leghari has written letters to all four chief ministers of the provinces seeking cooperation and assistance in bills recoveries and against power theft for bringing more and more areas under the zero loadsheddinng. The federal minister , in his letters to the chief minister , also proposed establishment of joint task force by the federal and provincial governments for development of uniform measures, information sharing and improved coordination. He also proposed to nominate concerned officials from the provincial government behalf to lead the efforts in this regard. Sardar Awais Ahmed Khan Leghari, in his letter, also expressed the readiness to meet the chief ministers at any time at their convenience for discussing the modalities for the cooperation.

The Businessmen Panel (BMP) has urged the Prime Minister to devise a policy in order to promote industrialisation in the country which is much needed for the economic prosperity. The Panel said, “We also need to revisit our trade policy as country’s exports declined in three years whereas Bangladesh’s exports rose from $ 24 billion to 36 billion. Comparatively our trade deficit was very alarming and if we include even overseas Pakistanis remittances still over $15 billion trade deficit is there.” These views were shared by the officials of BMP, led by its chairman Mian Anjum Nisar, coming from all four provinces who called on Prime Minister Shahid Khaqan Abbasi at the PM office.

A delegation of International Monetary Fund (IMF) called on Secretary Planning Commission Shoaib Ahmed Siddiqui here on Wednesday and discussed economic situation of the country. During the meeting, Shoaib Siddiqui briefed the delegation on progress of CPEC and the economic priorities of the government. The IMF delegation was headed by Herald Finger. Shoaib Siddiqui said due to appropriate economic prioritization, setting up achievable targets, and effective and robust planning, the economic indicators are improving gradually.

Market is expected to remain volatile today therefore a cautios trading strategy is recommended for current trading session.

Technical Analysis

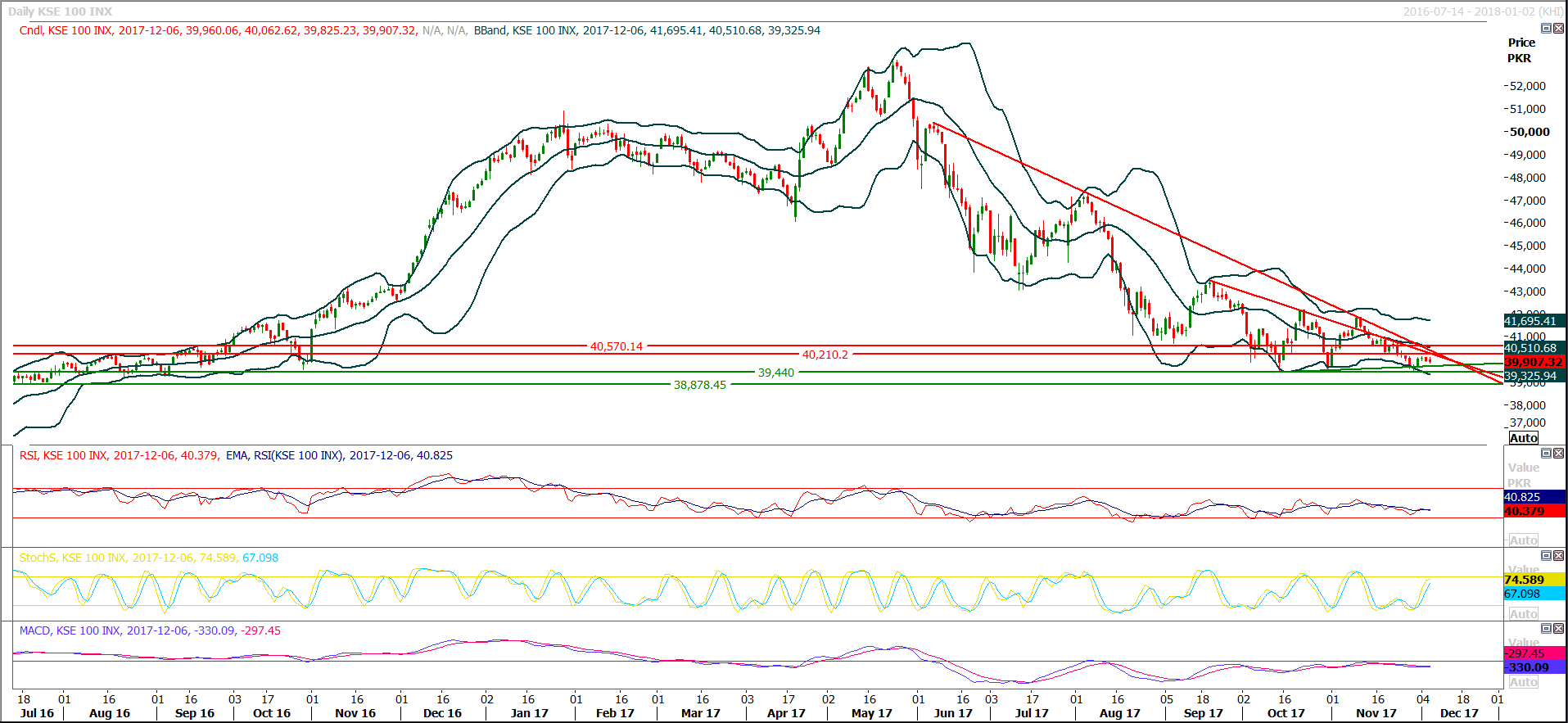

The Benchmark KSE100 Index is moving in a tight triangle on daily chart and as of right its first support from supportive trend line of said channel is standing at 39690 while resistance region of said traingle is standing 40217 points. Therefore it can be said that index is cagged between these two levels but as this triangle is becoming closer with every passing day therefore its expected that a breakout of this rangebound situation could happed any time in coming two or three situation. Index have to give a breakout of this region in either direction which would drive index for further 1000 points in bearish direction but 2000 points in bullish if broken in respective directions. Clear breakout of 40210 and 40431 in upward direction would call for 42800 and 43400 while penetration of 39690a and 39400 on bearish side would call for 38680 points. Therefore its recommended to stay cautious and wait for breakout on either direction to execute new trades.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.