Previous Session Recap

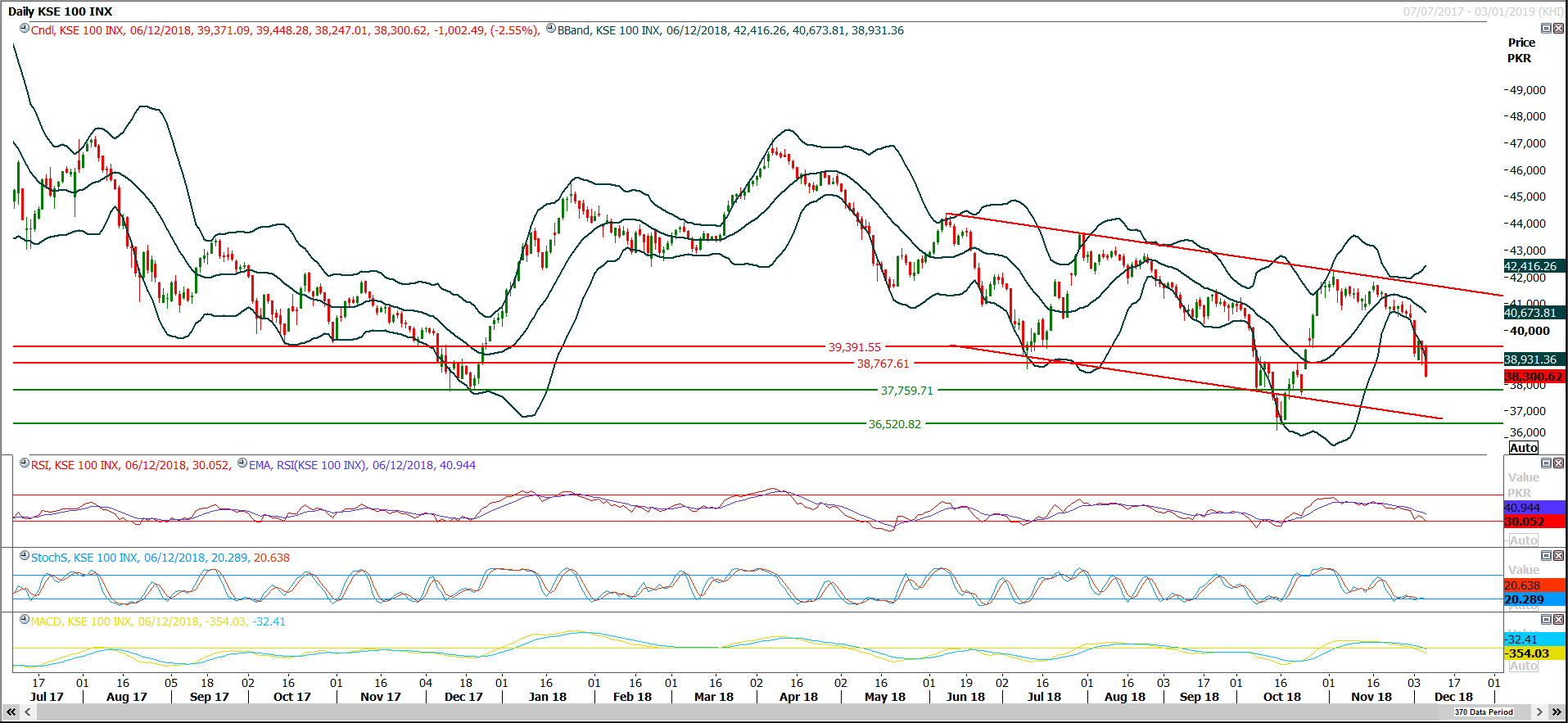

Trading volume at PSX floor increased by 51.66 million shares or 37.41% on DOD basis whereas the Benchmark KSE100 index opened at 39,371.09, posted a day high of 39,448.28 and day low of 38.247.01 during last trading session while session suspended at 38300.62 points with net change of -1,0002.49 points and net trading volume of 121.44 million shares. Daily trading volume of KSE100 listed companies increased by 33.49 million shares or 38.07% on DOD basis.

Foreign Investors remained in net buying positions of 1.65 million shares but net value of Foreign Inflow dropped by 0.35 million US Dollars. Categorically, Foreign Corporate investors remained in net selling positions of 0.53 million shares but Overseas Pakistanis remained in net buying positions of 2.18 million shares. While on the other side Local Individuals, Companies, Banks Brokers and Insurance Companies remained in net buying positions of 14.98, 5.41, 2.39, 2.6 ad 1.24 million shares respectively but NBFCs and Mutual Funds remained in net selling positions of 0.43 and 23.28 million shares.

Analytical Review

Asia shares struggle to rally, oil skids further

Asian shares fought to sustain the slimmest of recoveries on Friday amid speculation the Federal Reserve might be “one-and-done” with U.S. rate hikes, while oil fell anew as producers bickered over the details of an output cut. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.4 percent, though that followed a 1.8 percent drubbing on Thursday. Japan’s Nikkei added 0.2 percent and Chinese blue chips 0.3 percent. E-Mini futures for the S&P 500 started firmer but were last down 0.1 percent. There was no escaping concerns over Sino-U.S. relations after the arrest of smartphone maker Huawei Technologies Co Ltd Chief Financial Officer Meng Wanzhou threatened to chill talks on some form of trade truce. Markets also face a test from U.S. payrolls data later in the session amid speculation the economy was heading for a tough patch after years of solid growth.

LPG cylinder price again jumps to Rs1,600

The price of LPG domestic cylinder once again jumped to Rs1,600 on Thursday after the mafia created an artificial shortage. Many of dealers in the twin cities were out of gas and those who had sold it between Rs1,400-to 1600. One kilo gas was sold between Rs140-160 in different localities of the capital. “We are selling gas at higher price as the gas companies at Tarnol have increased the rates,” said Ghulam Hussain, a distributor at Barakahu. He said his company was not supplying him gas and he had to buy from the local companies at an exorbitant price. According to him, twin cities’ LPG sellers depend on gas companies, located at Tarnol, including City Gas, Ravi Gas and Wine gas. The legal status of these local plants is not clear.

FBR needs to collect Rs586b more in Dec

The Federal Board of Revenue (FBR) will have to collect mammoth Rs586 billion in current month (December) to meet the tax collection target of Rs1.96 trillion set for the first half (July to December) of ongoing fiscal year (FY2019). The FBR had collected Rs1.38 trillion during first five months (July to November) of the FY2019. The FBR had already facing Rs100 billion shortfall in tax collection, which is expected to increase by the end of current month. The FBR would have to collect Rs586 billion in December to reach the target of Rs1.96 trillion set for the first half of FY2019.

Oil, gas discoveries enhance in 4 months

The oil and gas findings were enhanced in the past four months as 5,358 barrels of oil per day and 105.18 MMCFD of gas has been discovered since August 2018. In Sindh province during August 2018, 23 mmcfd gas and 91 barrels per day oil were discovered in Sanghar by Pakistan Petroleum Limited (PPL), said the official documents. In September another discovery of 1056 barrels per day oil in Tando Allahyar was made by United Energy Pakistan Limited (UEPL). Similarly 6.48 mmcfd gas was discovered in Ghotki by OMV Maurice in the same month. In October, 6.3mmcfd of gas was discovered by UEPL in Tando Mohammad Khan and 9.5mmcfd was discovered in same month in Tando Allahyar.

Cabinet approves Rs25.7bn gas subsidy for exporters

Two months after the supplementary budget 2018-19, the federal cabinet on Thursday approved another Rs25.75 billion ‘supplementary grant’ to provide subsidised gas to five zero-rated export sectors in Punjab. The meeting of the federal cabinet presided over by Prime Minister Imran Khan also ratified another decision of the Economic Coordination Committee (ECC) of the Cabinet to extend Rs5.5bn subsidy to fertiliser units in the shape of cheaper natural gas. This will ensure that fertiliser prices remain stable in the market at existing rates of litter over Rs1,700 per bag, said Federal Minister for Petroleum and Natural Resources Ghulam Sarwar Khan.

Asian shares fought to sustain the slimmest of recoveries on Friday amid speculation the Federal Reserve might be “one-and-done” with U.S. rate hikes, while oil fell anew as producers bickered over the details of an output cut. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.4 percent, though that followed a 1.8 percent drubbing on Thursday. Japan’s Nikkei added 0.2 percent and Chinese blue chips 0.3 percent. E-Mini futures for the S&P 500 started firmer but were last down 0.1 percent. There was no escaping concerns over Sino-U.S. relations after the arrest of smartphone maker Huawei Technologies Co Ltd Chief Financial Officer Meng Wanzhou threatened to chill talks on some form of trade truce. Markets also face a test from U.S. payrolls data later in the session amid speculation the economy was heading for a tough patch after years of solid growth.

The price of LPG domestic cylinder once again jumped to Rs1,600 on Thursday after the mafia created an artificial shortage. Many of dealers in the twin cities were out of gas and those who had sold it between Rs1,400-to 1600. One kilo gas was sold between Rs140-160 in different localities of the capital. “We are selling gas at higher price as the gas companies at Tarnol have increased the rates,” said Ghulam Hussain, a distributor at Barakahu. He said his company was not supplying him gas and he had to buy from the local companies at an exorbitant price. According to him, twin cities’ LPG sellers depend on gas companies, located at Tarnol, including City Gas, Ravi Gas and Wine gas. The legal status of these local plants is not clear.

The Federal Board of Revenue (FBR) will have to collect mammoth Rs586 billion in current month (December) to meet the tax collection target of Rs1.96 trillion set for the first half (July to December) of ongoing fiscal year (FY2019). The FBR had collected Rs1.38 trillion during first five months (July to November) of the FY2019. The FBR had already facing Rs100 billion shortfall in tax collection, which is expected to increase by the end of current month. The FBR would have to collect Rs586 billion in December to reach the target of Rs1.96 trillion set for the first half of FY2019.

The oil and gas findings were enhanced in the past four months as 5,358 barrels of oil per day and 105.18 MMCFD of gas has been discovered since August 2018. In Sindh province during August 2018, 23 mmcfd gas and 91 barrels per day oil were discovered in Sanghar by Pakistan Petroleum Limited (PPL), said the official documents. In September another discovery of 1056 barrels per day oil in Tando Allahyar was made by United Energy Pakistan Limited (UEPL). Similarly 6.48 mmcfd gas was discovered in Ghotki by OMV Maurice in the same month. In October, 6.3mmcfd of gas was discovered by UEPL in Tando Mohammad Khan and 9.5mmcfd was discovered in same month in Tando Allahyar.

Two months after the supplementary budget 2018-19, the federal cabinet on Thursday approved another Rs25.75 billion ‘supplementary grant’ to provide subsidised gas to five zero-rated export sectors in Punjab. The meeting of the federal cabinet presided over by Prime Minister Imran Khan also ratified another decision of the Economic Coordination Committee (ECC) of the Cabinet to extend Rs5.5bn subsidy to fertiliser units in the shape of cheaper natural gas. This will ensure that fertiliser prices remain stable in the market at existing rates of litter over Rs1,700 per bag, said Federal Minister for Petroleum and Natural Resources Ghulam Sarwar Khan.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

Technical Analysis

The Benchmark KSE100 Index have dropped below its 61.8% correction during last trading session and now its heading towards 37,760 points where it would find initial support from a horizontal supportive region and if index would slide below that region then it can slide towards 36,520 in coming days. Daily & weekly momentum indicators are in bearish mode and these would lead index further downward and it’s recommended to stay on selling side instead of initiating new long positions. As index is moving in a bearish Elliot Wave on weekly chart and right now it’s completing its third wave of primary Elliot therefore it’s expected that index may slide further downward on short term basis from where its fourth wave would be started which would recover the index a little bit for correction of current bearish rally. But a secondary Elliot is going to be completed on daily chart whose fifth and final wave is being completed right now therefore it’s recommended to stay cautious with buying positions because sliding below 37,760 could start a free fall of more than one thousand points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.