Previous Session Recap

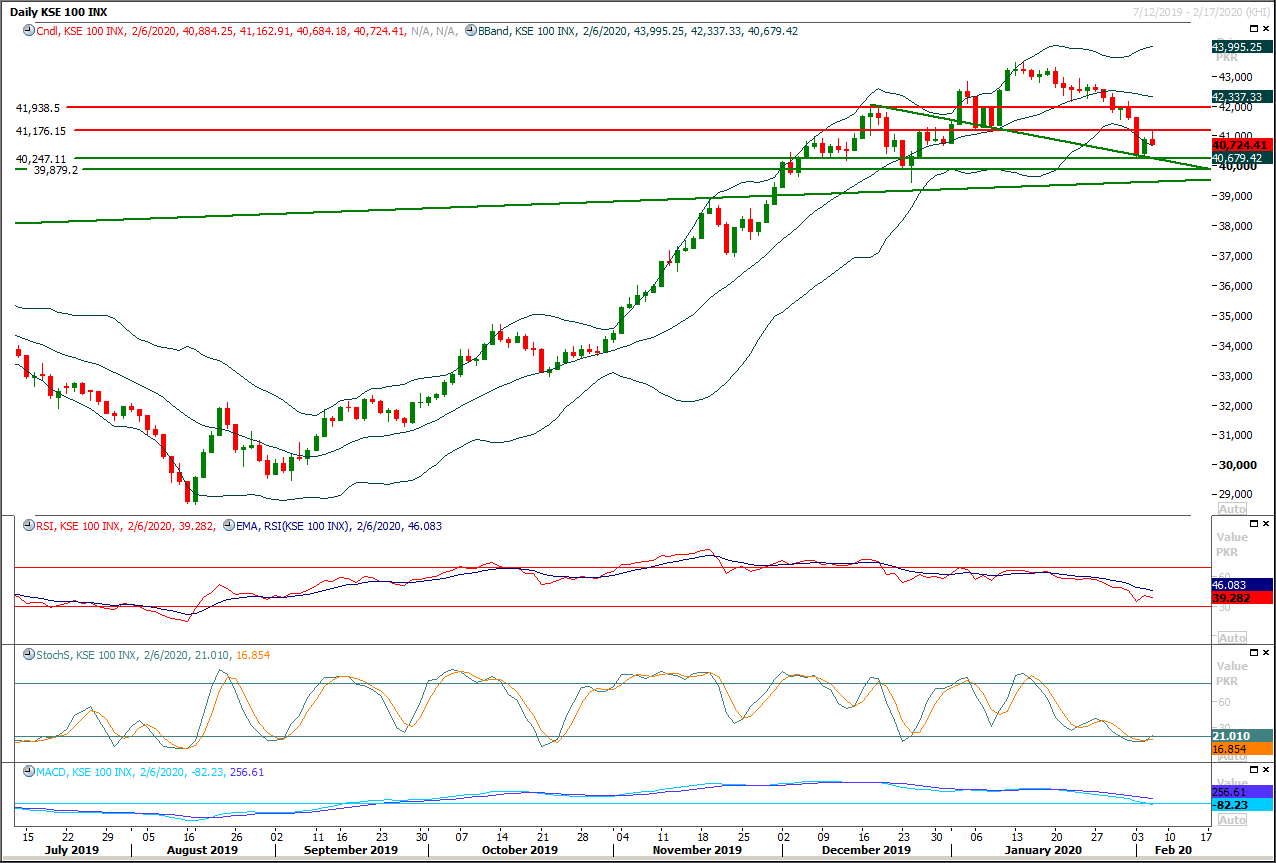

Trading volume at PSX floor dropped by 18.29 million shares or 12.52% on DoD basis, whereas the benchmark KSE100 index opened at 41,146.35, posted a day high of 41,162.91 and a day low of 40,684.18 points during last trading session while session suspended at 40,724.41 points with net change of -159.84 points and net trading volume of 92.547 million shares. Daily trading volume of KSE100 listed companies also dropped by 13.83 million shares or 13.00% on DoD basis.

Foreign Investors remained in net selling positions of 2.91 million shares and net value of Foreign Inflow dropped by 7.39 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani remained in net long positions of 0.0085 and 0.082 million shares but Foreign Corporate Investors remained in net selling positions of 3.00 million shares respectively. While on the other side Local Individuals, Banks and Mutual Fund remained in net selling positions of 5.09, 2.32 and 0.52 million shares but Local Companies, Brokers and Insurance Companies remained in net long positions of 3.18, 4.33 and 2.22 million shares respectively.

Analytical Review

Rally in stocks runs out of steam as coronavirus toll climbs

Asian share markets slipped on Friday and oil price gains stalled, as the growing death toll and economic damage from the coronavirus outbreak put a lid on the week’s sharp rally. The toll in mainland China from the new virus rose to 636, more than doubling in just under a week, with the number of infections at 31,161. In the early hours of the morning one of the first Chinese doctors to raise the alarm about the virus died from the illness at a hospital in Wuhan, the outbreak’s epicenter. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.7%. Japan's Nikkei .N225 and Korea's Kospi .KS11 were in the red. Hong Kong's Hang Seng .HSI fell 0.6% and the Shanghai Composite .SSEC was 0.1% weaker. Barring Shanghai, which has recovered about half of its $400 billion wipeout on Monday, all are ahead for the week, amid a broad global rally.

Mystery surrounds export of wheat, flour despite ban

Mystery prevails over the export of wheat and wheat flour — said to be responsible for the wheat flour price crisis — until the end of October despite a ban imposed in July and the ministries concerned are reluctant to offer any explanation. In June last year, the Economic Coordination Committee (ECC) of the cabinet had noted that wheat and wheat flour would be in short supply in the country, but did not halt their export as well as other processed products like suji and maida and put the issue on the back burner. Over the next few months — from end of July to first week of November — a number of notifications were issued by the ministries of food security and commerce to ban export of these products, but somehow these were reported in the data compiled by the Pakistan Bureau of Statistics (PBS).

Govt intends to borrow Rs1.9tr by July, NA told

With around 40 per cent increase in Pakistan’s public debt and liabilities in 15 months, the government on Thursday disclosed that it intended to borrow another Rs1.9 trillion for financing of its fiscal deficit from January to July 2020. The information was provided by the Ministry of Finance in a written reply to a question by Pakistan Muslim League-Nawaz (PML-N) MNA Afzal Khokhar in the National Assembly, which later witnessed another verbal clash between the treasury and opposition members on the issue of price hike. The information came almost a week after the government conceded major violations of the Fiscal Responsibility and Debt Limitation Act for massively exceeding debt acquisition limits.

Pak-Afghan border trade up 33pc

With materialising of government plan to keep function the Pak-Afghan sharing border trade has increased 33 per cent in addition with 36 per cent revenue in import has been added to national exchequer. It is worth mentioning here that last year Prime Minister Imran Khan had formally inaugurated the Integrated Transit Trade Management scheme 0n 18th of September to keep open the Pak-Afghan sharing Torkham border, for 7/24 hours. Sharing details superintendent custom center at Torkham, Att-ur-Rahman said that in the prevailed unfavorable condition, it was a tough job for the Federal Board of Revenue(FBR)to shape the 7/24 plan of the incumbent government, however with determination of the high officials of the department, practical shape was given to the scheme and started adding 33% increase in export while 45% enhancement had been noted in import in terms of foreign exchange and the government had earned 39% revenue in imports in last six months. He maintained that in spite of lack of basic needs like electricity, potable water, gas etc, the custom officials executed their duties at Torkham border round the clock in three shifts.

LCCI signs MoU with PABA for Pak-US trade promotion

The Lahore Chamber of Commerce & Industry (LCCI) and Pakistan American Business Association (PABA) have inked a memorandum of understanding (MoU) to increase cooperation with the aim of improving trade and economic activities between Pakistan and the United States. LCCI Senior Vice President Ali Hassam Asghar and Chairman PABA Siddique Sheikh signed the document on behalf of their respective institutions. Representative of PABA Pakistan Chapter Malik Sohail Hussain, LCCI Executive Committee members Zeeshan Sohail Malik, Aaqib Asif, Malik Khalid Gujjar, Sheikh Sajjad Afzal and Wasif Yousaf were also present. According to the signed document, PABA and LCCI will work in close collaboration with the respective governments to enhance the liaison and cooperation in key sectors including but not limited to agriculture, academics, art & cultural exchanges, business information and government policies, food, education, hospitality & tourism, infrastructure, investments, jewelry & handicrafts, marbles, pharmaceuticals, professional & technical services, real estate, retail, SMEs, steel, student exchanges, taxation, transportation & energy, telecom & information technology. Both LCCI and PABA will exchange appropriate information regarding the Custom’s procedures to promote cross-border trade and business.

Asian share markets slipped on Friday and oil price gains stalled, as the growing death toll and economic damage from the coronavirus outbreak put a lid on the week’s sharp rally. The toll in mainland China from the new virus rose to 636, more than doubling in just under a week, with the number of infections at 31,161. In the early hours of the morning one of the first Chinese doctors to raise the alarm about the virus died from the illness at a hospital in Wuhan, the outbreak’s epicenter. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.7%. Japan's Nikkei .N225 and Korea's Kospi .KS11 were in the red. Hong Kong's Hang Seng .HSI fell 0.6% and the Shanghai Composite .SSEC was 0.1% weaker. Barring Shanghai, which has recovered about half of its $400 billion wipeout on Monday, all are ahead for the week, amid a broad global rally.

Mystery prevails over the export of wheat and wheat flour — said to be responsible for the wheat flour price crisis — until the end of October despite a ban imposed in July and the ministries concerned are reluctant to offer any explanation. In June last year, the Economic Coordination Committee (ECC) of the cabinet had noted that wheat and wheat flour would be in short supply in the country, but did not halt their export as well as other processed products like suji and maida and put the issue on the back burner. Over the next few months — from end of July to first week of November — a number of notifications were issued by the ministries of food security and commerce to ban export of these products, but somehow these were reported in the data compiled by the Pakistan Bureau of Statistics (PBS).

With around 40 per cent increase in Pakistan’s public debt and liabilities in 15 months, the government on Thursday disclosed that it intended to borrow another Rs1.9 trillion for financing of its fiscal deficit from January to July 2020. The information was provided by the Ministry of Finance in a written reply to a question by Pakistan Muslim League-Nawaz (PML-N) MNA Afzal Khokhar in the National Assembly, which later witnessed another verbal clash between the treasury and opposition members on the issue of price hike. The information came almost a week after the government conceded major violations of the Fiscal Responsibility and Debt Limitation Act for massively exceeding debt acquisition limits.

With materialising of government plan to keep function the Pak-Afghan sharing border trade has increased 33 per cent in addition with 36 per cent revenue in import has been added to national exchequer. It is worth mentioning here that last year Prime Minister Imran Khan had formally inaugurated the Integrated Transit Trade Management scheme 0n 18th of September to keep open the Pak-Afghan sharing Torkham border, for 7/24 hours. Sharing details superintendent custom center at Torkham, Att-ur-Rahman said that in the prevailed unfavorable condition, it was a tough job for the Federal Board of Revenue(FBR)to shape the 7/24 plan of the incumbent government, however with determination of the high officials of the department, practical shape was given to the scheme and started adding 33% increase in export while 45% enhancement had been noted in import in terms of foreign exchange and the government had earned 39% revenue in imports in last six months. He maintained that in spite of lack of basic needs like electricity, potable water, gas etc, the custom officials executed their duties at Torkham border round the clock in three shifts.

The Lahore Chamber of Commerce & Industry (LCCI) and Pakistan American Business Association (PABA) have inked a memorandum of understanding (MoU) to increase cooperation with the aim of improving trade and economic activities between Pakistan and the United States. LCCI Senior Vice President Ali Hassam Asghar and Chairman PABA Siddique Sheikh signed the document on behalf of their respective institutions. Representative of PABA Pakistan Chapter Malik Sohail Hussain, LCCI Executive Committee members Zeeshan Sohail Malik, Aaqib Asif, Malik Khalid Gujjar, Sheikh Sajjad Afzal and Wasif Yousaf were also present. According to the signed document, PABA and LCCI will work in close collaboration with the respective governments to enhance the liaison and cooperation in key sectors including but not limited to agriculture, academics, art & cultural exchanges, business information and government policies, food, education, hospitality & tourism, infrastructure, investments, jewelry & handicrafts, marbles, pharmaceuticals, professional & technical services, real estate, retail, SMEs, steel, student exchanges, taxation, transportation & energy, telecom & information technology. Both LCCI and PABA will exchange appropriate information regarding the Custom’s procedures to promote cross-border trade and business.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have bounced back after getting resistance from a horizontal resistant region and now it's expected that index would take a further dip on intraday basis and then it would try to recover. Initially, index have supportive region ahead at 40,250pts where a crossover of a horizontal and trend lines would try to support index against bearish pressure and from there it could try a bounce back but breakout below that region would push index into bearish zone for short term. While on flip side index would face resistances at 41,000pts and 41,180pts. It's recommended to stay cautious and trade with strict stop loss until unless either index succeed in closing above 41,200pts or below 40,250pts.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.