Previous Session Recap

Trading volume at PSX floor dropped by 56.25 million shares or 17.42% on DoD basis, whereas the benchmark KSE100 index opened at 42,323.30, posted a day high of 42,323.30 and a day low of 41,296.24 points during last trading session while session suspended at 41,296.24 points with net change of -1027.06 points and net trading volume of 200.00 million shares. Daily trading volume of KSE100 listed companies dropped by 27.97 million shares or 12.27% on DoD basis.

Foreign Investors remained in net buying positions of 2.47 million shares and value of Foreign Inflow increased by 2.02 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis remained in net buying positions of 0.04, 0.72 and 1.71 million shares. While on the other side Local Companies, Banks, Brokers and Insurance Companies remained in net buying positions of 6.19, 3.51, 1.11 and 1.65 million shares but Local Individuals, NBFCs and Mutual Fund remained in net selling positions of 2.95, 0.97 and 12.79 million shares respectively.

Analytical Review

Asia stocks bounce, oil slips as Iran anxiety ebbs

Asian shares rebounded on Tuesday as a day passed without any new escalation in the Middle East and Wall Street erased early losses to end in the black as tech stocks climbed. Oil surrendered hefty gains as some speculated Iran would be unlikely to strike against the United States in a way that would disrupt supplies, and its own crude exports. Brent crude futures fell 54 cents to $68.37 a barrel, having been as high as $70.74 on Monday, while U.S. crude dropped 44 cents to $62.83. Gold also retreated to $1,557.54 an ounce, after scaling a near seven-year peak of $1,579.72 overnight.

ECC okays amendments to Nepra Act

Withdrawing a couple of key amendments on the objections of the power regulator, the Economic Coordination Committee (ECC) of the Cabinet on Monday cleared amendments to the Regulation of Generation, Transmission and Distribution of Electronic Power Act 1997 to meet conditions of the International Monetary Fund (IMF). The amendments to the Nepra Act are required under the IMF programme to recover additional cost of losses from consumers by imposing new surcharges aimed at financing power sector loans and generate more than Rs250 billion in annual revenue to address about Rs1.72 trillion worth of circular debt. The government has given an undertaking to the IMF to allow a fresh power tariff increase for covering the cost of capacity payments within the current month and to impose tariff surcharges through amendments to the Nepra Act so the regulator could determine and automatically notify quarterly tariffs under fresh benchmarks.

4pc growth target to be missed: SBP

Pakistan’s economy is unlikely to meet the GDP growth target of four per cent whereas inflation is expected to remain within the 11-12pc range, said the State Bank of Pakistan (SBP) in its first quarterly report of FY20 issued on Monday. Meanwhile, the bank estimates the current account deficit to remain low at 1.5-2.5pc in the ongoing fiscal year. The SBP said the agriculture output would be lower than target while the industrial sector’s performance would be subdued; only the services sector would be close to previous fiscal year.

Ecnec approves Rs261bn development projects

The Executive Committee of the National Economic Council (Ecnec) on Monday approved six development projects with a total estimated cost of Rs216.4 billion, including a hefty 47 per cent increase in the cost of Tarbela 4th Extension Project. The Ecnec meeting was presided over by Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh. Majority of the projects approved by committee pertained to the World Bank funding. The meeting gave a go ahead for the Terbela 4th Extension Hydropower Project with a revised total cost of Rs122.9bn, according to an official statement. A participant told Dawn that the cost of the project — which has already started power generation — has gone up by more than 47pc to Rs123bn from its previously approved cost of Rs83.6bn.

2nd phase of Pak-China FTA-II, ease of doing business to unlock potential foreign exchange revenue

The Pakistan Hosiery Manufacturers & Exporters Association has welcomed the growth of 8.69 per cent in knitwear exports from the country during the first five months (July-Nov 2019-20) of the current financial year compared to the exports in the corresponding period last year, saying the industry is now eyeing on Chinese tariff concessions under FTA-II phase and ease of doing business to unlock the potential foreign exchange revenue from the value-added textile sector. According to data from the Pakistan Bureau of Statistics, approximately 51,240 thousand dozens of knitwear worth $1.320 billion were exported compared to 48,315 thousand dozens valuing $1.215 billion exported last year.

Asian shares rebounded on Tuesday as a day passed without any new escalation in the Middle East and Wall Street erased early losses to end in the black as tech stocks climbed. Oil surrendered hefty gains as some speculated Iran would be unlikely to strike against the United States in a way that would disrupt supplies, and its own crude exports. Brent crude futures fell 54 cents to $68.37 a barrel, having been as high as $70.74 on Monday, while U.S. crude dropped 44 cents to $62.83. Gold also retreated to $1,557.54 an ounce, after scaling a near seven-year peak of $1,579.72 overnight.

Withdrawing a couple of key amendments on the objections of the power regulator, the Economic Coordination Committee (ECC) of the Cabinet on Monday cleared amendments to the Regulation of Generation, Transmission and Distribution of Electronic Power Act 1997 to meet conditions of the International Monetary Fund (IMF). The amendments to the Nepra Act are required under the IMF programme to recover additional cost of losses from consumers by imposing new surcharges aimed at financing power sector loans and generate more than Rs250 billion in annual revenue to address about Rs1.72 trillion worth of circular debt. The government has given an undertaking to the IMF to allow a fresh power tariff increase for covering the cost of capacity payments within the current month and to impose tariff surcharges through amendments to the Nepra Act so the regulator could determine and automatically notify quarterly tariffs under fresh benchmarks.

Pakistan’s economy is unlikely to meet the GDP growth target of four per cent whereas inflation is expected to remain within the 11-12pc range, said the State Bank of Pakistan (SBP) in its first quarterly report of FY20 issued on Monday. Meanwhile, the bank estimates the current account deficit to remain low at 1.5-2.5pc in the ongoing fiscal year. The SBP said the agriculture output would be lower than target while the industrial sector’s performance would be subdued; only the services sector would be close to previous fiscal year.

The Executive Committee of the National Economic Council (Ecnec) on Monday approved six development projects with a total estimated cost of Rs216.4 billion, including a hefty 47 per cent increase in the cost of Tarbela 4th Extension Project. The Ecnec meeting was presided over by Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh. Majority of the projects approved by committee pertained to the World Bank funding. The meeting gave a go ahead for the Terbela 4th Extension Hydropower Project with a revised total cost of Rs122.9bn, according to an official statement. A participant told Dawn that the cost of the project — which has already started power generation — has gone up by more than 47pc to Rs123bn from its previously approved cost of Rs83.6bn.

The Pakistan Hosiery Manufacturers & Exporters Association has welcomed the growth of 8.69 per cent in knitwear exports from the country during the first five months (July-Nov 2019-20) of the current financial year compared to the exports in the corresponding period last year, saying the industry is now eyeing on Chinese tariff concessions under FTA-II phase and ease of doing business to unlock the potential foreign exchange revenue from the value-added textile sector. According to data from the Pakistan Bureau of Statistics, approximately 51,240 thousand dozens of knitwear worth $1.320 billion were exported compared to 48,315 thousand dozens valuing $1.215 billion exported last year.

Market is expected to remain volatile during current trading session.

Technical Analysis

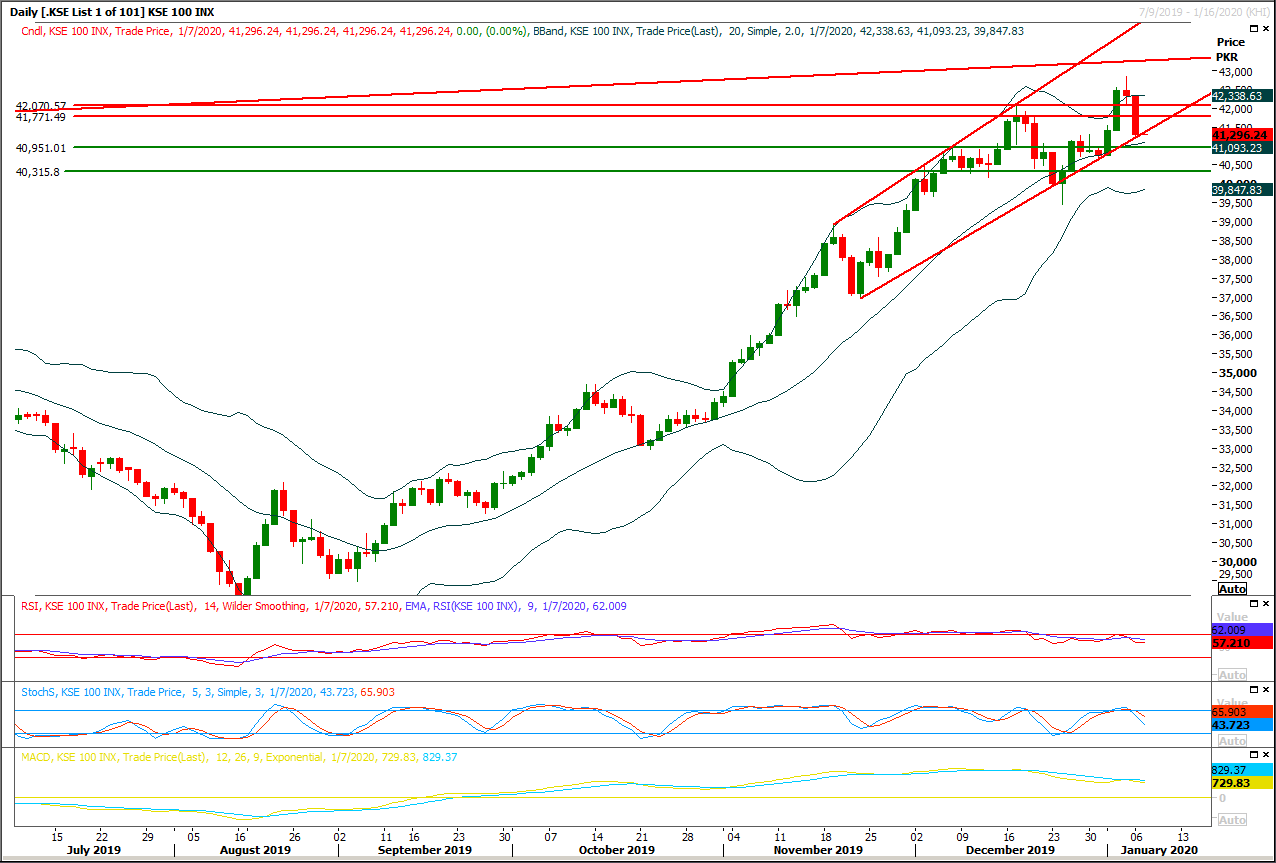

The Benchmark KSE100 index have created an evening shooting star on daily chart inside its rising wedge but it could not succeed in giving a breakout of its wedge in downward direction. it closed on supportive line of that wedge there it's expected that an intraday pull back could be witnessed during current trading session and index would try retest its resistant regions at 41,770 points and breakout above said region would call for 42,070 points. It's recommended to stay cautious and wait for a clear breakout either above 42,200 points or below 40,950 points before initiating new positions. Index would not enter into bearish zone until it would succeed in closing below 40,000 points on daily chart. As of today index have supportive regions at 40,950 points and breakout below that region would call for 40,300 points in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.