Previous Session Recap

Trading volume at PSX floor dropped by 40.06 million shares or 34.69%, DoD basis, whereas, the benchmark KSE100 Index opened at 41160.67, posted a day high of 41232.17 and a day low of 40928.27 during the last trading session. The session suspended at 41030.77 with a net change of -33.23 and net trading volume of 45.75 million shares. Daily trading volume of KSE100 listed companies dropped by 15.15 million shares or 24.88% on DoD basis.

Foreign Investors remained in a net selling position of 4.19 million shares and net value of Foreign Inflow dropped by 0.74 million US Dollars. Categorically, Foreign Corporate Investors remained in a net selling position of 5.13 million shares but Overseas Pakistanis remained in a net buying position of 0.95 million shares. While on the other side Local Individuals and Brokers remained in net selling positions of 3.77 and 0.83 million shares but Local Companies, Banks, Mutual Funds and Insurance Companies remained in net buying positions of 2.7, 0.95, 2.92 and 2.14 million shares respectively.

Analytical Review

Asian shares touched their highest in a decade on Tuesday, while oil prices edged down after surging to a more than two-year peak as Saudi Arabia’s crown prince cracked down on corruption. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.2 percent in early trade to its loftiest peak since November 2007, getting a bump higher after all three major U.S. equity indexes closed at record highs overnight. Japan's Nikkei .N225 slipped 0.2 percent, feeling the pinch as the yen remained well above the previous session's lows. U.S. crude CLc1 shed 12 cents to $57.23 after breaking above $56 a barrel for the first time in more than two years overnight.

Pakistan will get $1,100 million ($1.1 billion) to help finance crude oil imports and LNG, mainly by Pakistan State Oil in coming days. The facility will be available to the PSO this week, The News has learnt reliably. The move will also help avert pressure on the rupee-dollar parity in coming days and ensure to meet immediate needs of the PSO to import crude oil and LNG to be provided other companies, officials of Finance Ministry told. The government will borrow $900 million from International Islamic Trade Finance Corporation (ITFC) of the Jeddah-based Islamic Development Bank (IDB) to finance crude oil imports and $200 million from a local bank to import LNG.

The Federal Board of Revenue (FBR) will examine the Paradise Papers to seek information from Pakistani nationals about ownership of offshore companies and details about their tax matters, etc. Sources told Business Recorder here on Tuesday that so far the FBR has not designated Directorate General of Intelligence and Investigation Inland Revenue (IR) as the competent agency to investigate the matter. The list of names in Paradise papers is extensive and needs some time to be fully examined by investigators of the FBR. The FBR will examine names of Pakistani nationals appearing in the Paradise Papers. Once the list has been properly securitized, tax authorities would designate one of its departments to issue notices to the owners of offshore companies under relevant provisions of the Income Tax Ordinance 2001.

Fertilizer industry is reportedly putting pressure on the government to extend urea export deadline up to December 31, 2017, well informed sources told Business Recorder. In this regard Commerce Minister Pervaiz Malik presided over a meeting with the fertilizer manufacturers and other public sector stakeholders on November 6, 2017 and decided to delay the decision till after the Fertilizer Review Committee (FRC) meets on November 15, 2017 which is competent to recommend such a proposal to the government. The sources said the proposal was opposed on the ground that urea demand increases in November and December and any such decision will lead to shortage of urea and increase in price in the domestic market.

Today ENGRO, OGDC , PNSC and SSGC may lead the market in the positive direction.

Technical Analysis

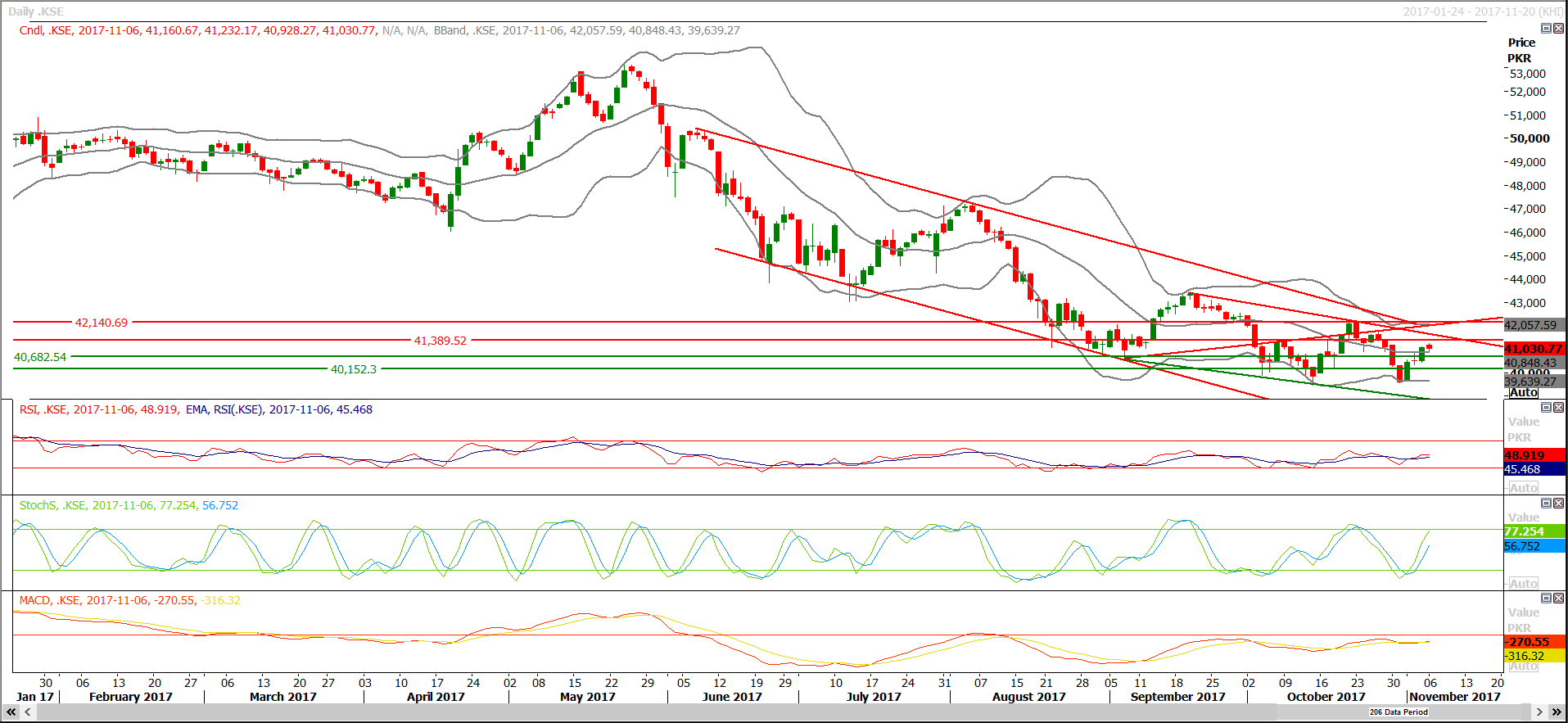

The Benchmark KSE100 Index has penetrated its major resistant region of 40900 in bullish direction and right now it is in short term momentum has been changed to positive, it also have maintained the same region as support during last trading session. As of now Index has resistance at 41400 while supportive regions are standing at 40660 and 40150. Index may complete 61.8% correction of its last bearish rally at 41170 therefore it is recommended to buy on dips and sell on strength for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.