Previous Session Recap

Trading volume at PSX floor dropped by 10.42 million shares or 3.38% on DoD basis, whereas the benchmark KSE100 index opened at 35,358.31, posted a day high of 35,985.21 and a day low of 35,358.31 points during last trading session while session suspended at 35,653.33 points with net change of 295.02 points and net trading volume of 194.37 million shares. Daily trading volume of KSE100 listed companies increased by 24.92 million shares or 14.70% on DoD basis.

Foreign Investors remained in net buying positions of 1.50 million shares and net value of Foreign Inflow increased by 0.50 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis investors remained in net selling positions of 0.08 and 0.38 million shares but Foreign Corporate investors remained in net buying positions of 1.96 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net buying positions of 18.12, 1.30 and 2.25 million shares respectively but Local Companies, Banks, NBFCs and Mutual Fund remained in net selling positions of 1.65, 10.56, 2.11 and 8.98 million shares respectively.

Analytical Review

Asia stocks stymied by trade talk frustration

Asian shares managed to cling near multi-month peaks on Thursday while bonds eked out a bounce as reports of delays in sealing a preliminary Sino-U.S. trade deal left investors frustrated at the lack of concrete progress. MSCI’s broadest index of Asia-Pacific shares outside Japan eased a slight 0.1%, just off a six-month high hit earlier in the week. Japan’s Nikkei dithered either side of flat in quiet trade, having touched a 13-month top on Wednesday. South Korean stocks were up 0.1% after hitting their highest since May. Shanghai blue chips added 0.3%, while E-Mini futures for the S&P 500 were down a touch. Reuters reported on Wednesday a meeting between U.S. President Donald Trump and Chinese President Xi Jinping to sign an interim trade deal could be delayed until December as discussions continue over terms and venue. Among various suggestions was to sign a deal after a scheduled NATO meeting in early December.

Lawmakers ask IMF to ease pace of adjustments; oppose centralisation of tax on services

The parliamentarians on Wednesday opposed government’s proposed move to centralise sales tax on services on the grounds of it being against the constitution and asked the International Monetary Fund (IMF) to relax economic targets set under the $6 billion extended fund facility that was adversely affecting the country’s businesses and the people. The IMF mission, however, showed its satisfaction over government’s macroeconomic policies including taxation, exchange and interest rates to steer the country out of challenges. This was the crux of a joint meeting of Standing Committees of the Senate and the National Assembly on Finance and Revenue with a visiting staff mission of the IMF led by Ernesto Ramirez-Rigo. Secretary Finance Naveed Kamran Baloch led the government side in the absence of PM’s Adviser on Finance Dr Abdul Hafeez Shaikh. The members of both houses called for rationalising the pace of stabilisation and adjustment to minimise shocks to the people, businesses, industry and the economy and reduce interest rates to help job creation and revenue generation.

World Bank eyes increase in tax ratio to 17pc by FY24

The World Bank-funded $400 million project is aimed at creating a sustainable increase in the country’s tax revenue, raising the tax-to-GDP ratio to 17 per cent and widening the tax net to 3.5m active taxpayers by 2023-24. A World Bank team led by Vice-President for Equitable Growth, Finance and Institutions (EFI) Ceyla Pazarbasioglu on Wednesday informed Finance Adviser Hafeez Shaikh that the under-consideration project will assist in simplifying the tax regime and strengthening tax and customs administration. It will also support the FBR with technology, digital infrastructure and technical skills. Country Director Illango Patchamuthu was also present in the meeting. The government has set improving tax revenue with low compliance costs as a high priority. The WB team also discussed the Resilient Institutions Strengthening Programme (Rise) which includes an integrated debt management office in the Finance Division. The meeting also focused on areas of harmonisation of tax regime, circular debt strategy and national tariff policy matters.

ECC okays Rs167bn power sector debt rescheduling

The Economic Coordination Committee (ECC) of the cabinet on Wednesday approved rescheduling of about Rs167 billion power sector debt. A meeting of the ECC, presided over by PM’s adviser on finance and revenue, Dr Abdul Hafeez Shaikh increased sale margins of oil marketing companies (OMCs) and dealers and ordered release of 1,107 imported vehicles impounded at ports for months. It also allowed a 6.5 per cent increase in dealers’ margins and OMCs commission on sale of petrol and high speed diesel with immediate effect despite opposition from the Oil and Gas Regulatory Authority (Ogra) and the Planning Commission. The OMCs’ margin was increased by 17 paisa per litre of both HSD and petrol instead of 25 paisa per litre proposed by the petroleum division. They would now charge Rs2.81 per litre commission instead of existing rate of Rs2.64.

‘Islamic banking can help address poverty’

Islamic banking can play a key role to address the four major challenges of poverty, income equality, regional disparity and illiteracy facing the country, said Austerity and Reforms Adviser Dr Ishrat Husain. Delivering a keynote address at the third International Conference on Islamic Banking and Finance on Wednesday, organised by the Institute of Business Management (IoBM), Husain argued that Islamic banking can contribute heavily to solving poverty alleviation, affordable housing, microfinance, financial inclusion and educational outreach. The two-day conference hosted international speakers from the USA, Australia, Saudi Arabia, Bahrain, Malaysia and Qatar. “Those who do not believe in financial inclusion because of faith can be reached through Islamic banking,” he said. The adviser highlighted that non-performing loans are one of the biggest challenges to the industry; Islamic banking, being Shariah-compliant, can assess the risk better than conventional institutions.

Asian shares managed to cling near multi-month peaks on Thursday while bonds eked out a bounce as reports of delays in sealing a preliminary Sino-U.S. trade deal left investors frustrated at the lack of concrete progress. MSCI’s broadest index of Asia-Pacific shares outside Japan eased a slight 0.1%, just off a six-month high hit earlier in the week. Japan’s Nikkei dithered either side of flat in quiet trade, having touched a 13-month top on Wednesday. South Korean stocks were up 0.1% after hitting their highest since May. Shanghai blue chips added 0.3%, while E-Mini futures for the S&P 500 were down a touch. Reuters reported on Wednesday a meeting between U.S. President Donald Trump and Chinese President Xi Jinping to sign an interim trade deal could be delayed until December as discussions continue over terms and venue. Among various suggestions was to sign a deal after a scheduled NATO meeting in early December.

The parliamentarians on Wednesday opposed government’s proposed move to centralise sales tax on services on the grounds of it being against the constitution and asked the International Monetary Fund (IMF) to relax economic targets set under the $6 billion extended fund facility that was adversely affecting the country’s businesses and the people. The IMF mission, however, showed its satisfaction over government’s macroeconomic policies including taxation, exchange and interest rates to steer the country out of challenges. This was the crux of a joint meeting of Standing Committees of the Senate and the National Assembly on Finance and Revenue with a visiting staff mission of the IMF led by Ernesto Ramirez-Rigo. Secretary Finance Naveed Kamran Baloch led the government side in the absence of PM’s Adviser on Finance Dr Abdul Hafeez Shaikh. The members of both houses called for rationalising the pace of stabilisation and adjustment to minimise shocks to the people, businesses, industry and the economy and reduce interest rates to help job creation and revenue generation.

The World Bank-funded $400 million project is aimed at creating a sustainable increase in the country’s tax revenue, raising the tax-to-GDP ratio to 17 per cent and widening the tax net to 3.5m active taxpayers by 2023-24. A World Bank team led by Vice-President for Equitable Growth, Finance and Institutions (EFI) Ceyla Pazarbasioglu on Wednesday informed Finance Adviser Hafeez Shaikh that the under-consideration project will assist in simplifying the tax regime and strengthening tax and customs administration. It will also support the FBR with technology, digital infrastructure and technical skills. Country Director Illango Patchamuthu was also present in the meeting. The government has set improving tax revenue with low compliance costs as a high priority. The WB team also discussed the Resilient Institutions Strengthening Programme (Rise) which includes an integrated debt management office in the Finance Division. The meeting also focused on areas of harmonisation of tax regime, circular debt strategy and national tariff policy matters.

The Economic Coordination Committee (ECC) of the cabinet on Wednesday approved rescheduling of about Rs167 billion power sector debt. A meeting of the ECC, presided over by PM’s adviser on finance and revenue, Dr Abdul Hafeez Shaikh increased sale margins of oil marketing companies (OMCs) and dealers and ordered release of 1,107 imported vehicles impounded at ports for months. It also allowed a 6.5 per cent increase in dealers’ margins and OMCs commission on sale of petrol and high speed diesel with immediate effect despite opposition from the Oil and Gas Regulatory Authority (Ogra) and the Planning Commission. The OMCs’ margin was increased by 17 paisa per litre of both HSD and petrol instead of 25 paisa per litre proposed by the petroleum division. They would now charge Rs2.81 per litre commission instead of existing rate of Rs2.64.

Islamic banking can play a key role to address the four major challenges of poverty, income equality, regional disparity and illiteracy facing the country, said Austerity and Reforms Adviser Dr Ishrat Husain. Delivering a keynote address at the third International Conference on Islamic Banking and Finance on Wednesday, organised by the Institute of Business Management (IoBM), Husain argued that Islamic banking can contribute heavily to solving poverty alleviation, affordable housing, microfinance, financial inclusion and educational outreach. The two-day conference hosted international speakers from the USA, Australia, Saudi Arabia, Bahrain, Malaysia and Qatar. “Those who do not believe in financial inclusion because of faith can be reached through Islamic banking,” he said. The adviser highlighted that non-performing loans are one of the biggest challenges to the industry; Islamic banking, being Shariah-compliant, can assess the risk better than conventional institutions.

Market is expected to remain volatile during current trading session.

Technical Analysis

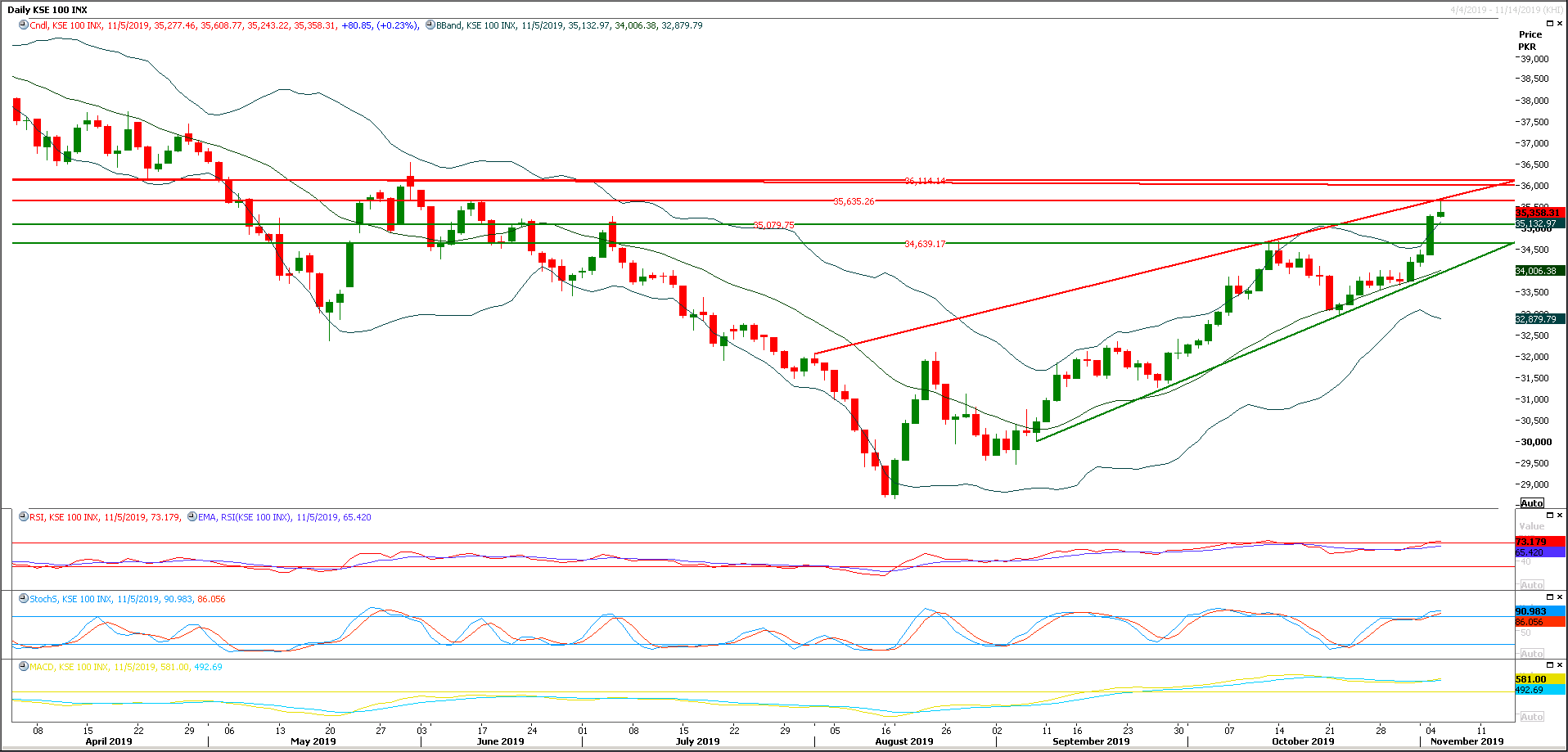

The Benchmark KSE100 index have got resistance from a strong horizontal resistant region along with an ascending trend line on daily chart while weekly corrections of last two major bearish rallies are also being completed on same region therefore it's expected that index would now face a strong resistance in case of any spike during current trading session at 35,600 points and 35,800 points and if index would not succeed in penetration above any of these regions then it try to take a dip to retest its supportive regions at 35,000 and 34,7000 points. If it would succeed in penetration below said region then a downward rally would start taking place and a weekly hammer could be formatted which would try to push index in negative zone. This weekly closing blow 34,700 points would add pressure on index and bulls would start losing the battel.

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.