Previous Session Recap

Trading volume at PSX floor dropped by 62.44 million shares or 19.26% on DoD basis, whereas the benchmark KSE100 index opened at 32,782.47, posted a day high of 33,053.79 and a day low of 32,699.24 points during last trading session while session suspended at 33,033.32 points with net change of 281.07 points and net trading volume of 144.77 million shares. Daily trading volume of KSE100 listed companies dropped by 65.45 million shares or 31.13% on DoD basis.

Foreign Investors remained in net selling positions of 4.34 million shares but net value of Foreign Inflow increased by 0.32 million US Dollars. Categorically, Foreign Individual & Overseas Pakistanis remained in net buying positions of 0.06 and 18.60 million shares but Foreign Corporate investors remained in net selling positions of 23.00 million shares. While on the other side Local Individuals, Companies, Mutual Fund and Brokers remained in net buying positions of 8.75, 1.03, 0.47 and 0.28 million shares respectively but Banks, NBFCs and Insurance Companies remained in net selling positions of 2.63, 0.12 and 3.70 million shares respectively.

Analytical Review

Asian shares up on U.S. jobs report, but caution seen on trade talks

Asian shares edged higher on Monday after data showed the U.S. unemployment rate dropped to the lowest in almost 50 years, easing concerns of a slowdown in the world’s largest economy. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.18%. Australian shares were up 0.5%. Japan's Nikkei stock index .N225 opened higher but reversed course and fell 0.3%. U.S. stock futures, ESc1 fell 0.44% in Asia on Monday after the S&P 500 .SPX surged 1.4% on Friday. The offshore yuan CNH fell 0.3% to 7.1352 to the dollar after Bloomberg reported that Chinese officials are signaling they are increasingly reluctant to agree to a broad trade deal pursued by U.S. President Donald Trump. There was no onshore yuan trading, as Monday is the last day of a long China holiday for its national day. The media report also pushed up safe-haven assets such as gold and the yen. Crude oil futures extended declines in a sign that investors remain cautious about a resolution to the trade dispute.

Pakistan boosts RDCE market to $800 million

Pakistan’s government is focused on achieving an environment of inclusive economy where citizens and businesses can be more productive and there’s a continuous feedback loop to manage their experiences. In the wider region we do see organisations of all sizes and industry verticals are ramping up their digital transformation agendas, with a focus on leveraging technology to enhance employee, citizen, and customer experiences. As a result, the Middle East and North Africa’s digital customer experience market is set to reach a record-high of $800 million, according to a recent report by Micro Market Monitor.

Ogra advises companies to ensure of LPG at notified price

With advent of the winter, the Oil and Gas Regulatory Authority (OGRA) has advised all Liquefied Petroleum Gas (LPG) marketing companies and distributors to ensure smooth provision of the commodity at the notified price across the country. To tackle the elements involved in black-marketing and creating artificial shortage of the commodity, a special squad of OGRA inspectors is conducting surprise visits to LPG production plants and distributors’ premises randomly to check stock and rates of LPG, besides status on implementation of the authority directives.

ignificant improvements in fight against money laundering, terror financing

Even though put on the “Enhanced Follow-Up” category by the Asia Pacific Group (APG) in August this year, Pakistan made significant improvements in its systems to fight money laundering (ML) and terror financing (TF) as per international standards. A Mutual Evaluation Report (MER) released here on Sunday by the APG — a regional affiliate of the Financial Action Task Force — showed that Pakistan was “non-compliant” on four out of 40 recommendations of the APG on effectiveness of the anti-money laundering and combating the financing of terrorism (AML/CFT) system. The report based on Pakistan’s performance as of October 2018 showed that the country was fully “compliant” only on one aspect relating to financial institutions secrecy laws. It was found “partially compliant” on 26 recommendations and “largely compliant” on nine others.

New projects offered to China as part of CPEC: minister

Amid a perceived slowdown on China-Pakistan Economic Corridor (CPEC), the federal Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar on Sunday said Pakistan would engage China at the highest level for talks on several big projects in the fields of hydropower, oil refinery and steel mills. Speaking at a press conference a day before Prime Minister Imran Khan’s three-day visit to Beijing, Mr Bakhtyar said Pakistan would start formal negotiations on additional projects, including a major overland LNG terminal, 7,000-megawatt Bunji hydropower project, Pakistan Steel Mills, oil refineries as well as joint ventures in businesses and science and technology, for agreements. “All the existing projects under the CPEC portfolio have been streamlined and there is no slowdown anywhere,” the minister said in his opening statement.

Asian shares edged higher on Monday after data showed the U.S. unemployment rate dropped to the lowest in almost 50 years, easing concerns of a slowdown in the world’s largest economy. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.18%. Australian shares were up 0.5%. Japan's Nikkei stock index .N225 opened higher but reversed course and fell 0.3%. U.S. stock futures, ESc1 fell 0.44% in Asia on Monday after the S&P 500 .SPX surged 1.4% on Friday. The offshore yuan CNH fell 0.3% to 7.1352 to the dollar after Bloomberg reported that Chinese officials are signaling they are increasingly reluctant to agree to a broad trade deal pursued by U.S. President Donald Trump. There was no onshore yuan trading, as Monday is the last day of a long China holiday for its national day. The media report also pushed up safe-haven assets such as gold and the yen. Crude oil futures extended declines in a sign that investors remain cautious about a resolution to the trade dispute.

Pakistan’s government is focused on achieving an environment of inclusive economy where citizens and businesses can be more productive and there’s a continuous feedback loop to manage their experiences. In the wider region we do see organisations of all sizes and industry verticals are ramping up their digital transformation agendas, with a focus on leveraging technology to enhance employee, citizen, and customer experiences. As a result, the Middle East and North Africa’s digital customer experience market is set to reach a record-high of $800 million, according to a recent report by Micro Market Monitor.

With advent of the winter, the Oil and Gas Regulatory Authority (OGRA) has advised all Liquefied Petroleum Gas (LPG) marketing companies and distributors to ensure smooth provision of the commodity at the notified price across the country. To tackle the elements involved in black-marketing and creating artificial shortage of the commodity, a special squad of OGRA inspectors is conducting surprise visits to LPG production plants and distributors’ premises randomly to check stock and rates of LPG, besides status on implementation of the authority directives.

Even though put on the “Enhanced Follow-Up” category by the Asia Pacific Group (APG) in August this year, Pakistan made significant improvements in its systems to fight money laundering (ML) and terror financing (TF) as per international standards. A Mutual Evaluation Report (MER) released here on Sunday by the APG — a regional affiliate of the Financial Action Task Force — showed that Pakistan was “non-compliant” on four out of 40 recommendations of the APG on effectiveness of the anti-money laundering and combating the financing of terrorism (AML/CFT) system. The report based on Pakistan’s performance as of October 2018 showed that the country was fully “compliant” only on one aspect relating to financial institutions secrecy laws. It was found “partially compliant” on 26 recommendations and “largely compliant” on nine others.

Amid a perceived slowdown on China-Pakistan Economic Corridor (CPEC), the federal Minister for Planning, Development and Reforms Makhdum Khusro Bakhtyar on Sunday said Pakistan would engage China at the highest level for talks on several big projects in the fields of hydropower, oil refinery and steel mills. Speaking at a press conference a day before Prime Minister Imran Khan’s three-day visit to Beijing, Mr Bakhtyar said Pakistan would start formal negotiations on additional projects, including a major overland LNG terminal, 7,000-megawatt Bunji hydropower project, Pakistan Steel Mills, oil refineries as well as joint ventures in businesses and science and technology, for agreements. “All the existing projects under the CPEC portfolio have been streamlined and there is no slowdown anywhere,” the minister said in his opening statement.

Market is expected to remain volatile during current trading session.

Technical Analysis

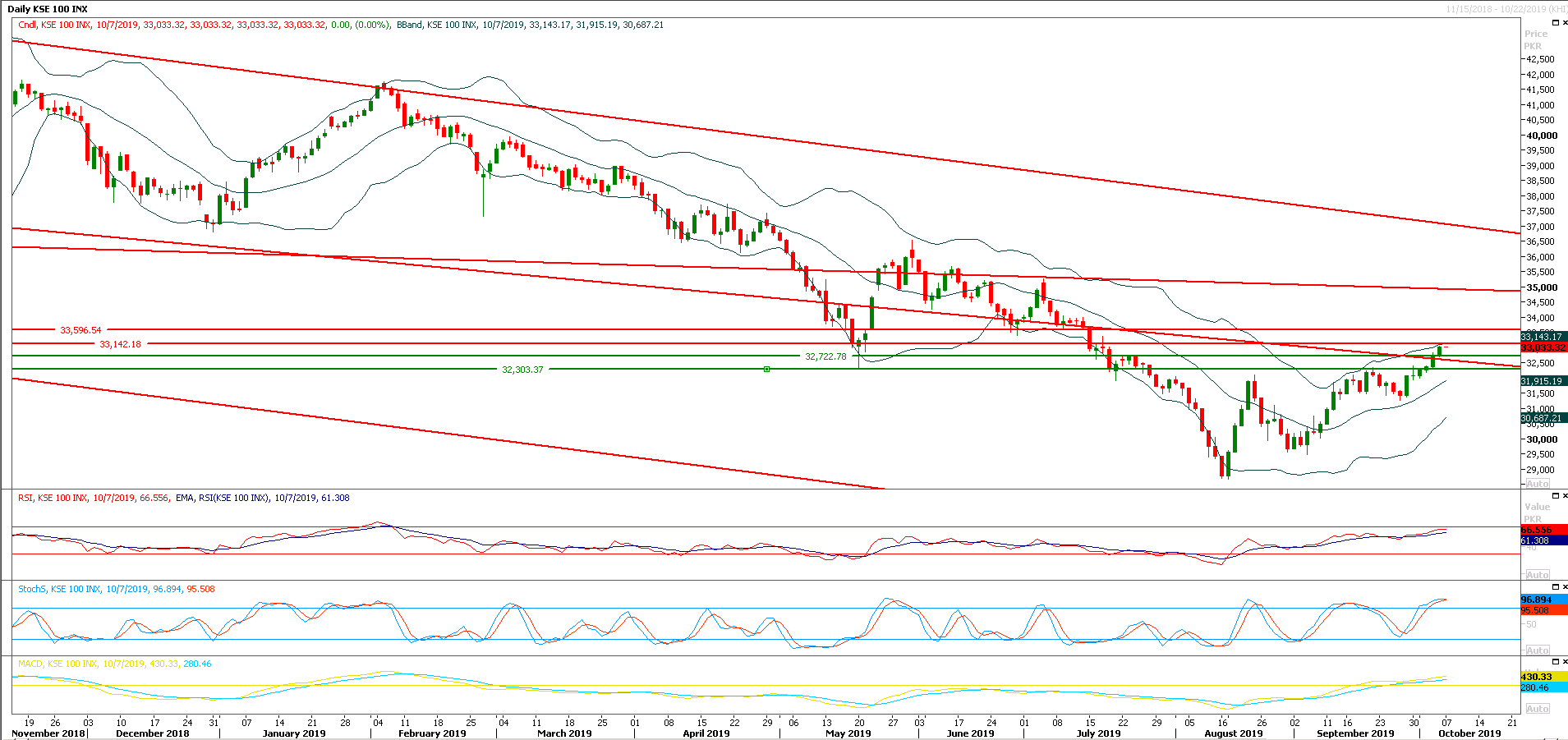

The Benchmark KSE100 index have succeed in penetration above its major resistant trend line during last trading session and it's expected that index would try to retest said trend line during current trading session by taking a dip and if it would succeed in maintaining above this trend line then index would continue its bullish momentum towards 33,260 and 33,500 points. But penetration below said region even on hourly chart will call for a trend change which may lead index towards 32,800 points and then 32,500 points. It's recommended to post trailing stop loss on long positions and practice caution or stay side line until index succeed in either penetration below 32,700 points or above 33,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.