Previous Session Recap

Trading volume at PSX floor dropped by 60.51 million shares or 25.95% on DoD basis, whereas the benchmark KSE100 index opened at 30,579.15, posted a day high of 31,303.13 and a day low of 30,579.15 points during last trading session while session suspended at 31,231.55 points with net change of 652.40 points and net trading volume of 142.65 million shares. Daily trading volume of KSE100 listed companies also dropped by 38.57 million shares or 21.28% on DoD basis.

Foreign Investors remained in net selling positions of 16.46 million shares and value of Foreign Inflow dropped by 6.25 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani remained in net selling positions of 0.10, 15.88 and 0.48 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net long positions of 14.55, 4.15, 0.05, 2.21 and 4.59 million shares but Local Companies and Mutual Fund remained in net selling positions of 5.56 and 1.61 million shares respectively.

Analytical Review

Asian shares turn cautious, oil rebounds in choppy trade

Asian stocks stepped back on Wednesday after two sessions of sharp gains as investors tempered their optimism about the coronavirus while death tolls were still mounting across the globe. While the number of COVID-19 hospitalizations seemed to be levelling off in New York state, deaths across the United States jumped by a record 1,800. Mainland China’s new coronavirus cases also doubled in 24 hours due to infected overseas travellers. Not helping sentiment were wild swings in the oil market, where prices rebounded in Asia after sliding on Tuesday to leave traders feeling dizzy. [O/R] U.S. crude futures jumped 5.5% to $24.93 a barrel, having shed 9.4% the session before, while Brent crude added 75 cents to $32.62.

Refineries face closure as oil marketing companies reluctant to pick up stocks

Amid wheat harvesting season, the government has asked the Oil and Gas Regulatory Authority (Ogra) to take action against oil marketing companies (OMCs) for their reluctance to uplift petroleum products from refineries, resulting in serious supply problems. A senior government official told Dawn that there are more than 80 OMCs operating in the country but none of them are maintaining their mandatory stockpiles to avoid inventory losses in the wake of depressed sales and lower prices. This is resulting in increased pressure on state-run Pakistan State Oil which is also finding it difficult to maintain its mandatory stocks at various locations across the country even though its overall stocks are well above its 20-day mandatory cover. The situation in case of smaller OMCs is more pronounced in rural areas where wheat harvesting is now entering full swing.

Small traders seek financial assistance from Sindh govt

Traders representatives on Tuesday urged the Sindh government to provide interest-free loans to taxpaying small traders and shopkeepers. They further sought financial assistance for paying salaries to workers as their businesses are closed amid lockdown to contain spread of Covid-19. Talking to Dawn, All City Tajir Itehad (ACTI) president Sharjeel Gopalani said that 10 days ago he wrote a letter to Sindh Chief Minister Syed Murad Ali Shah to address traders’ grievances. He urged the provincial government to disburse Rs100,000 to small traders for every month so that they could pay salaries to their workers.

LPG distributors in Azad Kashmir, GB and Northern Areas likely to go on strike

The Liquefied Petroleum Gas (LPG) Distributors in Azad Kashmir, Gilgit Baltistan and Northern Areas are likely to go on strike this week as a protest against less profit margin and high transportation cost of the commodity. A small domestic LPG cylinder of 11.8kg cost Rs350 to Rs400 in transportation charges which increase the cost of the LPG cylinder while decrease the margin of the distributors, LPG Industries Association of Pakistan Chairman of Irfan Khokhar told The Nation here Tuesday.

Oil rises as hopes build for global production cut

Oil prices clawed their way into positive territory on Tuesday as hopes that the world’s biggest producers will agree to cut output outweighed analyst fears that a global recession in the wake of the coronavirus crisis could be deeper than expected. Brent crude was up 72 cents, or 2.2%, at $33.77 a barrel after falling more than 3% on Monday. West Texas Intermediate crude was up 38 cents, or 1.5%, at $26.48, having dropped nearly 8% in the previous session. “Oil prices are holding their ground with market expectations building on an agreement for an output reduction of 10 million barrels per day (bpd), or at least close to 10 million bpd,” BNP Paribas analyst Harry Tchilinguirian told.

Asian stocks stepped back on Wednesday after two sessions of sharp gains as investors tempered their optimism about the coronavirus while death tolls were still mounting across the globe. While the number of COVID-19 hospitalizations seemed to be levelling off in New York state, deaths across the United States jumped by a record 1,800. Mainland China’s new coronavirus cases also doubled in 24 hours due to infected overseas travellers. Not helping sentiment were wild swings in the oil market, where prices rebounded in Asia after sliding on Tuesday to leave traders feeling dizzy. [O/R] U.S. crude futures jumped 5.5% to $24.93 a barrel, having shed 9.4% the session before, while Brent crude added 75 cents to $32.62.

Amid wheat harvesting season, the government has asked the Oil and Gas Regulatory Authority (Ogra) to take action against oil marketing companies (OMCs) for their reluctance to uplift petroleum products from refineries, resulting in serious supply problems. A senior government official told Dawn that there are more than 80 OMCs operating in the country but none of them are maintaining their mandatory stockpiles to avoid inventory losses in the wake of depressed sales and lower prices. This is resulting in increased pressure on state-run Pakistan State Oil which is also finding it difficult to maintain its mandatory stocks at various locations across the country even though its overall stocks are well above its 20-day mandatory cover. The situation in case of smaller OMCs is more pronounced in rural areas where wheat harvesting is now entering full swing.

Traders representatives on Tuesday urged the Sindh government to provide interest-free loans to taxpaying small traders and shopkeepers. They further sought financial assistance for paying salaries to workers as their businesses are closed amid lockdown to contain spread of Covid-19. Talking to Dawn, All City Tajir Itehad (ACTI) president Sharjeel Gopalani said that 10 days ago he wrote a letter to Sindh Chief Minister Syed Murad Ali Shah to address traders’ grievances. He urged the provincial government to disburse Rs100,000 to small traders for every month so that they could pay salaries to their workers.

The Liquefied Petroleum Gas (LPG) Distributors in Azad Kashmir, Gilgit Baltistan and Northern Areas are likely to go on strike this week as a protest against less profit margin and high transportation cost of the commodity. A small domestic LPG cylinder of 11.8kg cost Rs350 to Rs400 in transportation charges which increase the cost of the LPG cylinder while decrease the margin of the distributors, LPG Industries Association of Pakistan Chairman of Irfan Khokhar told The Nation here Tuesday.

Oil prices clawed their way into positive territory on Tuesday as hopes that the world’s biggest producers will agree to cut output outweighed analyst fears that a global recession in the wake of the coronavirus crisis could be deeper than expected. Brent crude was up 72 cents, or 2.2%, at $33.77 a barrel after falling more than 3% on Monday. West Texas Intermediate crude was up 38 cents, or 1.5%, at $26.48, having dropped nearly 8% in the previous session. “Oil prices are holding their ground with market expectations building on an agreement for an output reduction of 10 million barrels per day (bpd), or at least close to 10 million bpd,” BNP Paribas analyst Harry Tchilinguirian told.

Market is expected to remain volatile during current trading session.

Technical Analysis

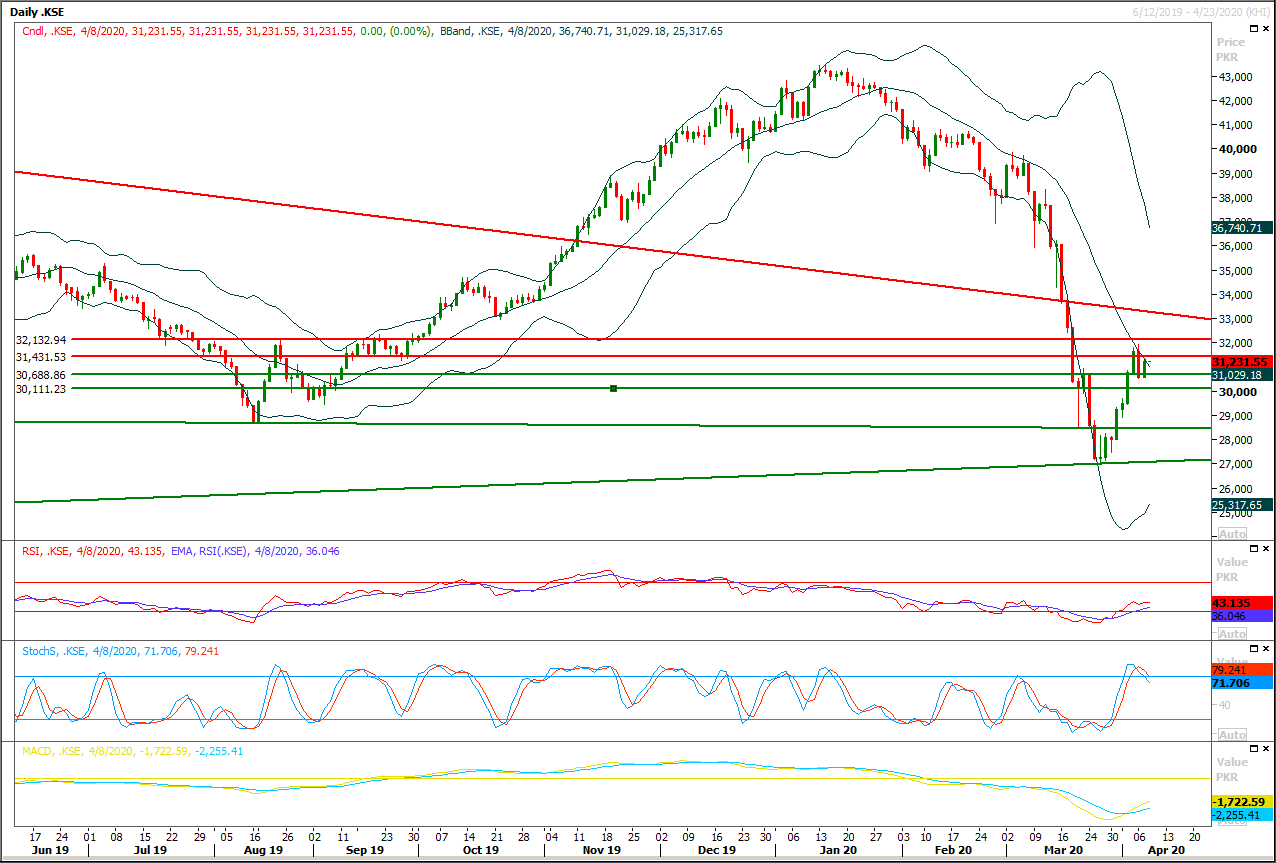

The Benchmark KSE100 Index is being capped by 38% correction of its last bearish rally and it's not becoming able to give a breakout above 32,000 points since last three trading session, but at day end yesterday index have generated a hope for bulls by creating a piercing line formation on daily chart but resistant regions are still intact and these would try to cap any bullish sentiment at 31500 points and 32,000 points. Index would remain bearish on short term basis until it would not succeed in closing above 32,500 points. Meanwhile bullish sentiment generated by weekly engulfing pattern would start losing strength if index would not succeed in closing above 32,500 points on weekly closing basis. Meanwhile on supportive side index would try to find some ground at 30,700 points in case of bearish pressure and breakout below that region would call for a sharp bearish rally towards 30,000 points and 29,500points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.