Previous Session Recap

Trading volume at PSX floor increased by 135.62 million shares or 130.54% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,838.30, posted a day high of 42,984.99 and a day low of 42,707.52 during last trading session. The session suspended at 42,760.13 with net change of -48.53 and net trading volume of 129.18 million shares. Daily trading volume of KSE100 listed companies increased by 53.32 million shares or 70.29% on DoD basis.

Foreign Investors remained in net selling position of 6.52 million shares and net value of Foreign Inflow dropped by 3.91 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.11 and 6.59 million shares but Overseas Pakistanis investors remained in net buying positions of 0.18 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net buying positions of 4.96, 1.28 and 9.12 million shares but Local Companies, Banks, NBFCs and Mutual Fund remained in net selling positions of 1.77, 1.54, 1.09 and 4.20 million shares respectively.

Analytical Review

Asian shares extend recovery on earnings, China policy hopes

Asian shares rose on Wednesday on the back of firmer Wall Street earnings while expectations for increased Chinese stimulus helped take the edge off wider concerns about the worsening Sino-U.S. trade dispute. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.22 percent while Japan’s Nikkei ticked up 0.05 percent. On Wall Street, the S&P 500 rose 0.28 percent to 2,858, which is just 14 points, or about 0.5 percent, below its record high marked in January. A strong second-quarter earnings season fueled optimism about U.S. economic strength. S&P 500 firms saw a 23.5 percent rise in their April-June profits, according to Thomson Reuters data.

Reforms, revenue vital for turnaround

Financial and revenue experts Tuesday called for long-term reforms and the need for exploiting massive potential of the youth to turn around the economy and to fulfill the election pledge of Pakistan Tehreek-e-Insaf (PTI) to provide jobs. PTI, which inherited a shattered economy, has made a smart move by planning to "create jobs through housing which mostly accommodates informal economy and is estimated to be roughly the same size as that of the formal economy," said project consultant Moeen Abbas. He was commenting on the mood of expectancy in Pakistani youth who constituted 63 per cent of its over 200 million population.

Financial Technology conference held

The Rawalpindi Chamber of Commerce and Industry (RCCI) organized Financial Technology conference (FinTech) here on Tuesday. The major purpose of this conference was to promote Information Technology (IT) and to bring awareness among key stakeholders for its use in financial management, lowering cost of production and enhancing innovation towards their businesses. On the occasion, FFC CEO Tariq Khan, who was chief guest on the occasion said that financial management offering big challenges and adaptation of modern information technology can help consumers in a big way.

CPEC potential for young entrepreneurs highlighted

Senior office bearer and Project Director in CPEC Secretariat, Ministry of Planning, Development and Reforms Hassan Dawood Butt highlighted the potential for young entrepreneurs to get involved into CPEC and cleared-out common misconceptions regarding this mega project. An open house event was organised by the Obortunity Consulting (Pvt.) Ltd. in collaboration with National Incubation Center Peshawar on China-Pakistan Economic Corridor and CPEC Driven Entrepreneurship for the industry, academia and government of KP. Dr Shahid Rashid, Executive Director, CPEC Centre of Excellence also briefed about the CPEC Long Term Plan in detail and listed his recommendations for the youth and how they can tap the emerging markets of CPEC. Overall, the event resulted in a very interactive and rigorous discussion on the shortcomings of the private sector, government and academia in failing to mobilise the youth in CPEC and how to address these issues as Pakistan moves forward. The organiser of the event, Obortunity Consulting (Pvt.) Ltd is working on the implementation of the triple helix model of innovation in CPEC, linking the relevant stakeholders in bridging research and development shortfalls, skills development and creating awareness amongst the masses.

MPs for integrated plan to revive textile sector

Senate Standing Committee on Commerce and Textile on Tuesday stressed the need for long-term strategy and adopting integrated institutional approach to revive the industry. The meeting of the committee held here in Parliament House on Tuesday under the chairmanship of Senator Shibli Faraz. It showed concern over the trade decline in textile sector and sought report from ministry of commerce to improve trade in this sector. The meeting was briefed regarding the closure of power looms and free trade agreement with China. The officials said after the implementation of China Pakistan Free Trade Agreement in 2007, Pakistan offered tariff concessions on 6,711 items to China, while China offered tariff concessions on 6,418 items to Pakistan.

Asian shares rose on Wednesday on the back of firmer Wall Street earnings while expectations for increased Chinese stimulus helped take the edge off wider concerns about the worsening Sino-U.S. trade dispute. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.22 percent while Japan’s Nikkei ticked up 0.05 percent. On Wall Street, the S&P 500 rose 0.28 percent to 2,858, which is just 14 points, or about 0.5 percent, below its record high marked in January. A strong second-quarter earnings season fueled optimism about U.S. economic strength. S&P 500 firms saw a 23.5 percent rise in their April-June profits, according to Thomson Reuters data.

Financial and revenue experts Tuesday called for long-term reforms and the need for exploiting massive potential of the youth to turn around the economy and to fulfill the election pledge of Pakistan Tehreek-e-Insaf (PTI) to provide jobs. PTI, which inherited a shattered economy, has made a smart move by planning to "create jobs through housing which mostly accommodates informal economy and is estimated to be roughly the same size as that of the formal economy," said project consultant Moeen Abbas. He was commenting on the mood of expectancy in Pakistani youth who constituted 63 per cent of its over 200 million population.

The Rawalpindi Chamber of Commerce and Industry (RCCI) organized Financial Technology conference (FinTech) here on Tuesday. The major purpose of this conference was to promote Information Technology (IT) and to bring awareness among key stakeholders for its use in financial management, lowering cost of production and enhancing innovation towards their businesses. On the occasion, FFC CEO Tariq Khan, who was chief guest on the occasion said that financial management offering big challenges and adaptation of modern information technology can help consumers in a big way.

Senior office bearer and Project Director in CPEC Secretariat, Ministry of Planning, Development and Reforms Hassan Dawood Butt highlighted the potential for young entrepreneurs to get involved into CPEC and cleared-out common misconceptions regarding this mega project. An open house event was organised by the Obortunity Consulting (Pvt.) Ltd. in collaboration with National Incubation Center Peshawar on China-Pakistan Economic Corridor and CPEC Driven Entrepreneurship for the industry, academia and government of KP. Dr Shahid Rashid, Executive Director, CPEC Centre of Excellence also briefed about the CPEC Long Term Plan in detail and listed his recommendations for the youth and how they can tap the emerging markets of CPEC. Overall, the event resulted in a very interactive and rigorous discussion on the shortcomings of the private sector, government and academia in failing to mobilise the youth in CPEC and how to address these issues as Pakistan moves forward. The organiser of the event, Obortunity Consulting (Pvt.) Ltd is working on the implementation of the triple helix model of innovation in CPEC, linking the relevant stakeholders in bridging research and development shortfalls, skills development and creating awareness amongst the masses.

Senate Standing Committee on Commerce and Textile on Tuesday stressed the need for long-term strategy and adopting integrated institutional approach to revive the industry. The meeting of the committee held here in Parliament House on Tuesday under the chairmanship of Senator Shibli Faraz. It showed concern over the trade decline in textile sector and sought report from ministry of commerce to improve trade in this sector. The meeting was briefed regarding the closure of power looms and free trade agreement with China. The officials said after the implementation of China Pakistan Free Trade Agreement in 2007, Pakistan offered tariff concessions on 6,711 items to China, while China offered tariff concessions on 6,418 items to Pakistan.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

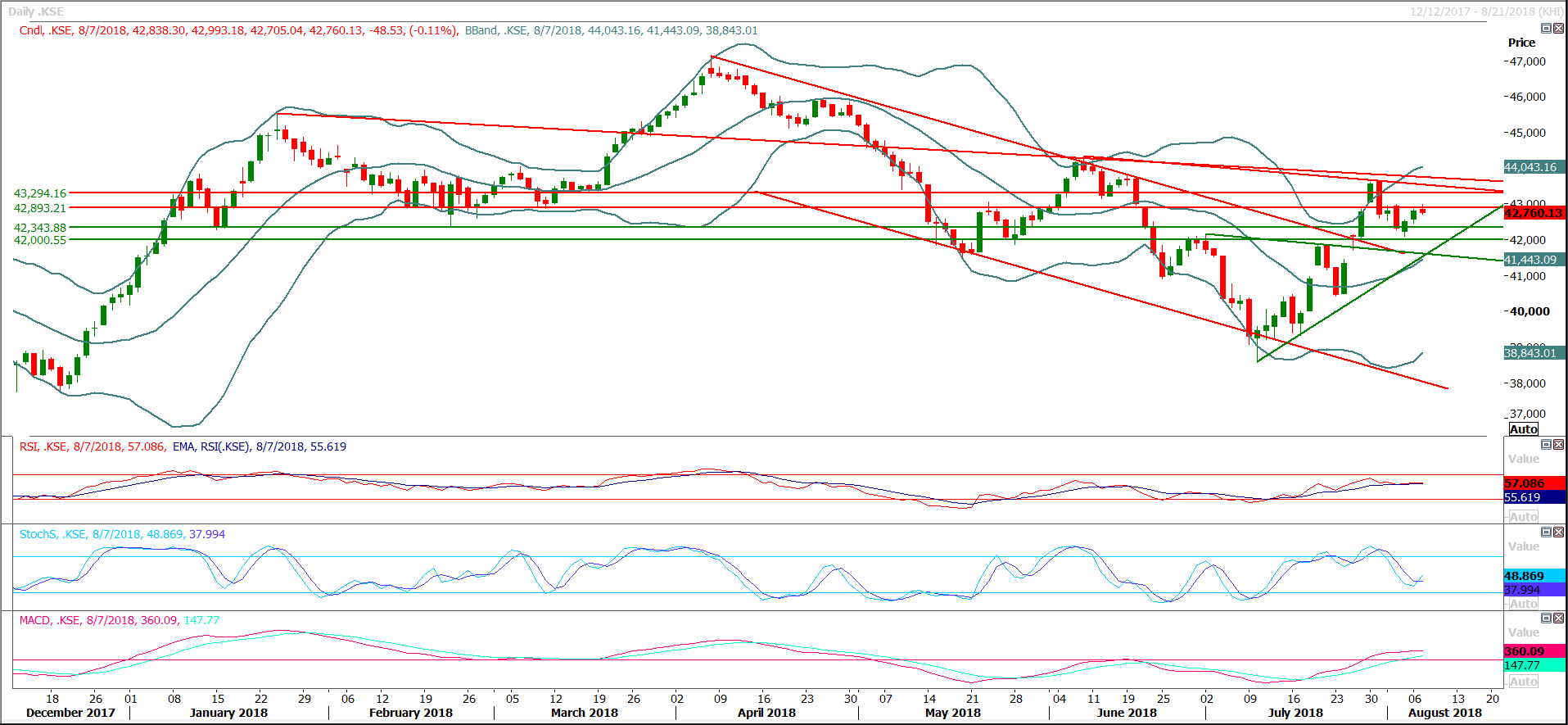

The Benchmark KSE100 Index is being capped by a horizontal resistant region which falls on 50% correction of last bearish rally and a daily triple top. Momentum indicators are in mixed situation because daily Stochastic is trying to generate a bullish crossover to push index upward but MAORSI is trying to generate a bearish crossover to add pressure on index, therefore it’s expected that index would remain volatile between 42,880 and 42,330 points. For a spike on intraday basis index needs to open with a positive gap above 42,880 points during current trading session and if it would not succeed in doing so then gradually it would be pushed downward. As of now its recommended to wait for breakout of either 43,330 points for new buying or 42,089 for initiating new short positions. It’s recommended to stay side line during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.