Previous Session Recap

Trading volume at PSX floor increased by 13.69 million shares or 9.16% on DoD basis, whereas, the benchmark KSE100 Index opened at 39880.82, posted a day high of 39880.82 and a day low of 38769.09 during last trading session. The session suspended at 338784.66 with net change of -1122.66 and net trading volume of 71.11 million shares. Daily trading volume of KSE100 listed companies increased by 21.84 million shares or 44.32% on DoD basis.

Foriegn Investors remained in net selling of 4.68 million shares but net value of Foreign Inflow Increased by 1.3 milllion US Dollars. Categorically, Foreign Individuals remained in net buying position of 0.3 million shares but Foreign Corporate and Overseas Pakistani Investors remained in net selling positions of 4.78 and 0.2 million shares. While on the other side Local Individuals, Companies, NBFCs and Insurance Companies remained in net buying postions of 4.79, 6.62, 1.53 and 1.5 million shares respectively, but Local Banks, Mutual Funds and Brokers remained in net selling positions of 0.5, 2.06 and 7.05 million shares.

Analytical Review

Asian shares rallied for a second session on Friday as investors awaited major economic data from China and the United States while marveling at the meteoric ascent of the market’s new crypto-star, bitcoin. Japan's Nikkei .N225 led the way again with an early gain of 0.9 percent, adding to Thursday's 1.45 percent bounce. Australian stocks put on 0.4 percent while MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.1 percent. Bidders were encouraged by a steadier performance on Wall Street, where the Dow .DJI rose 0.29 percent. The S&P 500 .SPX gained 0.29 percent and the Nasdaq .IXIC 0.54 percent.

The government’s policy of keeping the exchange rate stable by intervening in the foreign exchange market may become unsustainable if the US dollar appreciates against most major currencies in global markets, warns a new United Nations report. The stable exchange rate may be encouraging for some investors and traders, but the report warns that it is draining precious foreign exchange reserves. “In these circumstances, if the US dollar appreciates against most major currencies in the global markets, the policy approach currently being pursued by Pakistan could become unsustainable,” it warns, raising the spectre of a forced devaluation at some point down the road.

The government has decided to launch ‘Overseas Pakistanis Savings Certificates’ to tap the pool of $30 billion held by Pakistanis living abroad, the Senate Standing Committee on Finance was informed on Thursday. “In a conservative estimate, overseas Pakistanis had earnings of around $50bn out of which $20bn were remitted through formal channels while the rest $30bn remains untapped,” Zafar Masood, Director General Central Directorate of National Savings (CDNS) said.

The foreign exchange reserves have jumped to $21 billion after the country received $2.5bn it raised through auction of bond on the international market. The State Bank of Pakistan (SBP) on Thursday reported that the reserves held by it rose to $14.883bn after receiving bond auction proceeds on Dec 5. In fact, the SBP reserves during the week ending Nov 30 decreased by $887 million to $12.660bn due to external debt and other official payments. The foreign exchange reserves of the commercial banks slightly decreased by $62m to $6.084bn during the week.

Cement industry of Pakistan dispatched 2.261 million tons more cement in the first five months of this fiscal, which is 13.91 percent higher than the cement dispatched during the corresponding period of last fiscal. According to statistics issued on Wednesday by the All Pakistan Cement Manufacturers Association, the increase recorded in domestic consumption in November 2017 was 9.89 percent, but the overall growth of the sector stood at 5.16 percent, as it was negatively impacted by a steep decline in exports that went down by 27.11 percent. In November 2017, the mills situated in northern part of the country dispatched 2.967 million tons cement locally, which is 10.2 percent higher than 2.692 million tons local dispatches in the same month last year. The local dispatches in the southern region rose by 8.4 percent from 0.578 million tons in November 2016 to 0.626 million tons in November 2017.

ATRL, DGKC, PAEL and TRG may lead the market in positive direction

Technical Analysis

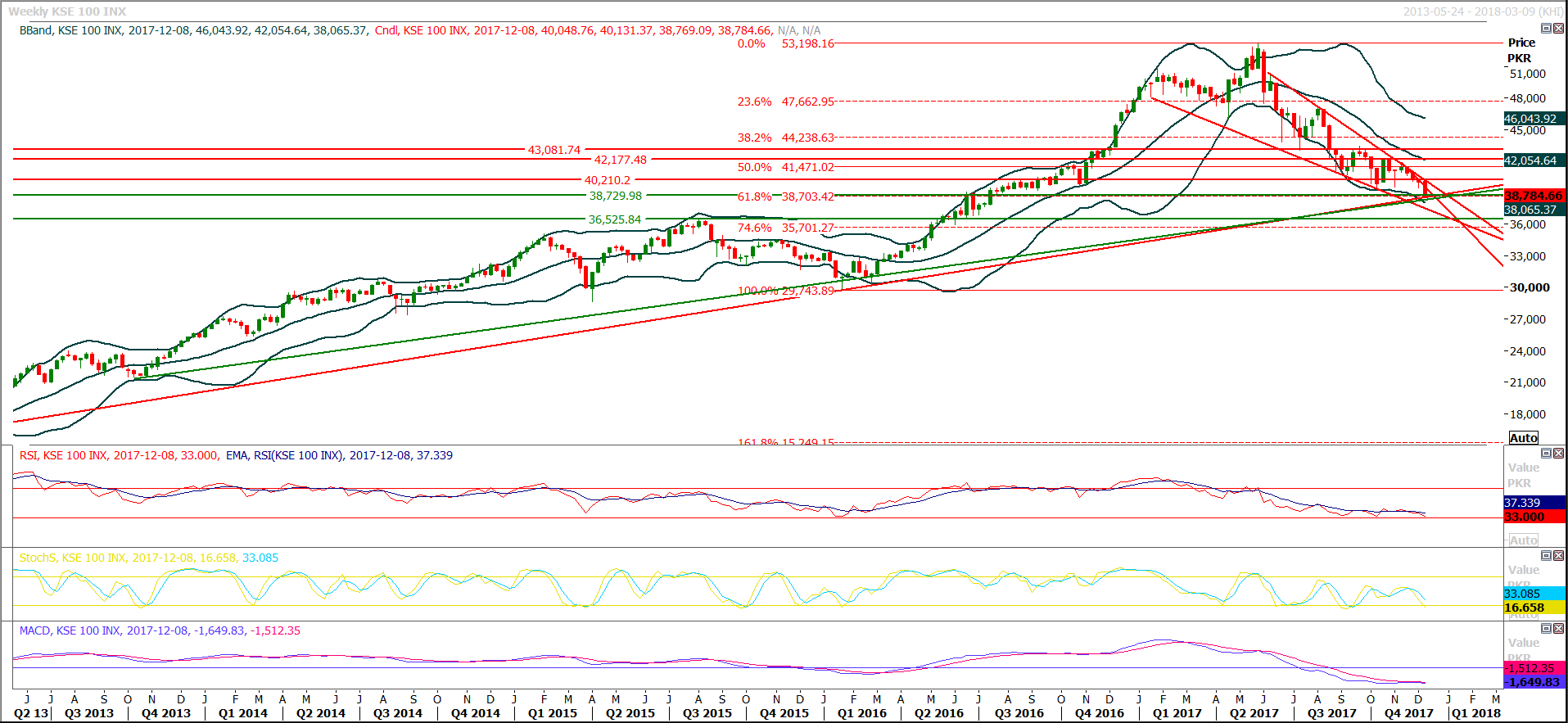

The Benchmark KSE100 Index is around to complete its 61.8% correction on weekly chart where it will also get support from two rising trend lines along with a horizontal supportive region. For current trading session index will have support from 38680 points if it would not open below that with a gap. For current trading session buying on dip is recommended. If index would start reversal from these levels then next targets for index would be 39478 where index could face a resistance and closing above 39478 will call for 40150 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.