Previous Session Recap

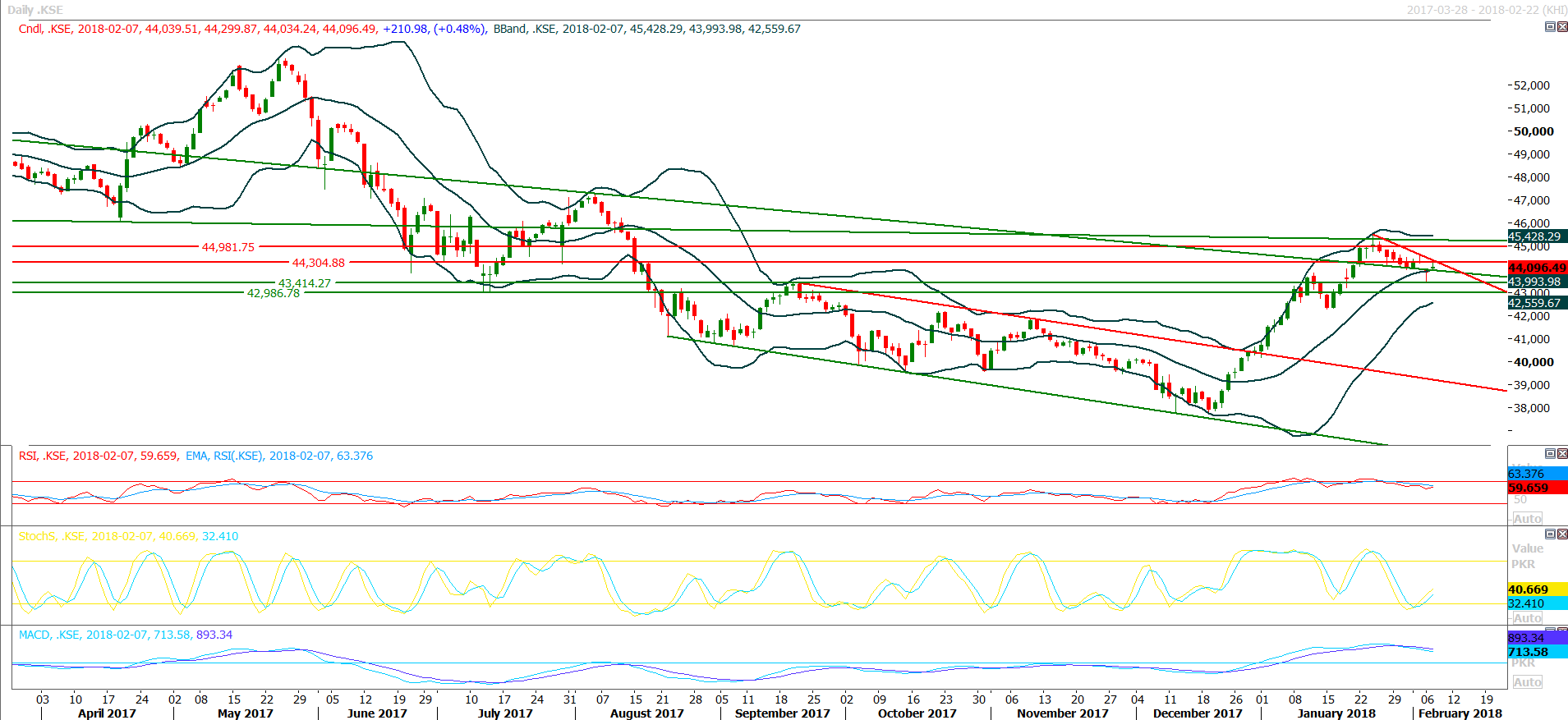

Trading volume at PSX floor increased by 32.03 million shares or 13.46% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44039.51, posted a day high of 44299.87 and a day low of 44034.24 during last trading session. The session suspended at 44096.49 with net change of 210.98 and net trading volume of 108.92 million shares. Daily trading volume of KSE100 listed companies increased by 25.54 million shares or 30.63% on DoD basis.

Foreign Investors remained in net selling position of 4.51 shares and net value of Foreign Inflow dropped by 3.58 million shares. Categorically, Foreign Corporate Investors remained in net selling position of 5.85 million shares but Overseas Pakistanis remained in net buying of 1.31 million shares. While on the other side Local Individuals, NBFCs, Mutual Funds and Insurance Companies remained in net buying positions of 8.84, 2.29, 3.71 and 1.58 million shares respectively, but Local Companies, Banks and Brokers remained in net selling positions of 4.15, 6.0 and 0.76 million shares respectively.

Analytical Review

Asian shares flirted with six-week lows on Thursday as U.S. bond yields crept up toward four-year highs as investors fretted that low borrowing costs enjoyed by companies for many years may be endangered by the threat of rising inflation. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent in early Thursday trade, staying near its six-week low touched on Tuesday. Japan’s Nikkei gained 0.6 percent, though it was still down more than six percent so far this week. MSCI’s broadest gauge of the world’s stock markets has lost ground in seven of the last eight sessions until Wednesday, a period in which it slumped 6.8 percent. U.S. stocks ran out of steam on Wednesday after an early surge, with the S&P 500 ending down 0.50 percent and the Nasdaq Composite losing 0.9 percent.

The loss-making public sector enterprises (PSEs) borrowed Rs115 billion during the first seven months of this fiscal year, reflecting the government’s utter failure to make them profitable. A latest report by the State Bank of Pakistan showed that banks extended Rs115.58bn loans to PSEs during the July-January period of 2017-18 while the government already borrowed Rs368bn for budgetary support during the same period. The flow of funds from the banking sector towards the PSEs has increased by 45 per cent compared to 2016-17. The credit to PSEs during the first seven months of 2016-17 stood at Rs79.8bn.

Executive Committee of the National Economic Council (ECNEC) on Wednesday approved development projects worth of over Rs167 billion. The ECNEC chaired by Prime Minister Shahid Khaqan Abbasi has approved the projects of different sectors including health, water, sewerage, infrastructure and irrigation. The ECNEC also approved Prime Minister's National Health Programmeme Phase-II at a total cost of Rs33,629.998 million. The project is in line with the vision of the present government to expand and extend provision of health services across the country especially to the women and children and to reduce out of pocket expenditures on health by vulnerable segments of the society. The representative of the Sindh government expressed his government's inability to make any financial contribution towards the health programmeme.

After a parliamentary committee, the local industry has also shown its concerns over the government's decision to give huge tax exemption of Rs11 billion to a Chinese company constructing the Multan-Sukkur section of the China-Pakistan Economic Corridor (CPEC). Pakistan Steel Melters Association (PSMA) has strongly rejected the recently granted tax exemptions to China State Construction Engineering Corporation Limited. The Senate Standing Committee on Finance and Revenue last week question federal government for giving huge tax exemption to the Chinese company. The Economic Coordination Committee (ECC) of the Cabinet in December last had allowed China State Construction Engineering Corporation Limited, which is working on Motorway Sukkar to Multan section, duty free import of construction materials and machinery in Pakistan. The Chinese company has been exempted from paying federal excise duty, sales tax and withholding tax on imported construction material and goods used in the construction of CPEC's Sukkur-Multan section.

Pakistan and Indonesia had finalized the review process for the Preferential Trade Agreement (PTA) and it would likely to enhance local exports to Indonesia by $ 200 million per annual. Pakistan and Indonesia has current annual trade volume of $ 170 million, which was expected to increase $ 370 million after renegotiation on PTA between the two countries, senior official of Ministry of Commerce told APP here on Wednesday Both the countries agreed to expand PTA and go for a Free Trade Agreement (FTA) between them, the official said. Both sides discussed 20 tariff lines and Indonesia agreed to give unilateral concession on major exports from Pakistan including zero percent tariff on tobacco, textile fabric, rice, ethanol, Citrus (Kinnow), woven fabric, t-shirts, apparel and mangoes during renegotiation on PTA, he said. Concession on 20 tariff lines was major success of Pakistan and now Pakistani citrus and mangoes exports to Indonesia will increase country's trade as compare with previous years.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

The Benchmark KSE100 Index have fulfilled its gap during last trading session and right now its capped by a resistant trend line along with a horizontal resistant region on daily chart. As of right now a descending trend line would try to support index around 43930 and if it would become able to slide below that level then next targets would be 43414 and 42980 points. Its recommended to initiate selling on strength as index seems in bearish momentum while closing below 43930 would confirm this bearish sentiment for time being. For current trading session index would find major resistances arouond 44304 and 44465 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.