Previous Session Recap

Trading volume at PSX floor increased by 92.67 million shares or 143.84% on DoD basis, whereas the Benchmark KSE100 Index opened at 37,631.80, posted a day high of 38,626.80 and a day low of 37,547.49 during last trading session while session while suspended at 38,562.40 with net change 1014.91 points and net trading volume of 103.49 million shares. Daily trading volume of KSE100 listed companies increased by 65.60 million shares or 173.16% on DoD basis.

Foreign Investors remained in net selling positions of 3.46 million shares and net value of Foreign Inflow dropped by 0.61 million US Dollars. Categorically, Foreign Corporate remained in net buying positions of 0.30 million shares but Overseas Pakistani investors remained in net selling positions of 3.75 million shares. While on the other side Local Individuals, Local Companies, Banks, and Insurance Companies remained in net selling positions of 15.23, 1.77, 3.38 and 1.35 million shares respectively but NBFCs, Mutual Fund and Brokers remained in net buying positions of 0.25, 18.71 and 3.94 million shares.

Analytical Review

Asian shares propped up by hopes for Sino-US trade deal, cautious Fed

Most Asian shares were propped up on Tuesday by hopes that Washington and Beijing may be inching towards a trade deal and that U.S. Federal Reserve would halt its tightening if economic growth slows further. Japan's Nikkei .N225 rose 0.9 percent while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up just 0.1 percent, though it was dragged down by falls in China .CSI300 and Taiwan .TWII.

Free economic zone with Pakistan to open soon: Iranian consul

Iranian Consul General Mohammad Rafiee in a meeting with Balochistan Chief Minister Jam Kamal on Monday said that the Pak-Iran free economic zone would be inaugurated in Mirjaveh city of Sistan-Baluchestan province in the coming days. During the meeting, the two sides called for expanding Pak-Iran border trade and economic zones to foster economic relations. They also discussed implementation of decisions taken by the Pak-Iran Border Commission and Joint Border Trade Commission.

ICCI lauds formalisation of UAE bailout package for Pakistan

The Islamabad Chamber of Commerce & Industry has hailed the formalization of UAE’s $6.2 billion bailout package for Pakistan during the recent visit of Crown Prince of Abu Dhabi Sheikh Mohammed bin Zayed Al Nahyan and termed it a positive development as it would help Pakistan address its balance of payment issues and improve the confidence of private sector and investors. Ahmed Hassan Moughal, president Islamabad Chamber of Commerce & Industry, said that UAE has always supported Pakistan in difficult times and its recent bailout package comprising $3 billion loan on 2.8 percent interest rate and $3.2 billion for supply of oil on deferred payment was a testimony of UAE’s continuous commitment and close friendship with Pakistan.

Ogra cuts RLNG price by up to 10.5pc

The Oil and Gas Regulatory Authority (Ogra) Monday announced a reduction of up to 10.54 percent in the price of re-gasified liquefied natural gas (RLNG) for SSGCL and SNGPL for the month of January 2019. A notification issued by OGRA here stated that the price of RLNG for consumers of SNGPL will be $11.038 per million British thermal units (mmbtu) and for consumers of SSGC at $11.3726 per mmbtu, for January 2019.

Knitwear export rises to $1.21b

The export of knitwear from the country increased by 10.58 percent to $1.21 billion during July-November 2018-19 against the export worth of $1.1 billion during same period of previous year. In terms of quantity, the export of knitwear witnessed a surge of 20.24 percent as it rose to 52.17 million dozens of knitwear in first five months of current fiscal year against the export of 43.4 million dozens in same period of the year 2017-18, says a latest data released by Pakistan Bureau of Statistics (PBS). On year-on-year basis, the export of knitwear increased by 11.19 percent to $251.6 million in November against the export of $226.27 million in same month of the preceding year.

Most Asian shares were propped up on Tuesday by hopes that Washington and Beijing may be inching towards a trade deal and that U.S. Federal Reserve would halt its tightening if economic growth slows further. Japan's Nikkei .N225 rose 0.9 percent while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up just 0.1 percent, though it was dragged down by falls in China .CSI300 and Taiwan .TWII.

Iranian Consul General Mohammad Rafiee in a meeting with Balochistan Chief Minister Jam Kamal on Monday said that the Pak-Iran free economic zone would be inaugurated in Mirjaveh city of Sistan-Baluchestan province in the coming days. During the meeting, the two sides called for expanding Pak-Iran border trade and economic zones to foster economic relations. They also discussed implementation of decisions taken by the Pak-Iran Border Commission and Joint Border Trade Commission.

The Islamabad Chamber of Commerce & Industry has hailed the formalization of UAE’s $6.2 billion bailout package for Pakistan during the recent visit of Crown Prince of Abu Dhabi Sheikh Mohammed bin Zayed Al Nahyan and termed it a positive development as it would help Pakistan address its balance of payment issues and improve the confidence of private sector and investors. Ahmed Hassan Moughal, president Islamabad Chamber of Commerce & Industry, said that UAE has always supported Pakistan in difficult times and its recent bailout package comprising $3 billion loan on 2.8 percent interest rate and $3.2 billion for supply of oil on deferred payment was a testimony of UAE’s continuous commitment and close friendship with Pakistan.

The Oil and Gas Regulatory Authority (Ogra) Monday announced a reduction of up to 10.54 percent in the price of re-gasified liquefied natural gas (RLNG) for SSGCL and SNGPL for the month of January 2019. A notification issued by OGRA here stated that the price of RLNG for consumers of SNGPL will be $11.038 per million British thermal units (mmbtu) and for consumers of SSGC at $11.3726 per mmbtu, for January 2019.

The export of knitwear from the country increased by 10.58 percent to $1.21 billion during July-November 2018-19 against the export worth of $1.1 billion during same period of previous year. In terms of quantity, the export of knitwear witnessed a surge of 20.24 percent as it rose to 52.17 million dozens of knitwear in first five months of current fiscal year against the export of 43.4 million dozens in same period of the year 2017-18, says a latest data released by Pakistan Bureau of Statistics (PBS). On year-on-year basis, the export of knitwear increased by 11.19 percent to $251.6 million in November against the export of $226.27 million in same month of the preceding year.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

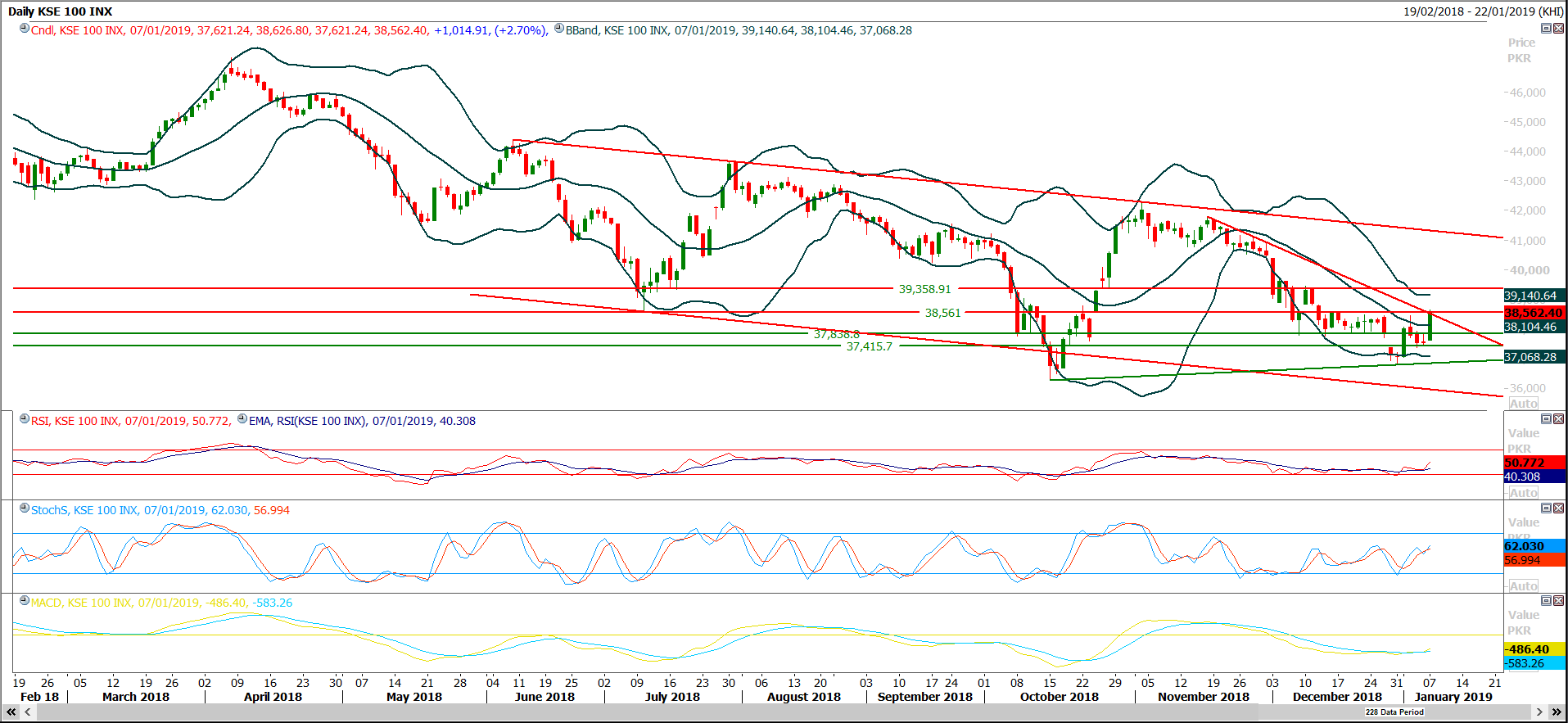

Technical Analysis

The Benchmark KS100 Index has bounced back after completing its 61.8% correction and has formatted a morning star on daily chart. As of now Daily and hourly momentum indicators have mixed on trend while weekly momentum have converged to bullish side but index is capped by strong horizontal resistances at 38,860 and 39,350 points while supportive regions are currently standing at 37,840 and 37,415 points. Index would try to target 39,500 points if it would succeed in penetration of 38,860 points but before reaching that region it would have to face strong resistances and these would react aggressively against current bullish momentum because weekly 50% correction of last bearish rally would be completed at that region. Currently index have closed at a very crucial level where it’s being capped by a crossover of a horizontal line along with a trend line and if index would not succeed in closing above 38,660 points during first half hour then it may face some pressure from bears. It’s recommended to post trailing stop losses on long positions.

PSO would face initial resistance at 238 Rs and breakout of that region would lead prices towards 242 and 244 where it would face strong resistances. ATRL would try to continue its bullish rally towards 145 and 150 Rs where it would face strong resistances. MLCF would face a strong resistance at 45.80 and penetration above that region on daily closing basis would call for 47.60. PAEL have succeeded in penetration above its resistant trend line and now it would try to target 26.18 and then 26.60.

PSO would face initial resistance at 238 Rs and breakout of that region would lead prices towards 242 and 244 where it would face strong resistances. ATRL would try to continue its bullish rally towards 145 and 150 Rs where it would face strong resistances. MLCF would face a strong resistance at 45.80 and penetration above that region on daily closing basis would call for 47.60. PAEL have succeeded in penetration above its resistant trend line and now it would try to target 26.18 and then 26.60.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.