Previous Session Recap

Trading volume at PSX floor dropped by 60.61 million shares or 54.19% on DoD basis, whereas the benchmark KSE100 index opened at 34,525.67, posted a day high of 34,570.62 and a day low of 34,062.98 points during last trading session while session suspended at 34,190.02 points with net change of -380.60 points and net trading volume of 42.35 million shares. Daily trading volume of KSE100 listed companies dropped by 46.59 million shares or 52.38% on DoD basis.

Foreign Investors remained in net buying positions of 0.008 million shares and net value of Foreign Inflow increased by 0.09 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net buying positions of 0.23 and 0.02 million shares but Foreign Individuals investors remained in net selling positions of 0.25 million shares. While on the other side Local Individuals, Companies, Banks and NBFCs remained in net buying positions of 6.49, 4.55, 0.14 and 0.04 million sharers respectively but Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 3.70, 0.08 and 5.19 million shares.

Analytical Review

Asian shares fall as bets off on sharp U.S. rate cuts

Asian shares fell on Monday after strong U.S. jobs data tempered expectations for a Fed rate cut, while the Turkish lira hovered near two-week lows on worries about central bank independence. Share sentiment was also dampened by U.S. investment bank Morgan Stanley’s decision to reduce its exposure to global equities due to misgivings about the ability of policy easings to offset weaker economic data. Asian shares were broadly weaker on Monday, tracking Wall Street which fell from record highs last week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost more than 1%, with every market in the red. Japan's Nikkei .N225 faltered 0.9%. Chinese shares started lower with the blue-chip index .CSI300 off 1.7% and Hong Kong's Hang Seng index .HSI down 1.5%. South Korea's KOSPI .KS11 was off 1.8% and Australian shares slipped about 1% to a five-week low.

RCCI award ceremony to be held in Malaysia

The Rawalpindi Chamber of Commerce and Industry (RCCI) would organize its 32nd Achievement Award ceremony in Kuala Lumpur, Malaysia on July 8-9. Prime Minister of Malaysia Dr. Mahateer Muhammad will be the chief guest of concluding ceremony. Former National Cricket team captain Shahid Afridi would also participate while renowned International Islamic scholar Dr Zakir Naik would deliver lecture on “Islam, Trade and Modern World”. This was informed by RCCI President Malik Shahid Saleem, In a statement issued here on Sunday. A business opportunity conference (BOC) will also be held on the side lines of the event and local chambers are showing interest in meeting with the Pakistani business men. He said that the basic purpose of organizing an awards ceremony and BOC was to improve bilateral trade and attract foreign direct investment (FDI) in the country.

Govt to take stakeholders on board for tax reforms

Minister of State for Revene Hammad Azhar here on Sunday said that the government will take business community and all the stakeholders on board for tax reforms. Talking to representatives of business community at the Lahore Chamber of Commerce and Industry, Hammad said the business community and industrialists would not be harassed by FBR officials. He said, “The government is working to enhance the tax to GDP ratio upto three or four percent within next three to four years.” The minister further said that their focus would remain on data integration, tax registration, automation and broadening of tax base. On the occasion, FBR Chairman Shabbar Zaidi said they were putting in place effective measures to curb under-invoicing and smuggling to stabilize local industry and businesses.

$35m project to improve water management, agriculture

The board of Green Climate Fund (GCF) on Sunday approved financing of $35 million for a project of the Food and Agriculture Organisation (FAO) of the United Nations to transform the Indus River Basin by improving agriculture and water management to make the vital food-producing region more resilient to climate change. The approval of the first FAO-led GCF project in Asia at the board’s meeting in Songdo, South Korea, is being seen as an important step forward in the FAO’s support for countries to respond to climate change in partnership with the new fund created to support the efforts of developing countries against climate change. In the Indus River Basin, agriculture employs nearly 26 per cent of Pakistan’s labour force and produces more than 90pc of the country’s agriculture outputs. However, extended droughts and floods have affected millions of people in recent years.

Pakistan to get $1.65bn net receipts out of $6bn IMF package

Pakistan will get net receipts of about $1.65 billion in four years from the International Monetary Fund (IMF) under the just concluded $6bn bailout as it delivers on a steep macroeconomic adjustment plan. A senior government official told Dawn that beginning this year Pakistan will receive a total of $6bn in about three years ending 2021-22 from the IMF, while it has to repay about $4.355bn in four years ending 2022-23, showing net receipts of $1.65bn. He said the government is expected to receive first disbursement of about $1bn this week under the $6bn Extended Fund Facility (EFF) that would boost the foreign exchange reserves in the short term, but its repayment obligations under the previous $6.4bn EFF have already begun.

Asian shares fell on Monday after strong U.S. jobs data tempered expectations for a Fed rate cut, while the Turkish lira hovered near two-week lows on worries about central bank independence. Share sentiment was also dampened by U.S. investment bank Morgan Stanley’s decision to reduce its exposure to global equities due to misgivings about the ability of policy easings to offset weaker economic data. Asian shares were broadly weaker on Monday, tracking Wall Street which fell from record highs last week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost more than 1%, with every market in the red. Japan's Nikkei .N225 faltered 0.9%. Chinese shares started lower with the blue-chip index .CSI300 off 1.7% and Hong Kong's Hang Seng index .HSI down 1.5%. South Korea's KOSPI .KS11 was off 1.8% and Australian shares slipped about 1% to a five-week low.

The Rawalpindi Chamber of Commerce and Industry (RCCI) would organize its 32nd Achievement Award ceremony in Kuala Lumpur, Malaysia on July 8-9. Prime Minister of Malaysia Dr. Mahateer Muhammad will be the chief guest of concluding ceremony. Former National Cricket team captain Shahid Afridi would also participate while renowned International Islamic scholar Dr Zakir Naik would deliver lecture on “Islam, Trade and Modern World”. This was informed by RCCI President Malik Shahid Saleem, In a statement issued here on Sunday. A business opportunity conference (BOC) will also be held on the side lines of the event and local chambers are showing interest in meeting with the Pakistani business men. He said that the basic purpose of organizing an awards ceremony and BOC was to improve bilateral trade and attract foreign direct investment (FDI) in the country.

Minister of State for Revene Hammad Azhar here on Sunday said that the government will take business community and all the stakeholders on board for tax reforms. Talking to representatives of business community at the Lahore Chamber of Commerce and Industry, Hammad said the business community and industrialists would not be harassed by FBR officials. He said, “The government is working to enhance the tax to GDP ratio upto three or four percent within next three to four years.” The minister further said that their focus would remain on data integration, tax registration, automation and broadening of tax base. On the occasion, FBR Chairman Shabbar Zaidi said they were putting in place effective measures to curb under-invoicing and smuggling to stabilize local industry and businesses.

The board of Green Climate Fund (GCF) on Sunday approved financing of $35 million for a project of the Food and Agriculture Organisation (FAO) of the United Nations to transform the Indus River Basin by improving agriculture and water management to make the vital food-producing region more resilient to climate change. The approval of the first FAO-led GCF project in Asia at the board’s meeting in Songdo, South Korea, is being seen as an important step forward in the FAO’s support for countries to respond to climate change in partnership with the new fund created to support the efforts of developing countries against climate change. In the Indus River Basin, agriculture employs nearly 26 per cent of Pakistan’s labour force and produces more than 90pc of the country’s agriculture outputs. However, extended droughts and floods have affected millions of people in recent years.

Pakistan will get net receipts of about $1.65 billion in four years from the International Monetary Fund (IMF) under the just concluded $6bn bailout as it delivers on a steep macroeconomic adjustment plan. A senior government official told Dawn that beginning this year Pakistan will receive a total of $6bn in about three years ending 2021-22 from the IMF, while it has to repay about $4.355bn in four years ending 2022-23, showing net receipts of $1.65bn. He said the government is expected to receive first disbursement of about $1bn this week under the $6bn Extended Fund Facility (EFF) that would boost the foreign exchange reserves in the short term, but its repayment obligations under the previous $6.4bn EFF have already begun.

Market is expected to remain volatile during current trading session.

Technical Analysis

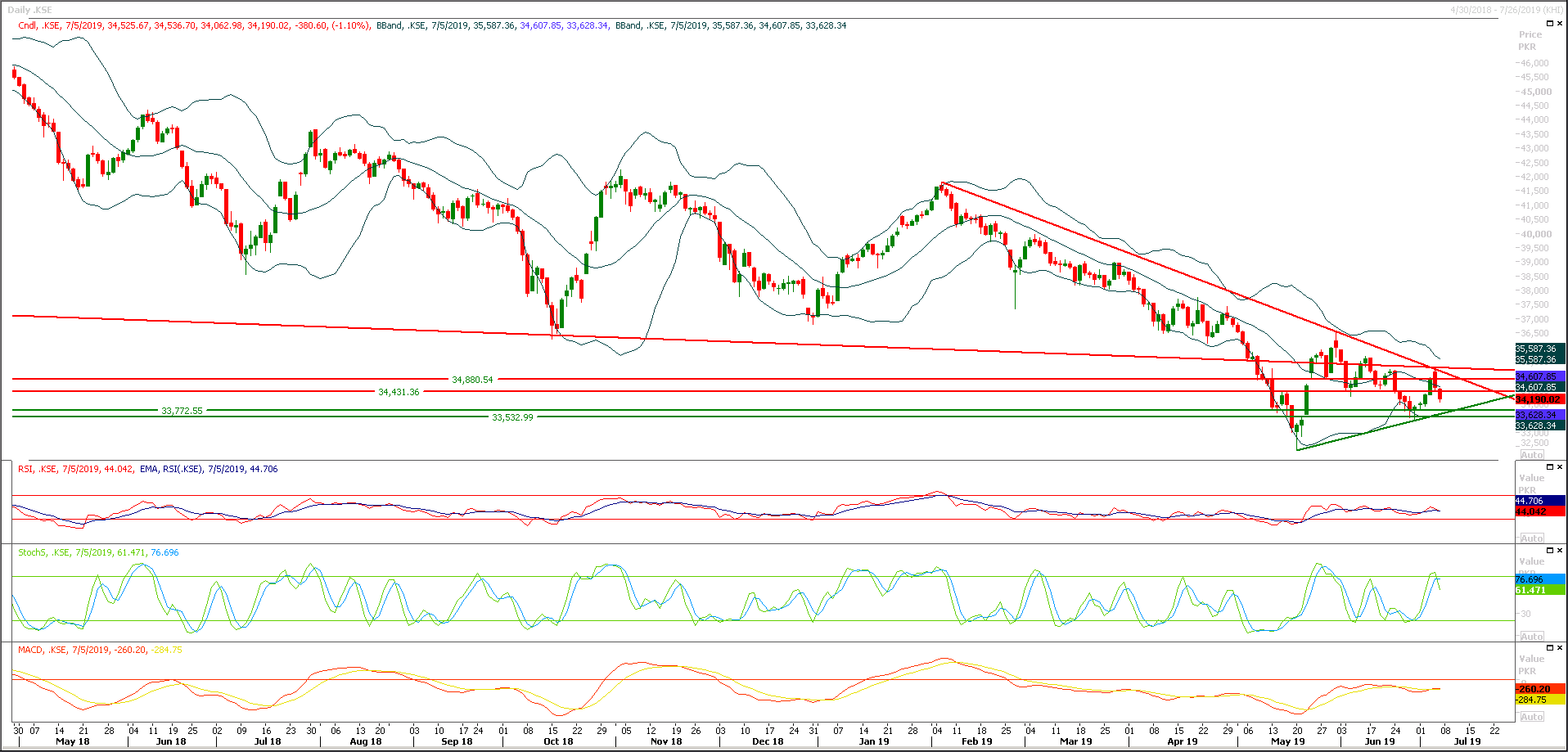

The Benchmark KSE100 index have completed 61.8% correction of its last bullish rally in just two days and right now it have a strong supportive region standing ahead at 34,000 points, it's expected that index would try to bounce back in a day or two after getting support from 34,000 or 33,760 points. Daily momentum indicators have changed direction towards bearish side but hourly momentum is fully charged and indicators have generated bullish crossovers, therefore it's expected that index would try to take start an intraday spike during current trading session and if this spike would succeed in giving a breakout of 34,500 points before day end then this momentum would prevail and index would try to penetrate above 35,300 points in coming days. It's recommended to post strict stop loss on long positions and trade long positions as long as index is sustained above 33,700 points, breakout of 33,700 points will call for a new low.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.